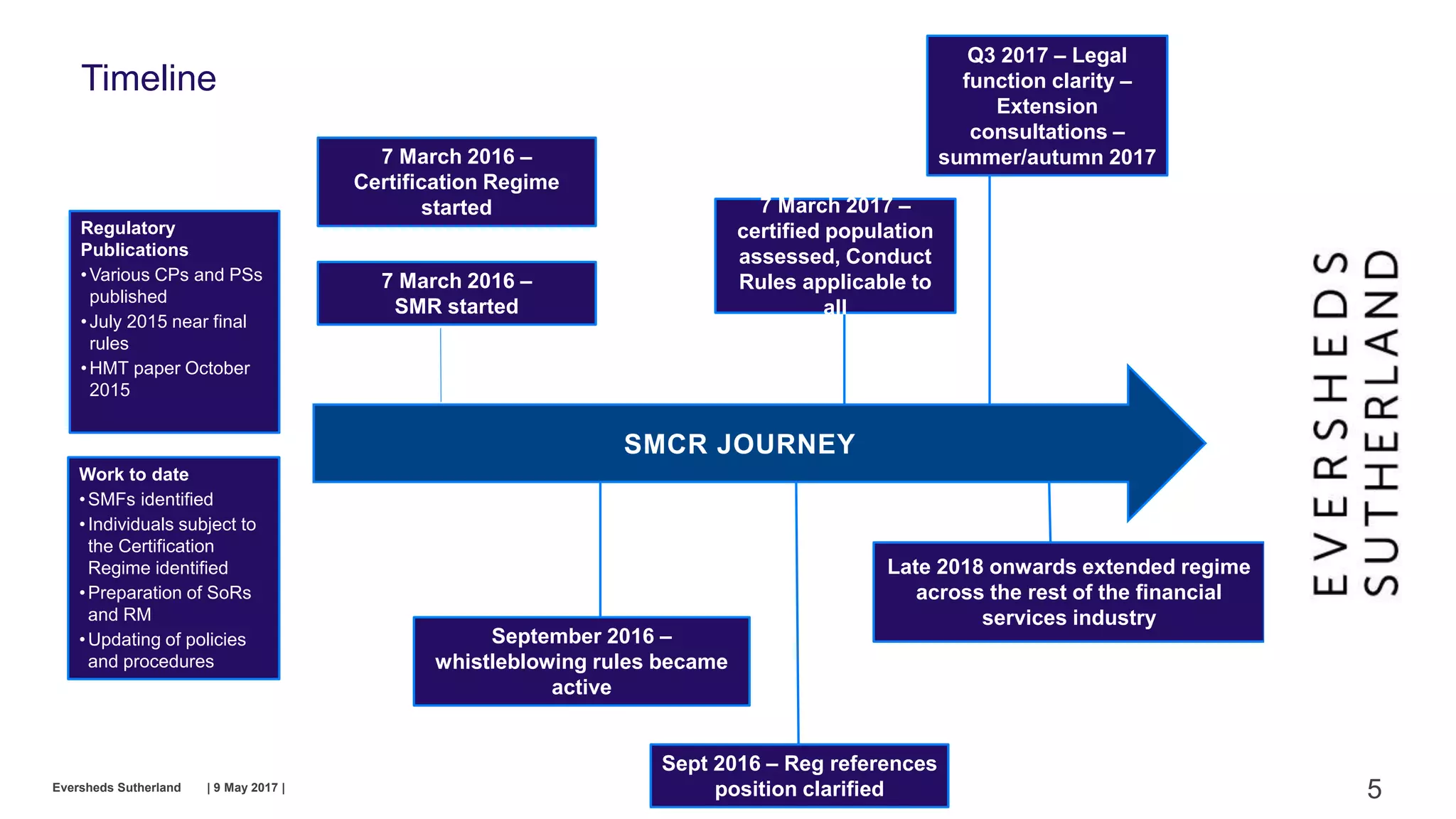

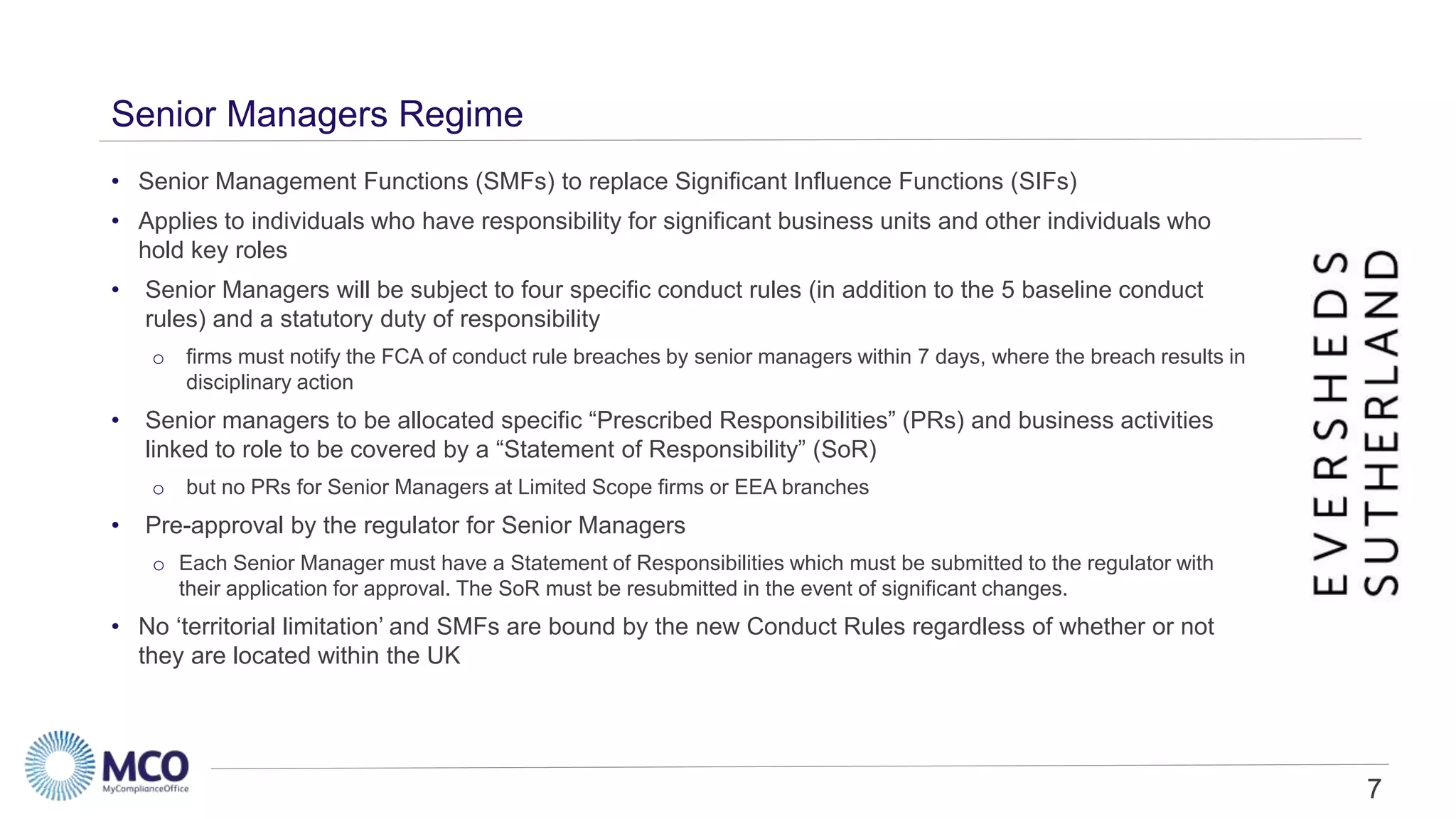

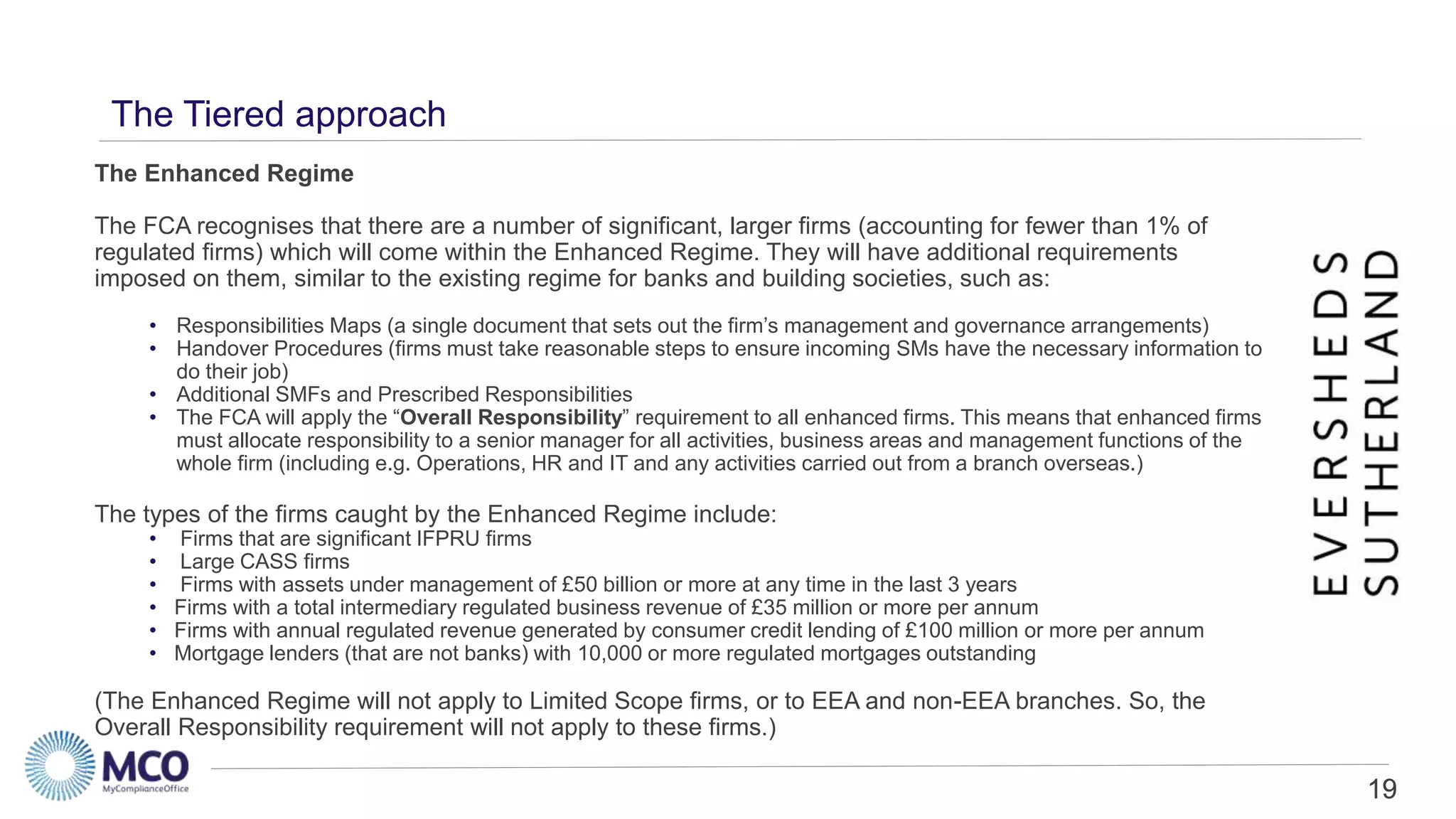

