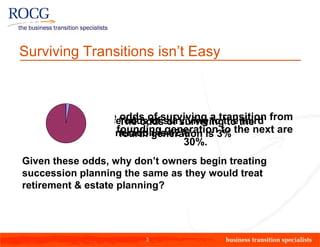

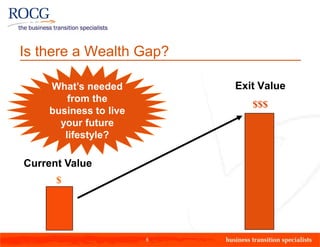

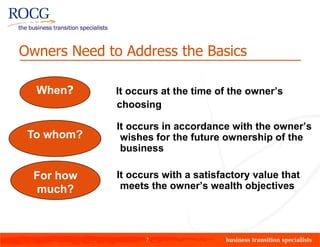

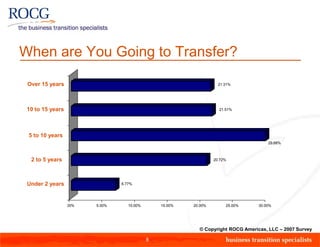

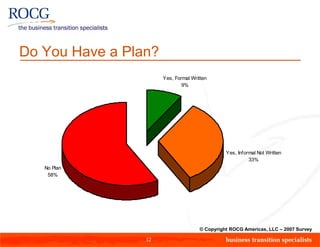

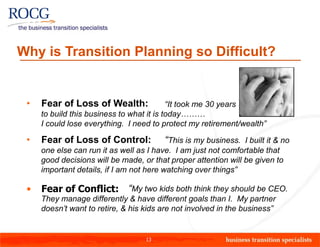

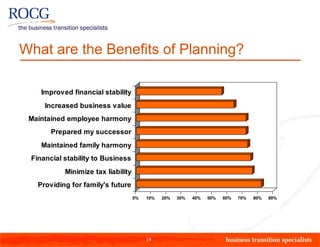

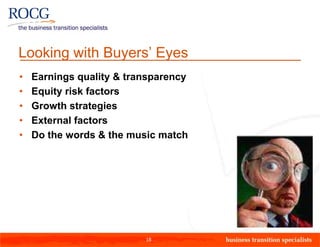

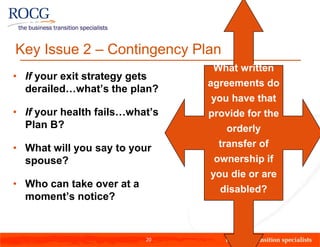

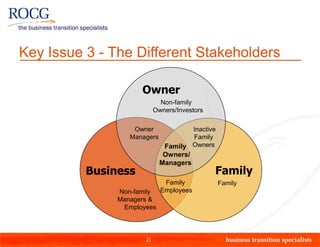

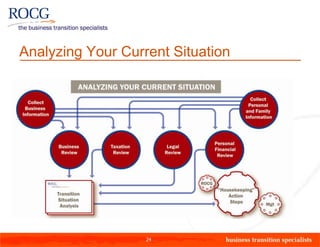

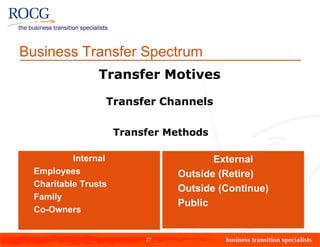

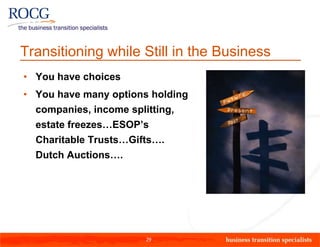

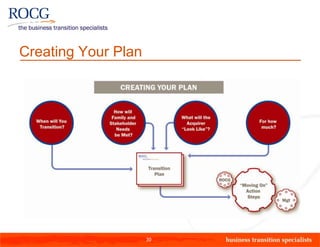

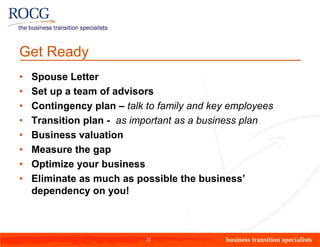

The document discusses business transition planning and succession. It notes that less than 40% of businesses successfully transition ownership, yet most business owners will need to transfer their businesses by 2015. Proper transition planning is important to maximize business value and provide financial security in retirement. The benefits of planning include improved financial stability, increased business value, and prepared successors. However, many owners fear loss of control and family conflicts. The key issues in transition include understanding how buyers value businesses, having contingency plans, managing different stakeholder interests, planning for family involvement, and coordinating advisors. Analyzing the current situation and building a customized transition plan based on objectives is important.