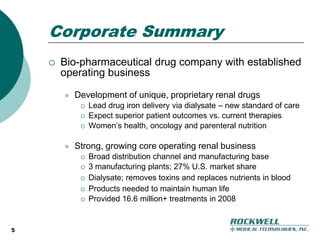

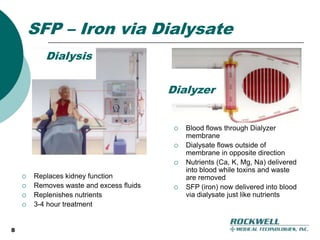

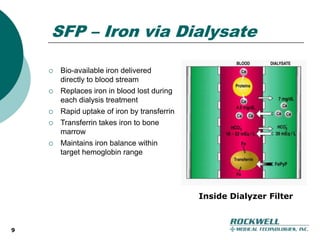

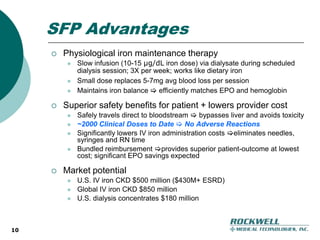

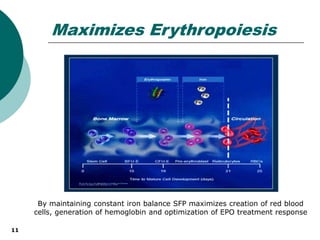

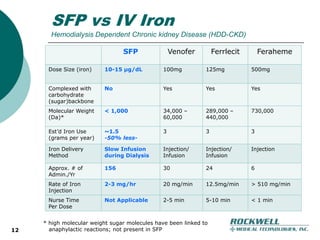

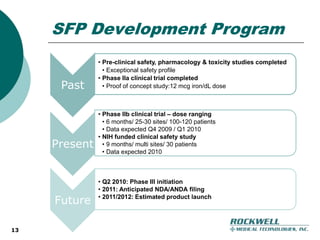

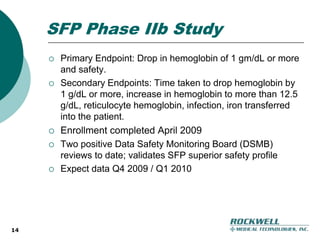

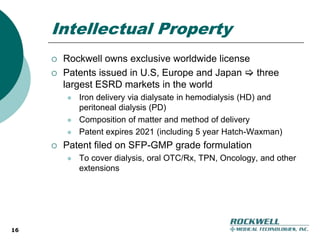

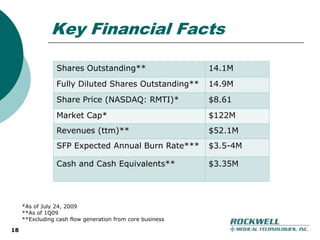

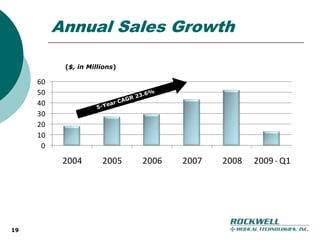

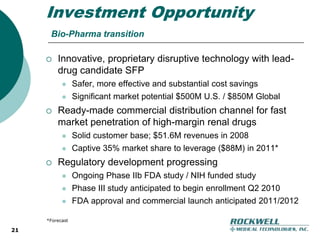

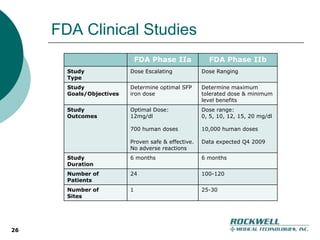

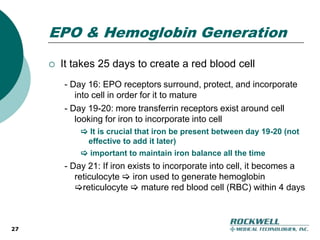

Rockwell Medical Technologies, Inc. focuses on the development of unique renal drugs, including a lead drug, soluble ferric pyrophosphate (SFP), which provides iron via dialysate for dialysis patients. The company anticipates strong market potential in the chronic kidney disease sector, with significant cost savings and improved patient outcomes compared to current therapies. Forward-looking statements indicate a solid growth strategy with expected FDA approval and commercialization of SFP by 2011/2012.