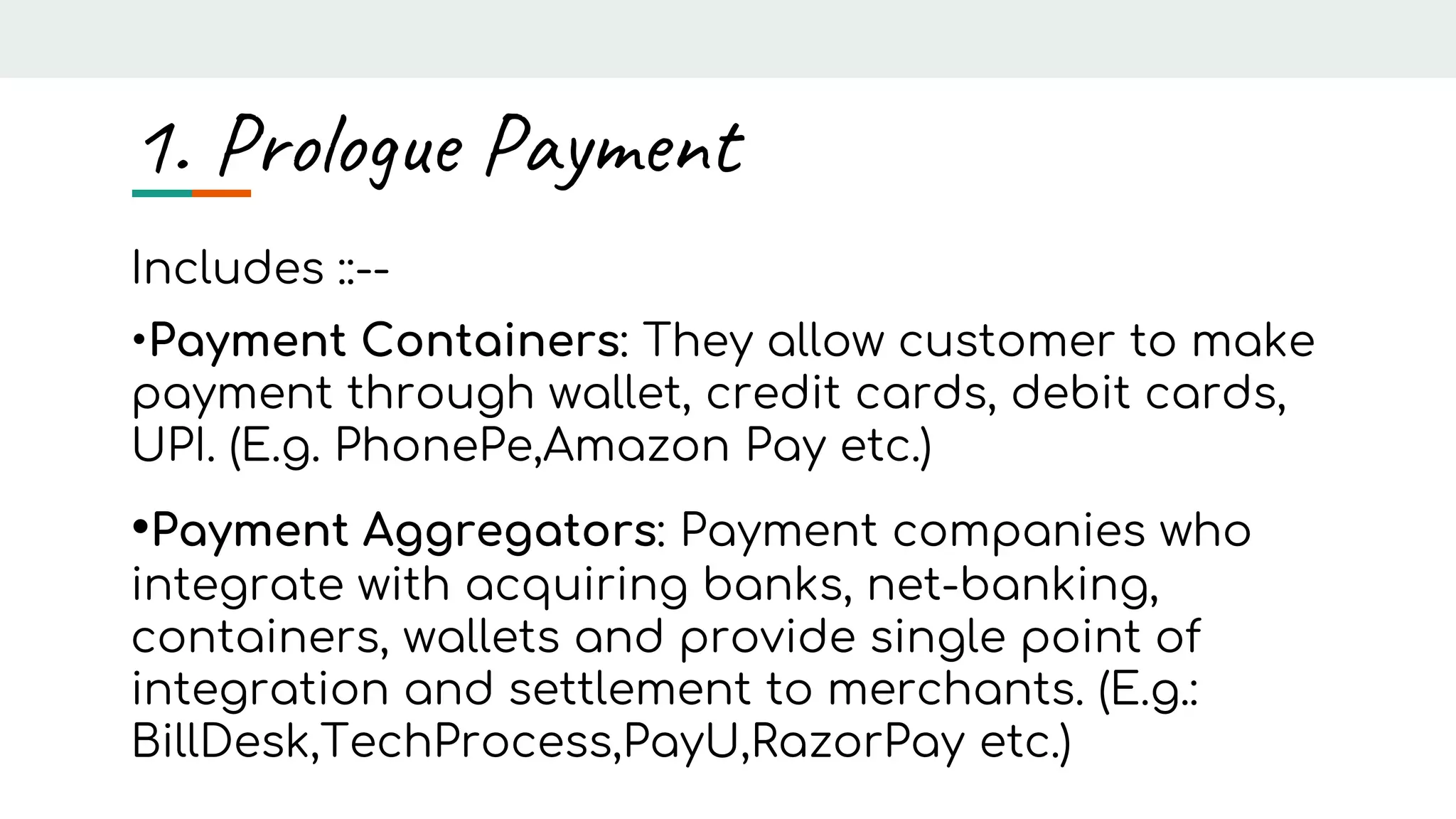

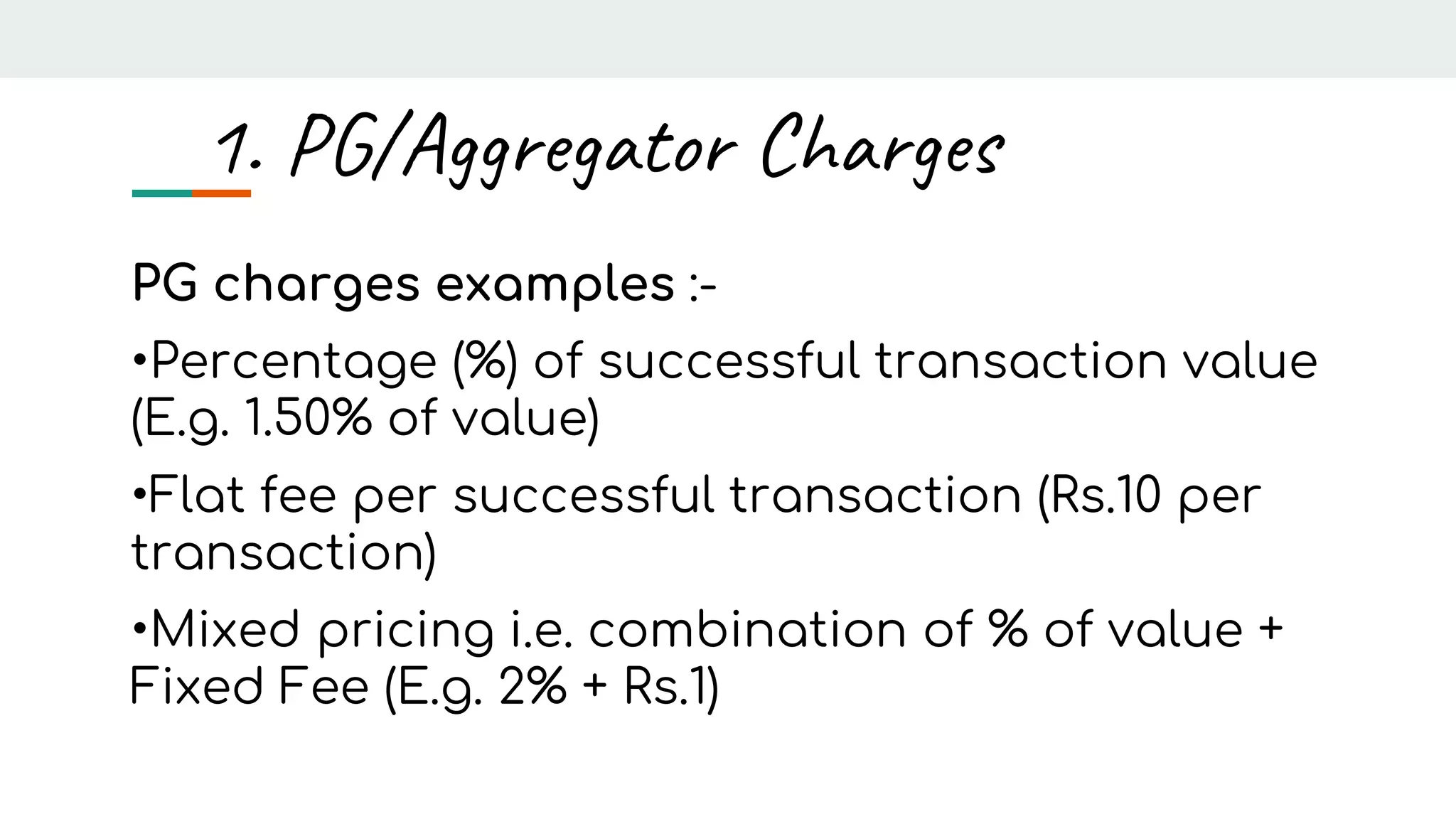

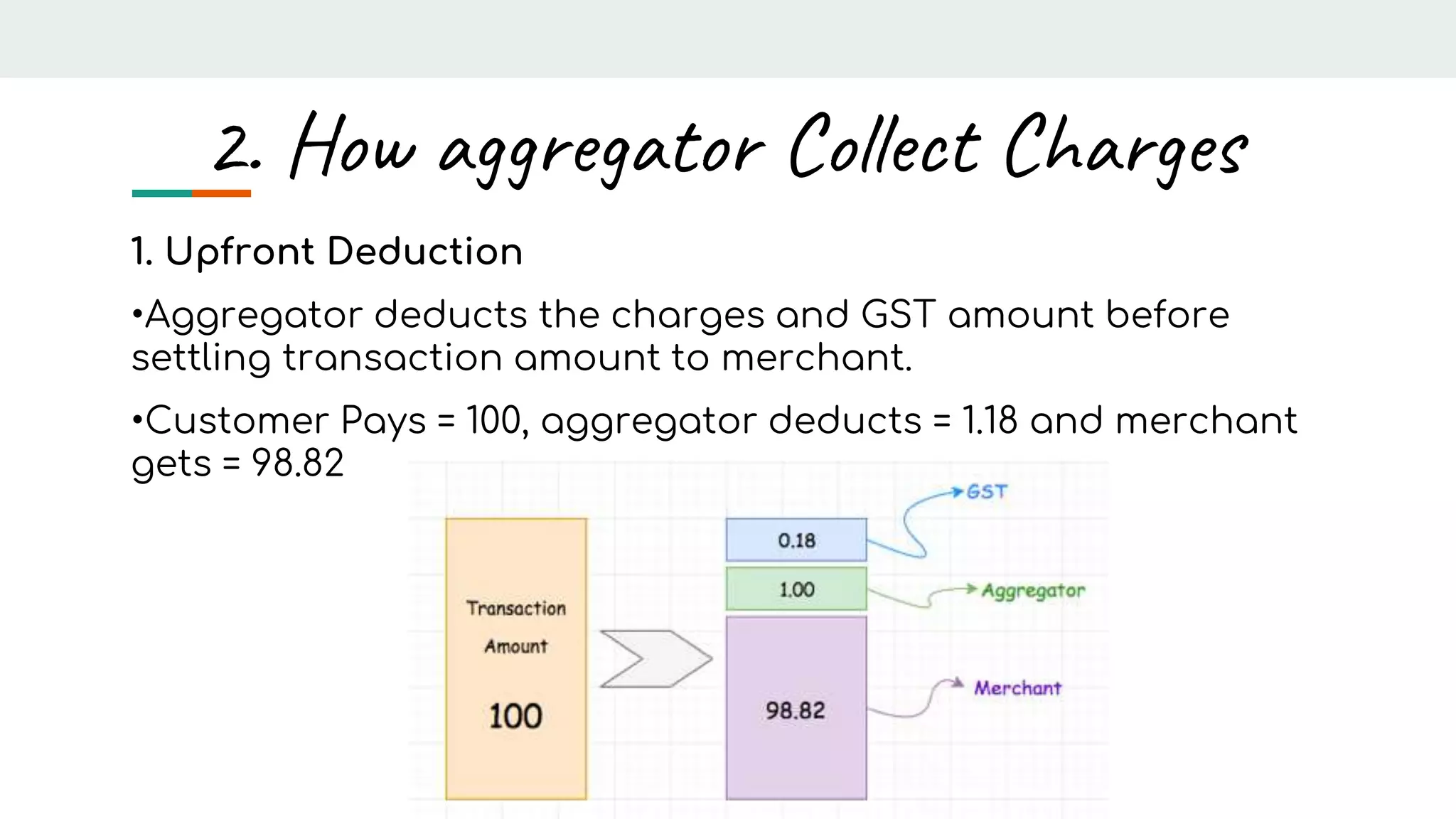

