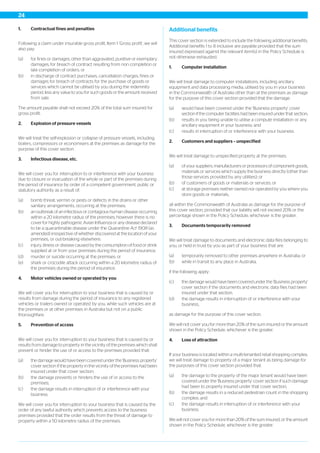

This document is a business insurance policy from QBE Insurance Australia Limited. It provides definitions, terms and conditions, exclusions, and coverage details for various types of insurance for business owners. Coverage sections include property, business interruption, theft, money, glass, liability, machinery breakdown, electronic equipment, employee dishonesty, tax audit, transit, employment practices, and statutory liability. The policy outlines what is and isn't covered, liability limits, excess amounts, duties of insured parties, and processes for making claims.