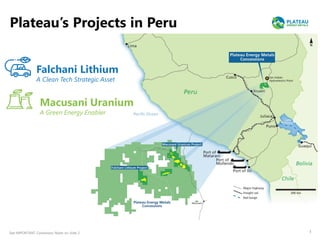

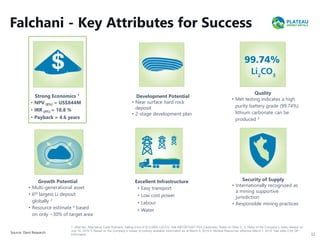

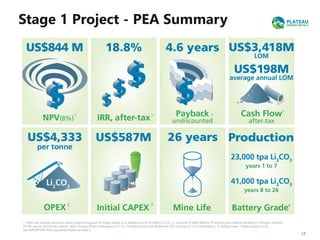

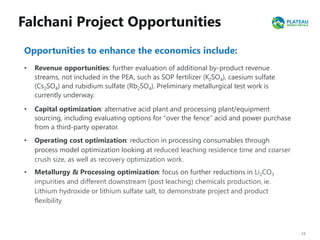

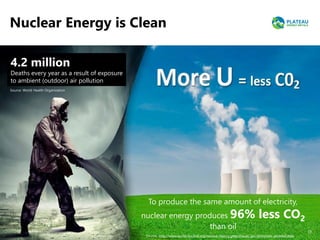

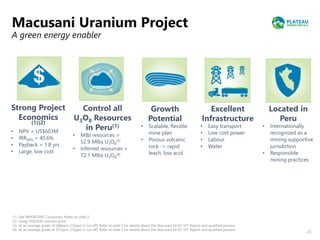

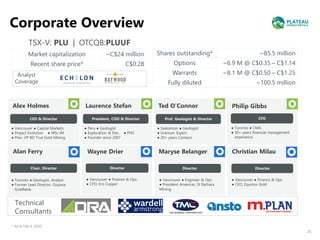

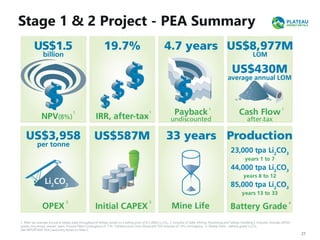

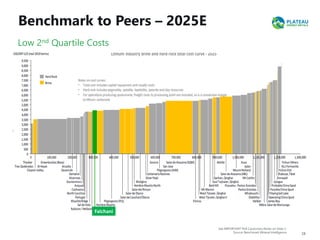

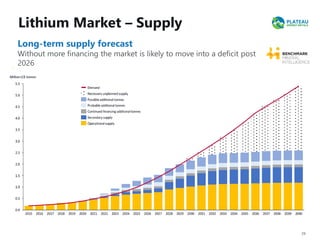

This document discusses Plateau Energy Metals' two projects in Peru - the Falchani Lithium Project and the Macusani Uranium Project. It notes that lithium and uranium are key to enabling clean energy technologies like electric vehicles and green power sources. The document provides an overview of the Falchani Lithium Project's potential based on preliminary economic assessments. It also cautions that the assessments are preliminary in nature and additional work is required.