QNBFS Daily Market Report June 05, 2023

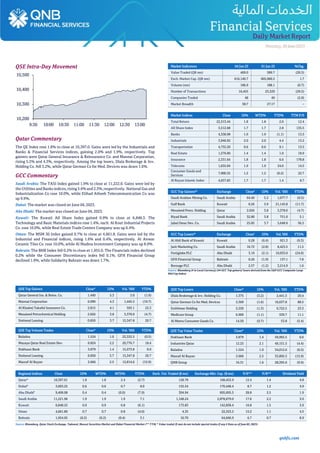

- 1. qnbfs.com Daily MarketReport Monday, 05June2023 QSE Intra-Day Movement Qatar Commentary The QE Index rose 1.8% to close at 10,397.0. Gains were led by the Industrials and Banks & Financial Services indices, gaining 2.0% and 1.9%, respectively. Top gainers were Qatar General Insurance & Reinsurance Co. and Mannai Corporation, rising 5.3% and 4.3%, respectively. Among the top losers, Dlala Brokerage & Inv. Holding Co. fell 3.2%, while Qatar German Co for Med. Devices was down 1.6%. GCC Commentary Saudi Arabia: The TASI Index gained 1.9% to close at 11,222.0. Gains were led by the Utilities and Banks indices, rising3.6% and 2.3%,respectively. National Gas and Industrialization Co rose 10.0%, while Etihad Atheeb Telecommunication Co was up 9.9%. Dubai: The market was closed on June 04, 2023. Abu Dhabi: The market was closed on June 04, 2023. Kuwait: The Kuwait All Share Index gained 0.9% to close at 6,848.3. The Technology and Basic Materials indices rose 1.4%, each. Al Kout Industrial Projects Co. rose 10.0%, while Real Estate Trade Centers Company was up 6.4%. Oman: The MSM 30 Index gained 0.7% to close at 4,661.8. Gains were led by the Industrial and Financial indices, rising 1.6% and 0.4%, respectively. Al Anwar Ceramic Tiles Co. rose 10.0%, while Al Madina Investment Company was up 8.0%. Bahrain: The BHB Index fell 0.2% to close at 1,955.0. The Financials index declined 0.2% while the Consumer Discretionary index fell 0.1%. GFH Financial Group declined 1.9%, while Solidarity Bahrain was down 1.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 1.440 5.3 3.0 (1.9) Mannai Corporation 6.090 4.3 1,445.5 (19.7) Al Khaleej Takaful Insurance Co. 2.815 4.1 593.1 22.3 Mesaieed Petrochemical Holding 2.026 3.8 3,378.0 (4.7) National Leasing 0.850 3.7 15,347.8 20.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Baladna 1.524 1.0 22,332.5 (0.5) Mazaya Qatar Real Estate Dev. 0.824 2.2 20,776.7 18.4 Dukhaan Bank 3.879 1.4 15,573.8 0.0 National Leasing 0.850 3.7 15,347.8 20.7 Masraf Al Rayan 2.666 2.5 12,814.6 (15.9) Market Indicators 04 Jun 23 01 Jun 23 %Chg. Value Traded (QR mn) 469.0 589.7 (20.5) Exch. Market Cap. (QR mn) 616,140.7 605,960.5 1.7 Volume (mn) 186.9 188.1 (0.7) Number of Transactions 16,455 23,329 (29.5) Companies Traded 48 49 (2.0) Market Breadth 38:7 27:17 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 22,313.44 1.8 1.8 2.0 12.4 All Share Index 3,512.68 1.7 1.7 2.8 135.5 Banks 4,338.98 1.9 1.9 (1.1) 13.3 Industrials 3,946.92 2.0 2.0 4.4 13.2 Transportation 4,732.20 0.6 0.6 9.1 13.5 Real Estate 1,576.00 1.4 1.4 1.0 18.9 Insurance 2,331.64 1.8 1.8 6.6 178.8 Telecoms 1,635.04 1.9 1.9 24.0 14.5 Consumer Goods and Services 7,900.32 1.2 1.2 (0.2) 22.7 Al Rayan Islamic Index 4,657.83 1.7 1.7 1.4 8.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Arabian Mining Co. Saudi Arabia 64.40 5.2 1,077.7 (0.5) Gulf Bank Kuwait 0.26 3.9 21,143.8 (11.7) Mesaieed Petro. Holding Qatar 2.026 3.8 3,378.0 (4.7) Riyad Bank Saudi Arabia 32.80 3.8 751.0 3.1 Jabal Omar Dev. Co. Saudi Arabia 25.85 3.7 5,648.9 56.5 GCC Top Losers## Exchange Close# 1D% Vol.‘000 YTD% Al Ahli Bank of Kuwait Kuwait 0.28 (6.4) 921.3 (9.3) Jarir Marketing Co. Saudi Arabia 16.72 (2.8) 8,423.5 11.5 Fertiglobe PLC Abu Dhabi 3.19 (2.1) 10,933.0 (24.6) GFH Financial Group Bahrain 0.26 (1.9) 137.1 7.8 Borouge PLC Abu Dhabi 2.57 (1.2) 3,214.9 1.6 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/ losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co. 1.375 (3.2) 2,441.5 20.4 Qatar German Co for Med. Devices 2.369 (1.6) 10,637.8 88.5 Estithmar Holding 2.220 (1.3) 6,722.5 23.3 Medicare Group 6.900 (1.1) 339.7 11.1 Al Meera Consumer Goods Co. 14.50 (0.7) 53.8 (5.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Dukhaan Bank 3.879 1.4 59,992.5 0.0 Industries Qatar 12.25 2.1 49,151.5 (4.4) Baladna 1.524 1.0 34,012.6 (0.5) Masraf Al Rayan 2.666 2.5 33,895.5 (15.9) QNB Group 16.31 1.6 28,395.6 (9.4) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,397.01 1.8 1.8 2.4 (2.7) 128.78 168,452.9 12.4 1.4 4.8 Dubai# 3,603.25 0.6 0.6 0.7 8.0 155.54 170,448.4 8.7 1.2 4.9 Abu Dhabi# 9,406.08 0.4 0.4 (0.0) (7.9) 304.94 695,695.5 28.8 2.5 1.9 Saudi Arabia 11,221.96 1.9 1.9 1.9 7.1 1,168.24 2,878,679.0 17.6 2.2 3.0 Kuwait 6,848.25 0.9 0.9 0.8 (6.1) 173.83 142,838.4 16.8 1.5 3.9 Oman 4,661.80 0.7 0.7 0.8 (4.0) 4.35 22,323.5 15.2 1.1 4.5 Bahrain 1,954.95 (0.2) (0.2) (0.4) 3.1 10.70 64,846.9 6.7 0.7 8.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades if any # Data as of June 02, 2023) 10,200 10,300 10,400 10,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. qnbfs.com Daily MarketReport Monday, 05June2023 Qatar Market Commentary • The QE Index rose 1.8% to close at 10,397.0. The Industrials and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari shareholders. • Qatar General Insurance & Reinsurance Co. and Mannai Corporation were the top gainers, rising 5.3% and 4.3%, respectively. Among the top losers, Dlala Brokerage & Inv. Holding Co. fell 3.2%, while Qatar German Co for Med. Devices was down 1.6%. • Volume of shares traded on Sunday fell by 0.7% to 186.9mn from 188.1mn on Thursday. Further, as compared to the 30-day moving average of 235mn, volume for the day was 20.5% lower. Baladna and Mazaya Qatar Real Estate Dev. were the most active stocks, contributing 11.9% and 11.1% to the total volume, respectively. Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 32.91% 39.10% (29,026,716.13) Qatari Institutions 25.80% 32.46% (31,212,964.70) Qatari 58.71% 71.56% (60,239,680.83) GCC Individuals 0.37% 0.40% (118,332.74) GCC Institutions 3.90% 1.11% 13,075,641.71 GCC 4.27% 1.51% 12,957,308.97 Arab Individuals 14.00% 12.86% 5,360,829.78 Arab Institutions 0.00% 0.00% - Arab 14.00% 12.86% 5,360,829.78 Foreigners Individuals 3.47% 3.98% (2,417,091.08) Foreigners Institutions 19.55% 10.09% 44,338,633.17 Foreigners 23.02% 14.08% 41,921,542.08 Source: Qatar Stock Exchange (*as a % of traded value) Qatar South Korea's 'Big 3' Shipbuilders enter 14tn Won ($10.7bn) negotiations for Qatar LNG Vessels - HD Hyundai Heavy Industries, Hanwha Ocean, and Samsung Heavy Industries, collectively known as the Big 3 of South Korean shipbuilding, are set to begin substantive negotiations this month for an order of LNG vessels from QatarEnergy worth 14tn won ($10.7bn). According to industry sources and foreign media on June 2, QatarEnergy is planning to commence negotiations this month with the Big 3 for LNG vessel procurement. In the first phase of the project in 2020, QatarEnergy ordered 54 vessels from the Big 3 (17 from HD Hyundai Heavy Industries, 19 from Hanwha Ocean, and 18 from Samsung Heavy Industries). HD Hyundai Heavy Industries and Samsung Heavy Industries have set their order negotiation deadline within this month, while Hanwha Ocean has set theirsby September. Notably, the second order quantity hasdecreased slightly from the first to around 40 vessels (10 from HD Hyundai Heavy Industries, 12 from Hanwha Ocean, and 16 from Samsung Heavy Industries). However, the profitability is expected to increase due to the rising price of LNG vessels. In the first contract last year, each LNG vessel cost $215mn, but this year, each is likely to cost over $230mn. Industry sources predict that if QatarEnergy orders 170,000 m³ LNG vessels, the price per ship would reach around $260mn. The second order quantity from QatarEnergy is expected to be close to $10bn. QatarEnergy plans to finalize contracts with the shipowners that will operate the vessels by the end of the year. HD Hyundai Heavy Industries has preliminarily achieved 72.6% of its annual order goal of $15.74bn by winning orders for 93 vessels amounting to $11.42bn this year. Meanwhile, Samsung Heavy Industries and Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering) have displayed relatively slower progress in achieving their annual targets. Samsung Heavy Industries has so far secured orders for seven vessels, amounting to $2.7bn, representing 28% of their annual order goal of $9.5bn. Hanwha Ocean has obtained orders for 5 vessels, totaling $1.06bn, achieving about 15.2% of its target of $6.98bn. (Bloomberg) Dlala Brokerage and Investment Holding Company discloses the issuance of the judgment in Case No. (98//2023/investment/commercial/general) in favor of one of its subsidiaries - Dlala Brokerage and Investment Holding Company discloses that it has been informed by the external law firm of the issuance of the court Judgment in Appeal No. (98/2023/appeal/investment/commercial/General) submitted by one of its subsidiaries against the judgment in Case No. (555/2022/ investment / commercial / General) filed against one of the contractor, which Judgment to cancel the appealed judgment and oblige him