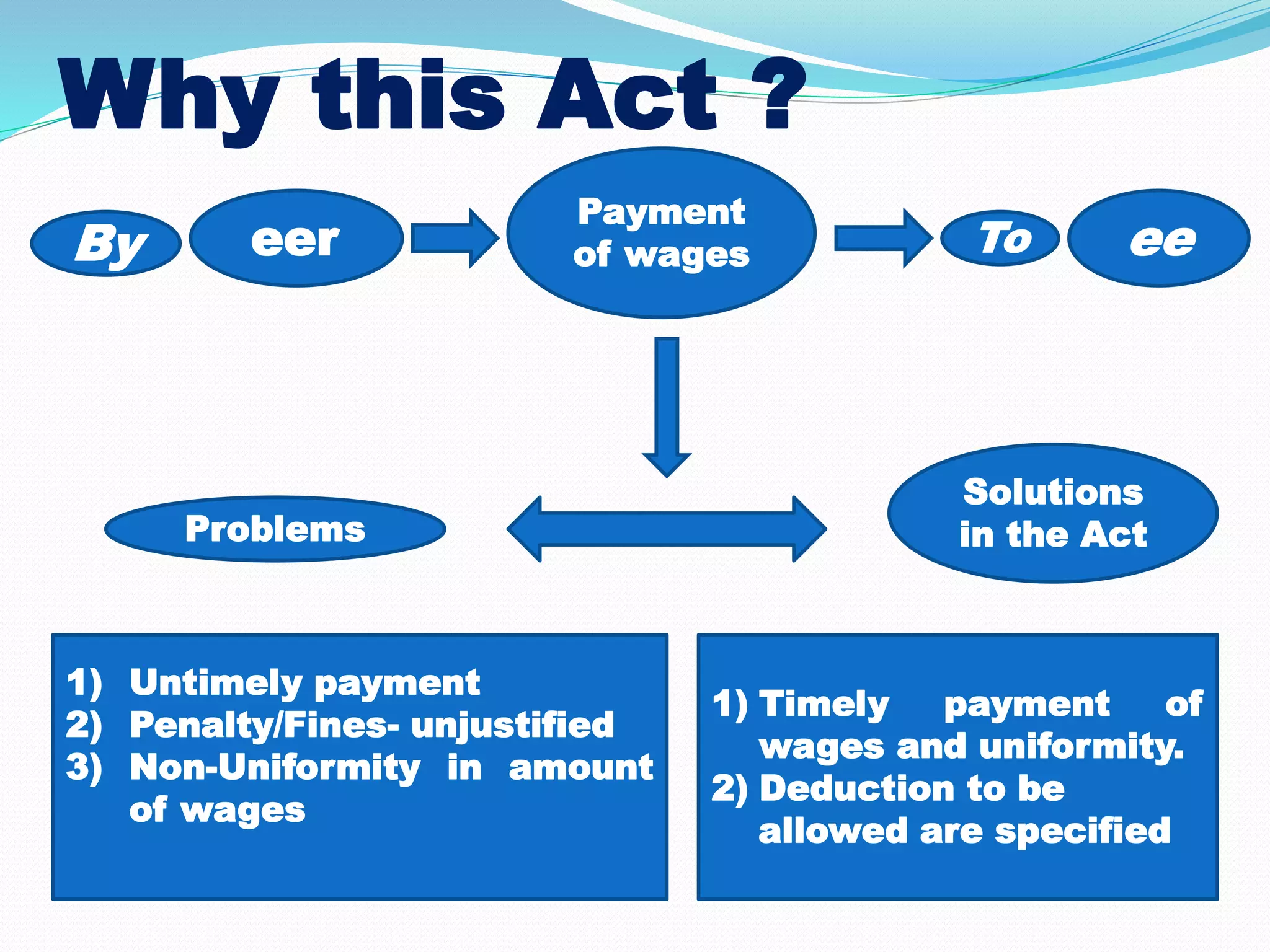

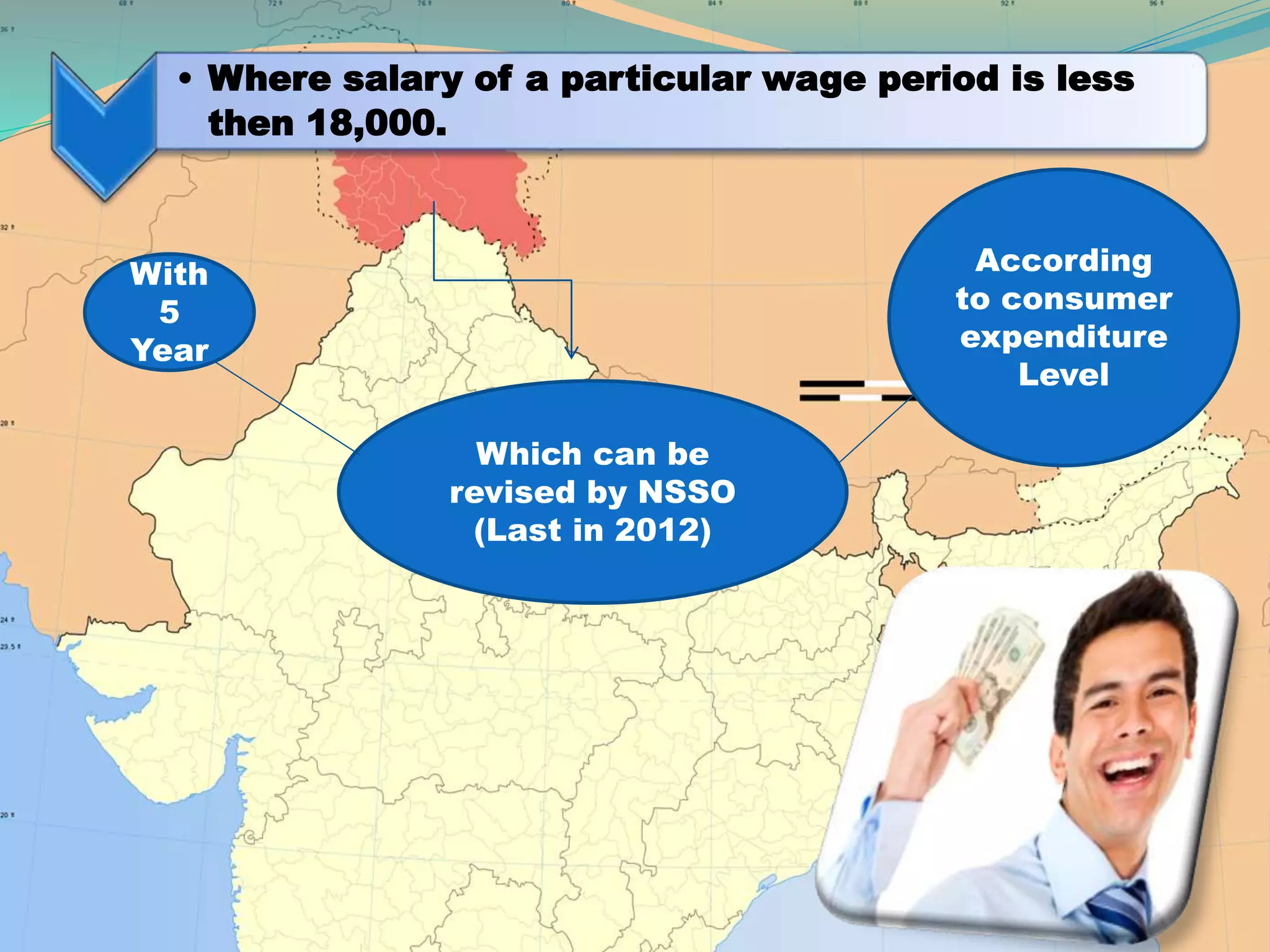

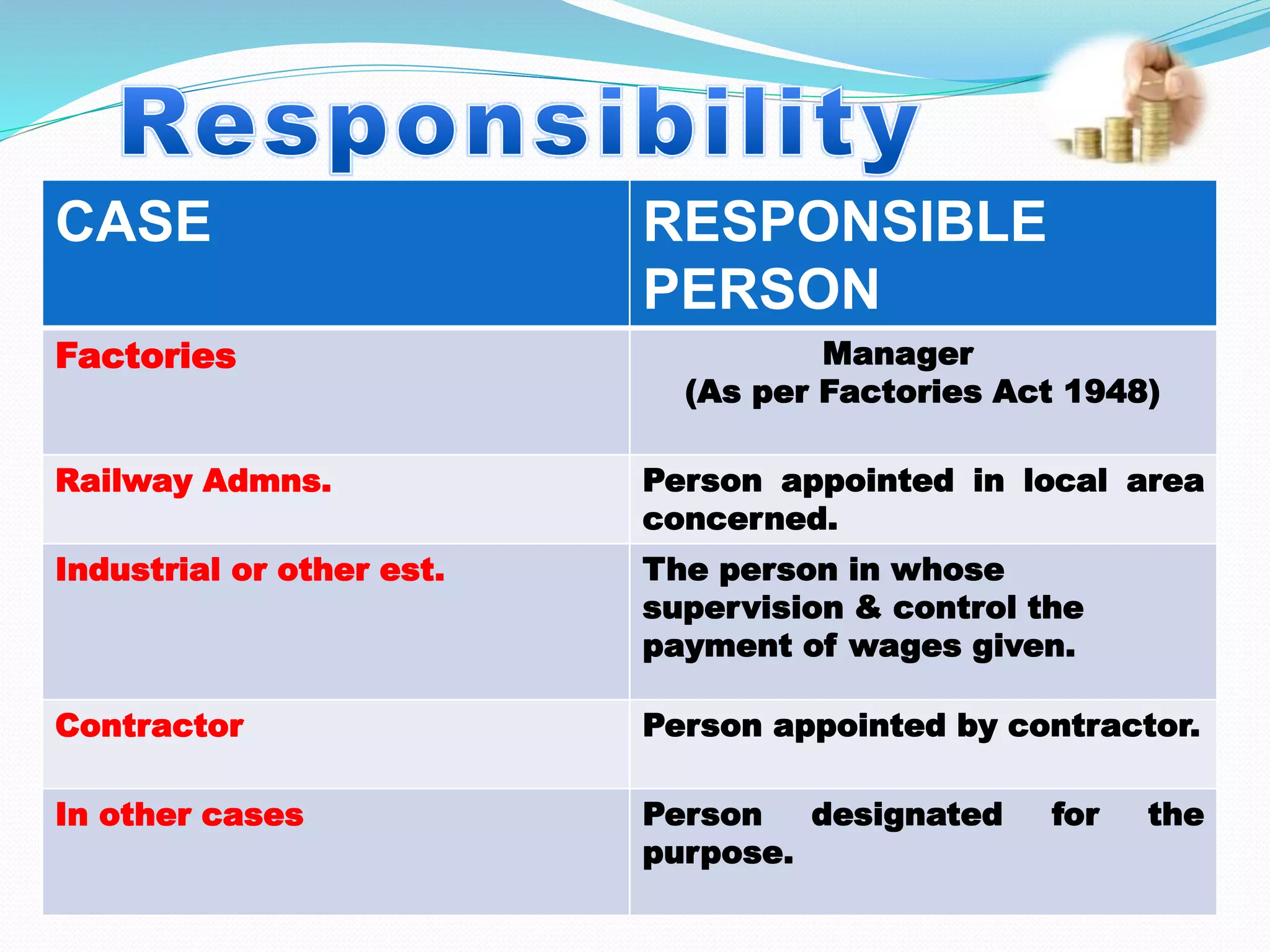

