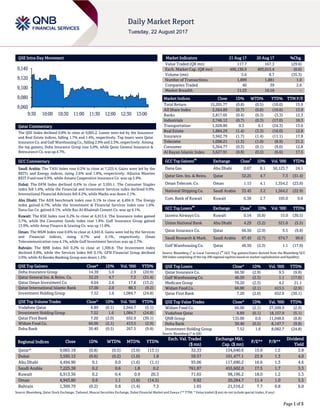

QNBFS Daily Market Report August 22, 2017

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.8% to close at 9,065.2. Losses were led by the Insurance and Real Estate indices, falling 1.7% and 1.4%, respectively. Top losers were Qatar Insurance Co. and Gulf Warehousing Co., falling 2.9% and 2.3%, respectively. Among the top gainers, Doha Insurance Group rose 5.0%, while Qatar General Insurance & Reinsurance Co. was up 4.7%. GCC Commentary Saudi Arabia: The TASI Index rose 0.2% to close at 7,225.4. Gains were led by the REITs and Energy indices, rising 2.6% and 1.8%, respectively. AlJazira Mawten REIT Fund rose 9.9%, while Amana Cooperative Insurance Co. was up 5.9%. Dubai: The DFM Index declined 0.6% to close at 3,595.1. The Consumer Staples index fell 1.6%, while the Financial and Investment Services index declined 0.9%. International Financial Advisors fell 8.2%, while Marka was down 2.1%. Abu Dhabi: The ADX benchmark index rose 0.1% to close at 4,494.9. The Energy index gained 6.7%, while the Investment & Financial Services index rose 1.6%. Dana Gas Co. gained 8.1%, while Ras Al-Khaimah Cement Co. was up 4.1%. Kuwait: The KSE Index rose 0.2% to close at 6,913.4. The Insurance index gained 3.7%, while the Consumer Goods index rose 1.8%. Gulf Insurance Group gained 13.9%, while Amar Finance & Leasing Co. was up 11.8%. Oman: The MSM Index rose 0.6% to close at 4,943.8. Gains were led by the Services and Financial indices, rising 0.7% and 0.1%, respectively. Oman Telecommunication rose 4.1%, while Gulf Investment Services was up 2.7%. Bahrain: The BHB Index fell 0.2% to close at 1,309.8. The Investment index declined 0.8%, while the Services index fell 0.1%. GFH Financial Group declined 2.0%, while Al Baraka Banking Group was down 1.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Doha Insurance Group 14.39 5.0 2.9 (20.9) Qatar General Ins. & Reins. Co. 32.25 4.7 7.3 (31.4) Qatar Oman Investment Co. 8.64 2.6 17.8 (13.2) Qatar International Islamic Bank 57.00 2.0 88.3 (9.2) Investment Holding Group 7.52 1.6 1,084.7 (24.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 8.89 (0.1) 2,044.7 (5.1) Investment Holding Group 7.52 1.6 1,084.7 (24.8) Qatar First Bank 7.20 (2.0) 652.9 (30.1) Widam Food Co. 66.00 (2.1) 413.5 (2.9) Doha Bank 30.40 (0.5) 267.5 (9.8) Market Indicators 21 Aug 17 20 Aug 17 %Chg. Value Traded (QR mn) 117.7 167.3 (29.6) Exch. Market Cap. (QR mn) 490,136.9 493,015.4 (0.6) Volume (mn) 5.6 8.7 (35.3) Number of Transactions 1,899 1,881 1.0 Companies Traded 40 39 2.6 Market Breadth 11:23 16:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,201.77 (0.8) (0.5) (10.0) 15.6 All Share Index 2,564.89 (0.7) (0.8) (10.6) 13.9 Banks 2,817.05 (0.4) (0.3) (3.3) 12.3 Industrials 2,746.12 (0.7) (0.3) (17.0) 18.3 Transportation 1,928.80 0.3 0.1 (24.3) 13.0 Real Estate 1,884.29 (1.4) (3.3) (16.0) 12.8 Insurance 3,942.79 (1.7) (1.4) (11.1) 17.8 Telecoms 1,098.21 (1.3) (1.0) (8.9) 21.2 Consumer 5,364.77 (0.3) (0.1) (9.0) 12.8 Al Rayan Islamic Index 3,627.91 (0.8) (0.5) (6.6) 17.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Dana Gas Abu Dhabi 0.67 8.1 50,123.7 24.1 Qatar Gen. Ins. & Reins. Qatar 32.25 4.7 7.3 (31.4) Oman Telecom. Co. Oman 1.15 4.1 1,354.2 (23.8) National Shipping Co. Saudi Arabia 33.45 3.2 1,564.2 (22.9) Com. Bank of Kuwait Kuwait 0.38 2.7 105.0 0.6 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Jazeera Airways Co. Kuwait 0.54 (6.8) 15.0 (30.5) Union National Bank Abu Dhabi 4.29 (3.2) 521.0 (5.5) Qatar Insurance Co. Qatar 66.50 (2.9) 9.5 (9.8) Saudi Research & Mark. Saudi Arabia 67.43 (2.7) 674.7 99.0 Gulf Warehousing Co. Qatar 46.50 (2.3) 1.1 (17.0) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Insurance Co. 66.50 (2.9) 9.5 (9.8) Gulf Warehousing Co. 46.50 (2.3) 1.1 (17.0) Medicare Group 76.20 (2.3) 4.2 21.1 Widam Food Co. 66.00 (2.1) 413.5 (2.9) Qatar First Bank 7.20 (2.0) 652.9 (30.1) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Widam Food Co. 66.00 (2.1) 27,509.9 (2.9) Vodafone Qatar 8.89 (0.1) 18,157.9 (5.1) QNB Group 135.00 0.0 11,048.0 (8.8) Doha Bank 30.40 (0.5) 8,147.7 (9.8) Investment Holding Group 7.52 1.6 8,082.7 (24.8) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,065.18 (0.8) (0.5) (3.6) (13.1) 32.33 134,640.6 15.6 1.5 3.8 Dubai 3,595.13 (0.6) (0.2) (1.0) 1.8 59.57 101,477.1 23.9 1.3 4.0 Abu Dhabi 4,494.90 0.1 0.0 (1.6) (1.1) 93.06 117,690.2 16.6 1.3 4.6 Saudi Arabia 7,225.38 0.2 0.6 1.8 0.2 761.87 455,602.0 17.5 1.7 3.3 Kuwait 6,913.36 0.2 0.4 0.9 20.3 71.65 98,196.2 18.0 1.2 5.3 Oman 4,943.80 0.6 1.1 (1.6) (14.5) 9.92 20,284.7 11.4 1.0 5.5 Bahrain 1,309.79 (0.2) 0.8 (1.4) 7.3 1.65 21,516.2 7.7 0.8 6.0 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,060 9,080 9,100 9,120 9,140 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 0.8% to close at 9,065.2. The Insurance and Real Estate indices led the losses. The index fell on the back of selling pressure from non-Qatari shareholders despite buying support from Qatari and GCC shareholders. Qatar Insurance Co. and Gulf Warehousing Co. were the top losers, falling 2.9% and 2.3%, respectively. Among the top gainers, Doha Insurance Group rose 5.0%, while Qatar General Insurance & Reinsurance Co. was up 4.7%. Volume of shares traded on Monday fell by 35.3% to 5.6mn from 8.7mn on Sunday. Further, as compared to the 30-day moving average of 8.0mn, volume for the day was 29.5% lower. Vodafone Qatar and Investment Holding Group were the most active stocks, contributing 36.3% and 19.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/21 Japan METI All Industry Activity Index MoM June 0.4% 0.4% -0.8% 08/21 China China Ministry of Commerce Foreign Direct Investment YoY CNY July – – 2.3% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Capital Intelligence affirms QNB Finansbank’s ratings – Capital Intelligence Ratings (CI Ratings) has affirmed the ratings of QNB Finansbank, based in Istanbul, Turkey. In June 2017, the Bank’s Long-term Foreign Currency rating (FCR) was affirmed at ‘BB+’ and the Short-Term FCR at ‘B’. At the same time, the outlook on the Long-Term FCR was changed to ‘Negative’ from ‘Stable.’ This action was taken because of a change in the Sovereign Ratings of Turkey. In the current rating action, the bank’s Financial Strength Rating (FSR) is maintained at ‘BBB’. The rating is supported by the Bank’s sound capital profile, strong and improving operating profitability, and by the benefits to be obtained from its new ownership. The rating is constrained by the Bank’s tight liquidity and the current operating environment. The Long-Term FCR is affirmed at ‘BB+’, while the Short-Term FCR is affirmed at ‘B’. In view of the Bank’s prominent position in the Turkish banking sector, official support is expected to be forthcoming in the event it is needed. (Peninsula Qatar) S&P reaffirms DOHI’s rating with ‘Stable’ outlook – S&P has reaffirmed the current ‘A-’ rating of Doha Insurance Group (DOHI) with a ‘Stable’ outlook. DOHI’s Chairman, Sheikh Nawaf Nasser Bin Khaled Al-Thani said, “We are delighted with the decision and DOHI has successfully maintained its share within Qatar and the region with a balanced income from underwriting and investment.” Furthermore, he stressed that “this outcome is a true reflection of the solid financial position of the Qatari economy and the unwavering support of the State of Qatar.” (Gulf-Times.com) Qatar’s trade deficit with the US narrows sharply in 1H2017 – Qatar’s trade deficit with the US narrowed sharply YoY during 1H2017. The trade deficit during 1H2017 stood at QR1.67bn as compared to the combined trade deficit of QR10.98bn registered during the corresponding period last year. Despite subdued commodity prices, Qatar’s exports of goods to the US during 1H2017 (first half of the current fiscal year) touched QR2.11bn, up 10.4% compared to QR1.91bn registered in 2H2016, according to the data available at the US Census Bureau website. The fall in Qatar’s trade deficit with the US is largely due to the decline in two-way trade volume. The bilateral trade volume in goods during 1H2017 reached QR5.86bn, showing a sharp decline of 61.4% YoY compared to QR15.22bn witnessed during the corresponding period last year. (Peninsula Qatar) Kahramaa signs QR350mn deal with Omani firm for transformers – Qatar General Electricity and Water Corporation (Kahramaa) has entered into a QR350mn contract with Voltamp Oman for