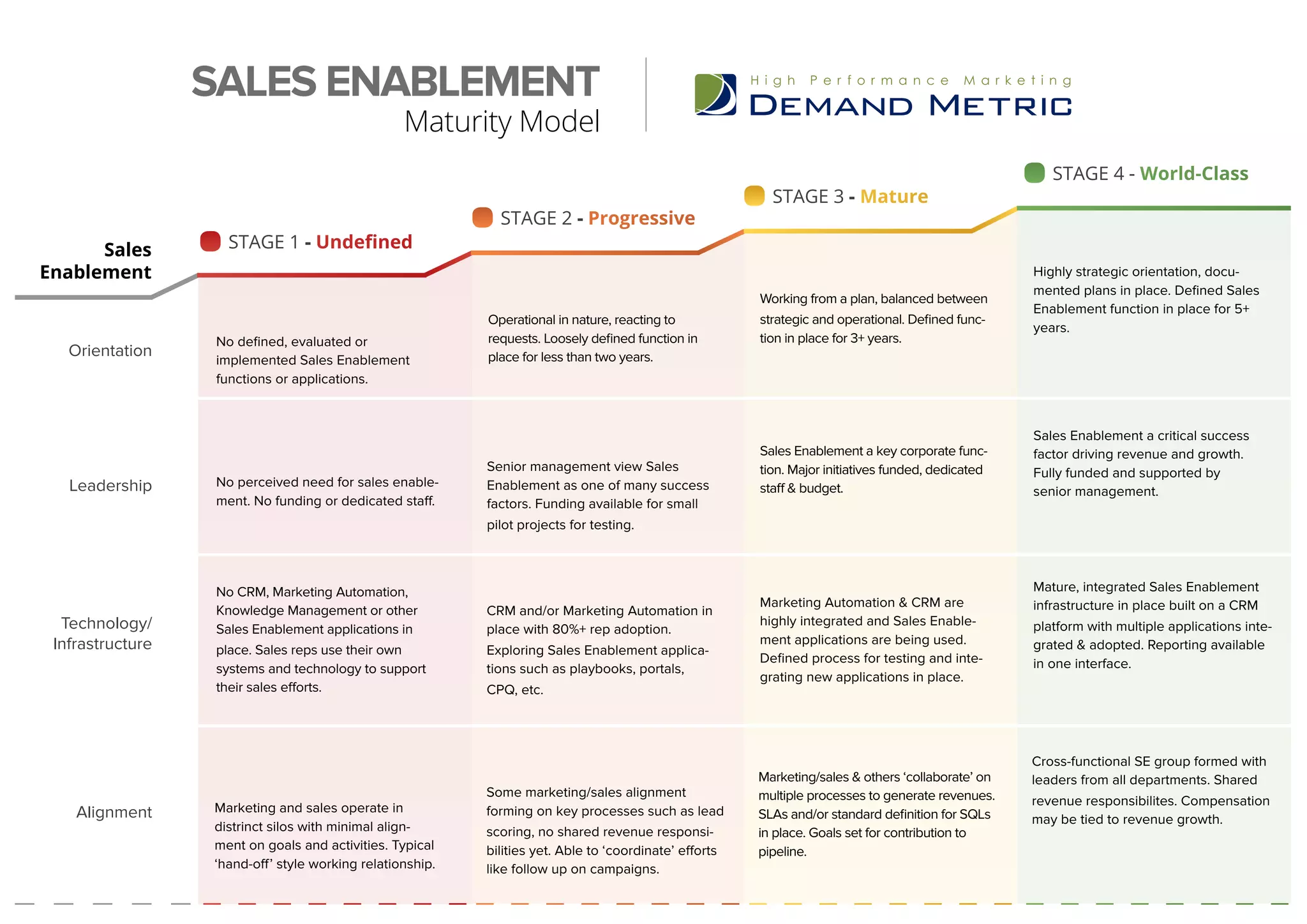

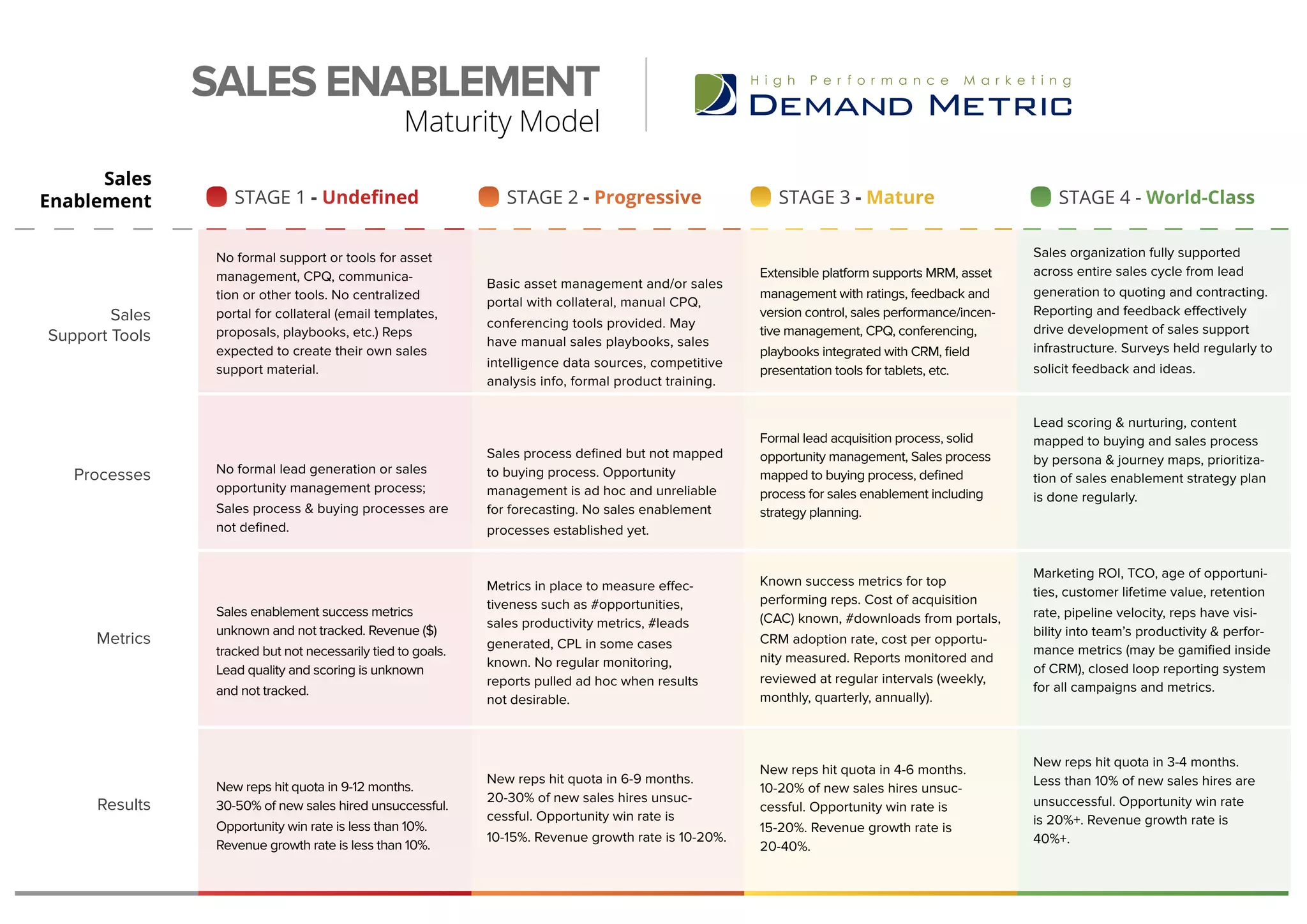

The document outlines a sales enablement maturity model divided into four stages: undefined, progressive, mature, and world-class. Each stage highlights the development of technology infrastructure, leadership perception, cross-functional alignment, and sales enablement processes, coupled with metrics for assessing success. The model emphasizes the increasing integration and sophistication of tools and strategies as organizations progress and achieve better sales outcomes.