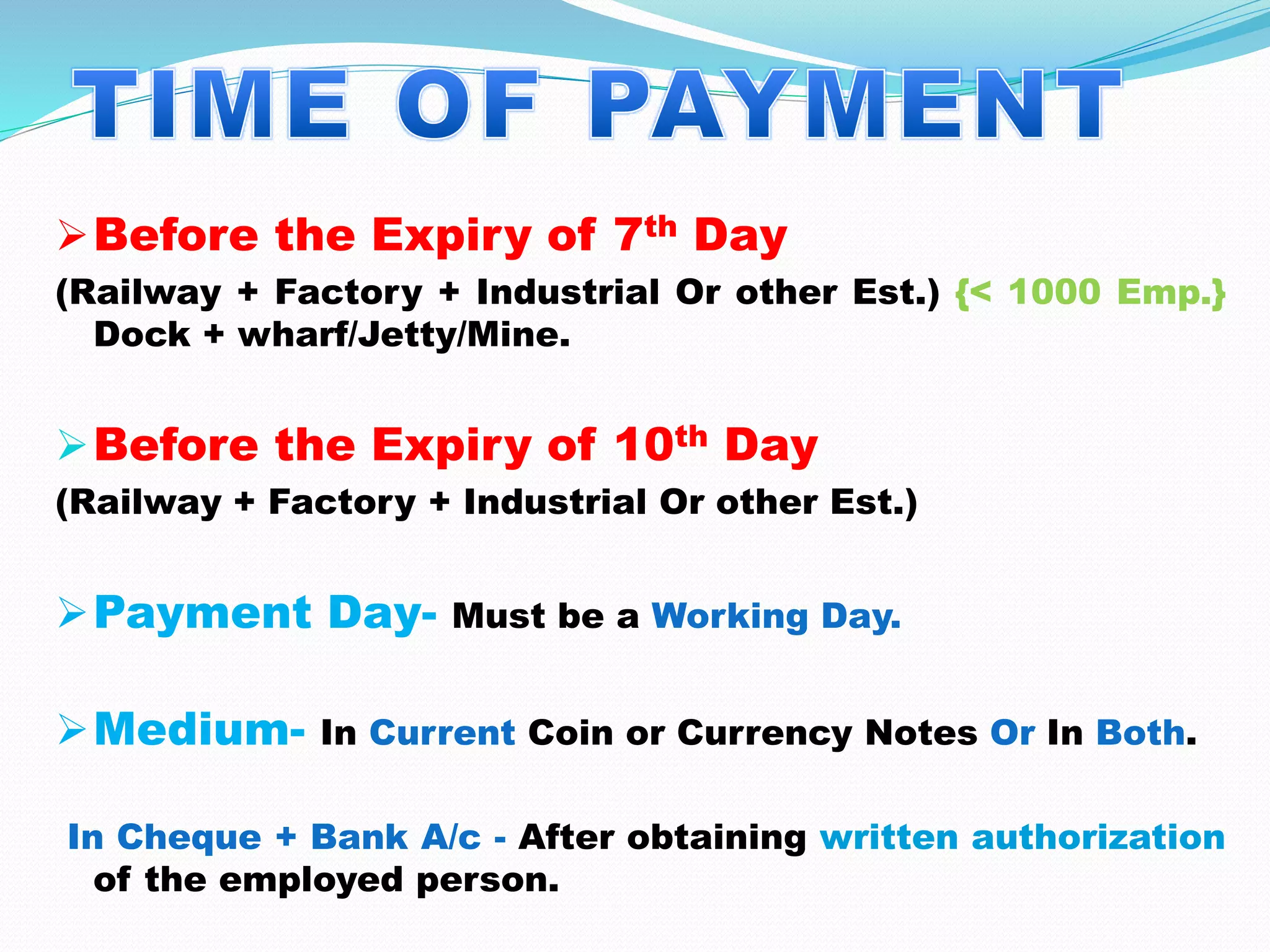

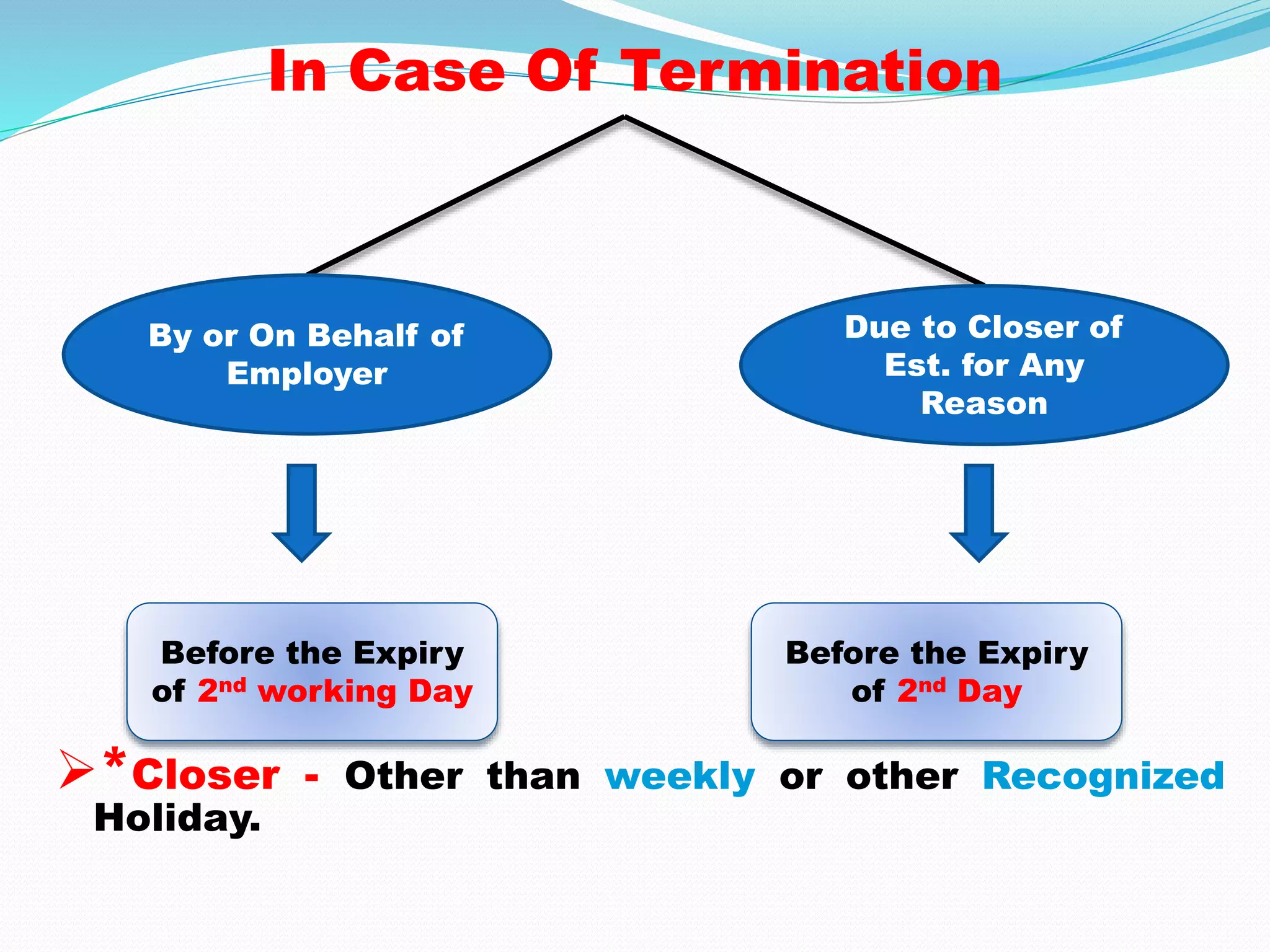

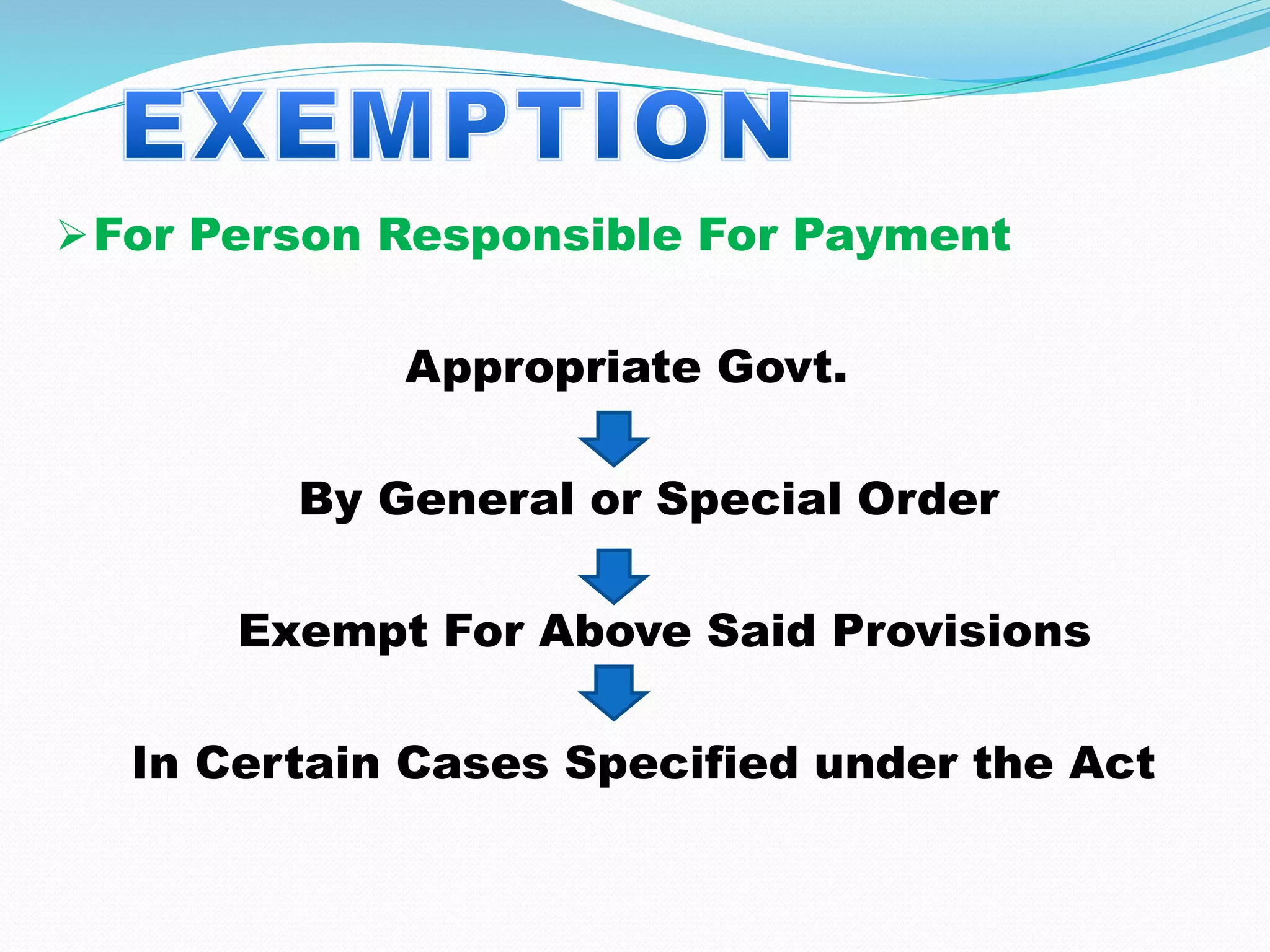