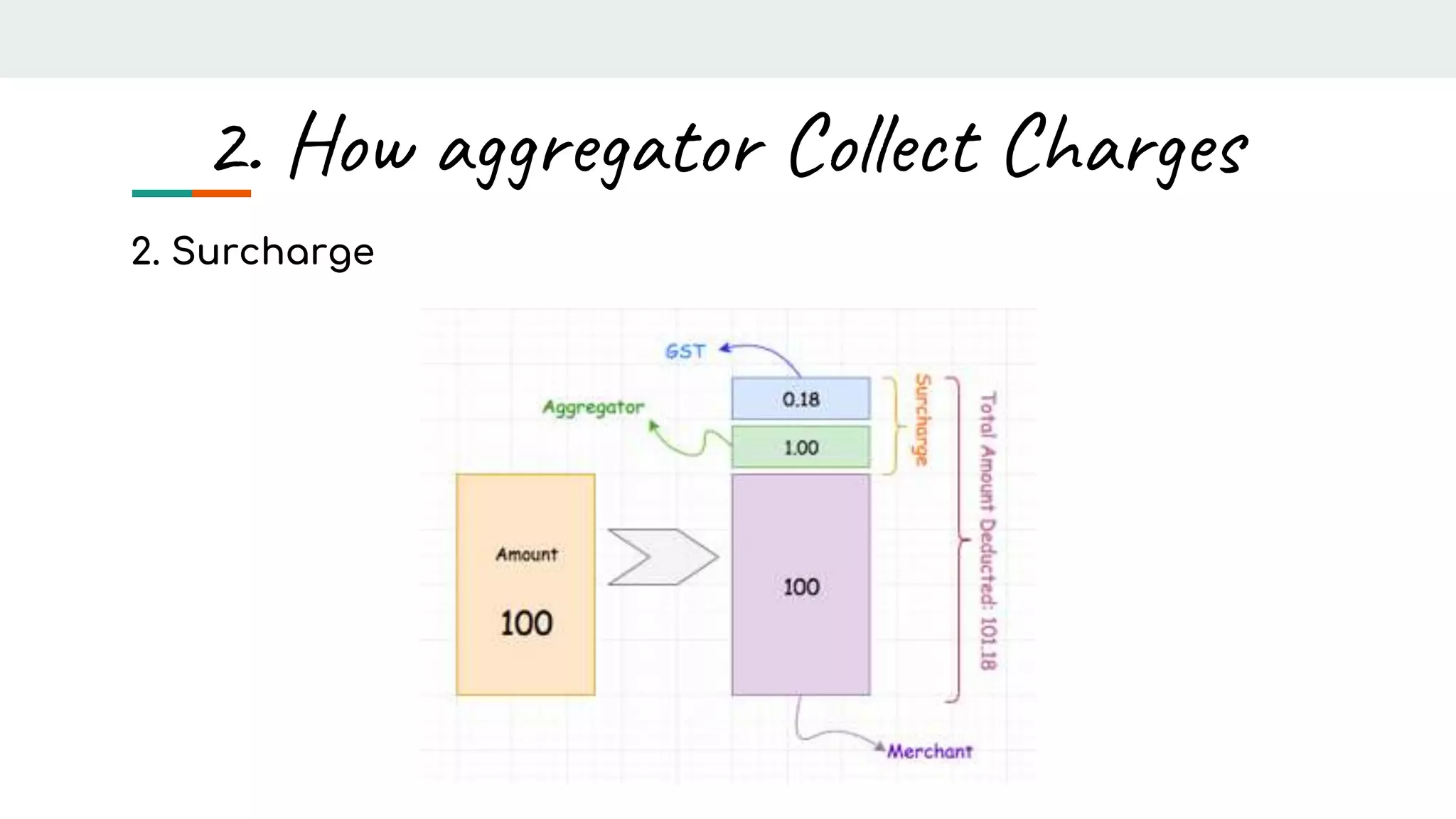

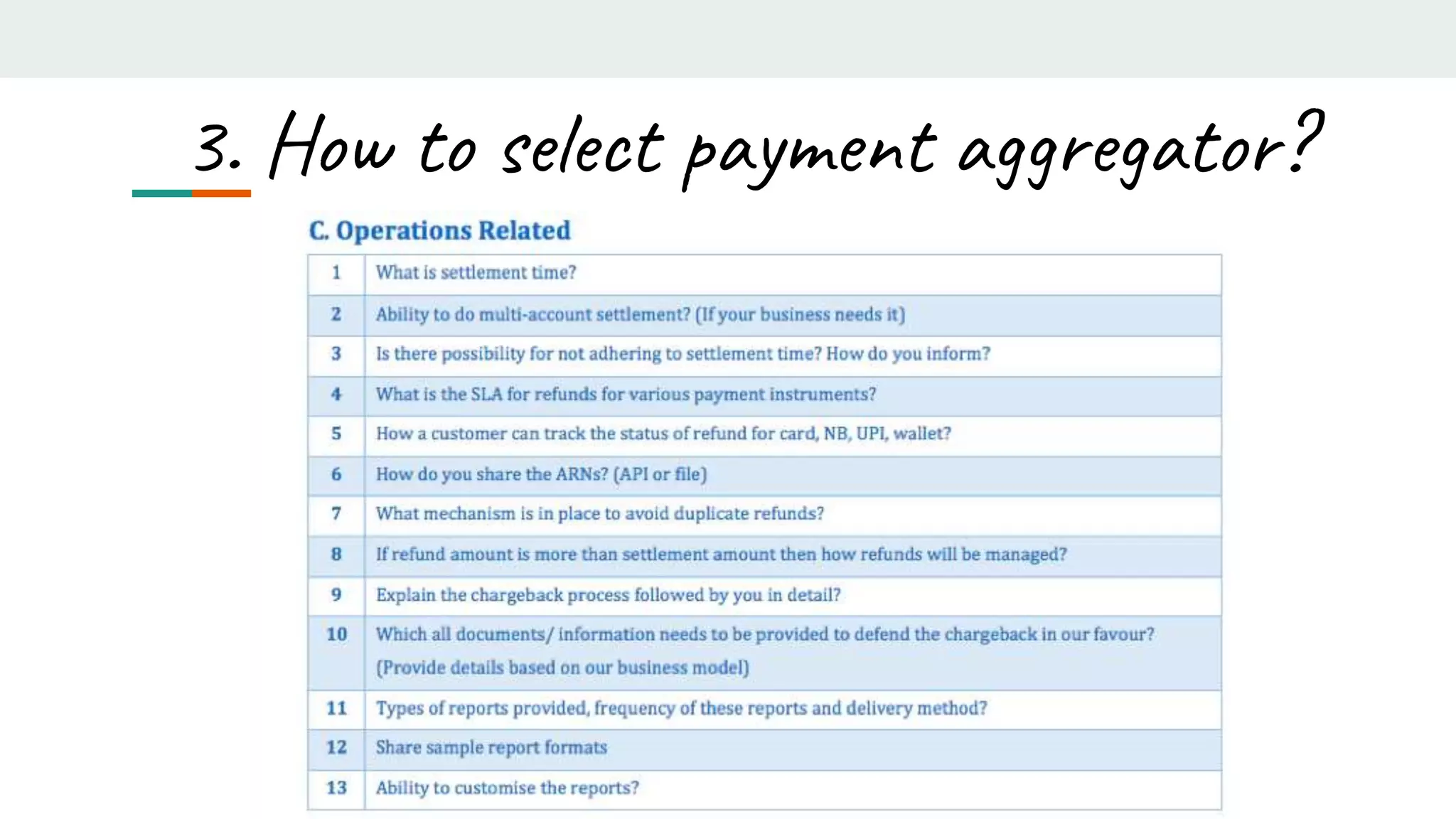

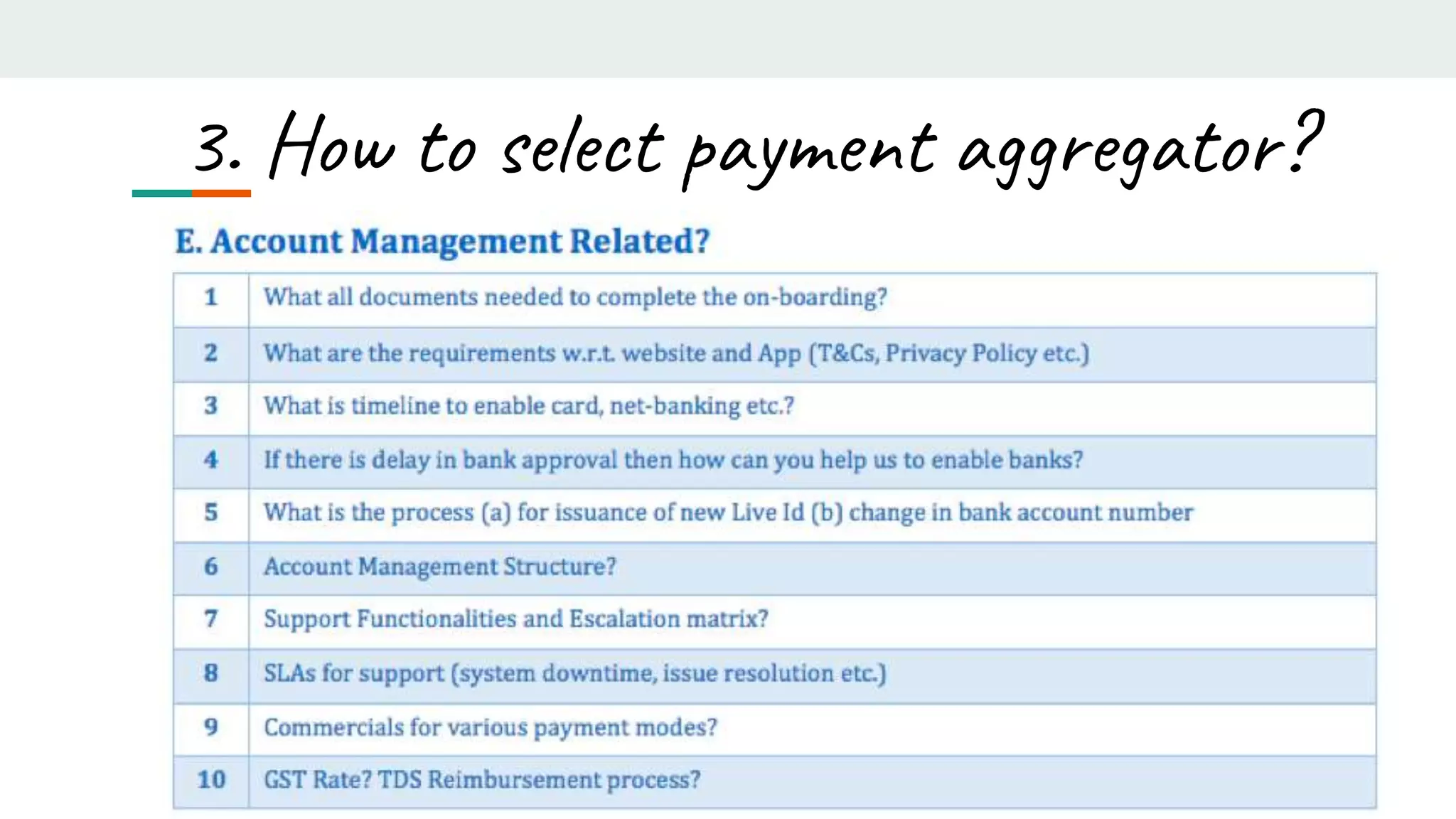

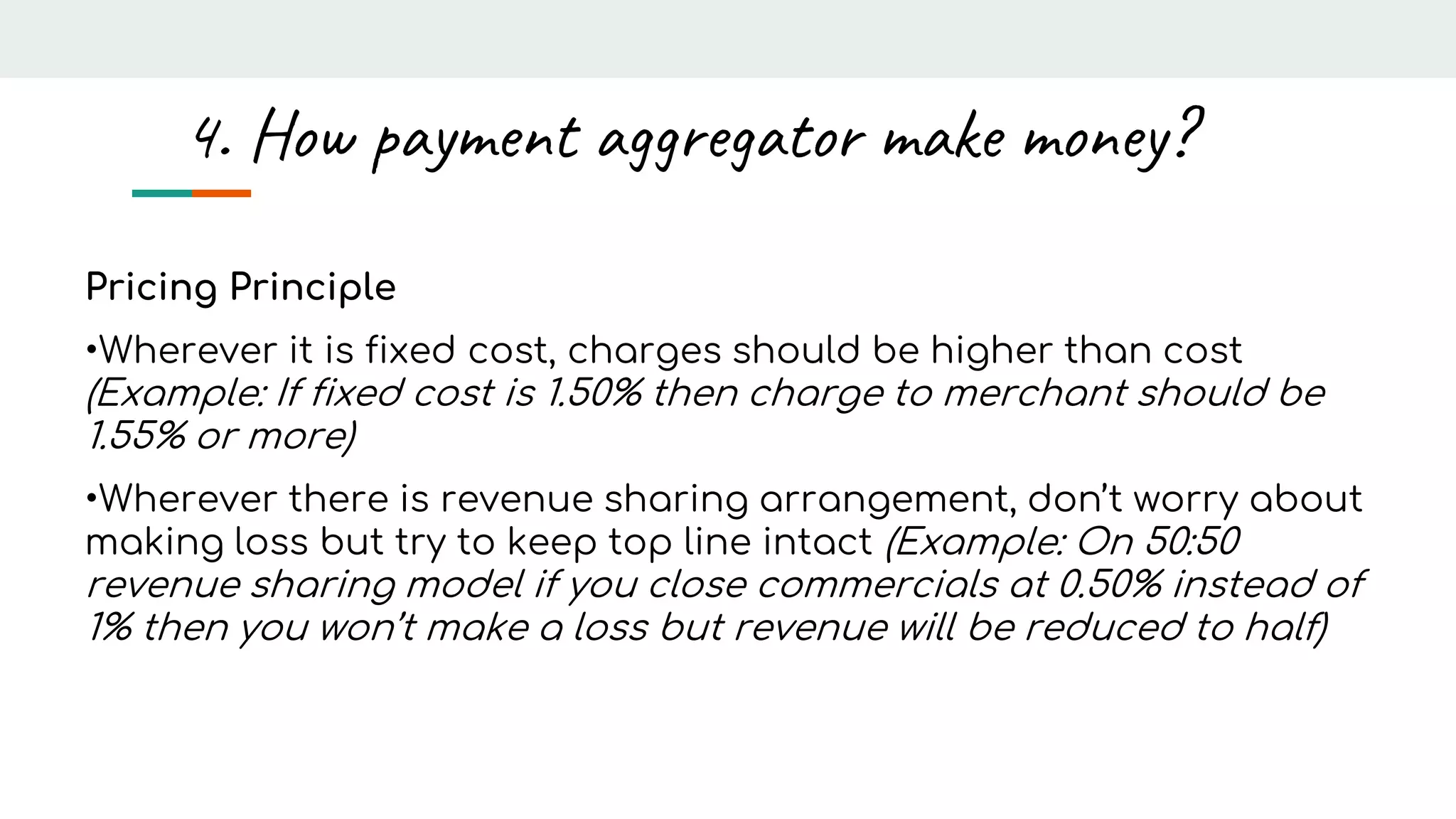

