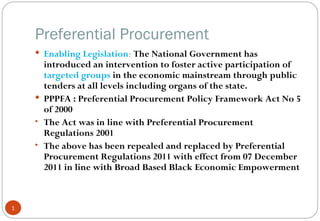

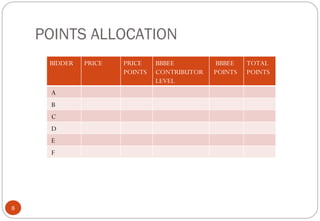

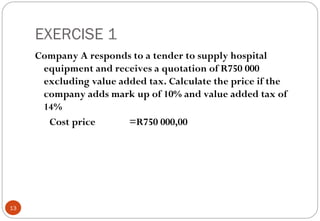

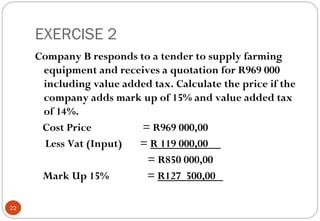

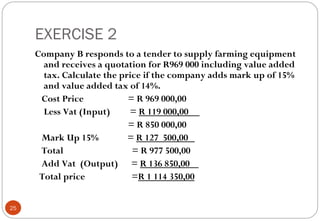

The document discusses South Africa's Preferential Procurement Policy Framework Act and regulations, which aim to promote participation of targeted groups in public tenders. It outlines challenges small businesses face in accessing tenders, such as lack of skills, resources, and information. Interventions like training and consortium-building are proposed to address these challenges. The tender procurement process and criteria for evaluating bids based on price and B-BBEE score are also explained. Examples calculate tender prices including markups and taxes. Overall, the document provides information on South Africa's preferential procurement system and support for small businesses to participate in public tenders.