the supply of 4,900 transformers for the electric distribution grid in Qatar. Kahramaa signed two agreements in this regard with the Omani firm. Kahramaa’s President, Essa Bin Hilal Al-Kuwari explained that Voltap Oman will supply about 4,900 transformers to Kahramaa over the next two years. The total cost of the generators is QR350mn. They will be used for the power distribution network of Kahramaa, in order to supply electricity to infrastructure projects, industrial projects as well as for residential units across the country. (Gulf-Times.com) Thumama water project’s partial opening expected by year end – The Al Thumama water reservoir project (Package-C), part of the Water Mega Reservoir Project, will partially start operating by the end of 2017, according to Kahramaa’s (Qatar General Electricity and Water Corporation) Director of Technical Affairs, Ahmed Nasser Al-Nasr. He also revealed that Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 49.96% 44.53% 6,395,843.32 Qatari Institutions 31.64% 33.60% (2,309,580.65) Qatari 81.60% 78.13% 4,086,262.67 GCC Individuals 2.36% 1.27% 1,278,158.45 GCC Institutions 0.11% 0.15% (41,875.00) GCC 2.47% 1.42% 1,236,283.45 Non-Qatari Individuals 6.97% 6.63% 394,939.27 Non-Qatari Institutions 8.96% 13.82% (5,717,485.39) Non-Qatari 15.93% 20.45% (5,322,546.12)

- 3. Page 3 of 5 Kahramaa has started work on a new power generation facility. Al-Nasr said, “It is under the planning stage now. We have already identified the consultants for the project. We have applied to the municipality to allocate the land for the new facility.” (Gulf-Times.com) Qatar launches program to boost public transport – The Ministry of Transport and Communications (MoTC) launched the Qatar Transport Resilience Program (QTRP), which aims to deliver a resilient, sustainable, and efficient intermodal transport network for higher level of quality that encourages public transport ridership. The program was developed as part of the MoTC’s ongoing efforts to respond to key strategic transport requirements for the nation, in alignment with the Qatar National Vision 2030. (Gulf-Times.com) International Federal Reserve survey: US workers have low hopes for higher pay – US workers see little hope for higher paychecks, and while they are increasingly searching for new jobs, they expect fewer offers to fall into their laps, according to a Federal Reserve survey published on August 21. The first of its kind New York Fed study, to be published three times per year, paints a gloomy picture of US workers' aspirations. Even though the unemployment rate at 4.4% is near a 16-year low after more than eight years of economic recovery, national measures of wages have shown only modest growth. Survey respondents on average said in July that the lowest annual salary they would accept in a new job would be $57,960, down from $59,660 only four months earlier. This measure has declined since November, with most of the changes coming from older and higher-income Americans. (Reuters) ONS: Britain's current account deficit was bigger than thought in 2015 – Britain's current account deficit, the largest of any major economy last year, was even bigger in 2015 than previously thought, according to new estimates from the Office for National Statistics (ONS). The current account deficit has been in the spotlight since last year's vote on leaving the European Union, and although it has narrowed recently, is not far off levels that would trigger a currency crisis in a less developed economy. Bank of England Governor, Mark Carney said in the run-up to the referendum that Britain was reliant on the "kindness of strangers", highlighting how the country needed tens of billions of Pounds of foreign finance a year to balance its books. The ONS said it now estimated the current account deficit was 98bn Pounds in 2015, equivalent to 5.2% of gross domestic product, compared with its previous estimate of 80bn Pounds or 4.3% of GDP. (Reuters) Bundesbank: Germany growth could top expectations this year – The German economy could grow faster this year than earlier expected on the back of exceptionally strong industrial production, exports and consumption, the Bundesbank said in a monthly