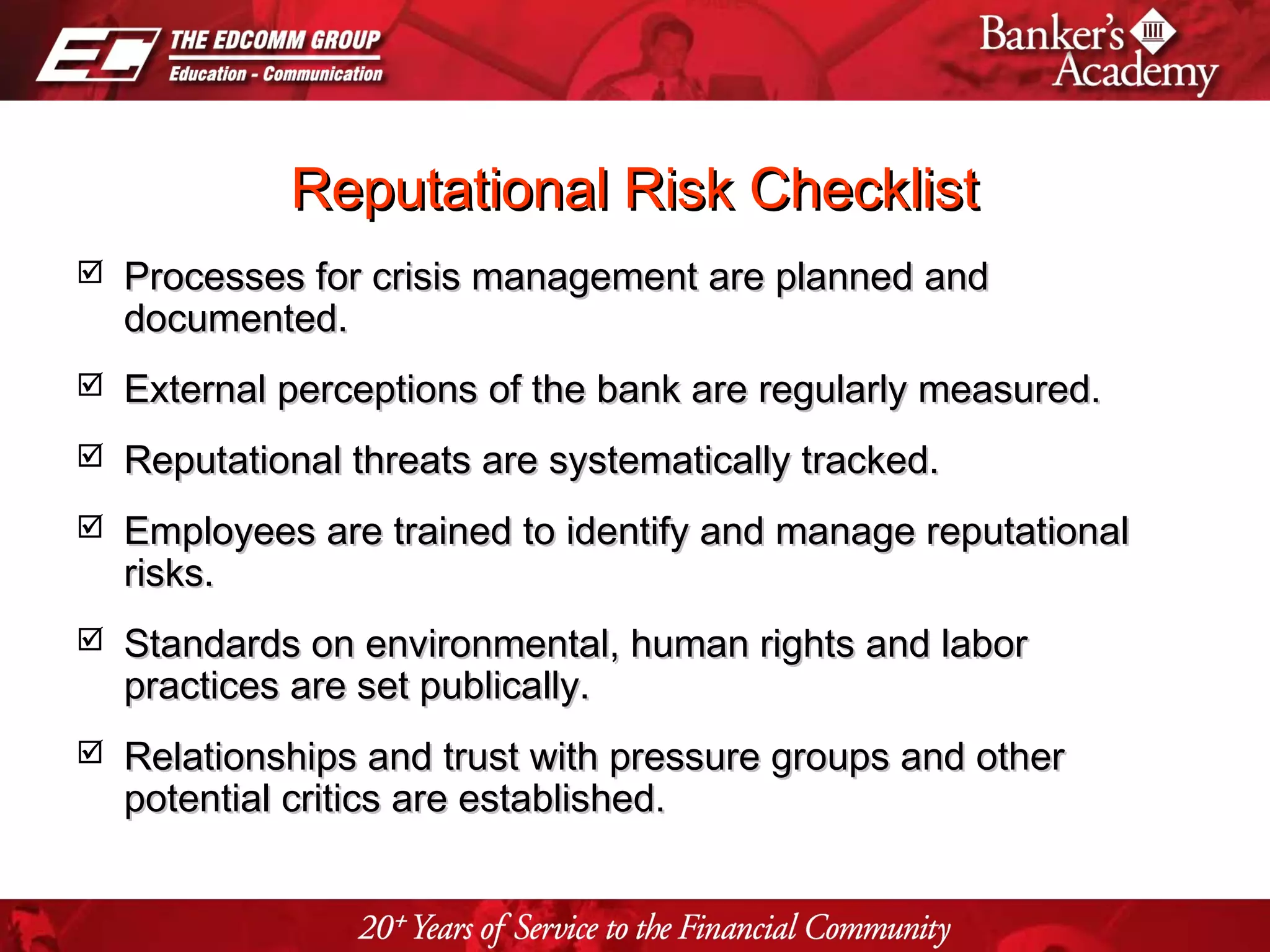

This document discusses risk management in banking. It describes different types of risk including operational risk, credit risk, and reputational risk. Operational risk includes internal fraud, external fraud, risks related to employment practices, risks related to clients and products, risks of damage to physical assets, risks of business disruptions, and risks related to execution and processes. Credit risk refers to the uncertainty in a counterparty's ability to meet its obligations. The document provides checklists and guidelines for managing operational and credit risks, including establishing appropriate risk environments, credit granting processes, credit administration, and risk controls.