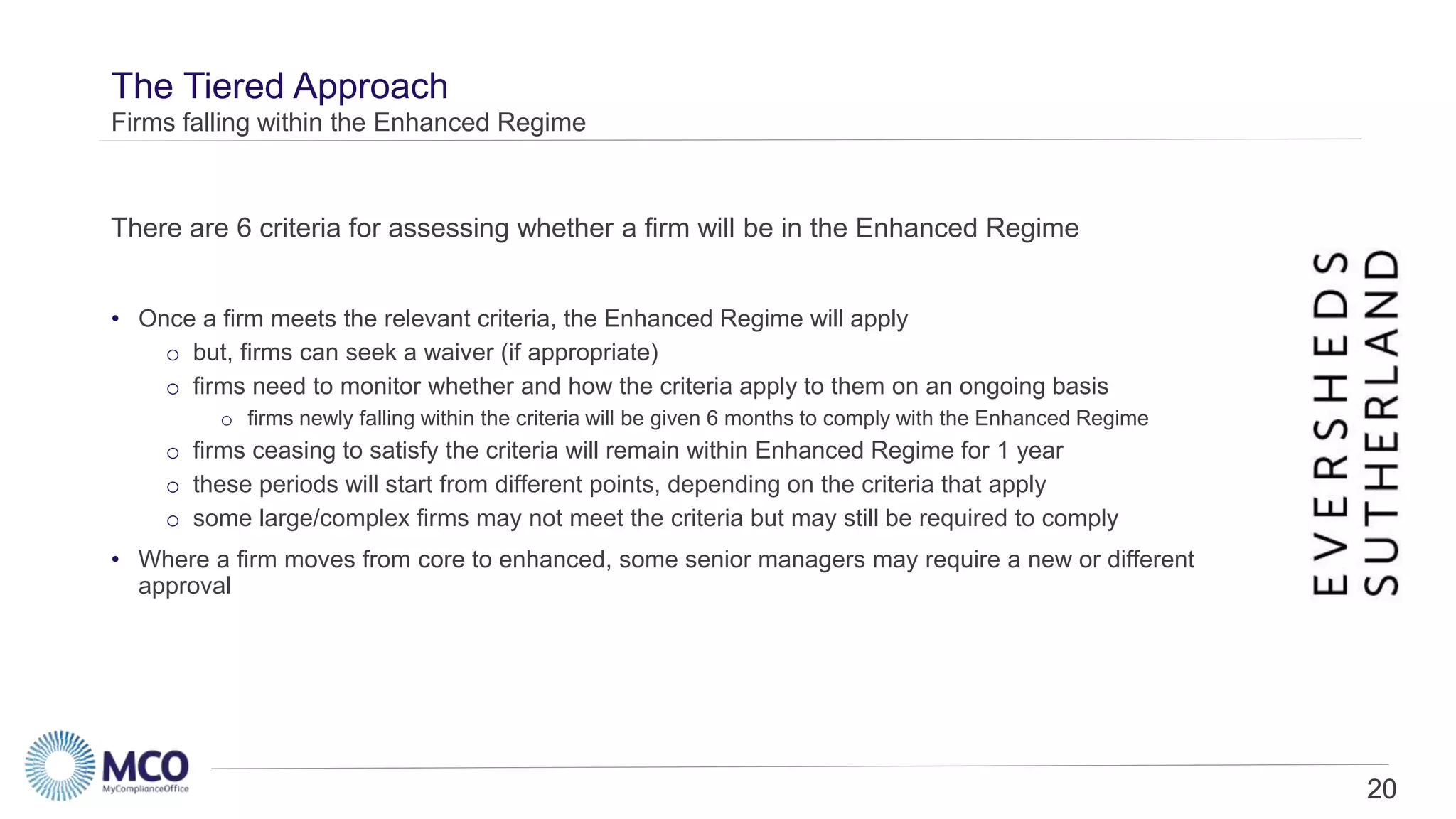

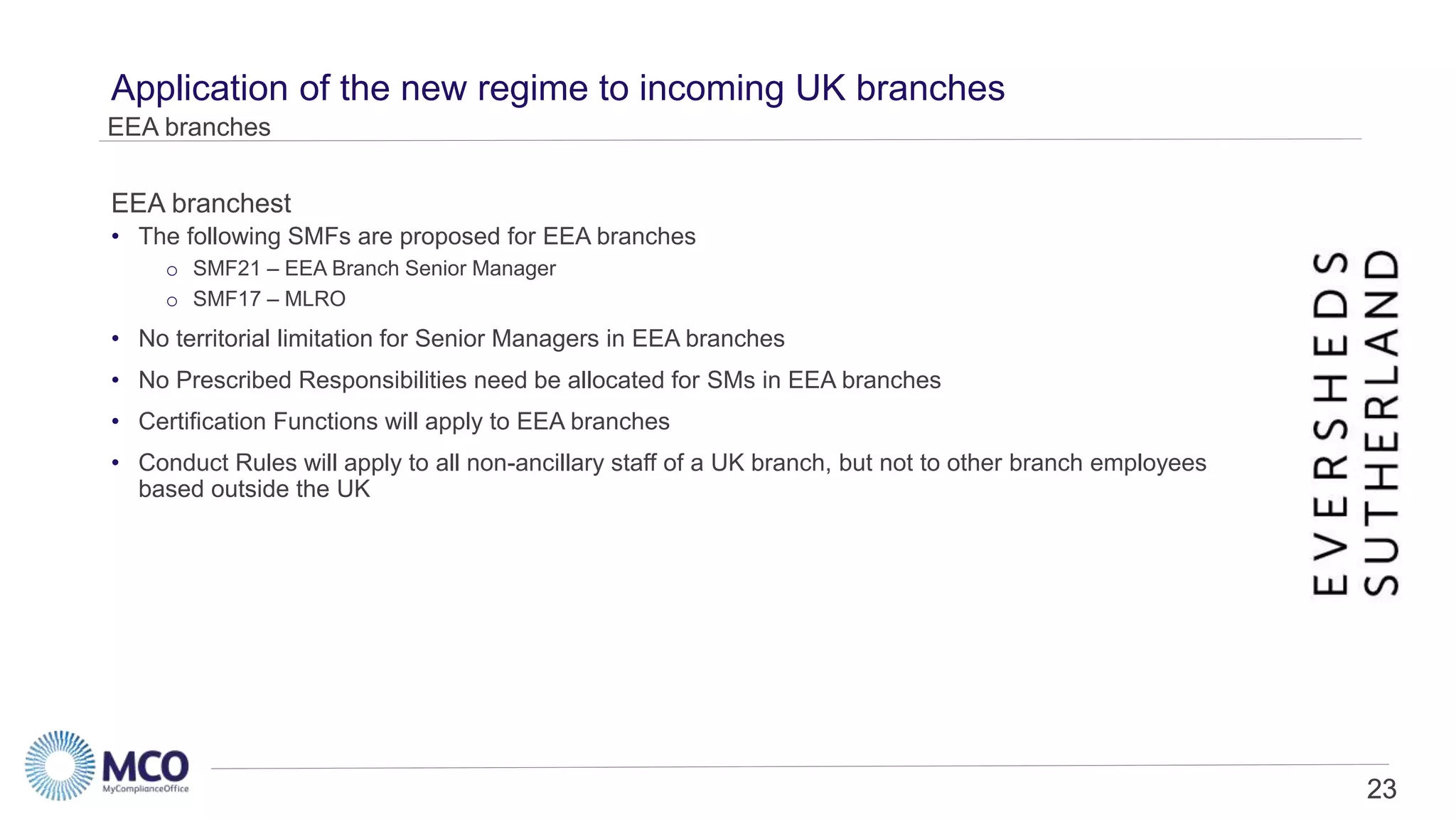

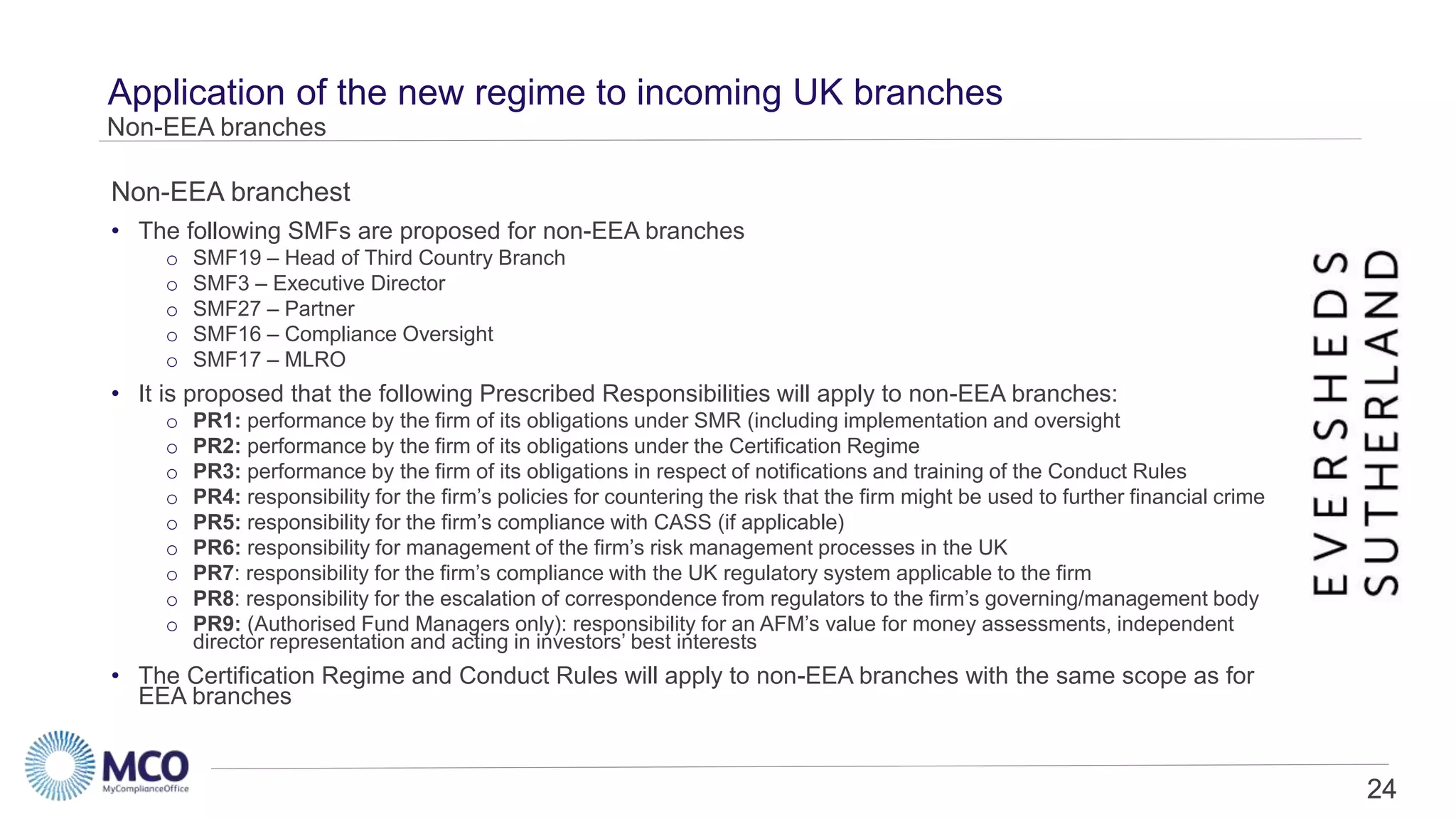