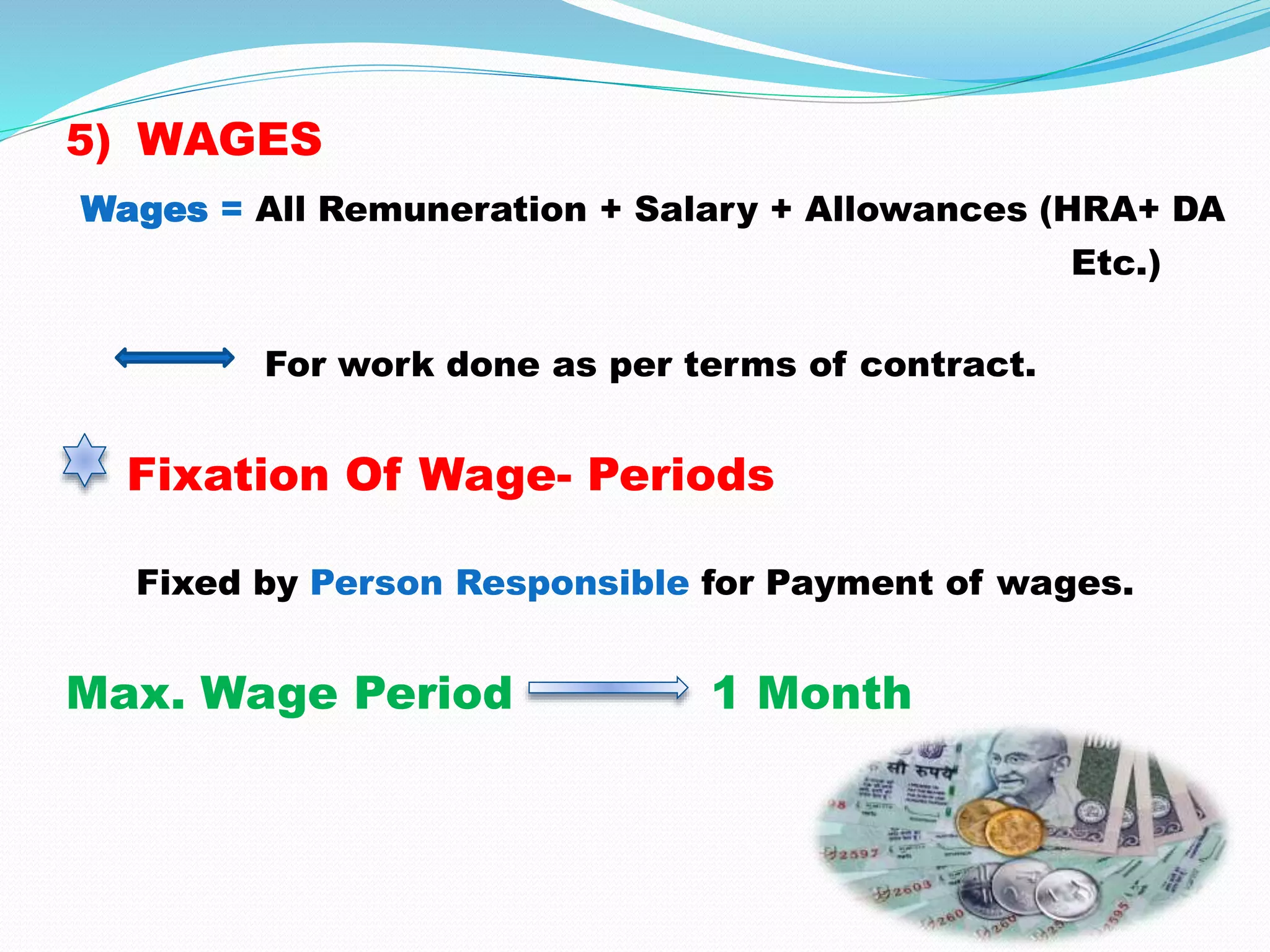

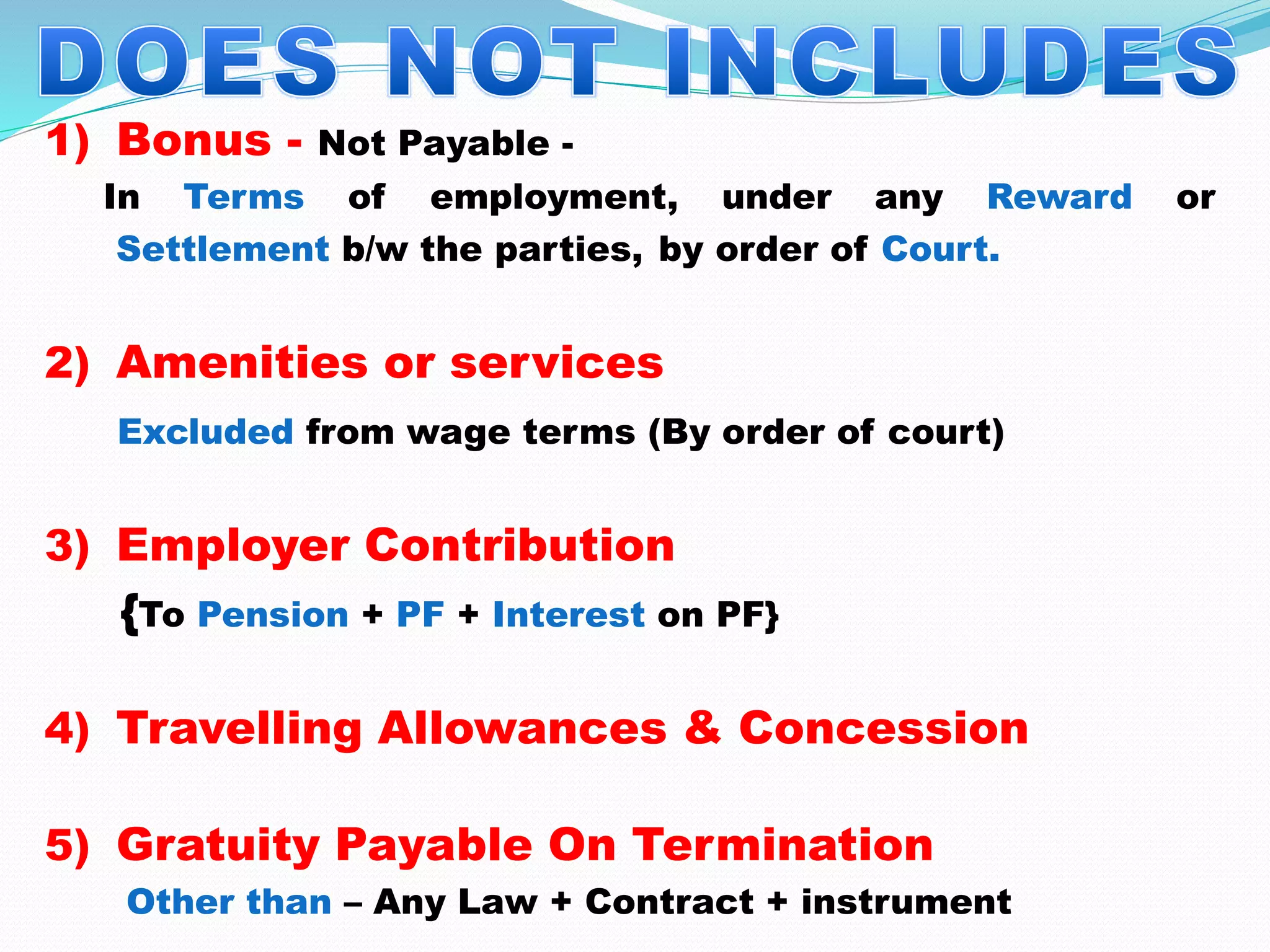

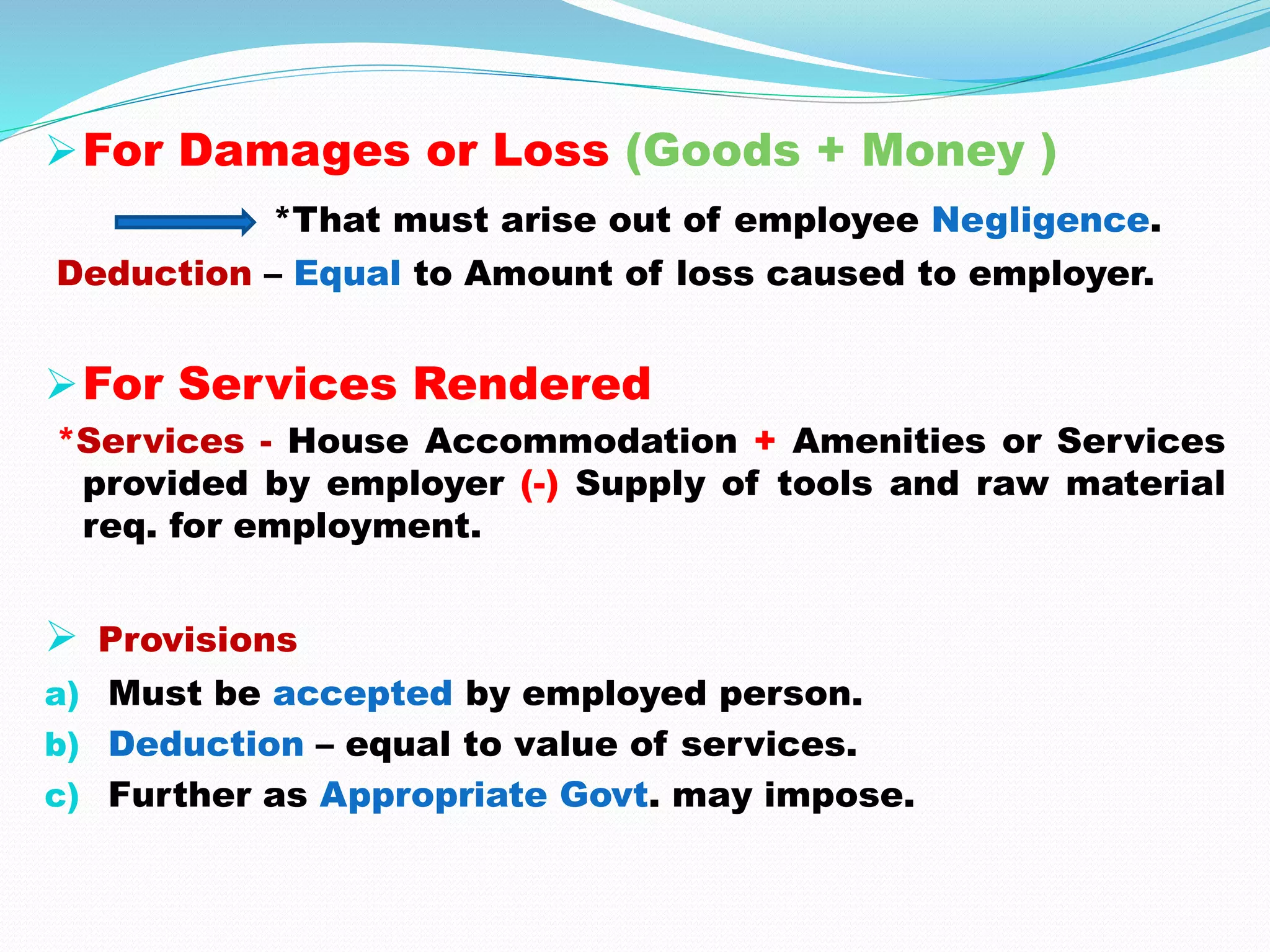

