Embed presentation

Download to read offline

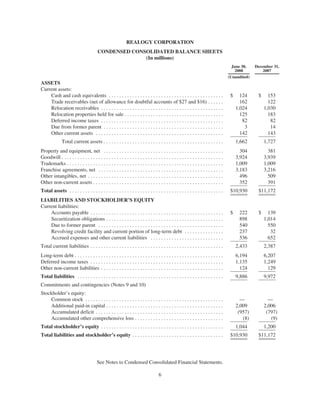

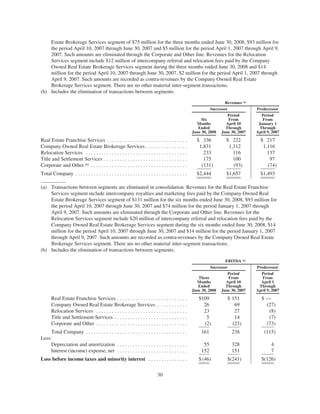

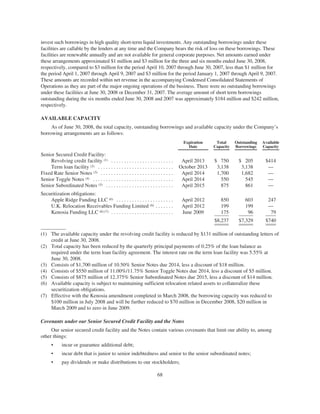

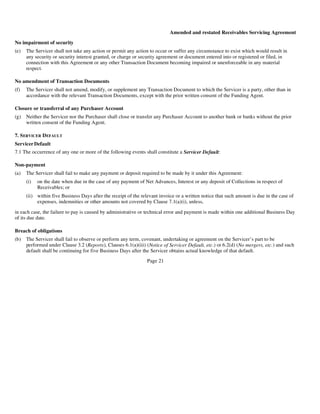

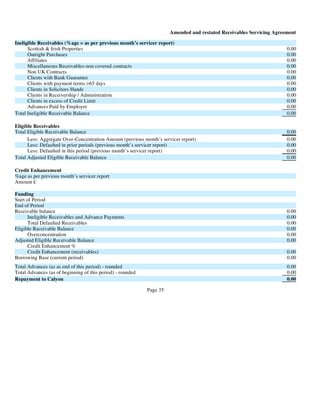

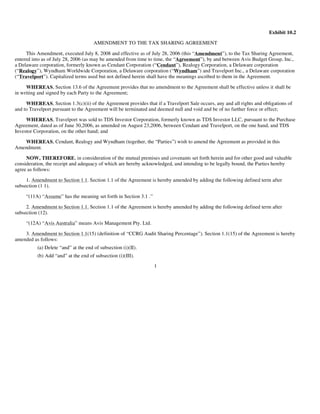

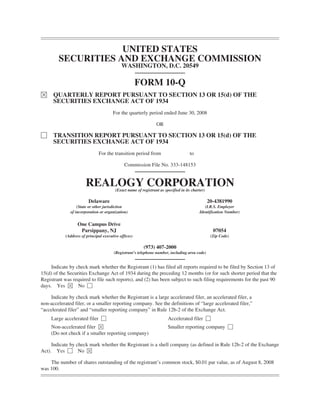

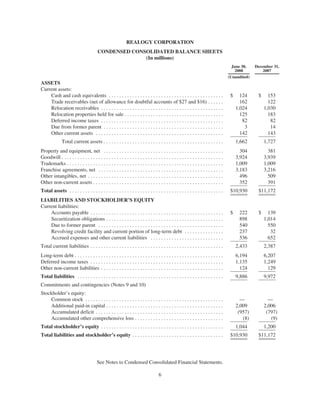

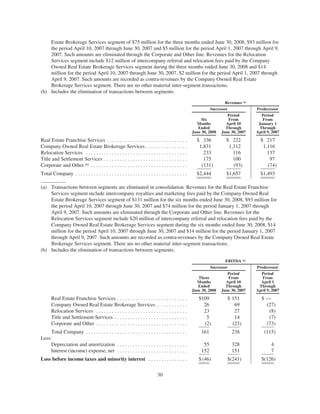

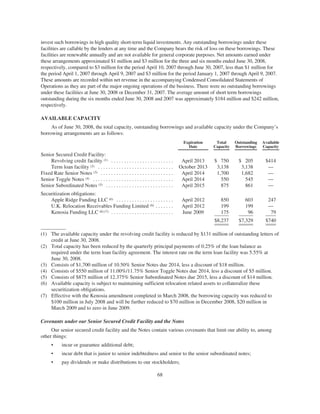

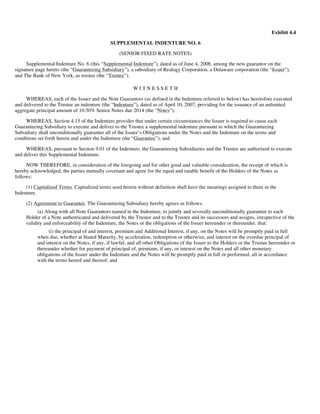

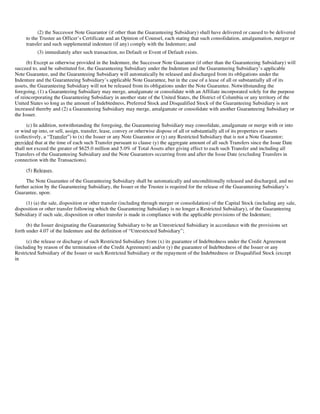

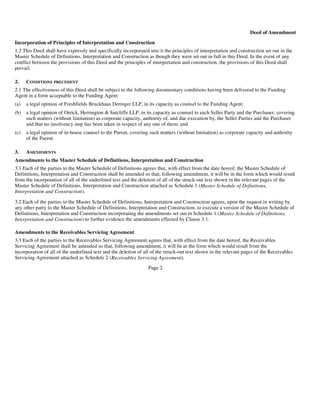

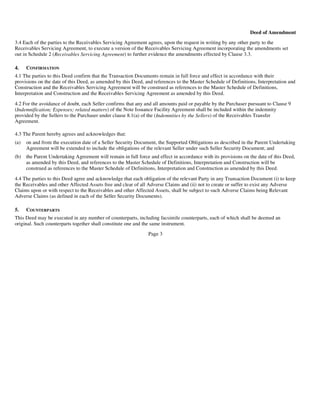

This document is Realogy Corporation's quarterly report filed with the SEC for the quarter ended June 30, 2008. It includes condensed consolidated financial statements for the second quarter of 2008, the first quarter of 2008, and comparative periods in 2007. It also includes notes to the financial statements and sections for management's discussion of financial results, market risk disclosures, and certifications of internal controls. Realogy is a large residential real estate services company that was spun off from Cendant Corporation and acquired by Apollo Management in a leveraged buyout transaction. It operates real estate brokerages and franchises real estate brokerage brands.