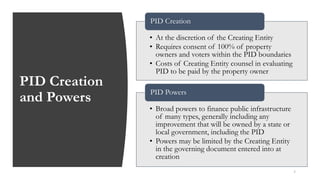

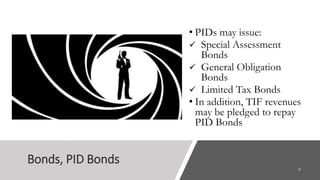

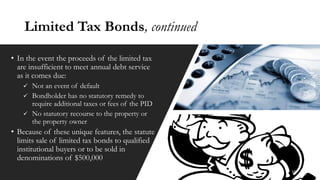

Senate Bill 228 allows cities and counties to create public infrastructure districts (PIDs) for financing public infrastructure through property taxes and assessments. PIDs function independently, governed by their own boards, and can issue various types of bonds to support infrastructure projects without affecting the creating entity's balance sheet. This legislation provides municipalities and property owners with a tool to stimulate economic development while addressing limitations of existing financing methods.