to return to the company the sum of (7,750,000) seven million seven hundred and fifty thousand Qatari riyals. (QSE) QCB grants paywise license - The Qatar Central Bank (QCB) has granted Paywise (Dibsy) a license to provide digital payment services in a continuation of the efforts to develop and reinforce the financial technology sector (Fintech). In a tweet, QCB said that the number of companies under QCB’s supervision in the Fintech sectorhas reachednine companies. (Peninsula Qatar) ‘Real estate second fastest growing sector in Qatar’ - Prime Minister and Minister of Foreign Affairs HE Sheikh Mohammed bin Abdulrahman bin Jassim Al Thani inaugurated the first Qatar Real Estate Forum 2023 yesterday. The two-day event is being organized by the Ministry of Municipality under the theme ‘Regulations and Legislations for an Optimal Quality of Life and a Sustainable Real Estate Industry'. The slogan of ‘Real Estate Regulatory Authority’ was launched at the opening ceremony, marking a new phase of the institutional work for the real estate sector in Qatar, after the issuance of Amiri Decision No. 28 of 2023, under which the authority was established. The Prime Minister also toured an associated exhibition showcasing the latest technologies in the field of engineering, technology and the sustainable real estate industry by exhibitors from prominent private companies working in the real estate sector in Qatar. The opening ceremony was attended by a number of ministers, ambassadors, and senior officials from Qatar and abroad, as well as representatives of local and regional companies. Addressing the event, Minister of Municipality H E Dr. Abdullah bin Abdulaziz bin Turki Al Subaie said the forum aims at highlighting the tireless efforts made by Qatar to support the real estate sector and its sustainability to make it an exceptional investment destination. “The real estate sector today is one of the fastest growing sectors in Qatar, as it ranks second after the energy sector, by attracting investments exceeding QR82bn equivalent to over $23bn during 2022 when 135 real estate projects were launched,” he said. He said the forum comes in light of the unprecedented success achieved by Qatar by hosting FIFA World Cup Qatar 2022, which had a positive impact in attracting a large number of foreign investors, thus enhancing the distinguished position that Doha occupies today as a thriving financial, commercial and eco-nomic center. “The forum holds dialogues for exchanging views, in order to enhance synergies between the main parties in the economic arena at the local, regional and international levels,” said Al Subaie. The Minister also touched on the remarkable rise and annual growth achieved by Qatar in foreign direct investment projects, which amounted to 70% between 2019 and 2022, with an expected growth of 2.4% by the end of 2023.“This made Qatar ranked first among the best countries attracting foreign direct investment in the world for the year 2023.” He stressed the great interest that Qatar attaches to the development of the real estate sector, under the wise leadership of Amir HH Sheikh Tamim bin Hamad Al Thani. The Minister said that the forum comes in the wake of the issuance of Amiri Decision No. 28 of 2023, establishing the Real Estate Regulatory Authority, which is a pioneering and important step to strengthen this vital sector and continue its development, by organizing, motivating and contributing to its advancement. This is, he said, in implementation of the state’s policies

- 3. qnbfs.com Daily MarketReport Monday, 05June2023 and ambitious directions within the Qatar National Vision 2030, taking into account economic and social development plans, and achieving urban development in a balanced and integrated manner that preserves the quality of life and sustainability. The Minister said Qatar has one of the best infrastructures of the world, and also ranked first among the safest countries for the fifth year in a row. (Peninsula Qatar) Al-Kaabi meets director of National Energy Administration of China - HE Saad bin Sherida al-Kaabi, the Minister of State for Energy Affairs, Sunday met with Zhang Jianhua, the director of the National Energy Administration of China. Discussions during the meeting dealt with energy relations and co-operation between Qatar and China and means to enhance them. (Gulf Times) Minister Al Subaie: Qatar’s foreign direct investments surge by 70% in 3 years - Qatar has witnessed an impressive 70% annual growth in foreign direct investment projects between 2019 and 2022, solidifying its position as a leading recipient of foreign direct investment worldwide. This projection was highlighted by His Excellency Minister of Municipality Abdullah bin Abdulaziz bin Turki Al Subaie duringhis address at the Qatar Real Estate Forum 2023, which commenced today at the Sheraton Doha Hotel. Minister Al Subaie emphasized that the real estate sector in Qatar has emerged as one of the fastest-growing industries, ranking second only to the energy sector. With investments surpassing QR 82bn (over $23bn) and the initiation of 135 real estate projects in 2022, the sector continues to flourish. The minister attributed this remarkable achievement to Qatar’s world-class infrastructure and its status as the world’s safest country for the fifth consecutive year. Qatar boasts highly advanced health and education sectors, a flexible sovereign fund, robust financial institutions, and an environment conducive to business growth, fostering a steady increase in local investments. Additionally, Qatar stands as the first Middle Eastern nation to have all its municipalities awarded the Healthy City title by the World Health Organization. Minister Al Subaie praised the collective efforts of the country’s sectors in providing sustainable options to ensure the health and well-being of Qatar’s residents. He also commended their dedication to implementing a comprehensive urban plan and directing infrastructure investments, aligning with the Ministry of Municipality’s national and sustainable development strategy. These endeavors are crucial steps towards realizing the Qatar National Vision 2030, which aims to achieve comprehensive economic, social, and environmental development for the country in the coming decades. Furthermore, Minister Al Subaie highlighted the significant impact of hosting the FIFA World Cup Qatar 2022 in attracting a multitude of foreign investors. Doha now stands as a thriving financial center, facilitating dialogues and the exchange of ideas to enhance synergies among key players in the local, regional, and international economic arenas. Expressing his delight at the inauguration of the first edition of the Qatar Real Estate Forum 2023, Minister Al Subaie underscored the event’s focus on regulations, legislation, and their role in fostering a sustainable real estate industry. The forum aims to showcase regional and global best practices and experiences in the sector, fostering an environment conducive to real estate investment. The minister expressed gratitude for the State of Qatar’s unwavering commitment to developing the real estate sector, under the wise leadership of HH the Amir Sheikh Tamim bin Hamad Al-Thani. He also noted the establishment of the Public Authority for Regulating the Real Estate Sector through Amiri Order No. 28 of 2023, marking a significant milestone in strengthening and advancing this vital sector. (Qatar Tribune) Diar CEO: Qatar is fertile ground for real estate investment - The CEO of Qatari Diar Real Estate Investment and Development Company Eng. Abdullah bin Hamad Al Attiyah said the State of Qatar is a fertile ground for real estate investment as land prices have spiked multiple times, pointing out that Qatar is one of the most secure countries in the world and is politically and economically stable. During the 2nd session of Qatar Real Estate Forum that was held under the theme of real estate’s foreseeable future, Eng. Abdullah bin Hamad Al Attiyah revealed that Diar’s investments size in 27 countries around the world reaches over $60bn, pointing out that the company focuses on profitability and transformation when it carries out projects which positively affect the place and environment in which the company invests and contributes to changing them for the better. This sector is the best economic one for any country in the world, he emphasized, adding that the State of Qatar and the rest of world countries generally scramble to attract foreign investments to this sector, because it operates other numerous sectors and offers multiple job opportunities whether in construction or operation phases. He added that the State of Qatar is like other countries which tries to attract investors and real estate developers through providing a wide range of legislative, tax