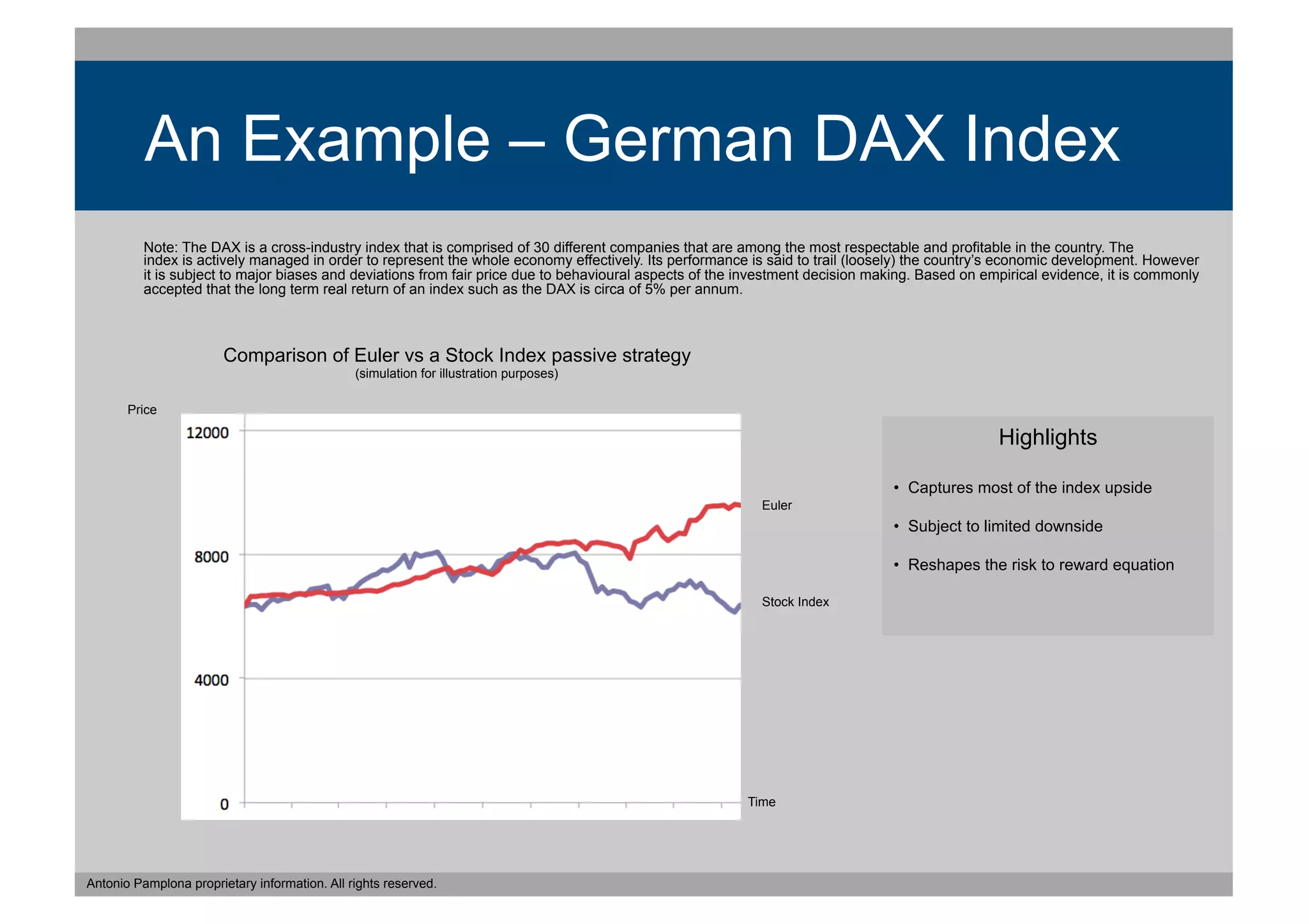

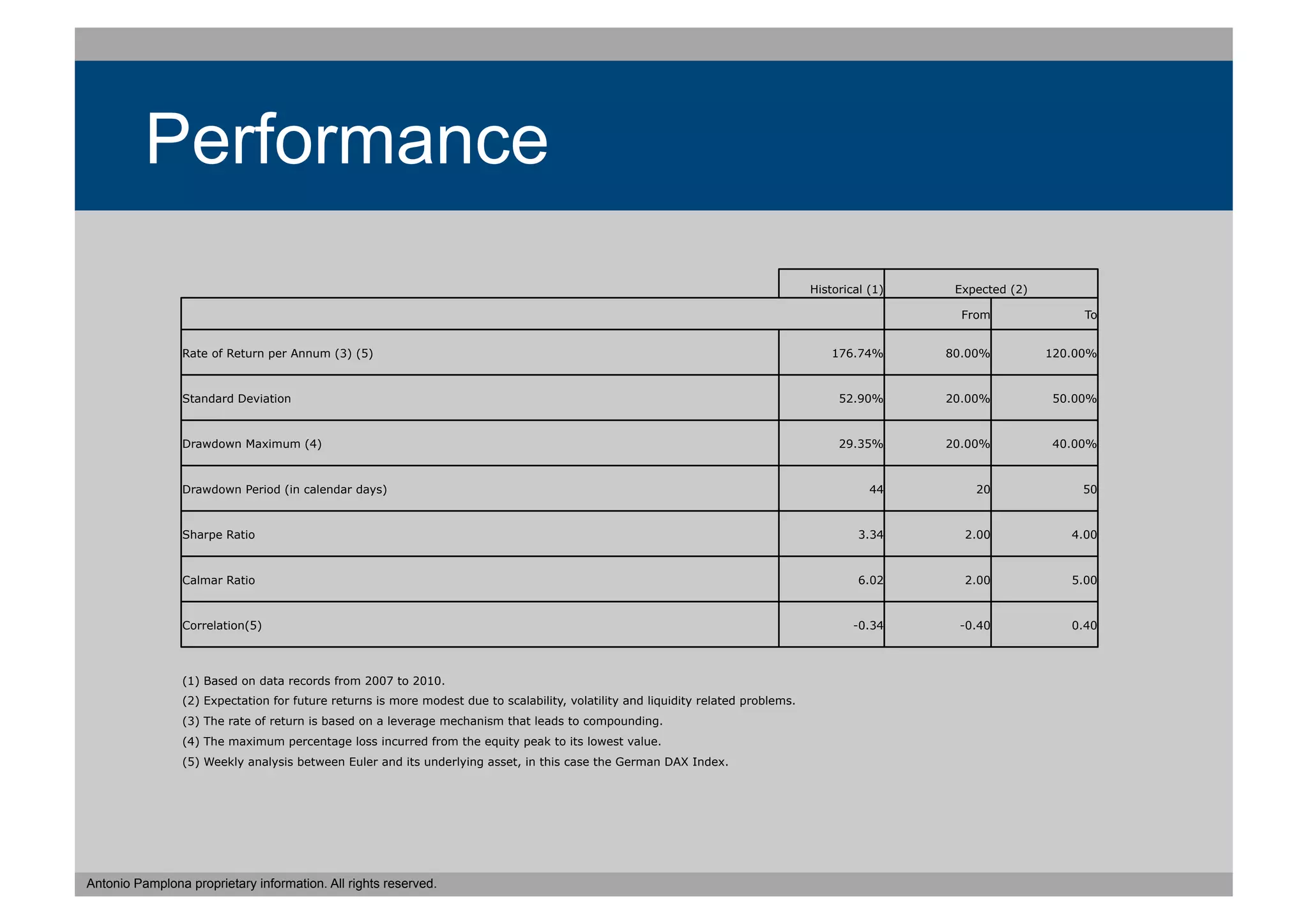

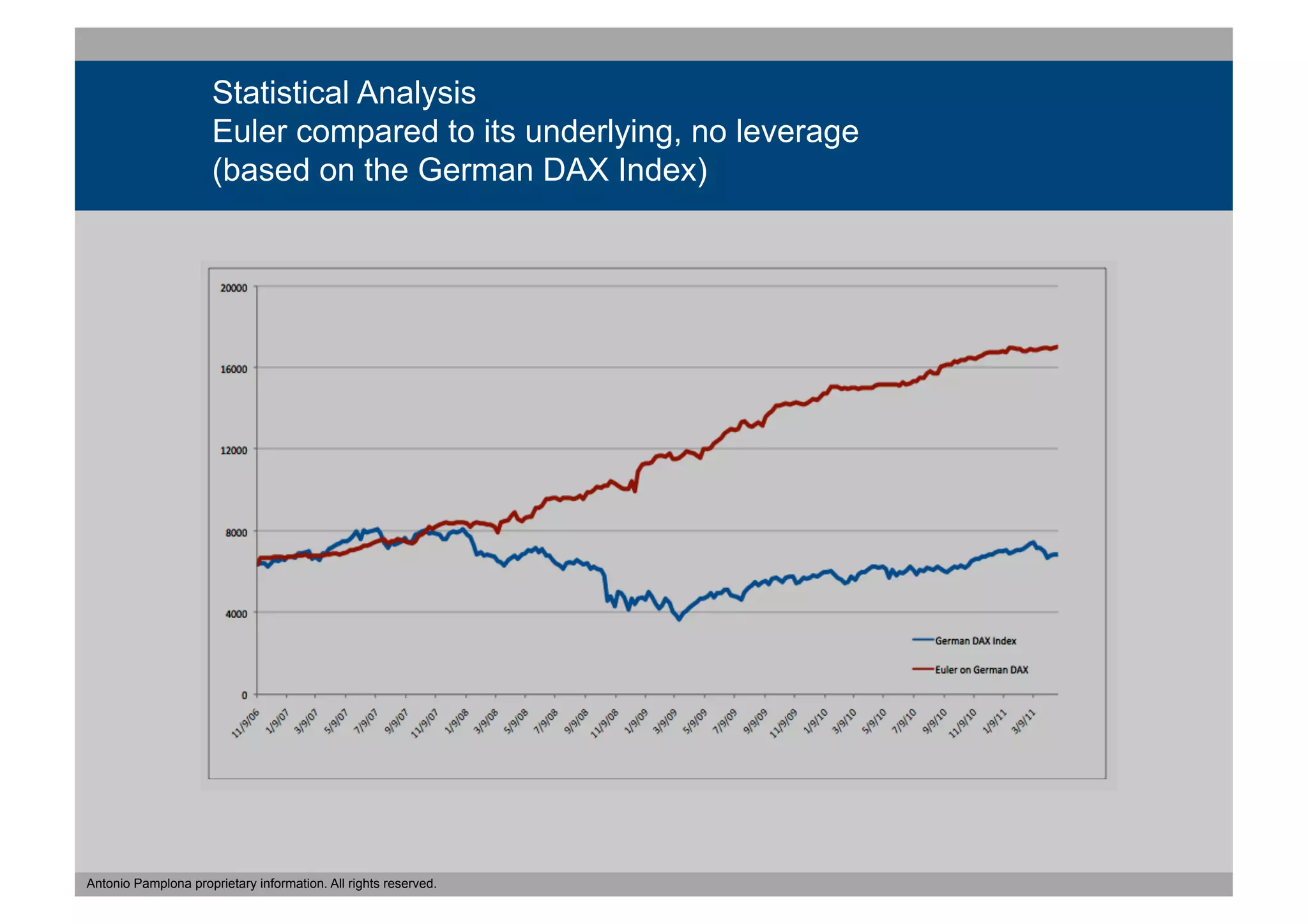

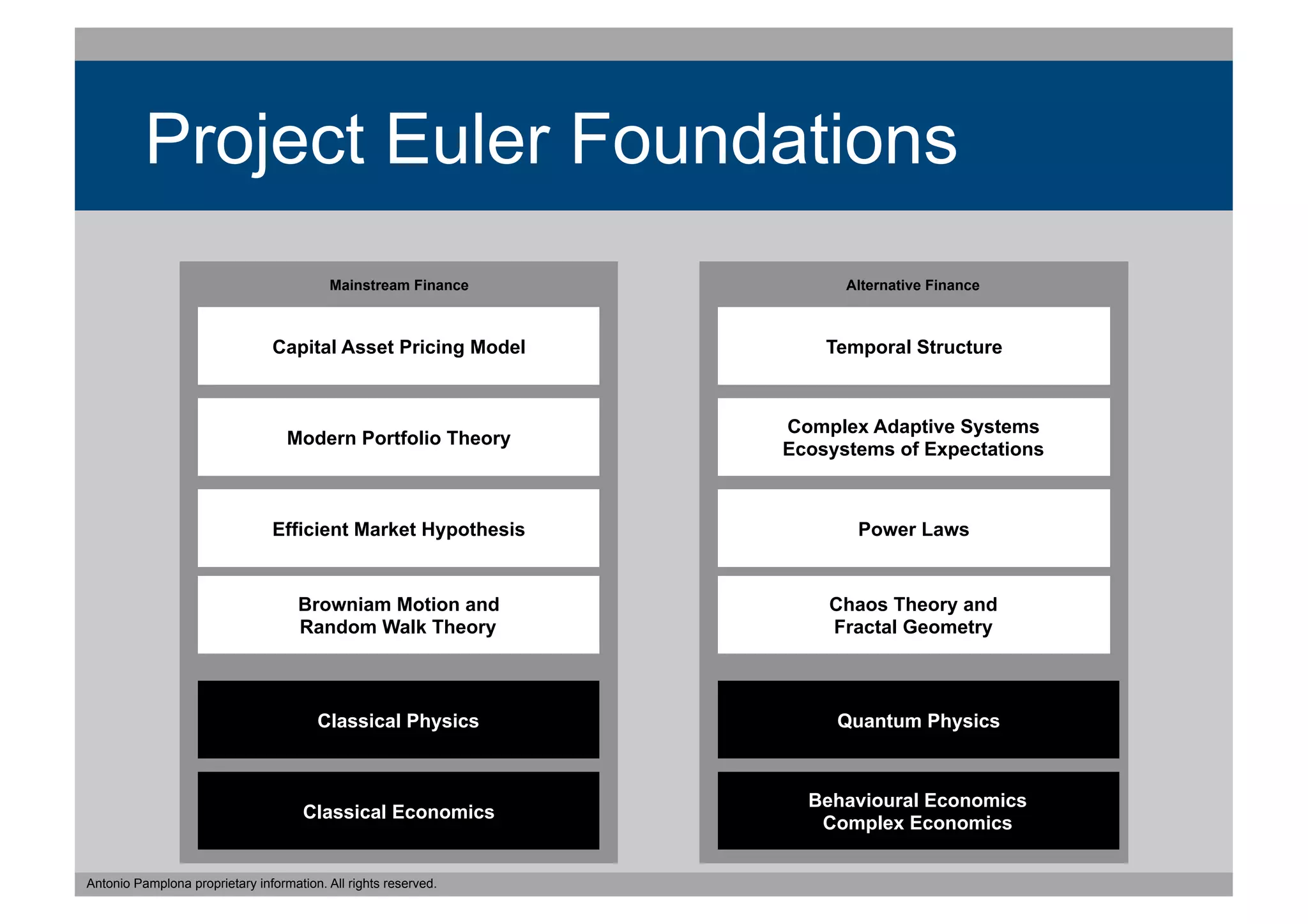

The document discusses Project Euler, a quantitative framework focusing on positive expectancy in financial markets from 2004 to 2011, highlighting the shift from human to machine-based decision-making. It outlines the principles and approaches taken, such as leveraging behavioral finance and automated execution to exploit market inefficiencies, specifically in the context of the German DAX index. The text also reviews the performance and statistical analysis of these strategies compared to conventional market theories.