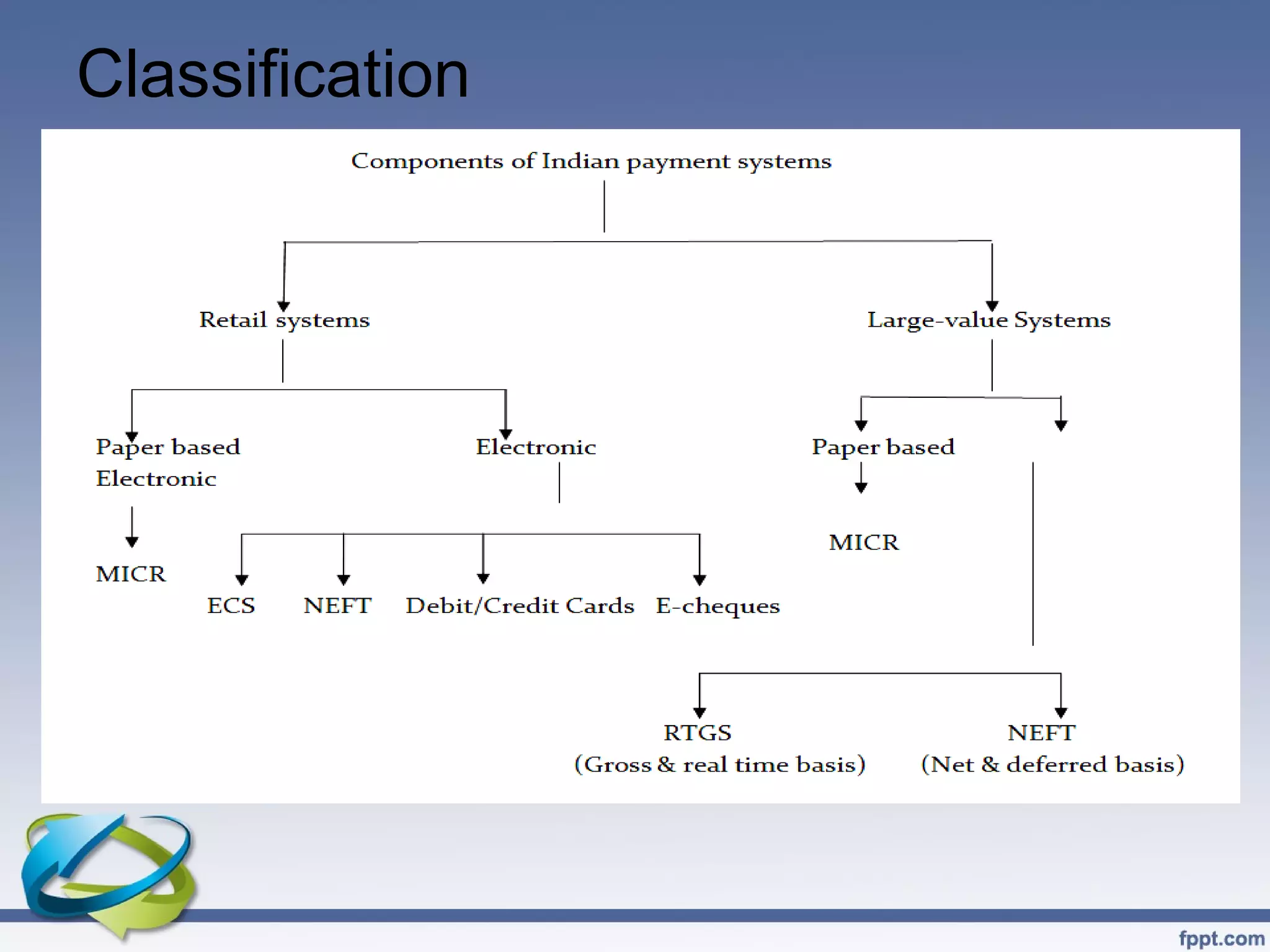