and infrastructure facilitations, along with free ownership assurances and others. He pointed out that infrastructure in Qatar has been designed to accommodate 5mn people whilst the current number of populations is 2.7mn which implies that it is essential to focus on axes that contribute to driving the number of populations, including the Real Estate ownership law. Eng. Abdullah bin Hamad Al Attiyah outlined that political stability, separating policy from economy and existential non-bureaucratic system are one of the critical factors for investment abroad. However, this does not imply non-investment in countries that do not have political stability, because those countries have opportunities whose profitability cannot be recompensed, therefore companies never close doors in front of assured profitability, he said. Unless investors feel that they are protected in the country where they invest this means that investment will be increasingly challenging, he underlined. He pointed out that real estate is persistently growing and it can slow down but never end, confirming that when people compare real estate prices during the 1980s with the current status, they will discover that prices have been doubled with 500%, asserting that hosting the FIFA World Cup Qatar 2022 was the beginning for Qatar but not the end, adding that such a tournament revealed that the State of Qatar is a secure and perfect family place for people to live and invest and the country has been working for future not for the tournament only. Eng. Al Attiyah added that the tournament was a big challenge and motive for Diar to prove that Lusail City that was implemented by the company had been ready to hold the tournament in a record time, noting that the city is designed to accommodate 450,000 people whose population number has increased with more than 5% compared to the same period of last year, which underscores the substantial growth Lusail is witnessing, whose infrastructure had been connected with public utilities by leveraging the cutting-edge technology. (Qatar Tribune) Qatar expanding economic ties with Central Asia for diversification - Sheikh Faisal bin Qassim Al-Thani, Chairman of the Qatari Businessmen Association (QBA), highlighted Qatar’s strategy to diversify and expand its revenue sources beyond energy by building economic relations with countries worldwide. In pursuit of this goal, Qatar has focused on expanding its relations with Central Asian countries due to the economic and investment opportunities they offer, which can result in significant benefits for both sides, stated Sheikh Faisal in an interview with QNA. Referring to the upcoming visit of HH the Amir Sheikh Tamim bin Hamad Al-Thani to Uzbekistan, the first stop of his Central Asian tour, Sheikh Faisal emphasized the importance of the visit. He noted that Uzbekistan, with its natural resources and natural gas reserves, presents attractive investment prospects for Qatari companies in sectors such as energy, agriculture, medicine, banking, and the halal industry. He highlighted Uzbekistan’s recent legislative reforms and economic laws, which have enhanced its investment appeal. Moreover, Sheikh Faisal emphasized the strategic geographical position of Uzbekistan, making it a vital gateway to a market with over 300mn consumers in Central Asia. He stressed Qatar’s keen interest in developing trade and economic relations with Uzbekistan, particularly in the agricultural sector. Uzbekistan currently exports 60% of its agricultural products to Asian countries and Russia, offering substantial trade potential. To facilitate communication and identify available opportunities, HE Sheikh Faisal bin Qassim Al-Thani underscored the importance of establishing a joint business council between Qatari and Uzbek businessmen. Such a council would enhance the potential for effective partnerships and enable Qatari and Uzbek companies to collaborate successfully. He further expressed the QBA’s readiness to participate in these councils. In conclusion, Sheikh Faisal called on friendly countries to establish joint funds involving associations and companies, with potential government participation. This initiative would streamline the process of exploring opportunities across various fields and facilitate the export and marketing of products worldwide. (Qatar Tribune)

- 4. qnbfs.com Daily MarketReport Monday, 05June2023 Realty experts give insights on industry challenges, objectives - The first day of the Qatar Real Estate Forum witnessed several experts providing insights into the industry as a whole and how it is performing in the GCC market. During the session entitled ‘Governance of the real estate sector’, industry officials explicated the impact of regulations and legislation on the development of the real estate sector in the region. The panelists included Saeed Abdulla Saeed Al Suwaidi, Assistant Undersecretary for Real Estate Registration and Authentication Affairs Chairman of the Committee for Non-Qatari Ownership and Use of Real Estate, representing Qatar, Eng. Abdullah Saud Al Hammad, CEO, Real Estate General Authority, Saudi Arabia, Eng. Essam Abdullah Khalaf, Chairman of the Board of directors of the Real Estate Regulatory Authority, Bahrain, Marwan Ahmed bin Ghalita, CEO of the Real Estate Regulatory Agency Dubai Land Department, UAE, Dani Kabbani, Managing Partner at Eversheds Sutherland and was moderated by Khalid Al Yahya. Qatari official Al Suwaidi explained that “Today the governance in the real estate market is working very hard to develop ideas and make it successful”. He lauded the position of Qatar in the realty industry as enormous projects are flowing in with modern infrastructures and facilities attracting investments. He said: Today, Qatar is one of the best in the world and in the licensing of the construction sector, Qatar ranks 13th.” The official also stated that by looking at accurate data, huge transactions and projects are being carried out in the country. Expounding on the obstacles in the real estate sector in Saudi Arabia, one of the biggest GCC markets, Eng. Al Hammad said that “There are two main challenges for us in the real estate sector. They are not having clear ideas of activities and not unifying the strategic goals in terms of social and economic goals.” He highlighted that GCC is the second biggest market for real estate and one of the key sectors includes housing. “There are three main stakeholders in the industry such as buyers, developers, and practitioners,” Eng. Al Hammad said. The Saudi official also emphasized that the first edition of the real estate forum is a “platform that promises” various real estate activities to make a positive impact in the GCC market. The experts also spoke on the legal and regulatory framework to promote Qatar’s real estate industry in the country and on the establishment of the public authority for regulating the real estate sector. Representing the Kingdom of Bahrain, Eng. Khalaf said “As we speak about this topic, the objective is to highlight the real estate authority which established the law. This law was made to enable the plans of development and to look at the main pillars supporting economies in the GCC and Bahrain. “Eng. Khalaf also said that there are various complex issues involved including cities because “big investments are open for citizens in the GCC and for foreign nationals, they can invest in resorts, schools and other facilities available. “The expert elucidated that these projects are implemented to maintain relationships between stakeholders, especially investors. He also said that “numerous success factors like stability, security and modern infrastructures and existing services for investors ensures a promising environment.” “Health sector and educational services are also vital as investors must feel free to invest and feel that this country is like their own home. These laws will ensure that the investor acquires all of them,” he added. For his part, Ghalita out-lined the significance of the real estate sector in the UAE. He said, “I look at primarily two things, and that includes maintaining the rights and governance.” He also stressed that any investor having the desire to work in the sector will need to maintain his right. (Peninsula Qatar) Global Trading and Shipping closes its first transaction involving investment of QR41mn - Global Trading and Shipping WLL (GTS), Qatar, a company founded by S’hail Shipping and Maritime Services for developing strategic investments structured to deliver sustainable growth in maritime industry has successfully closed its first transaction. This involved an investment of QR41mn towards acquiring MV Ripley Prosperity (2008 Japan built dry bulk carrier of 76565 dwt) with long term bareboat charter to Ripley Prosperity Ltd, UAE