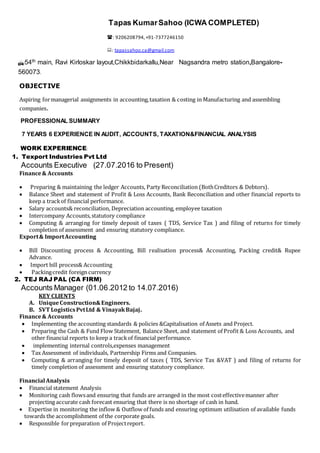

The document provides a summary of a candidate's professional experience and qualifications. In 3 sentences:

The candidate has over 7 years of experience in audit, accounts, taxation, and financial analysis working for both an accounting firm and manufacturing company. Their experience includes preparing financial reports, ensuring statutory compliance, cost control analysis, and financial statement analysis. The candidate holds a B.Com, CA Inter, CWA Inter and Final, and is a member of the Institute of Cost Accountants with a focus on accounting, taxation, costing, and financial analysis.