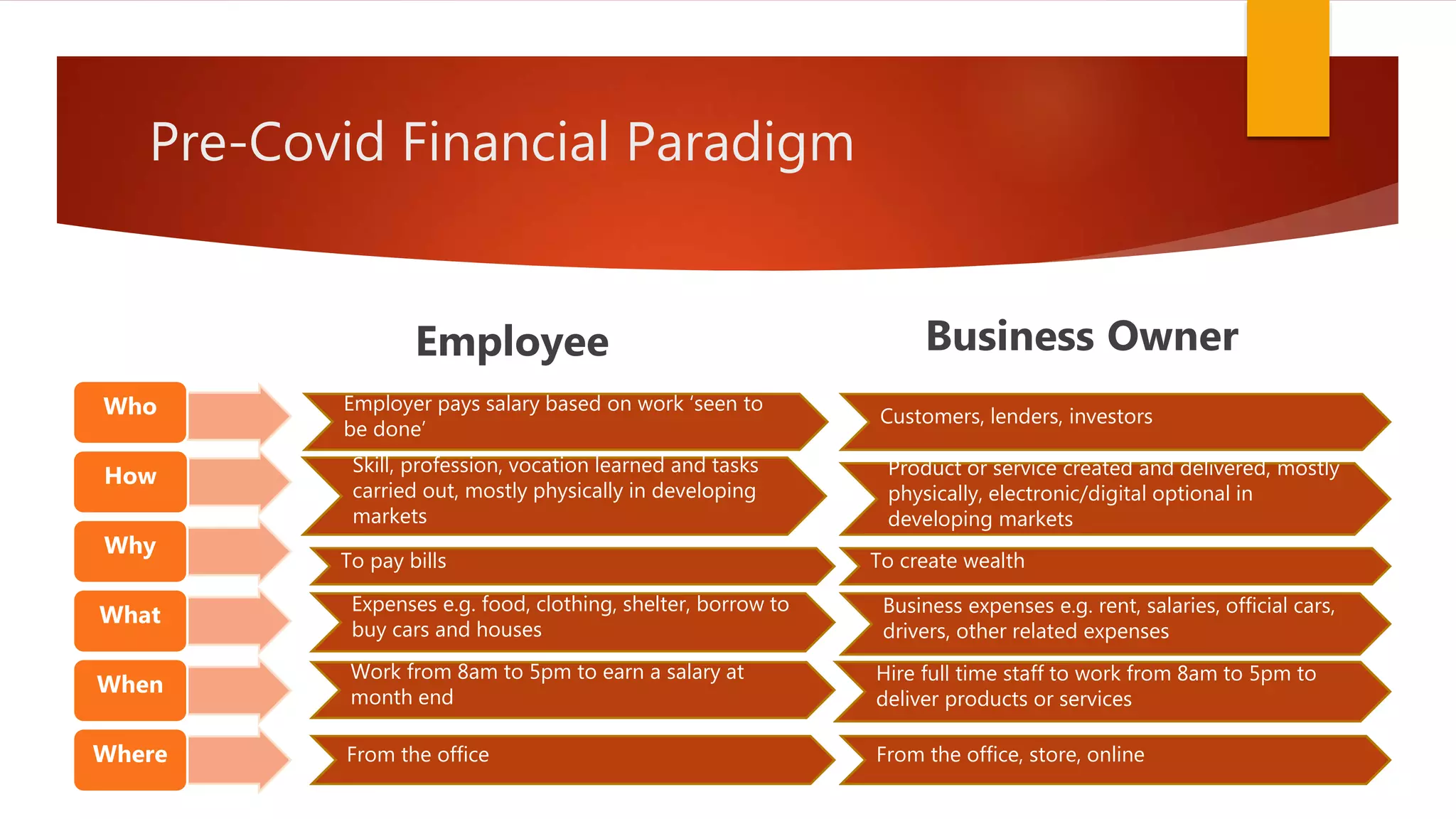

The document discusses the shift in financial paradigms due to the COVID-19 pandemic, highlighting the need for digital transformation in business operations. It emphasizes the importance of creating value and wealth, rather than merely paying bills, and outlines essential services that have gained prominence. The next steps include managing existing cash, evolving customer relations, and enhancing value creation skills in a more flexible work environment.