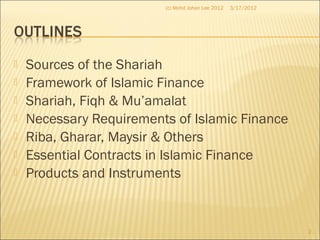

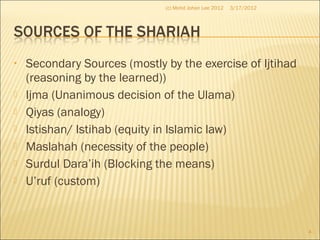

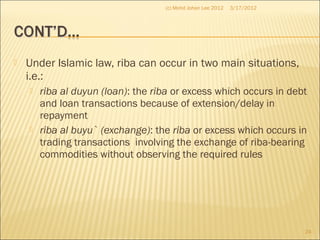

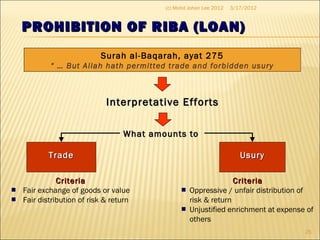

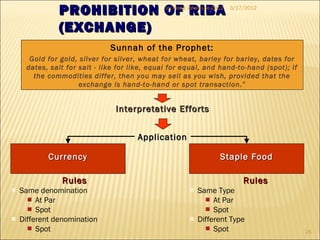

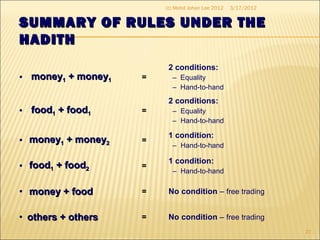

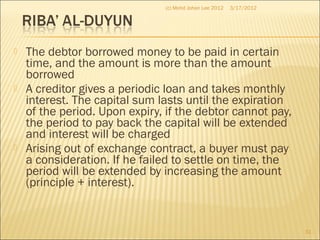

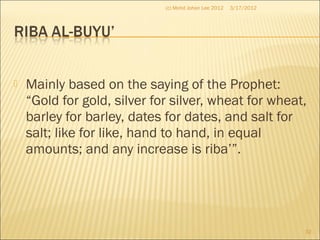

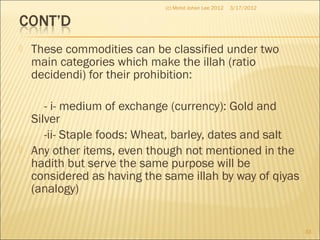

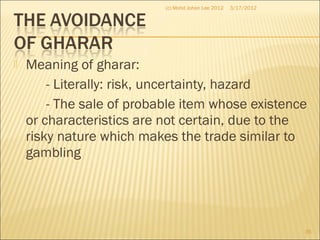

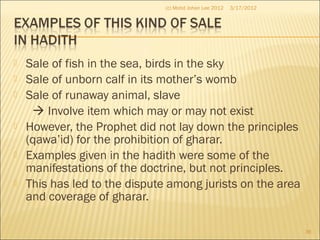

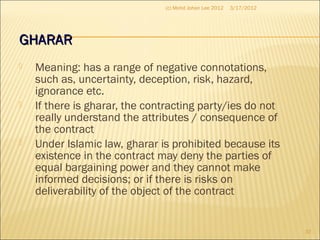

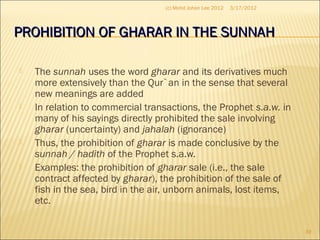

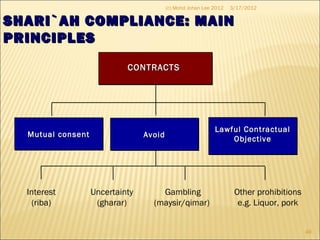

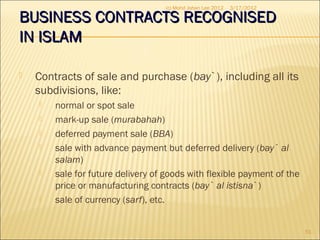

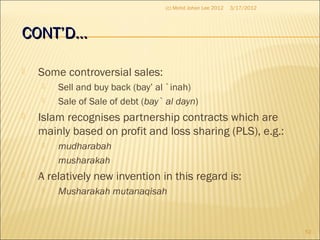

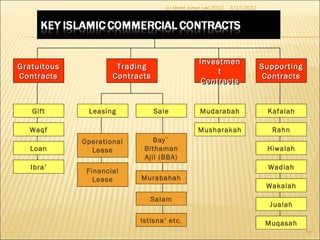

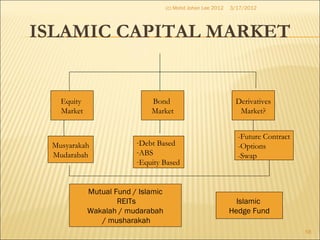

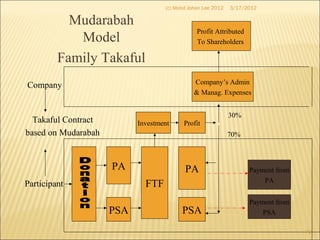

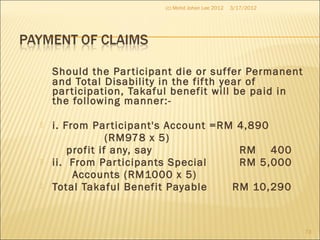

The document discusses the framework of Islamic finance, emphasizing its adherence to Shariah principles which differ from conventional finance. Key prohibitions in Islamic finance include riba (usury), gharar (excessive uncertainty), and maysir (gambling), establishing that all contracts must avoid these to be deemed compliant. Additionally, various sources such as the Quran and sunnah, along with methods like ijtihad (reasoned analysis), guide the application of Islamic financial laws.