of Ripley Group of India. Ripley Group is a well-established player in Port and Terminal Operations, Stevedoring and Cargo handling, Owning/operating maritime assets including floating cranes, tugs, barges, bulk terminals particularly in east coast of India. The closing was held in Dubai on 31 May 2023. Gracing the occasion, Jaber Al Mohannadi (Vice-Chairman of GTS) congratulated the team for conceptualizing, developing, and executing this unique transaction. During the closing, Shoumik Bose (Promotor of Ripley Group) expressed his deep satisfaction, said he is delighted by joining hands with GTS. He pointed out that India is now the world’s destination for business growth. He therefore looks forward to growing and strengthening this relationship by exploring business opportunities of mutual interest. Rajiv Pal (CEO-S’hail Shipping), who was also present at the time of closing, was pleased to see the conclusion of the transaction developed through in-house expertise meeting the expectations of all the stakeholders. Global Trading and Shipping WLL headed by Girish Jain, is a growing warehouse of investments in maritime industry encompassing from asset ownership held to maturity such as ships and terminals to asset management including ship management and chartering. (Peninsula Qatar) Nebras Power builds, operates large power generation project - Over the past few years, Nibras Energy has witnessed significant expansion in its investments in various regions worldwide, particularly in Central Asia, including Turkiye and Uzbekistan. Uzbekistan is the latest destination for Nibras Energy company, with its initial investments focused on signing a long-term Power Purchase Agreement (PPA) in the country. The objective is to build and operate the Syrdarya II Combined Cycle Gas Thermal (CCGT) power plant in the central region of the country. The project, expected to enter production by the end of 2025 or early 2026, aims to expand Nibras Energy’s global asset portfolio. In addition, it seeks to provide communities and cities across the country with access to a reliable and cleanenergy source. Thepresence in Uzbekistanreaffirms the company’s stature and the role it plays as one of the major energy companies in Central Asian countries. Nibras Energy is proud to be awarded this opportunity to develop and manage a large-scale power project in Uzbekistan. It also promises to deliver significant technical and project expertise to support and strengthen the country’s power industry. In its first investment in Uzbekistan, Nebras Power partnered with an international consortium of power companies, including French company EDF (Electricité de France) and Japanese-based Sojitz Corporation and Kyuden Group. The alliance submitted the winning tender to build and manage the 1600 MW power facility in the region of Syrdarya, which is located approximately 150 km south of the capital city of Tashkent. Syrdarya II is contracted to provide power to the National Power Grid of Uzbekistan as part of a 25-year off-take agreement. It will be one of the nation’s largest power-generating facilities upon completion and will be instrumental in helping the country meet its growing energy demands from both industry and residential sectors. Enersok, a newly formed project company, will be tasked with carrying out the construction and management of Syrdarya II. As part of the sales purchase agreement, Nebras will control 33.3% of Enersok, while the remaining shares will be divided amongst EDF, Sojitz and Kyuden. The building of Syrdarya II will follow international guidelines on sustainability and conservation. Operations and maintenance will also adhere to stringent industry and environmental emission standards and protocols. (Peninsula Qatar) QT campaign boosts long-term tourism strategy - Qatar Tourism’s summer campaign is set to contribute significantly to the country’s long- term tourism strategy. Chief Operating Officer of Qatar Tourism (QT), Berthold Trenkel, expressed his confidence in the ongoing campaign, highlighting its potential to not only attract tourists but also to foster sustainable growth in the industry. “Qatar Tourism’s summer campaign goes above and beyond in its efforts to attract tourists by offering a packed schedule of activities, enticing hotel promotions, and creating a vibrant atmosphere throughout the country,” Trenkel told The Peninsula. The campaign offers diverse activities, ensuring that there is something for every visitor to enjoy. From cultural festivals and sporting events to immersive experiences and family-friendly attractions, the campaign aims to create a vibrant and engaging atmosphere throughout the country. “This comprehensive approach creates a highly appealing destination for tourists to spend their summer months in Qatar, leading to increased visitor numbers, eco-nomic growth, and a sustainable future for the tourism industry.” One of the key aspects of the summer campaign is enticing hotel promotions. Qatar Tourism has collab-orated with various hotels and accommodations to provide attractive packages, discounts, and special offers for visitors. This initiative aims to make Qatar an even more appealing destination, encouraging tourists to choose it as their preferred summer getaway. The COO said: “By aligning with Qatar Tour-

- 5. qnbfs.com Daily MarketReport Monday, 05June2023 ism’s strategic objectives of doubling employment in the sector, increasing in-country tourism spend, and boosting the sector’s contribution to GDP by 2030, the summer campaign serves as a catalyst for achieving these goals.” Qatar aims to attract over 6mn visitors annually by 2030.Qatar has been making significant investments in its tourism infrastructure and attractions in recent years, including the construction of world-class hotels, the development of cultural and sporting venues, and the enhancement of transportation networks. These efforts have helped position Qatar as an emerging tourism destination. Qatar Tourism has curated a line-up of thrilling activities and recommendations from family-friendly adventures, summer water activities, indoor wonders, cultural offerings from museums and libraries, shopping options from a wide range of malls in the country, and its top ten picks of Qatar beaches. (Peninsula Qatar) Municipality Minister: Qatar developing laws to boost realty sector - The Ministry of Municipality is developing Property Owners’ Association Law and other laws and regulations to govern real estate sector, which are being prepared with the concerted efforts of all relevant ministries and agencies in the country, including the Ministry of Justice. Minister of Municipality HE Dr. Abdullah bin Abdulaziz bin Turki Al Subaie said that the Ministry is supporting the development and regulation of real estate sector through the preparation of laws, legislation and regulations that will help in regulating the real estate sector, which include amending the “Real Estate Development Law” that was approved in 2023.He said that it also included the issuance of the “sorting of real estate and real estate units” decision, whichregulates off-plan sales. TheMinister was speaking yesterday in a panel discussion on ‘Future Trends in Real Estate’ at First Qatar Real Estate Forum which is being held at Sheraton Hotel. The panelists also included HE Mutlaq Naief Omar Abu Raqaba Al Otaibi, Minister of Electricity,Water and Renewable Energy and Ministerof State for Housing, Kuwait and HE Eng. Hamad Ali Sulaiman Al Nazwani, Undersecretary of Oman’s Ministry of Housing and Urban Planning for Housing, Oman. Mohamed Al Marri moderated the session. The Minister of Municipality added that the Ministry is currently working on establishing a unified electronic real estate platform since the beginning of the first quarter of this year, with the aim of developing a central real estate platform that provides real estate indicators for stakeholders in the real estate sector in Qatar, He said that the platform will ensure transparency and provide support to decision makers in that sector. “The project is based on collecting real estate data from its various sources in the Ministry of Municipality and other relevant parties in the Qatar, to analyze and upload real estate data in a central platform, to achieve the future and strategic goals of the real estate sector in the Qatar,” said Al Subaie. He said that these steps are within the support of the Ministry and all development partners to transform the sector into a sustainable industry. The Minister said that the government reinforced these steps with the issuance of Amiri Decision No. 28 of 2023, to launch the “Real Estate Regulatory Authority”. He said that Authority will be responsible for creating an attractive real estate investment environment, which requires assistance