The document provides an overview of the new Senior Managers and Certification Regime and Conduct Rules that will extend individual accountability across the UK financial services industry. Key points:

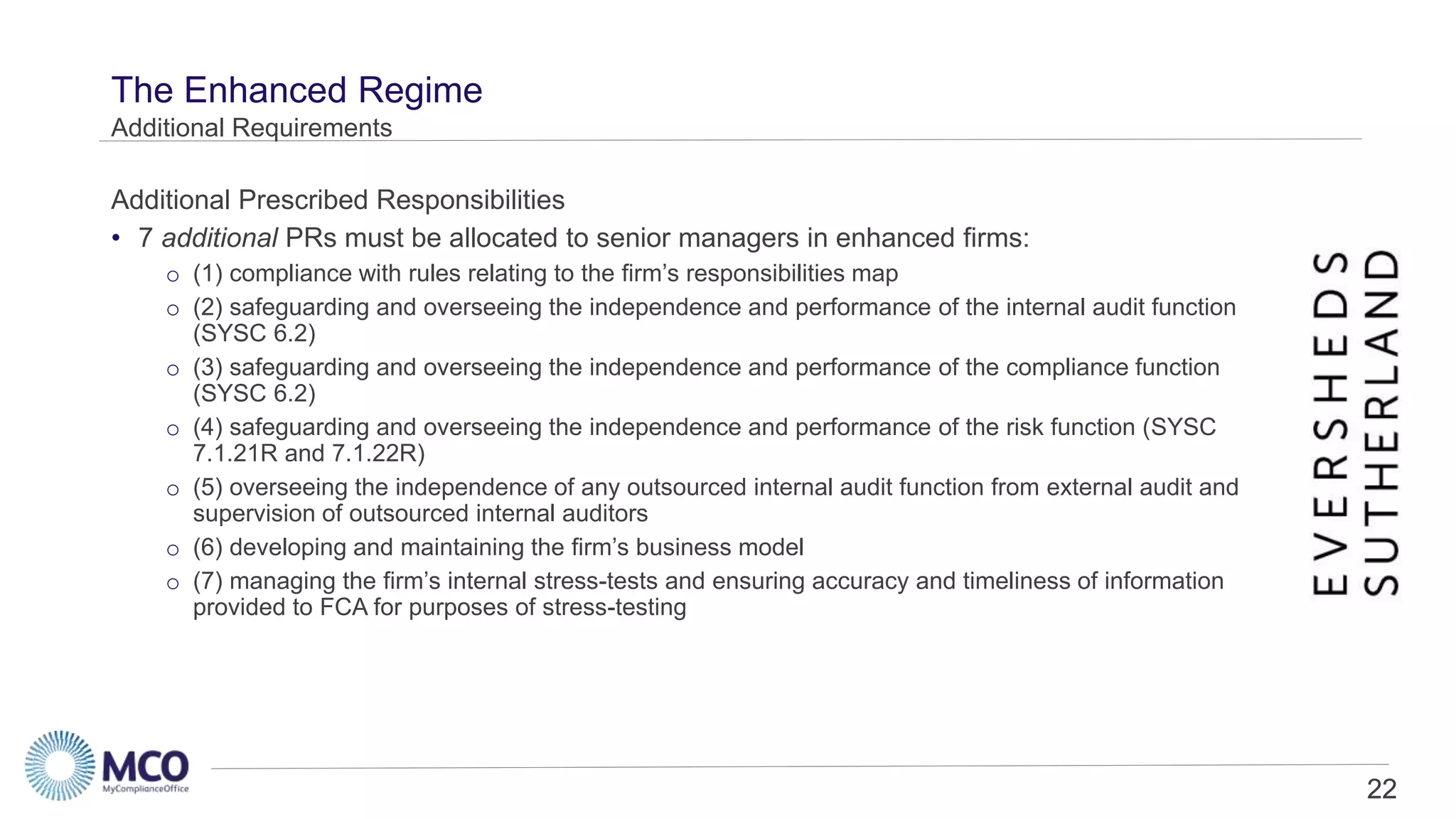

- The new regime aims to increase