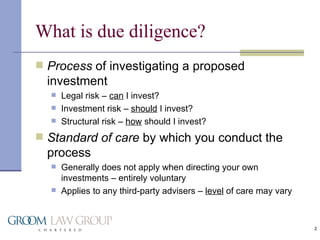

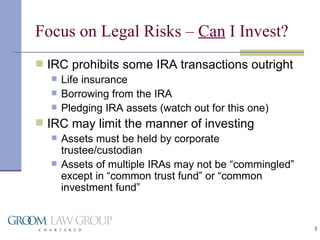

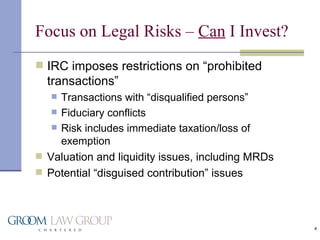

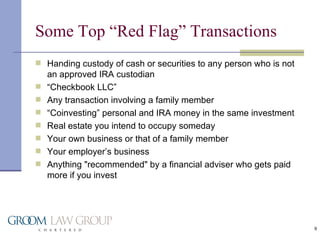

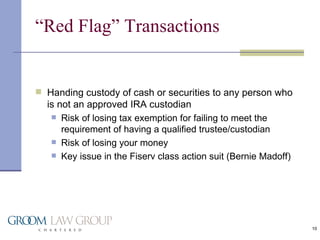

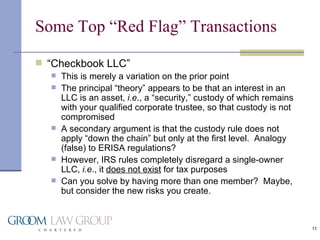

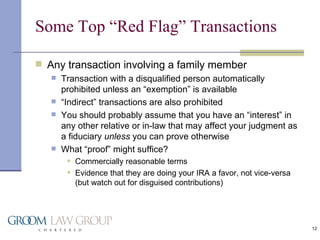

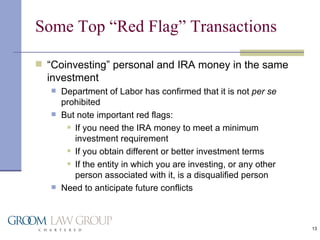

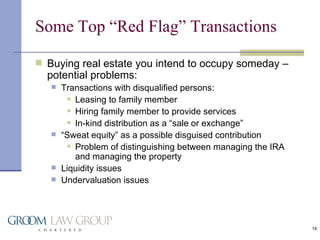

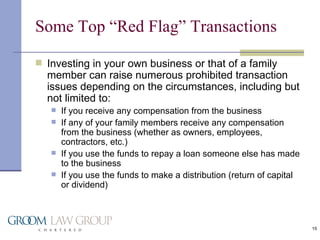

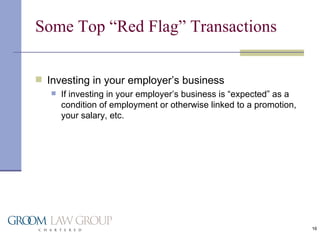

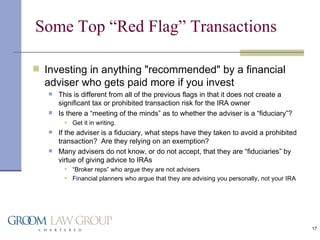

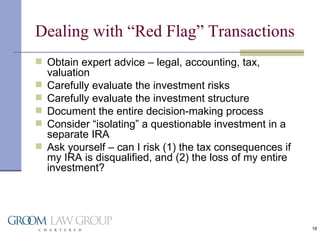

The document discusses legal "red flags" to consider when making self-directed IRA investments. Some key red flags include investing in real estate you plan to occupy, your own business or a family member's business, anything recommended by an adviser who earns higher fees if you invest, and "checkbook LLCs" that do not use an approved IRA custodian. The document advises obtaining expert advice when considering investments with red flags and carefully documenting the decision process to demonstrate compliance with IRA rules.