and support from all relevant ministries and agencies in the real estate sector. The Ministry will support this through the preparation and implementation of a number of projects that will promote the development of the real estate sector and make it a competitive sector at the regional and global levels, such as the “National Strategy for Open Areas and Recreational Activities” that is being prepared. (Peninsula Qatar) HIA reaffirms commitment to environmental sustainability - Hamad International Airport (HIA) supports the UN’s World Environment Day theme for 2023 – to Beat Plastic Pollution -- which focuses on encouraging people and businesses around the world to review their plastic consumption and introduce a shift towards a circular economy. Part of HIA’s environmental sustainability goals consists of waste management and reducing greenhouse gas emissions. The airport is tackling its waste management processes, and engaging with commercial stakeholders and government entities in order to adopt the best environmental standards that will have a positive impact on the environment. Beating plastic pollution: Thanks to an improved waste management system implemented at the airport, approximately 40% of the waste generated by airport operations in the fiscal year 2022-2023 was reused or recycled, including 736 tonnes of plastic waste. Non-recyclable waste is used to produce electricity. The Oryx Airport Hotel, situated at departures, has replaced plastic with more sustainable solutions, with water containers created from 76% vegetable origin replacing plastic bottled water, introducing bamboo guestroom cards, utilizing recycled paper for all hotel collaterals and substituting plastic hotel amenities with more biodegradable materials. Managing airport waste: To maintain the airport landscape features and requirements, organic fertilizer originating from recycled green waste is used. It was introduced as one of the initiatives by HIS’s partnership with theMinistryof Municipality. Through the airport’s dedicated wastewater treatment plant, 100% of the wastewater generated from the airport is reused for landscape irrigation, resulting in zero wastewater being discharged to the sea. HIA’s commitment to environment protection and objective of zero waste to landfill has initiated processes to further enhance its waste management systems, resulting in over 1,200 tonnes of waste being diverted from landfill for further segregation, recycling and energy recovery, each month. Energy conservation and greenhouse gas emissions During the construction of the airport, energy conservation was a key environmental factor taken into account. The structural design was specifically planned to facilitate energy conservation necessary for cooling purposes. Additionally, solar materials were carefully selected for the installation of the roof and walls, further enhancing the airport’s energy-saving capabilities. Since then, HIA has implemented multiple initiatives and environmental controls to further reduce energy within its daily operations such as cooling system optimization, smart-metering, ambient air quality and noise monitoring, and incorporating LED lighting to control and reduce carbon dioxide emissions at the airport. HIA’s efforts to decrease its overall carbon dioxide emissions was recognized through the recent renewal of its ACI ACA Level-3 of the Airport Carbon Accreditation. Furthermore, HIA has been awarded the ISO 14001 Environmental Management Systems accreditation, demonstrating its effective implementation and adherence to the ISO 14001:2015 requirements in managing environmental aspects. The Global Sustainability Assessment System (GSAS) from Gulf Organization for Research & Development (GORD) granted a 4-star rating for six of the airport’s projects from its recent expansion plan, including the ORCHARD, Oryx Garden Hotel and lounges at the North Plaza, Al Mourjan Business lounge - the Garden, the Remote Transfer Baggage Facility, Cargo Bridging Facility and the AVI Facility. HIA is actively involved in collaborating with airport stakeholders and commercial partners to implement environmentally friendly solutions aimed at reducing energy consumption. The airport is dedicated to investing in cutting-edge technologies that are both efficient and reliable to achieve its environmental objectives. These initiatives align with Qatar’s National Vision 2030, which emphasizes sustainable development and environmental preservation. (Qatar Tribune) Ooredoo, Axon ink strategic agreement to advance public safety technologies - Leading international communications company Ooredoo announced a strategic agreement with Axon, a global leader in connected public safety technologies. With this partnership, Ooredoo, leading provider of Internet of Things (IoT) managed connectivity and solutions to customers across its global footprint, will be Axon’s preferred connectivity provider in Middle East and North Africa, covering Algeria, Tunisia, Jordan, Kuwait, Qatar, Oman, Iraq and Bahrain. Axon, headquartered in Scottsdale, Arizona, leverages a suite of connected devices and software solutions for public safety. Axon’s network includes TASER energy devices, body-worn cameras, in-car cameras, cloud-hosted digital evidence management solutions, productivity software and real- time operations capabilities. Ooredoo stands to consolidate and build on its profile as leading IoT managed connectivity provider reinforced across the region, including some of the world’s largest manufacturers of connected products – will benefit from the best IoT managed connectivity in the region, with full local support and single points of contact. End-to- end customers will also experience enhanced services. Ooredoo Group operating companies in Qatar, Kuwait, Algeria, Tunisia, Iraq and Oman will feature in the partnership, which will take shape via a phased roll-out. (Bloomberg)

- 6. qnbfs.com Daily MarketReport Monday, 05June2023 International CaixinPMI:China's services activitypicks up in Mayon improveddemand - China's services activity picked up in May, a private-sector survey showed on Monday, as a rise in new orders shored up a consumption-led economic recovery in the second quarter. The Caixin/S&P Global services purchasing managers' index (PMI) rose to 57.1 in May from 56.4 in April. The 50-point mark separates expansion from contraction in activity. The reading contrasts with the official PMI released last week that showed a slower pace of expansion in the services sector. Some economists warn the pent-up demand for in-person services may fade due to slowing income growth and mounting unemployment pressures, raising headaches for policymakers alreadystruggling with weakforeign demand and an uneven post-COVID recovery. The Caixin survey showed service companies reported a rise in new business last month when the first May Day holiday following China's COVID reopening boosted orders for hotels, restaurants and travel agencies. Increased workloads led firms to grow headcount for the fourth consecutive month, although the speed of job creation slowed. Average prices charged by service companies rose by the fastest since February 2022. The survey also indicated that capacity pressures persisted, as highlighted by sustained growth in outstanding business. Caixin/S&P's composite PMI, which includes both manufacturing and services activity, picked up to 55.6 from 53.6 in April, marking the quickest expansion since December 2020. Even if firms in the services sector remained upbeat with business activity over the next 12 months, the level of optimism eased to the lowest since December 2022 when Beijing lifted anti-virus curbs. China's economy rebounded faster than expected in the first quarter but lost momentum at the beginning of the second quarter as April data broadly undershot forecasts. Factory activity in May shrank faster than expected on weakening demand, reinforcing the unbalanced feature in the economic recovery. "In general, it remains a prominent feature of the Chinese economy that the services sector is stronger than manufacturing," said Wang Zhe, senior economist at Caixin Insight Group. "This divergence highlights that economic growth is lacking internal drive and market entities lack sufficient confidence, underscoring the importance of expanding and restoring demand," he said. (Reuters) Japan's service activity expands at record pace in May - Japan's service sector activity expanded at a record pace in May, a private-sector survey showed on Monday, thanks to a recovery in overseas demand and a surge of foreign tourists as pandemic restrictions were eased further. The final au Jibun Bank Japan Services purchasing managers' index (PMI) rose to a seasonally adjusted 55.9 last month from the previous peak of 55.4 in April. That