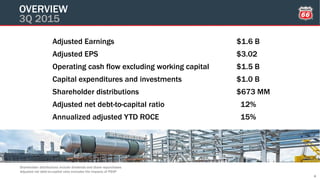

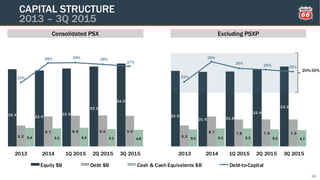

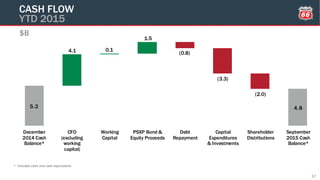

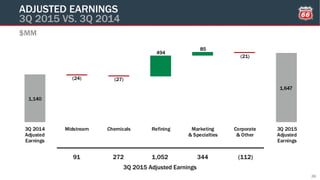

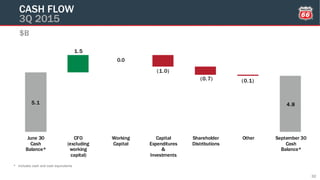

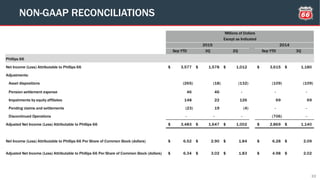

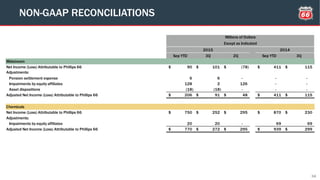

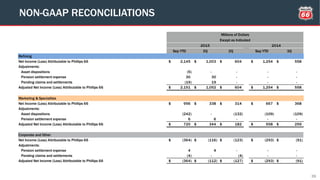

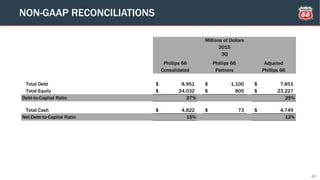

Phillips 66 reported adjusted earnings of $1.6 billion for the third quarter of 2015. The company's adjusted earnings per share were $3.02. Operating cash flow excluding working capital was $1.5 billion for the quarter. Capital expenditures and investments totaled $1 billion. The company's adjusted net debt-to-capital ratio was 12% at the end of the third quarter.