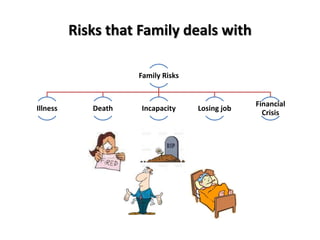

This document provides information on risks families face and how to manage them. It discusses illness, death, job loss, and financial crisis as key risks. It recommends having insurance, estate planning, health savings, power of attorney, and separate savings for education, special situations, and retirement. The document also discusses how families can be informed about risks through government advertising, various media like television, radio, newspapers and social media. Finally, it discusses how families can handle risks through open discussion, utilizing members' experiences, and consulting experts to determine the best investment and savings strategies based on their needs.