compared with the flash reading of 56.3 and was well above the 50-mark that separates expansion from contraction for a ninth straight month. "Firms were buoyed by the easing of the few remaining pandemic restrictions and have noted strong increases in demand, notably from overseas and inbound tourism," said Usamah Bhatti, economist at S&P Global Market Intelligence. "The upward trend looks set to continue in the near and medium term," as outstanding business expanded at a record rate and business optimism held near an all-time high. The government has scrapped strict pandemic-related border controls and reclassified COVID-19 to the same level as seasonal flu. The number of foreign visitors to Japan climbed to a post-pandemic high of nearly 2 million in April. The subindex measuring outstanding business rose at the fastest pace on record as disruptions caused by the pandemic continued to wane. Business expectations for the coming year remained robust, though the pace of increase slowed slightly from April, the survey showed. Service sector companies hired more workers for the fourth month in a row, with the rate of job creation the second fastest since September 2007. Input prices and prices charged for services continued to rise but at a slower pace than in April. The composite PMI, which combines the manufacturing and services activity figures, expanded at the fastest pace since October 2013. The index advanced to 54.3 in May from 52.9 in April, staying above the break-even 50 mark for the fifth straight month. (Reuters) Regional Saudi to cut oil output in July; Opec extends deal into 2024 - Saudi Arabia will make deep production cuts in July as part of a broader output-limiting Opec+ deal as the group faces flagging oil prices and a looming supply glut. Saudi EnergyMinister Prince Abdulaziz said the cut of 1mn barrels per day (bpd) by Riyadh could be extended beyond July if needed. "This is a Saudi lollipop," he said. Opec+, which groups the Organization of the Petroleum Exporting Countries and allies led by Russia, reached a deal on output policy after seven hours of talks and decided to reduce overall production targets from 2024 by a further total of 1.4mn barrels per day. However, many of these reductions will not be real as the group lowered the targets for Russia, Nigeria and Angola to bring them into line with their actual current production levels. By contrast, the United Arab Emirates was allowed to raise output. Opec+ pumps around 40% of the world's crude, meaning its policy decisions can have a major impact on oil prices. Opec+ already has in place a cut of 2mn bpd agreed last year and amounting to 2% of global demand. In April, it also agreed a surprise voluntary cut of 1.6mn bpd that took effect in May until the end of 2023. Saudi Arabia said yesterday it would extend its portion of voluntary cuts of 0.5mn bpd into 2024. It was not clear if the July reduction of 1mn was on top of 0.5mn bpd or the latter would be included in the July reduction. The April announcement helped to drive oil prices about $9 per barrel higher to above $87, but they swiftly retreated under pressure from concerns about global economic growth and demand. On Friday, international benchmark Brent settled at $76. Western nations have accused Opec of manipulating oil prices and undermining the global economy through high energy costs. The West has also accused Opec of siding with Russia despite Western sanctions over Moscow's invasion of Ukraine. In response, Opec insiders have said the West's money-printing over the last decade has driven inflation and forced oil-producing nations to act to maintain the value of their main export. Asian countries, such as China and India, have bought the greatest share of Russian oil exports and refused to join Western sanctions on Russia. (Gulf Times) IATA regional chief: Air passenger numbers in Middle East to double by 2040 - Air passenger numbers in the Middle East will double to 550mn by 2040, International Air Transport Association (IATA) regional vice- president (Middle East) Kamil al-Awadhi said Sunday. GCC carriers will continue to drive the Middle Eastern growth, al-Awadhi told Gulf Times in Istanbul. However, IATA did not provide a breakup of the projected passenger numbers in the GCC region during the review period. Al- Awadhi also said the Middle Eastern carriers, particularly, those based in energy-rich GCC, are looking increasingly at sustainable aviation fuel (SAF) because of their focus on environment. But he admitted that there was not enough SAF in the market to meet the growing needs of airlines. “Airlines cannot do much about it; they don’t produce SAF,” al-Awadhi noted. Recently, Qatar Airways signed a deal with Shell to source 3,000 metric tonnes of neat SAF at Amsterdam Schiphol airport. It encompasses the existing jet fuel contract with Shell at Amsterdam which will now see Qatar Airways using at least a 5% SAF blend over the contract period for the fiscal year 2023-2024. Qatar Airways' bilateral agreement with Shell is part of a wider effort initiated by the one world alliance, which has set the target of using SAF for 10% of combined fuel volumes by 2030. Qatar Airways is the first carrier in the Middle East and Africa to procure a large SAF amount in Europe beyond government mandates. SAF offers significant potential for decarbonization as the neat fuel can reduce full lifecycle emissions by up to 80% compared to conventional jet fuel. This means that Qatar Airways will be reducing its emissions on flights from Amsterdam by approximately 7,500 tonnes of CO2 for the fiscal year. Meanwhile, IATA’s latest data indicate Middle Eastern airlines posted a 38% traffic increase in April this year compared to a year ago. Capacity climbed 27.8% and load factor rose 5.6 percentage points to 76.2%. On the cargo side, Middle Eastern carriers experienced a 6.8% year-on-year decrease in volumes in April this year. This was a slight decline in cargo sector performance compared to the previous month (-5.5%). Cargo capacity increased 10.0% compared to April 2022. Middle East will be one of world’s fastest-growing aviation markets in the next decade, according to management consulting firm OliverWyman. In a recent report, OliverWyman noted the Middle East remains among the fastest-growing aviation markets in the world, with the regional fleet set to expand 5.1%

- 7. qnbfs.com Daily MarketReport Monday, 05June2023 annually over the next decade. The maintenance, repair, and overhaul (MRO) sector will grow at a compound annual growth rate (CAGR) of 4.9% during the same period. The Middle East aviation market is heavily dependent on international travel, which has been slower to rebound to pre-pandemic levels than domestic travel. However, last year the region benefitted from air traffic around events such as the World Cup, which was held in Qatar in the final two months of the year. The Middle East’s share of the global fleet will grow over the decade from 4.9% in 2023 to 6% in 2033. Meanwhile, the global fleet is projected to expand one-third by 2033, to well over 36,000 aircraft, with Oliver Wyman also anticipating a record number of aircraft deliveries over thenext 10 years (despite current supply chain constraints). The Middle East fleet’s growth over the next decade will primarily be driven by the addition of narrow bodies. Historically, the Middle Eastern fleet has been primarily made up of wide bodies. But moving forward, narrow bodies will increase to 48% of the fleet from 39%, while wide bodies will decline to 48% from 56%, OliverWyman said. (Gulf Times) Saudi authority approves over $8bn in financing to boost Saudi economy - The Development Ecosystem in the Kingdom of Saudi Arabia, the National Development Fund (NDF), and its supervised development funds and banks concluded 2023’s first quarter with numerous achievements, agreements, and new development initiatives, focusing on achieving economic, social, and cultural objectives of Saudi Vision 2030 and maximizing the developmental impact on the Saudi economy. These achievements included signing cooperation agreements and financing beneficiaries from various economic sectors and segments of society with over SAR 30bn approved financing and support in the last quarter. Industry: According to the quarterly report issued by the Media Center of NDF, the Saudi Industrial Development Fund (SIDF) approved over SAR 875mn in financing for 24 businesses. SIDF signed an agreement with the Small and Medium Enterprises General Authority (Monsha'at) to operate the program “How to start your industrial project?” that targets empowering entrepreneurs and facilitates their enrollment in the industrial sector through building knowledge, developing, and motivating young Saudi men and women interested in the industrial