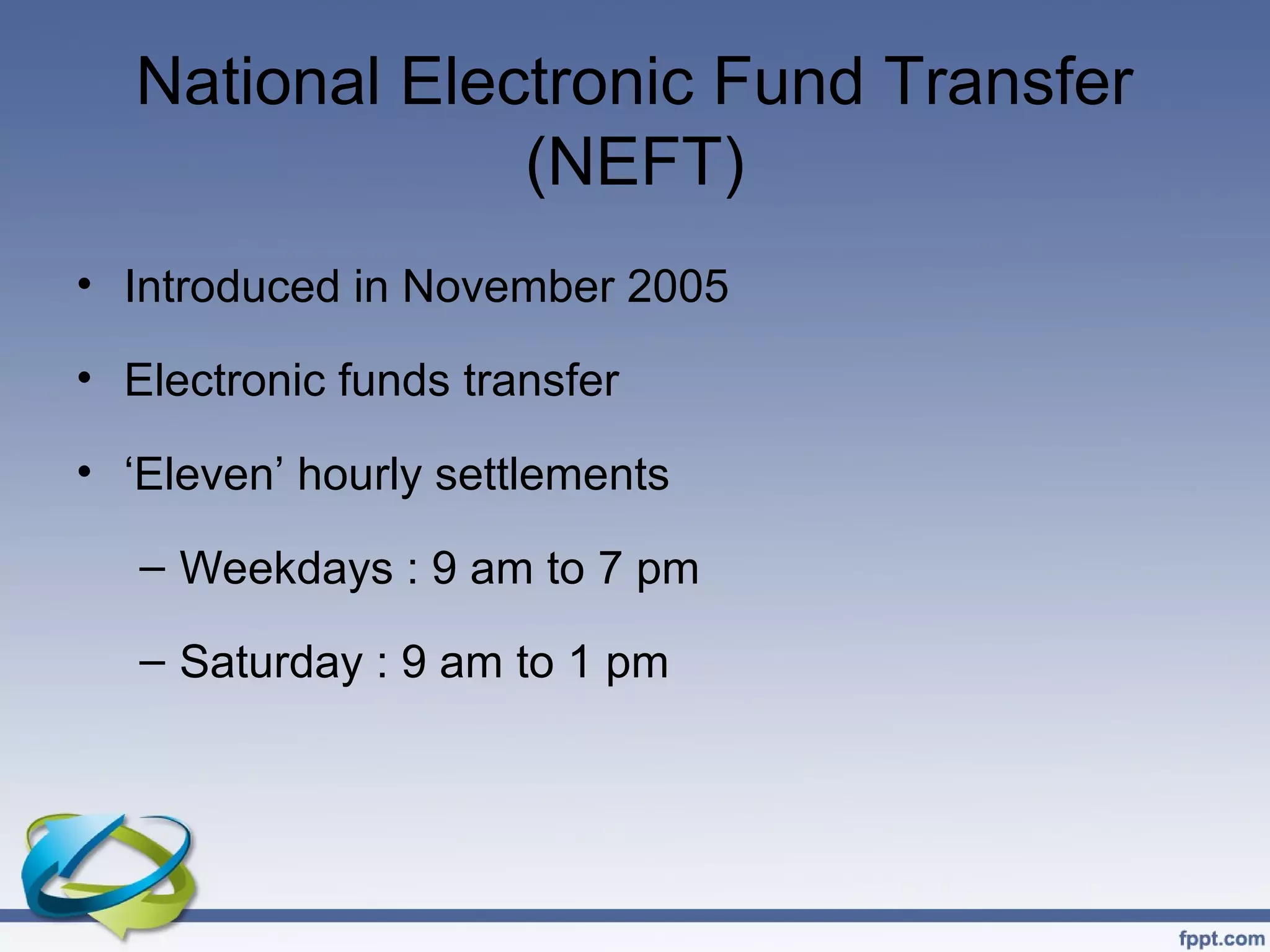