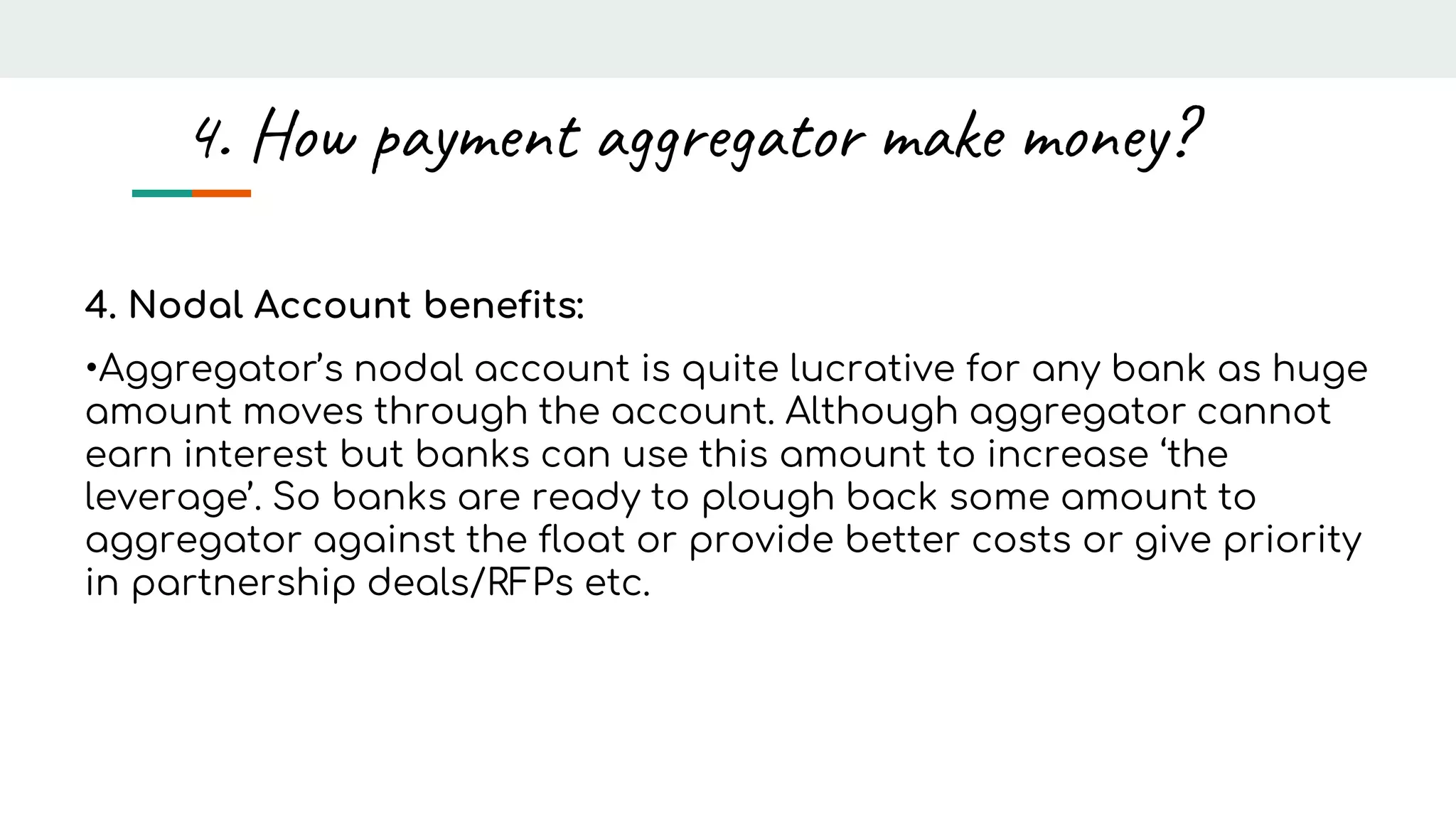

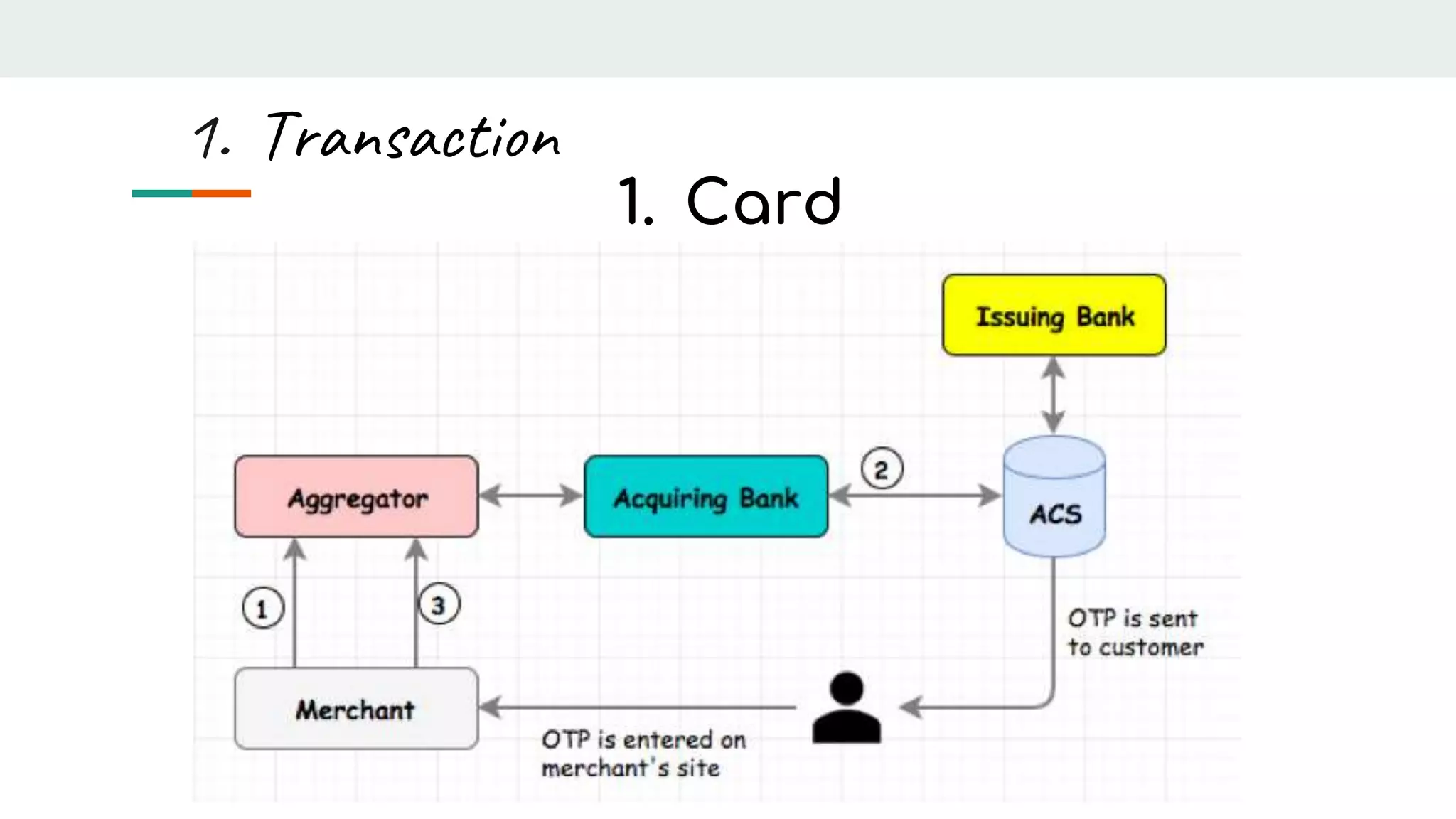

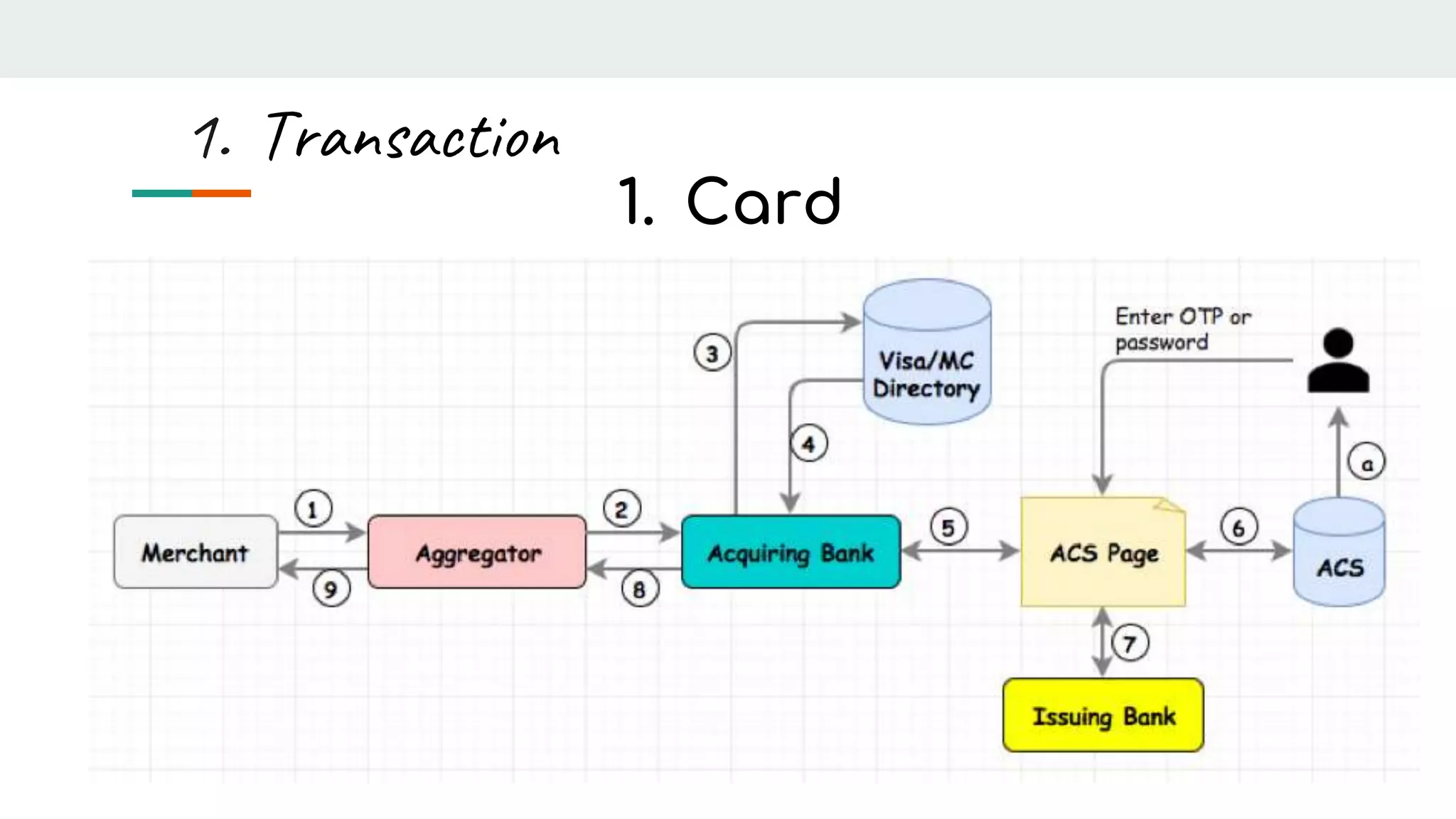