sector. Additionally, SIDF supported over 100 beneficiaries through the industrial fund’s academic and advisory programs. Tourism: The Tourism Development Fund (TDF) approved over SAR 260mn in financing to 11 businesses in the tourism sector and served 57 beneficiaries through its pre-financing counseling and logistical support programs. During the first quarter, TDF sponsored Foras Forum and Biban 23 Forum as the enabling partner for the two events to raise awareness of the Fund's services and encourage new investments. Moreover, as part of its efforts to attract private sector investors, TDF signed memorandums of understanding with various local and international companies. These included signing a financing agreement with Ezdihar Real Estate Development Company to establish the Jeddah Cove project, signing a memorandum of understanding with Ashraq Development Company to develop a tourist resort on the Half Moon Bay in the eastern region operated by Accor, one of the world's leading hotel and hospitality companies. Culture: To boost cultural projects, the Cultural Development Fund (CDF) provided support that exceeded SAR 15mn and issued guarantees amounting to SAR 16mn. During the first quarter, the fund launched a program for financing the film sector with a budget of SAR 879mn as part of Ignite initiative to provide financing and investment solutions to encourage an active and sustainable film sector by providing financing packages dedicated to the development, production and distribution of feature films and series, and empowering investors in the film sector. The fund also sponsored several initiatives to support authors, artists, and cultural content makers. Human Capital: In developing human capital, the Human Resources Development Fund provided support to more than 836,000 individuals and 73,000 enterprises, with value amounting to more than SAR 2.2bn in employment support programs, empowerment programs, job search assistance, and training, contributing to employing more than 96,000 individuals in the Saudi labor market. The Fund also launched its new strategy and identity under the slogan "Empowerment and Partnerships," which focuses on stimulating the private sector's contribution to Saudization and strengthening partnerships with all relevant parties in training and employment to empower national cadres and increase their competitiveness in the labor market. Small and Medium Enterprises: In cooperation with partners and financial institutions, the Small and Medium Enterprises Bank provided over SAR 1.1bn in financing through the financing portal and the indirect lending initiative to 301 SMEs. The bank also signed a set of agreements and memorandums of understanding to enhance its activities and support the business environment in the Kingdom. In addition, during the first quarter, the bank launched the "Financing in Two Days" initiative, which provides direct financing to targeted enterprises. Society and Entrepreneurs: During the first quarter of 2023, the Social Development Bank (SDB) provided financing to about 9,000 individuals, with a value amounting to SAR 454mn, and to about 25,000 beneficiaries in freelance, with a value amounting to SAR 1.5bn, and 3,000 small and emerging enterprises, with a value amounting to SAR 1.1bn. Moreover, SDB approved the first financings to grow this sector with a total value of SAR 14.2mn to boost Gaming and Esports in the kingdom. The bank also signed agreements and memorandums of understanding with the private sector during the financial sector conference, which was held on 15-16 last March. These memorandums come within the cooperation framework to improve SDB’s savings programs in cooperation with commercial banks. Real Estate Development: The Real Estate Development Fund (REDF) served about 21,000 beneficiaries of housing support programs and enabled them to sign their financing contracts with total value accounting to SAR 13.7bn. Additionally, REDF deposited more than SAR 2.7bn to “Sakani” beneficiaries during the first quarter of 2023, continuing its contributions to the objectives of the Housing Program, one of the Saudi Vision 2030 programs. Moreover, the real estate advisor service of REDF recorded about 53,000 new beneficiaries during the last quarter and issued more than 36,000 financing and housing recommendations. Agriculture and Food Security: The Agricultural Development Fund provided over SAR 2.6bn in financing to more than 2086 individuals and 21 establishments during the first quarter of 2023. The fund financed various projects and segments: small farmers and breeders, poultry projects, greenhouse projects, fish production in inland waters, and dates production. The fund also approved financing to construct silos for storing grains in three locations in the Kingdom, in addition to financing the import of agricultural products targeted in the food security strategy. Non-oil Exports: The Saudi Export-Import Bank targets encouraging non-oil exports and enhancing access to global markets by covering financing gaps and reducing export risks. The Saudi EXIM Bank provided credit facilities to support Saudi non-oil exports with a total value of about SAR 4.26bn during the first quarter of 2023. The share of the insurance products amounted to SAR 2.3bn, while the share of financing products amounted to about SAR 1.96bn. Empowering Growth for Developing Countries: Through the Saudi Fund for Development (SFD), the Kingdom has been a significant player in international development aid, providing critical financial support to various countries. This includes offering a deposit of $5bn in the Central Bank of Turkey to bolstereconomic stability in the country, providing financing to support oil derivatives in Pakistan with a value of $1bn, and signing an agreement worth $80mn to finance the expansion of the University of the West Indies at Five Islands (UWI) in Antigua and Barbuda. This contribution solidifies Saudi Arabia's commitment to education in the Caribbean region, making Antigua and Barbuda the 85th country worldwide to receive funding from the Saudi Fund for Development. An MoU further strengthened Saudi Arabia's economic ties with Oman to finance an infrastructure development project in the Special Economic Zone in Ad Dhahirah, Oman. The project, valued at SAR 1.2bn, aims to stimulate trade, foster economic partnerships, devise new industrial solutions, and promote sustainable economic growth between the two nations. Finally, Saudi Arabia reaffirmed its commitment to aid Least Developed Countries (LDCs) at the Fifth United Nations Conference on the Least Developed Countries held in Doha, announcing an allocation of $800mn through SFD to finance development projects in LDCs across Africa and Asia. This action further illustrates Saudi Arabia's role as a significant global partner in fostering development in the world's most vulnerable regions. (Zawya) Saudi: Number of female employees in construction sector reached 152,500 - The number of workers in the construction sector, who are subjected to the rules and regulations of social insurance, has reached about 2.46mn workers by the end of the fourth quarter of 2022. According to Al-Eqtesadiah, the foreign workers, who are subjected to the social

- 8. qnbfs.com Daily MarketReport Monday, 05June2023 insurance regulations, have the largest percentage in the sector at about 85.4%, equivalent to 2.1mn workers. Saudis working in the construction sector constitute 14.6%, equivalent to 369,600 employees, while the number of female employees in the sector reached 152,500 employees, of whom Saudi women represent the highest percentage. As for the Saudi cities with the highest percentage of workers in the construction sector, the capital, Riyadh, constituted the highest rate with 39.6%, with 972,600 employees, followed by the Eastern region (Al-Sharqiyah) with 648,900 workers, then Makkah with 444,700. employee. (Zawya) UAE: Progress of key projects under Hatta Master Development Plan reviewed - HH Sheikh Ahmed bin Mohammed bin Rashid Al Maktoum, Second Deputy Ruler of Dubai, today reviewed the progress of key development projects in Hatta during a visit to the region. The projects, whose progress His Highness reviewed, are part of the first two phases of the Hatta Master Development Plan launched under the directives of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, and the follow up of HH Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of the Executive Council of Dubai. Sheikh Ahmed said the Hatta projects form part of Dubai’s ambitious development plan created within the framework of His Highness Sheikh Mohammed bin Rashid’s vision for the emirate’s growth. Developed in accordance with the highest global standards of excellence, the projects seek to enhance services for UAE