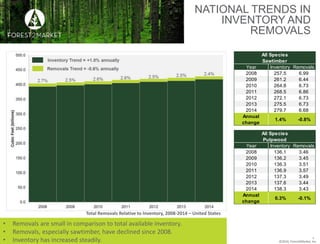

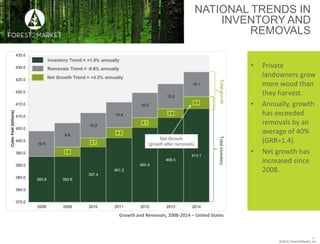

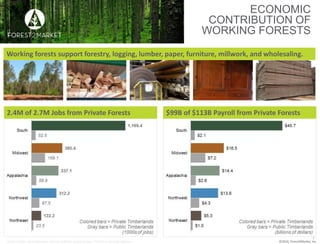

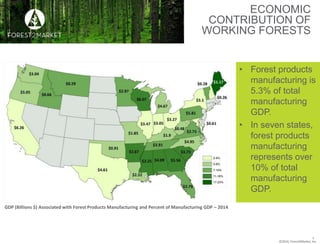

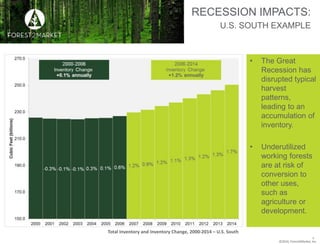

This document summarizes recent trends in privately owned forests in the United States. It finds that while removals from forests are small compared to total inventory, removals have declined since 2008. However, overall inventory has increased steadily as growth continues to exceed removals by around 40% annually on average. Working forests support over 2 million jobs and $99 billion in payroll in the US, demonstrating their significant economic contributions, especially in rural areas. Declining demand puts working forests at risk of conversion to other land uses.