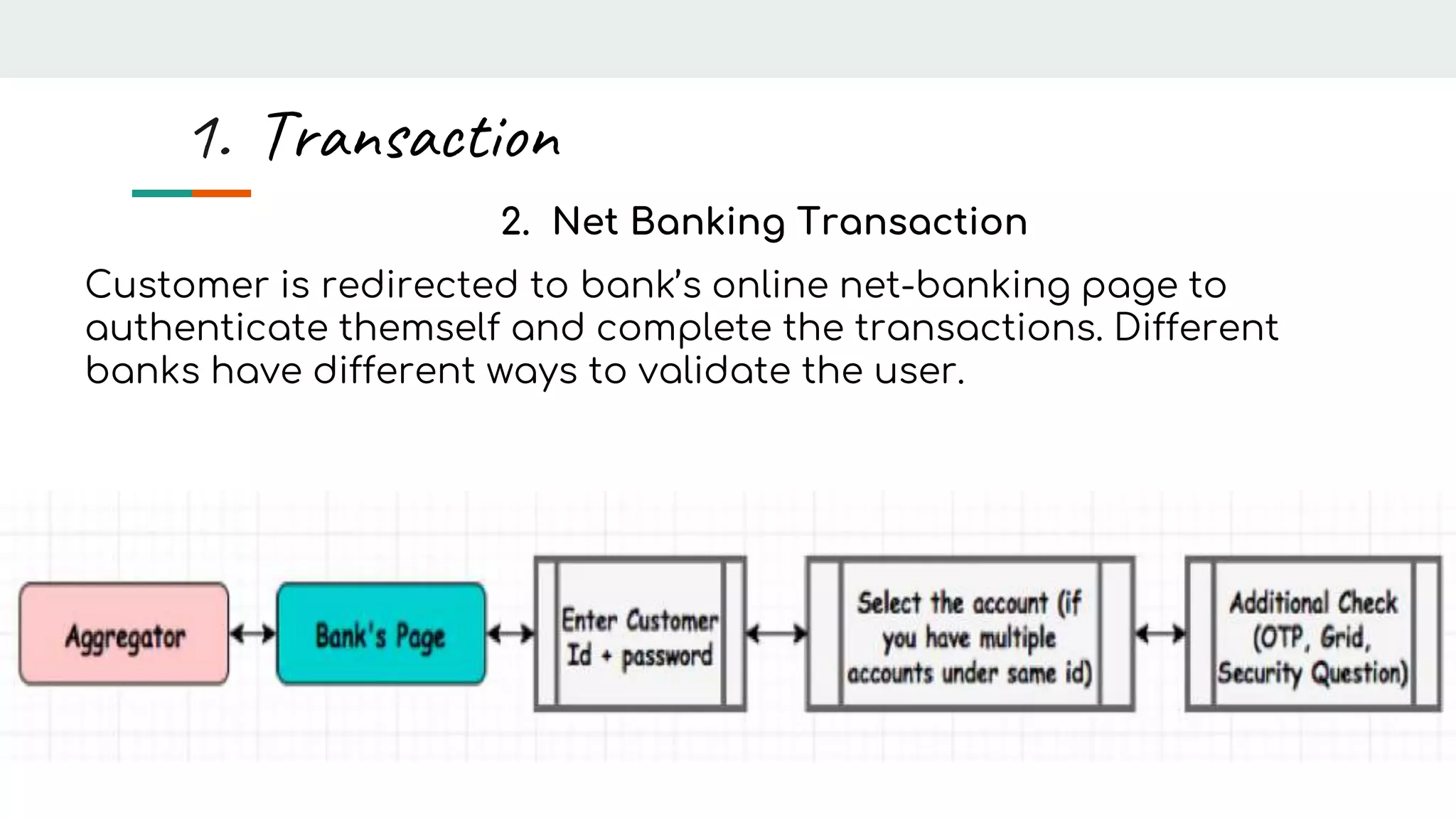

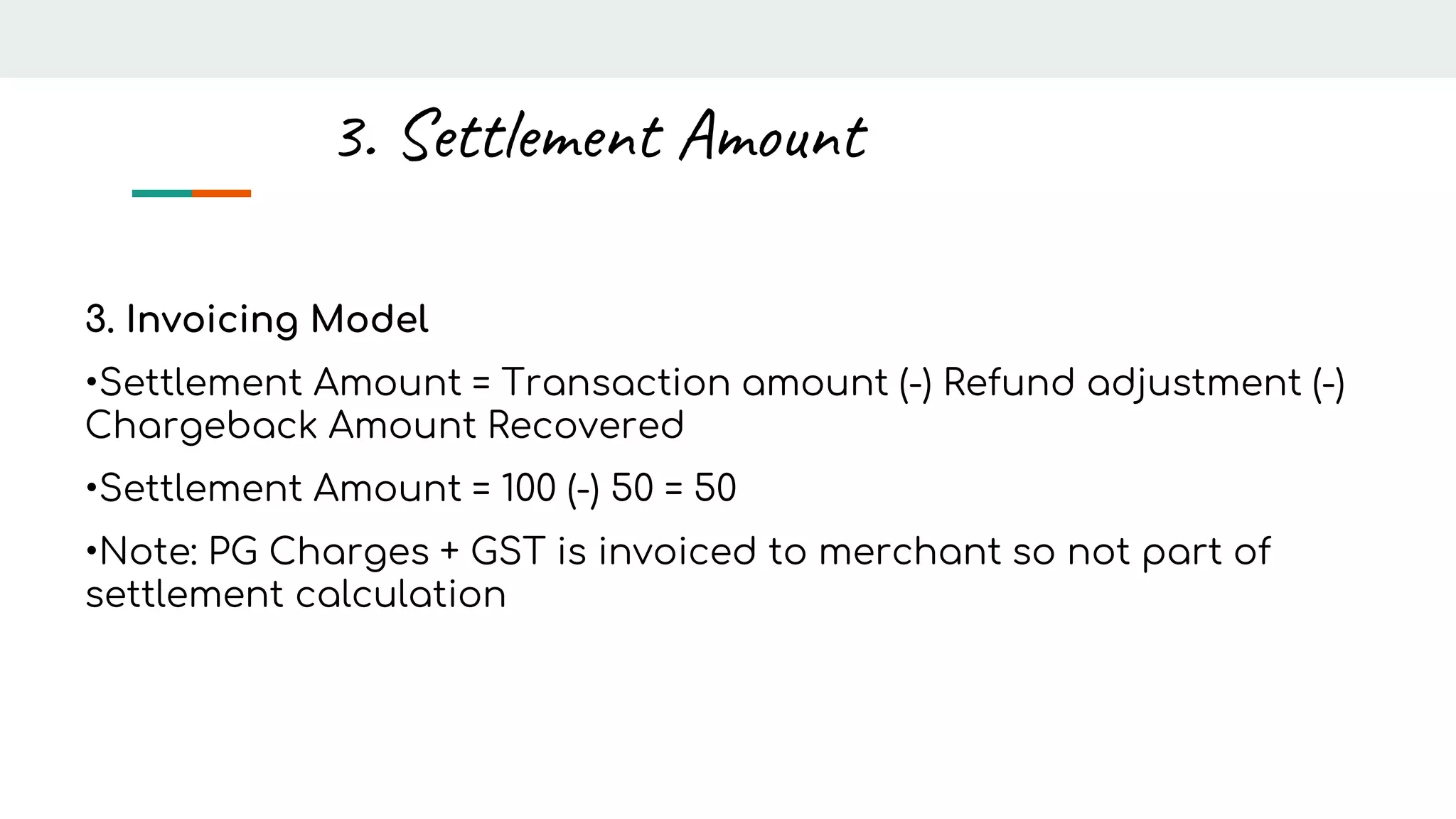

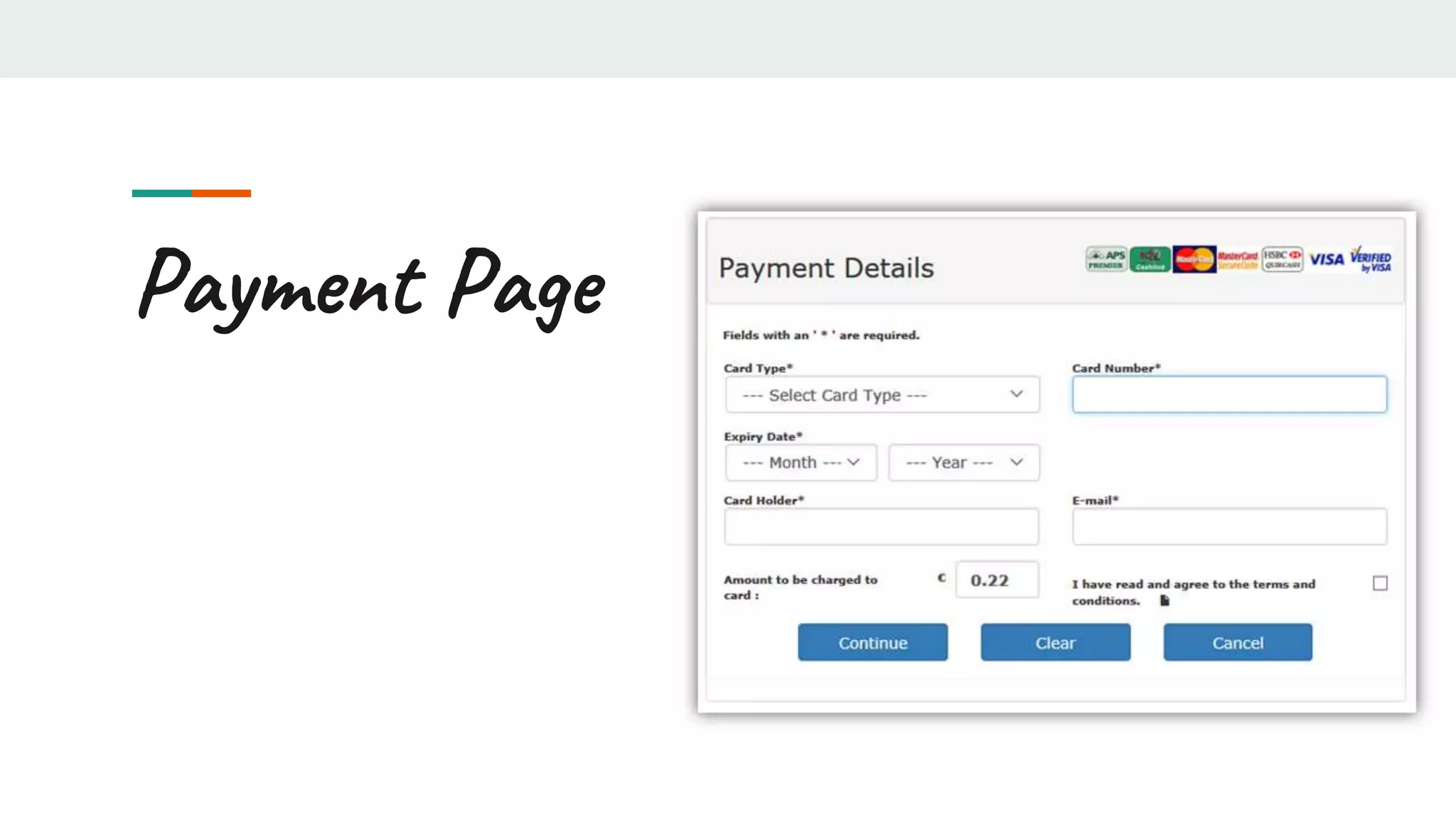