citizens, residents and visitors, and raise the quality of life of all segments of society. Sheikh Ahmed commended the efforts of entities involved in the development plan and highlighted the leadership’s commitment to provide exceptional services to the people of Hatta. Sheikh Ahmed was accompanied on the tour by Mattar Al Tayer, Dubai’s Commissioner General for the Infrastructure, Urban Planning, and Wellbeing Pillar and Chairman of the Supreme Committee to Oversee the Development of Hatta; Saeed Mohammed Al Tayer, Managing Director and CEO of the Dubai Electricity & Water Authority (DEWA); Major General Mohamed Ahmed Al Marri, Director General of the General Directorate of Residency and Foreigners Affairs (GDRFA) in Dubai; Dawood Al Hajri, Director General of Dubai Municipality; Dr. Amer Sharif, CEO of the Dubai Academic Health Corporation, and a number of senior officials. During his visit, Sheikh Ahmed visited the Hatta Border Crossing, which handles entry and exit procedures for 350,000 travelers per month. His Highness was briefed about the initiatives of the General Directorate of Residency and Foreigners Affairs in Dubai to enhance the experience of travelers passing through the border crossing point. His Highness visited Hatta Municipality, where he reviewed the progress of projects being implemented as part of the Hatta Master Development Plan. He was briefed about the development of archaeological sites in Hatta, and the nomination of these sites to the United Nations Educational, Scientific and Cultural Organization’s (UNESCO) World Heritage Tentative List. His Highness also stopped by the Hatta Hospital, where he reviewed the progress of its expansion project. He was also briefed about the Hospital’s major accomplishments including its collaboration with the Noor Dubai Foundation as part of a national campaign to prevent blindness and visual impairment. His Highness later visited the Hatta Heritage Village and Sharia Farms, which contain the oldest documented charitable endowment in the history of the UAE dating back to 130 years. The Sharia Farms include ancient farms that have been passed down for generations. Sheikh Ahmed later visited a private school in Hatta that has 500 students. His Highness also visited the Hatta Dam where he was briefed about the ongoing construction of DEWA’s hydroelectric power plant. The first project of its kind in the GCC, the pumped-storage hydroelectric power station in Hatta will have a production capacity of 250 megawatts (MW), and a storage capacity of 1,500 megawatt-hours. (Zawya) Kuwait-US boost cooperation to enhance cybersecurity - Following his recent meeting with the Head of the National Center for Cybersecurity Major General Eng. Mohamed Bouarki and their discussion regarding ways to enhance joint cooperation in the field of cybersecurity in the future, the Charge d’Affaires of the U.S. Embassy in Kuwait James Holtsnider said, “The United States and Kuwait are strategic allies that enjoy close cooperation in many areas”,reports Aljarida daily.He affirmed that the US embassy in Kuwait is looking forward to linking American cybersecurity experts with the National Center for Cybersecurity in Kuwait to create a strong foundation for future cooperation. In an exclusive press statement, Holtsnider said, “The United States and Kuwait look forward to working closely together to develop cybersecurity infrastructure and protect Kuwait’s critical infrastructure, military and government facilities, and communications networks from potential threats. On March 2, President Joe Biden’s administration issued its National Cybersecurity Strategy to achieve the full benefits of a secure digital ecosystem for all Americans. This National Cybersecurity Strategy calls for two fundamental shifts – rebalancing responsibility for the cyber defense electronically, and reorganizing incentives in favor of long-term investments. The United States’ commitment to international partnerships on cyber issues remains strong. The National Cybersecurity Strategy emphasizes working with our allies and partners to build a defensible, resilient, and value-compliant digital ecosystem.” Regarding his assessment of the level of cybersecurity in Kuwait, and how this matter helps protect government and private institutions, Holtsnider said, “Cybersecurity is important for all countries. For example, in the United States, we face the daily threat of cyberattacks from malicious actors on our critical infrastructure, communications networks and government facilities and the military. We are facing a complex environment, as governmental and non-governmental actors are developing and implementing new campaigns to threaten the national interests of our country. Cyber-attacks are a global phenomenon, and Kuwait faces the same threats that the United States faces. Strong cybersecurity will protect our critical infrastructure and our government and private institutions. It will also ensure that we have a digital ecosystem that will enable next-generation technologies to create paths and new innovations, in addition to increasing digital interdependence, which will lead to economic growth and scientific progress. The US continues to seek international partnerships to promote a global cyberspace, where countries are expected to be rewarded for their responsible behavior, and where irresponsible behavior is isolated and costly. The USgovernment has a lot to offer in terms of cyber cooperation, including the US Department of Homeland Security’s Cyber Security and Infrastructure Agency (CISA), which offers free online training on a variety of topics related to cyber security. In 2022, the US State Department established a new office – the Office of Cyberspace and Digital Policy. In January 2023, through the State Department’s American Speakers Program, the embassy was pleased to welcome a cybersecurity expert Guillermo Christensen to Kuwait to attend a series of lectures and workshops with Kuwait’s public and private sector entities.” The Chargé d’Affaires of the US Embassy concluded his statement by affirming that, “The US Embassy in Kuwait looks forward to linking our cybersecurity experts with the National Cybersecurity Center in Kuwait to create a strong foundation for our future cooperation.” (Zawya)

- 9. qnbfs.com Daily MarketReport Monday, 05June2023 Rebased Performance Source: Bloomberg Daily Index Performance Source: Bloomberg Asset/Currency Performance Close ($) 1D% WTD% YTD% Gold/Ounce 1,947.97 (1.5) 0.1 6.8 Silver/Ounce 23.61 (1.1) 1.3 (1.5) Crude Oil (Brent)/Barrel (FM Future) 76.13 2.5 (1.1) (11.4) Crude Oil (WTI)/Barrel (FM Future) 71.74 2.3 (1.3) (10.6) Natural Gas (Henry Hub)/MMBtu 1.77 0.0 (5.9) (49.7) LPG Propane (Arab Gulf)/Ton 58.50 2.1 (5.6) (17.3) LPG Butane (Arab Gulf)/Ton 43.00 (6.5) (19.5) (57.6) Euro 1.07 (0.5) (0.1) 0.0 Yen 139.92 0.8 (0.5) 6.7 GBP 1.25 (0.6) 0.9 3.1 CHF 1.10 (0.4) (0.4) 1.7 AUD 0.66 0.6 1.4 (3.0) USD Index 104.02 0.4 (0.2) 0.5 RUB 110.69 0.0 0.0 58.9 BRL 0.20 1.1 0.7 6.6 Source: Bloomberg Global Indices Performance Close 1D%* WTD%* YTD%* MSCI World Index 2,873.37 1.5 1.6 10.4 DJ Industrial 33,762.76 2.1 2.0 1.9 S&P 500 4,282.37 1.5 1.8 11.5 NASDAQ 100 13,240.77 1.1 2.0 26.5 STOXX 600 462.15 1.0 0.1 8.8 DAX 16,051.23 0.8 0.3 15.3 FTSE 100 7,607.28 0.9 0.6 5.1 CAC 40 7,270.69 1.4 (0.8) 12.3 Nikkei 31,524.22 0.4 2.5 13.1 MSCI EM 984.36 2.3 1.2 2.9 SHANGHAI SE Composite 3,230.07 0.9 0.2 1.8 HANG SENG 18,949.94 3.9 1.1 (4.6) BSE SENSEX 62,547.11 0.1 0.3 3.2 Bovespa 112,558.15 3.1 2.2 9.3 RTS 1,051.53 (1.0) (0.4) 8.3 Source: Bloomberg (*$ adjusted returns if any, Data as of June 02, 2023) 60.0 80.0 100.0 120.0 140.0 160.0 180.0 May-19 May-20 May-21 May-22 May-23 QSE Index S&P Pan Arab S&P GCC 1.9% 1.8% 0.9% (0.2%) 0.7% 0.4% 0.6% (2.0%) 0.0% 2.0% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai 113.3 112.5 100.0

- 10. qnbfs.com Daily MarketReport Monday, 05June2023 Contacts QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 info@qnbfs.com.qa Doha, Qatar Saugata Sarkar, CFA, CAIA Head of Research saugata.sarkar@qnbfs.com.qa Shahan Keushgerian Senior Research Analyst shahan.keushgerian@qnbfs.com.qa Phibion Makuwerere, CFA Senior Research Analyst phibion.makuwerere@qnbfs.com.qa Roy Thomas Senior Research Analyst roy.thomas@qnbfs.com.qa Dana Saif Al Sowaidi Research Analyst dana.alsowaidi@qnbfs.com.qa Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arisingfrom use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warrantiesastotheaccuracyandcompletenessoftheinformationitmaycontain,anddeclinesany liabilityinthatrespect.Forreports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendationsofQNBFSFundamentalResearchasaresultofdependingsolelyonthehistoricaltechnicaldata(priceandvolume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS.