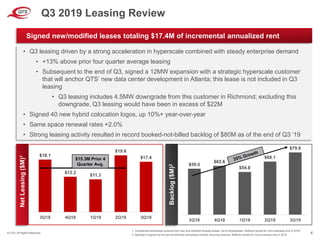

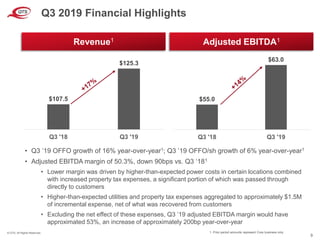

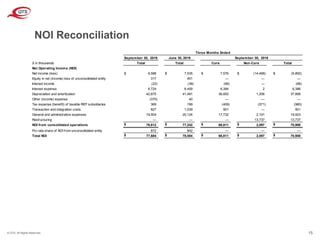

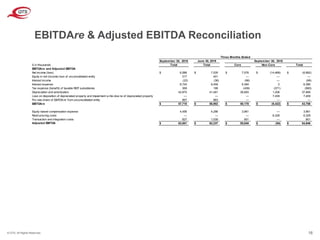

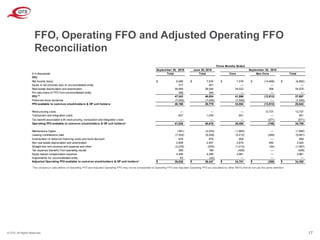

QTS reported financial results for the third quarter of 2019. Total revenue increased 17% year-over-year to $125.3 million. Operating FFO grew 16% year-over-year to $63 million. Adjusted EBITDA margin was 50.3%, down from the prior year primarily due to higher-than-expected power and property tax costs. Excluding these costs, adjusted EBITDA margin would have been approximately 53%, up 200 basis points year-over-year. QTS signed $17.4 million in new and modified leases during the quarter and had a record $80 million backlog as of the end of the third quarter.