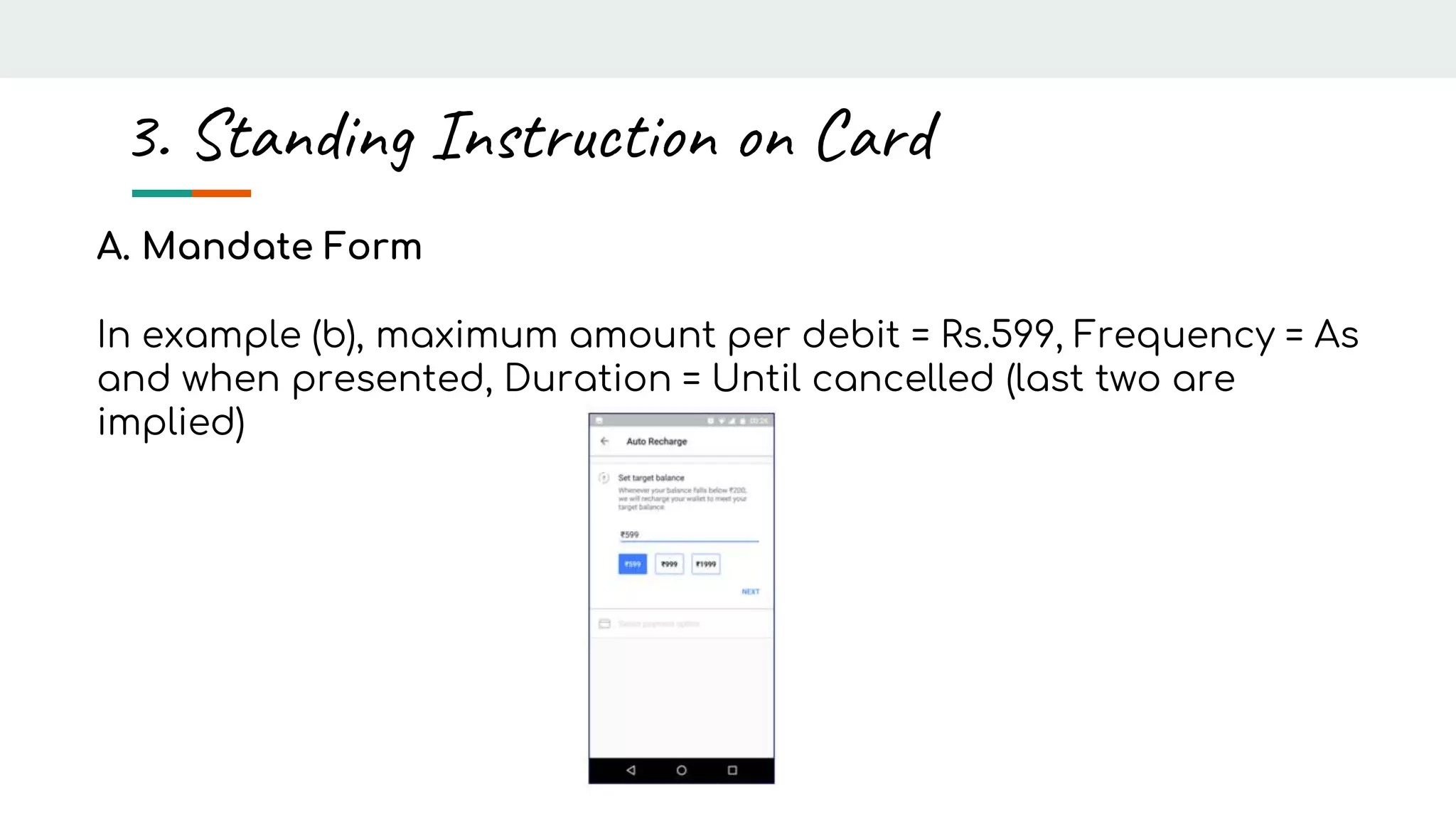

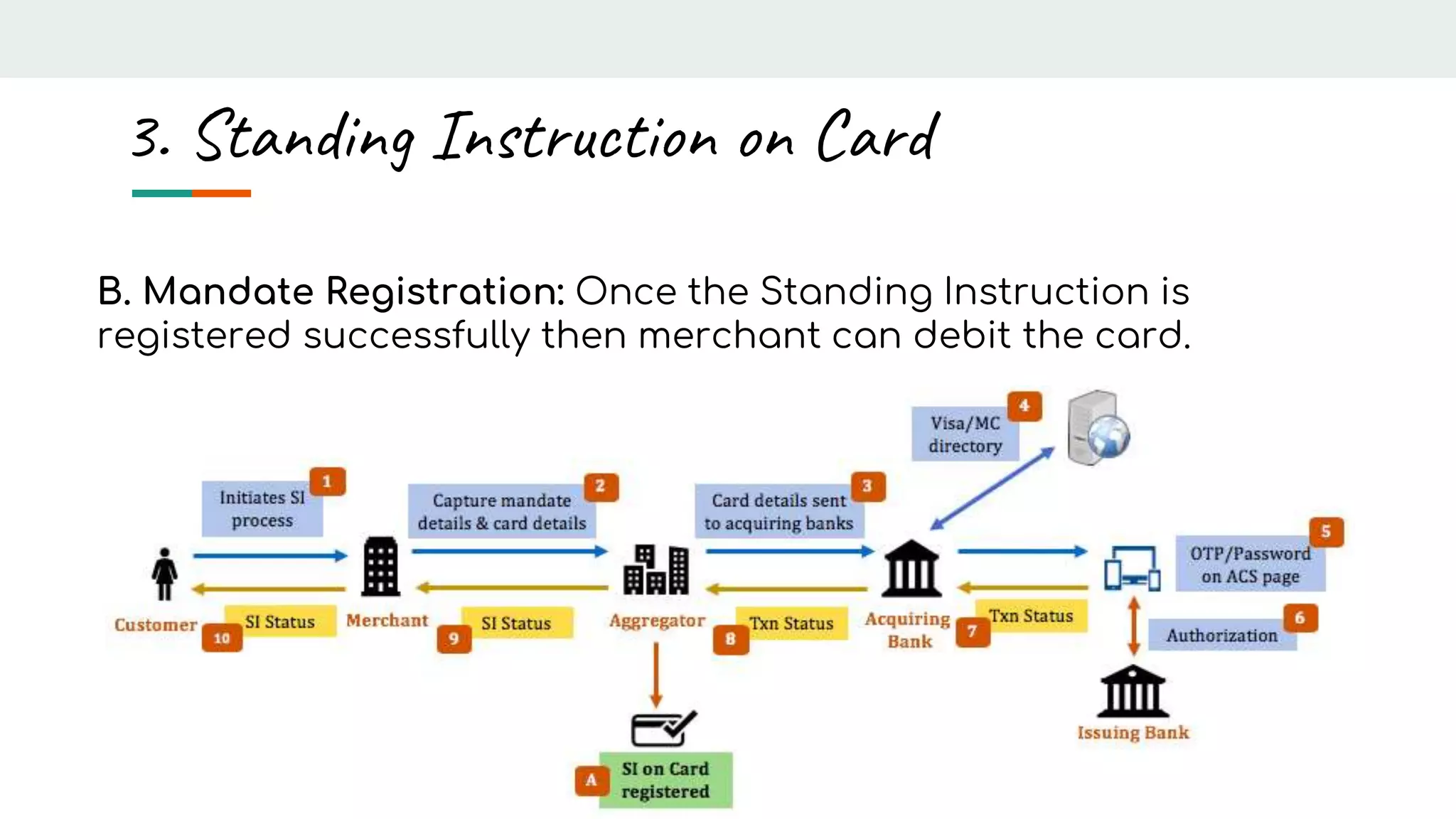

The document outlines the complex ecosystem of payment methods, including key entities like merchants, acquiring and issuing banks, payment aggregators, and various transaction processes. It explains the roles of payment gateways and aggregators, the fees associated with transactions, and the nuances of settlement, including commercial models and refund processing. Additionally, it provides guidance on selecting payment aggregators and details on transaction flows within different payment methods.