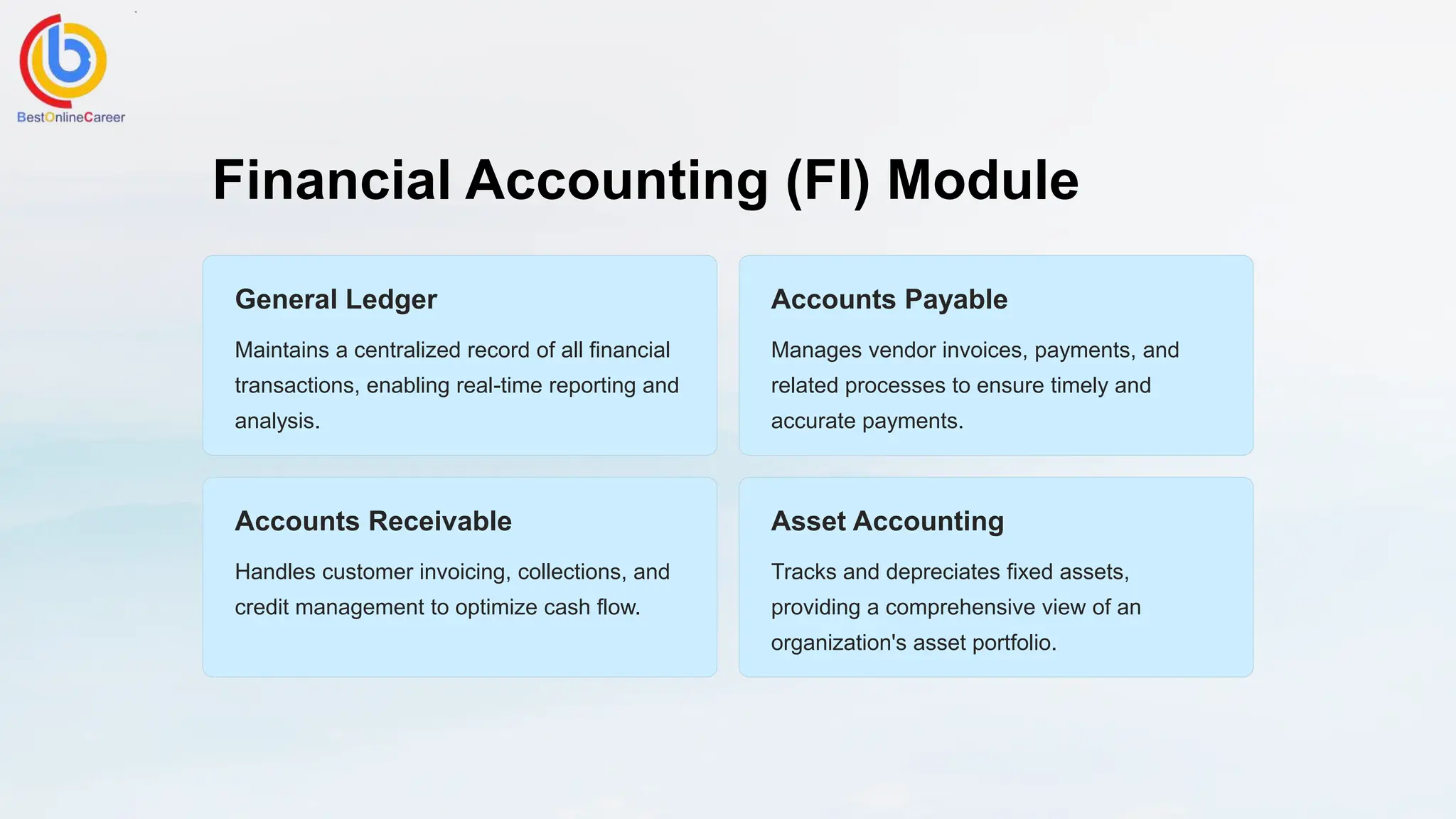

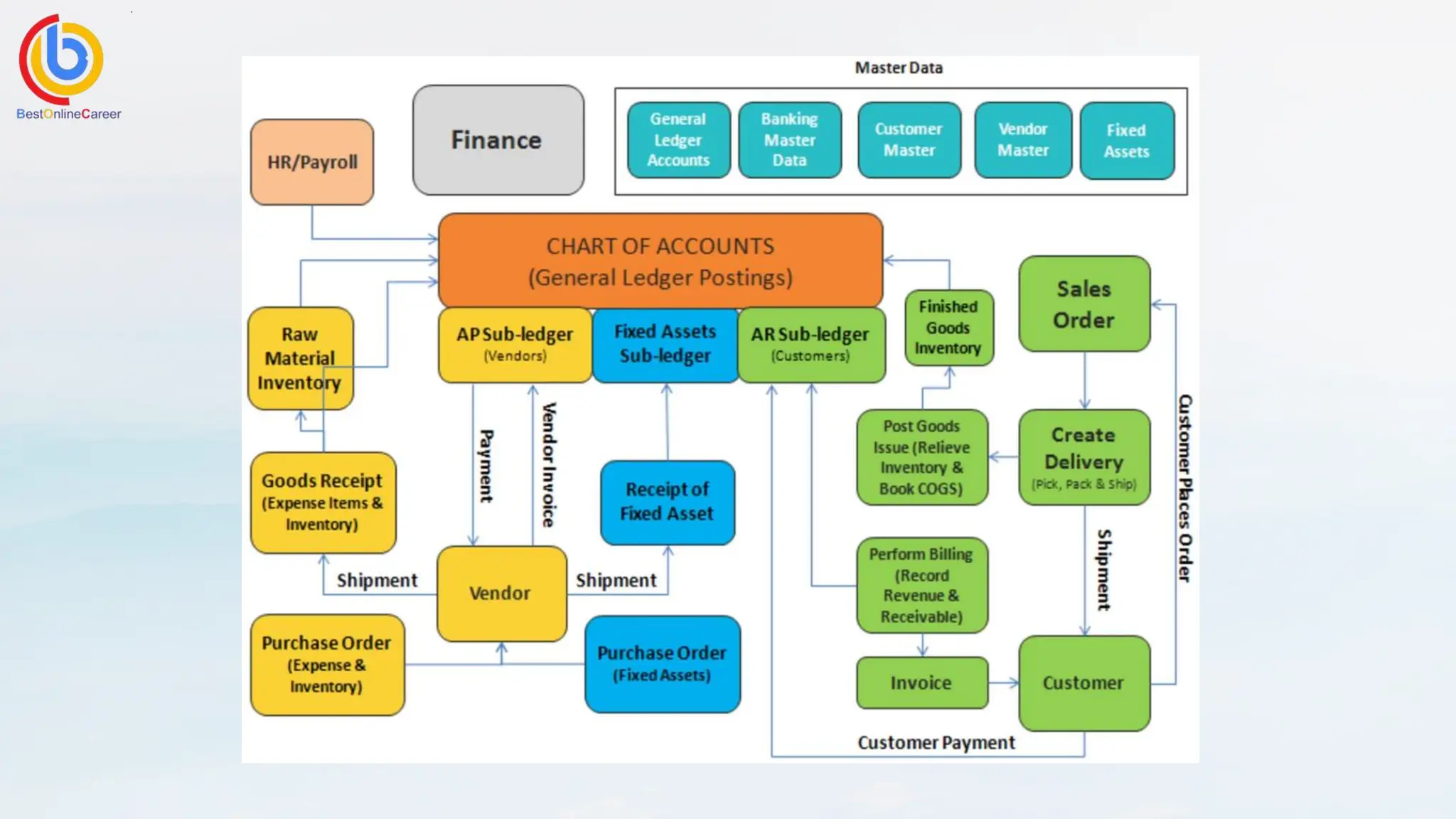

SAP FICO (Financial Accounting and Controlling) is a financial management solution within the SAP ERP system that integrates financial operations and provides advanced cost accounting and reporting capabilities. It includes modules for financial accounting (FI) and controlling (CO), facilitating processes like general ledger maintenance, accounts payable, and profitability analysis. Implementing SAP FICO enhances automation, data-driven decision-making, compliance, and cost optimization while addressing challenges such as data migration and change management.