personal responsibility of senior individuals through prescribed responsibilities, conduct rules, and regulatory references.

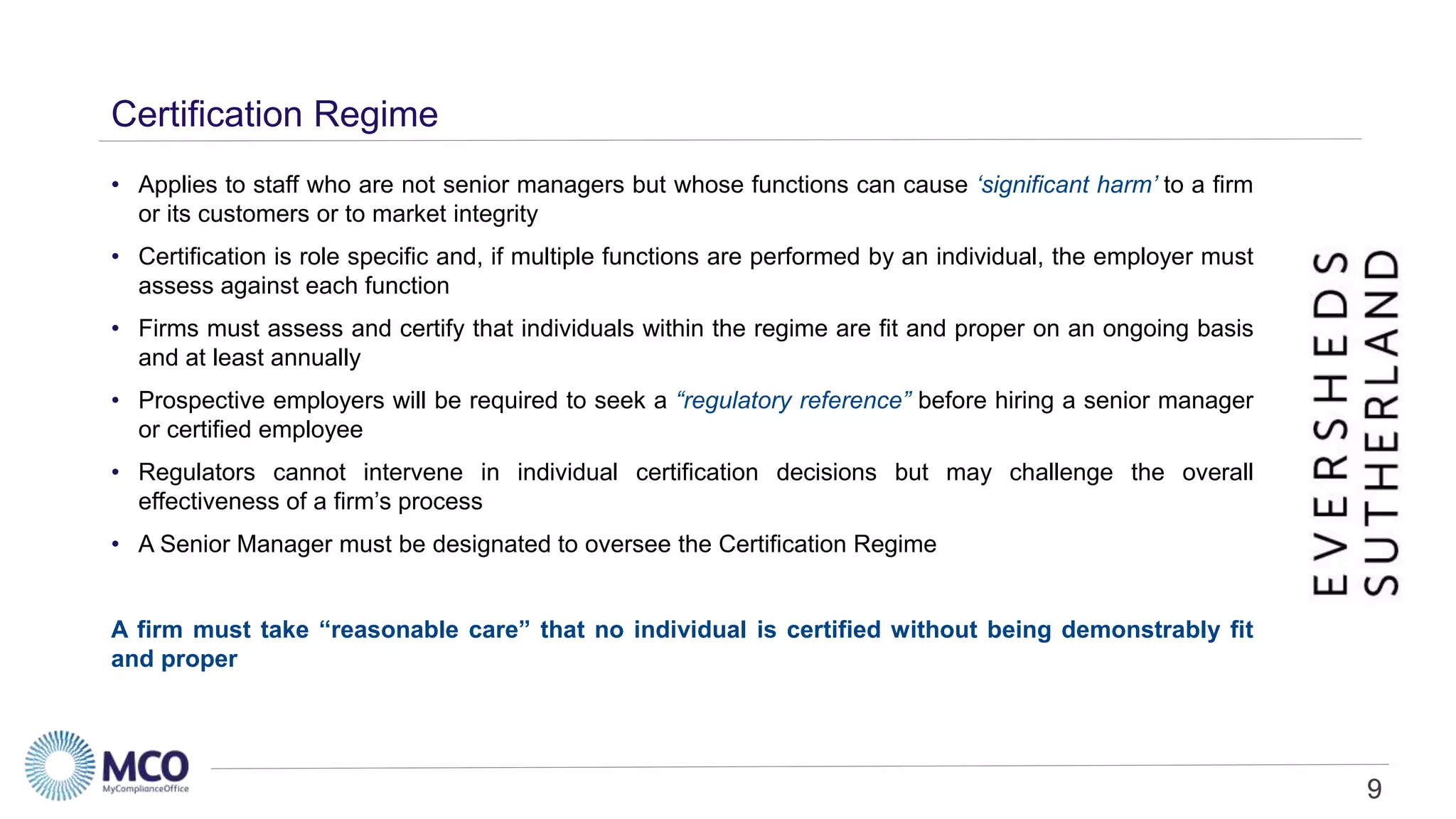

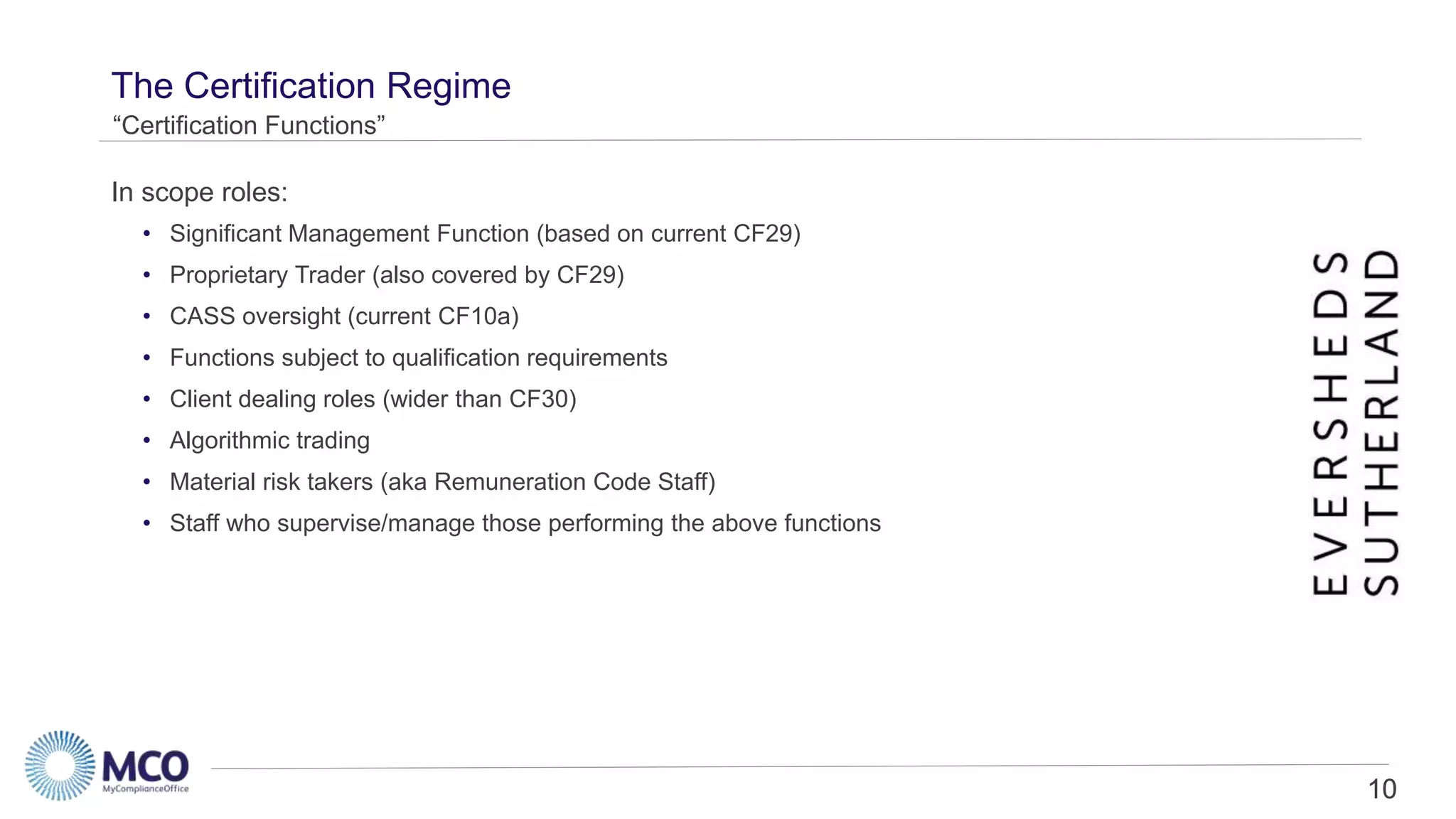

- Senior managers will be subject to specific conduct rules and responsibilities. Other individuals whose roles could significantly harm the firm are subject to annual certification.

