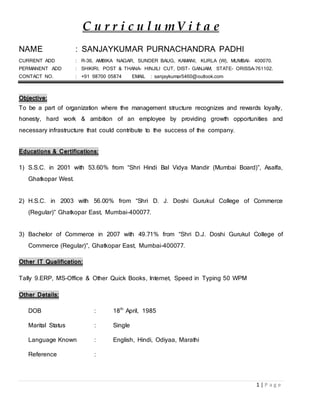

1. This CV summarizes Sanjaykumar P. Padhi's work experience and qualifications.

2. He has over 10 years of experience working in accounting roles for CA firms and companies in various industries like manufacturing, real estate, and IT.

3. His responsibilities have included bookkeeping, tax filing, financial statement preparation, and assisting with audits.