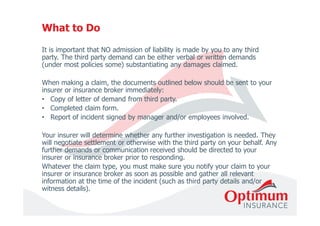

The document outlines the procedures for making claims under various 'claims made' insurance policies, such as professional indemnity and directors & officers liability insurance. It emphasizes the importance of notifying claims immediately to insurers and gathering relevant information, while advising against admitting liability to third parties. Additionally, it provides contact information for Optimum Insurance Services for assistance with claims and emphasizes their commitment to a fast and efficient claims service.