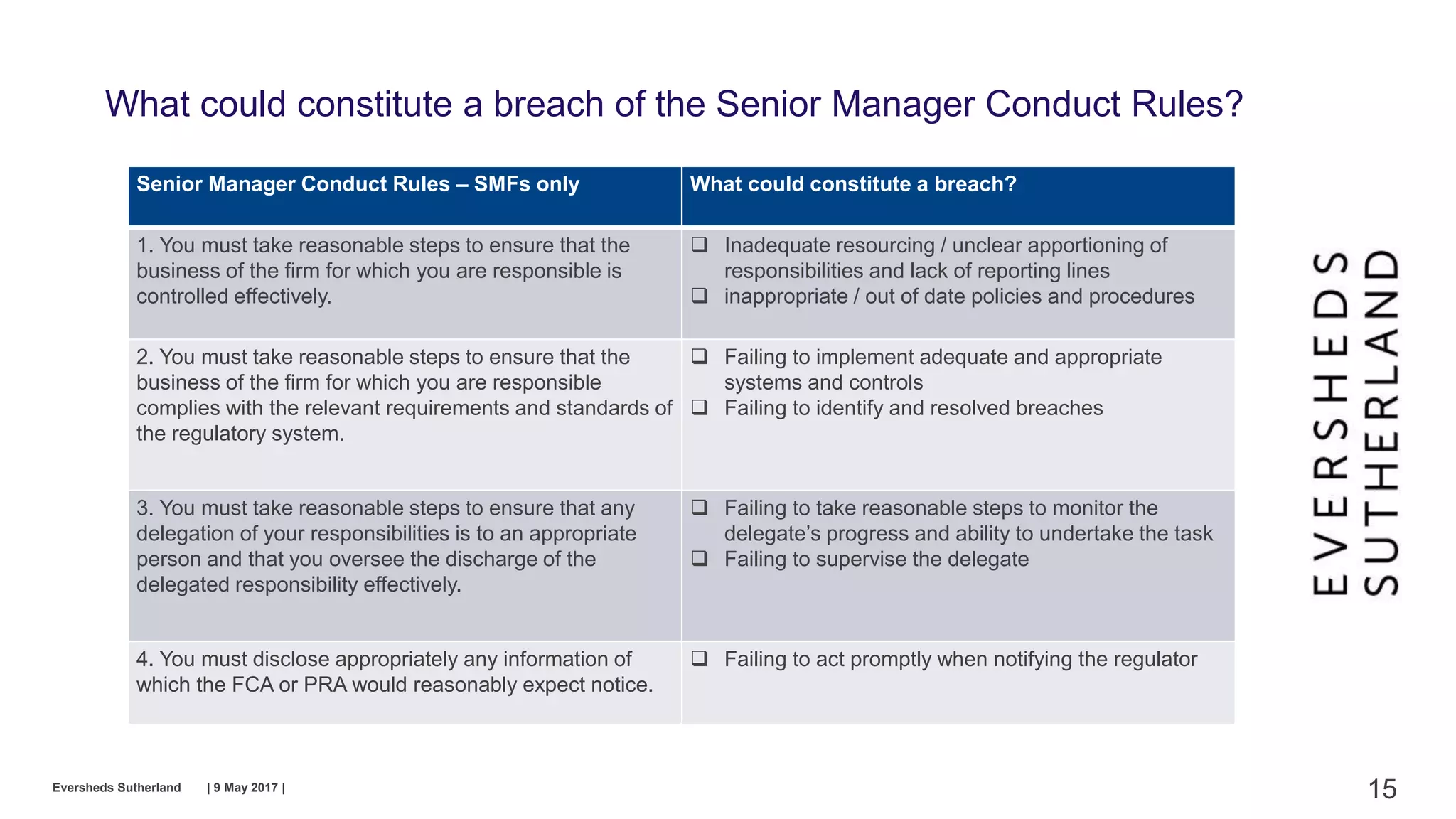

- All staff except ancillary workers must follow new conduct rules focused on integrity, skill/care, cooperation, customer interests, and market conduct. Senior managers have four additional rules.

- Firms must have processes to assess individuals' fitness and propriety and provide regulatory