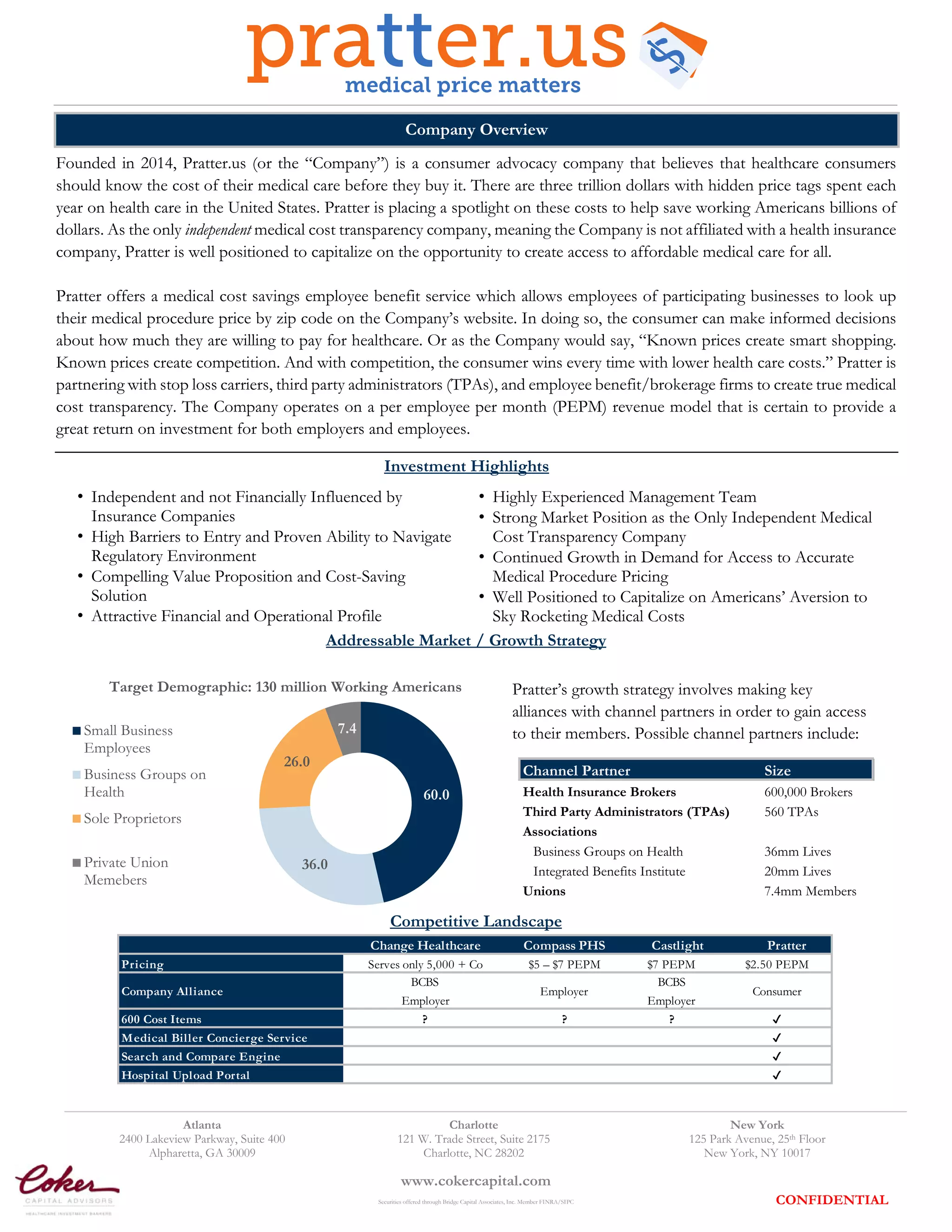

Pratter.us is a consumer advocacy company that provides a medical cost savings employee benefit service allowing employees to look up procedure prices by zip code on their website. This creates medical cost transparency which Pratter believes will save Americans billions by allowing consumers to make informed healthcare decisions. Pratter partners with stop loss carriers, TPAs, and brokers to access their members and operates on a monthly fee per employee revenue model that promises a great return for employers and employees.