report. Solid sales are pushing capacity utilization in manufacturing even higher, fuelling a further rise in corporate investment in the Eurozone's biggest economy, the central bank said after growth rose to its fastest annualized rate in over two years in the second quarter. With the Eurozone economy now expanding for the 17th straight quarter, Germany has been the engine of recovery, giving the European Central Bank some room to at least discuss curtailing its unprecedented stimulus cocktail. The Bundesbank earlier expected the economy to grow by 1.9% in 2017, based on calendar adjusted data and second quarter figures showed an annualized growth rate of 2.1%, due to solid consumption and manufacturing. With elections just a month away, the German economy is enjoying its best run since the global financial crisis, a boost to the economic credentials of Chancellor Angela Merkel, who is holding a comfortable poll lead in her bid for a fourth term. The Bundesbank predicted another budget surplus for this year, arguing that further surpluses would be generated in the coming years without policy changes. (Reuters) Regional Kuwait’s Oil Minister: OPEC to discuss ending or extending production cut in November – Kuwait's Oil Minister, Essam al- Marzouq said that OPEC will discuss at a meeting in November whether to extend or end production cuts. He also said that oil inventories in recent weeks fell more than expected and that one-week forecasts were 2mn barrels a day, down from 6.5mn. (Reuters) Saudi Arabia could get $21.3bn non-oil boost in 2018 – Saudi Arabia’s non-oil revenue could increase by about $21.3bn next year, according to Bank of America Merrill Lynch, boosting the Kingdom’s efforts to reduce the economy’s reliance on crude. The increase would be driven by the implementation of value- added taxation, a tax on luxury products and higher fees imposed on expatriates’ dependents. Meanwhile, Saudi Arabia’s deficit reached SR20.7bn in June, reflecting decrease of 33.8% YoY. June non-oil exports fell to SR12.1bn (down 18.9% YoY), and imports also dropped to SR32.8bn (down 29% YoY). (Bloomberg) Applications for Saudi Arabia’s second Sukuk exceed SR38bn – Applications for Saudi Arabia’s second Sukuk exceeded SR38bn, with coverage ratio of 295%. Issuance size was set at SR13bn, Saudi Arabia’s Finance Ministry reported. (Bloomberg) CMA approves public offering of Alinma Makkah Real Estate Fund – Saudi Arabia’s Capital Markets Authority (CMA) issued its resolution, approving the public offer by Alinma Investment Company, of Alinma Makkah Real Estate Fund. (GulfBase.com) Saudi Arabia to transfer airports to sovereign fund in privatization drive – Saudi Arabia plans to transfer ownership of all its airports to its main sovereign wealth fund, the Public Investment Fund, as part of a drive to privatize them, a senior aviation official said. Companies will be set up for each airport under Saudi Civil Aviation Holding, a spin-off from the General Authority of Civil Aviation (GACA), which will continue to regulate the industry. (Reuters) Bank statutory reserves at CBUAE rose to AED125.5bn – The banking sector increased their statutory reserves at the Central Bank of the UAE (CBUAE) by AED8.6bn during 1H2017, bringing the total required reserves to AED125.5bn by the end of June 2017. Statutory reserves are the minimum liquidity banks are required to hold against client deposits without getting interests in return. The required minimum level of compulsory reserves now stands at 14% on current, savings and demand accounts, and 1% on term deposits. In a move reflecting banks’ commitment to keep high solvency ratios, required reserves have been progressively growing over