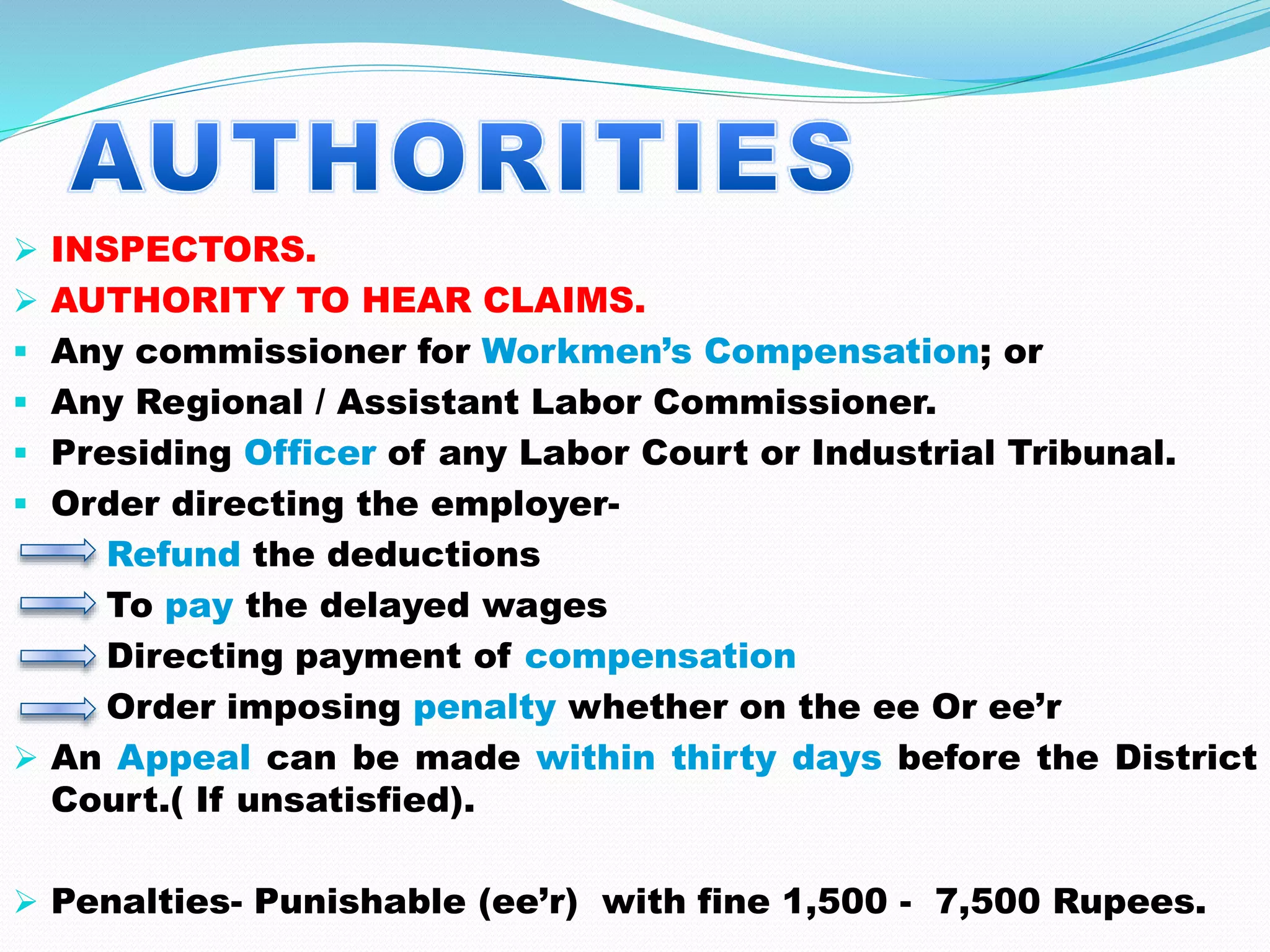

The Payment of Wages Act, 1936 aims to ensure timely payment of wages to workers in establishments like factories, mines and plantations. It mandates that wages be paid before the expiry of the 7th/10th day of the wage period. Permissible deductions include fines, absence from work and advances. Fines cannot exceed 3% of wages and are to be used for worker welfare. The Act specifies authorities to address wage claims and impose penalties on employers for non-compliance. It was introduced to protect workers against unjustified deductions and delays in wage payments.