- 4. Page 4 of 5 1H2017, rising by AED1.9bn to AED118.7bn in February and to AED119.9bn by the end of March. (GulfBase.com) UAE banks poised for strong 2H2017 performance – Financial results of the UAE’s banks in 2Q2017 point to improving profitability, modest balance sheet growth, margin expansion and improving costs, according to banking sector analysts. While the underlying trend of a turnaround in growth and profitability is in its early stages, analysts say these are sustainable. UAE banks in general have reported resilient earnings in 2Q2017. Earnings benefited from an improvement in credit cost, as well as modest loan growth. Margins were slightly compressed YoY, but have improved since the start of this year, due to two rate hikes in 2017. Banks continue to put a lid on cost growth, further supporting profitability. Meanwhile, asset quality was better than a year ago and somewhat stable sequentially as the macro-environment continues to improve in the UAE. (GulfBase.com) Fitch affirms Ras Al Khaimah’s IDRs at ‘A’; outlook ‘Stable’ – Fitch Ratings (Fitch) affirmed Ras Al Khaimah's Long-Term Issuer Default Ratings (IDRs) at ‘A’ with ‘Stable’ outlook. The ratings reflect the benefits of Ras Al Khaimah's membership of the UAE, a low government debt burden, high GDP per capita and governance indicators that are close to the ‘A’ median. (Reuters) CBO: Banks in Oman achieve 6.6% growth in credit at OMR23bn – Omani banks, including Islamic institutions, achieved YoY 6.65% growth in total credit to OMR22.9bn by June-end this year. Credit to the private sector grew by 7.4% to OMR20.6bn as of the end of June 2017. Out of the total credit to the private sector, the household sector (mainly under personal loans) and non-financial corporate sector each contributed 45.9%, while financial corporations and other sectors contributed 5.1% and 3.1%, respectively, according to the Central Bank of Oman (CBO). (GulfBase.com) Oman launches development bonds – Central Bank of Oman announced the new issuance of government development bonds. The size of the new issue is fixed at OMR150mn with a maturity period of ten years, and the issue will carry a coupon rate of 5.75% per annum. (Gulf-Times.com) Standard Chartered supports $12bn worth deals for Oman – Standard Chartered continues to play a pivotal role in supporting the fund-raising initiatives of the Omani government and various state-backed entities that in the past six months alone have resulted in financing deals totaling $12bn. Fund-raising efforts spearheaded by the global lender have led to the successful closure of, among other financing deals, the Omani government’s $5bn international bond issue, and $2bn Sukuk issue, as well as project finance linked to the implementation of a pair of major midstream and petrochemical ventures. (GulfBase.com) Bahrain may need to boost interest rates to protect currency, IMF warns – Bahrain may need to raise its market interest rates to protect its currency and must refrain from having its central bank lend money to cover the government's budget deficit, the International Monetary Fund (IMF) said. In a statement released after annual consultations with the Bahraini government, the IMF repeated earlier warnings that more steps by Bahrain to cut its deficit were urgently needed to stabilize state finances and support the Bahraini Dinar's peg to the US Dollar. (Reuters)

- 5. Contacts Saugata Sarkar, CFA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 70.0 90.0 110.0 130.0 150.0 170.0 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 QSE Index S&P Pan Arab S&P GCC 0.2% (0.8%) 0.2% (0.2%) 0.6% 0.1% (0.6%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,291.88 0.6 0.6 12.1 MSCI World Index 1,932.22 0.1 0.1 10.3 Silver/Ounce 17.02 0.3 0.3 6.9 DJ Industrial 21,703.75 0.1 0.1 9.8 Crude Oil (Brent)/Barrel (FM Future) 51.66 (2.0) (2.0) (9.1) S&P 500 2,428.37 0.1 0.1 8.5 Crude Oil (WTI)/Barrel (FM Future) 47.37 (2.4) (2.4) (11.8) NASDAQ 100 6,213.13 (0.1) (0.1) 15.4 Natural Gas (Henry Hub)/MMBtu 2.98 3.1 3.1 (19.2) STOXX 600 372.72 0.2 0.2 15.6 LPG Propane (Arab Gulf)/Ton 75.50 (1.9) (1.9) 5.2 DAX 12,065.99 (0.2) (0.2) 17.8 LPG Butane (Arab Gulf)/Ton 87.75 (2.0) (2.0) (9.5) FTSE 100 7,318.88 0.3 0.3 7.1 Euro 1.18 0.5 0.5 12.3 CAC 40 5,087.59 0.1 0.1 17.3 Yen 108.98 (0.2) (0.2) (6.8) Nikkei 19,393.13 0.2 0.2 8.7 GBP 1.29 0.2 0.2 4.5 MSCI EM 1,063.66 0.4 0.4 23.4 CHF 1.04 0.3 0.3 5.9 SHANGHAI SE Composite 3,286.91 0.7 0.7 10.4 AUD 0.79 0.1 0.1 10.1 HANG SENG 27,154.68 0.4 0.4 22.3 USD Index 93.10 (0.4) (0.4) (8.9) BSE SENSEX 31,258.85 (1.0) (1.0) 24.4 RUB 59.15 0.3 0.3 (3.9) Bovespa 68,634.65 (0.1) (0.1) 17.6 BRL 0.32 (0.6) (0.6) 2.8 RTS 1,034.29 0.6 0.6 (10.2) 97.8 97.3 97.2