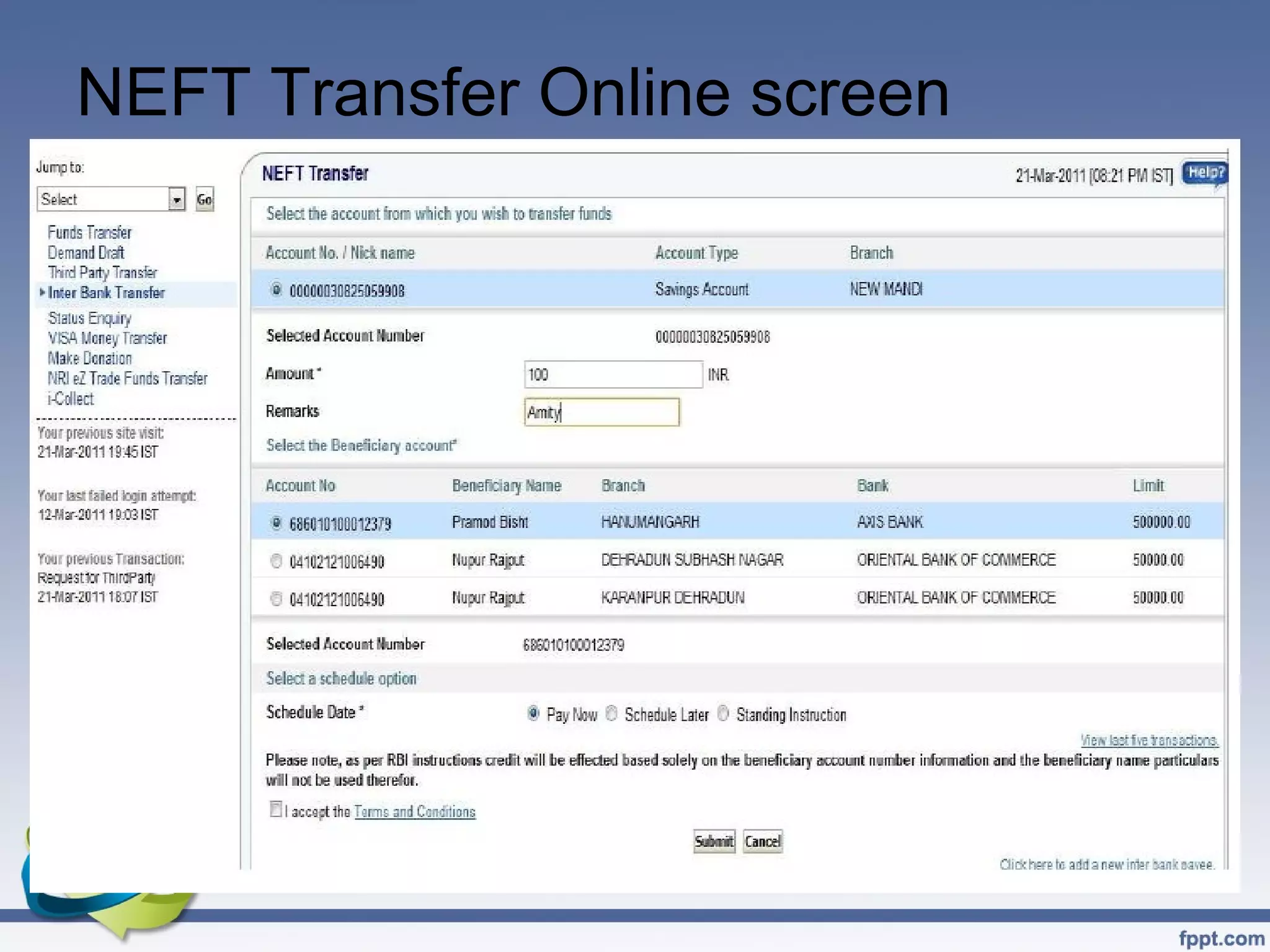

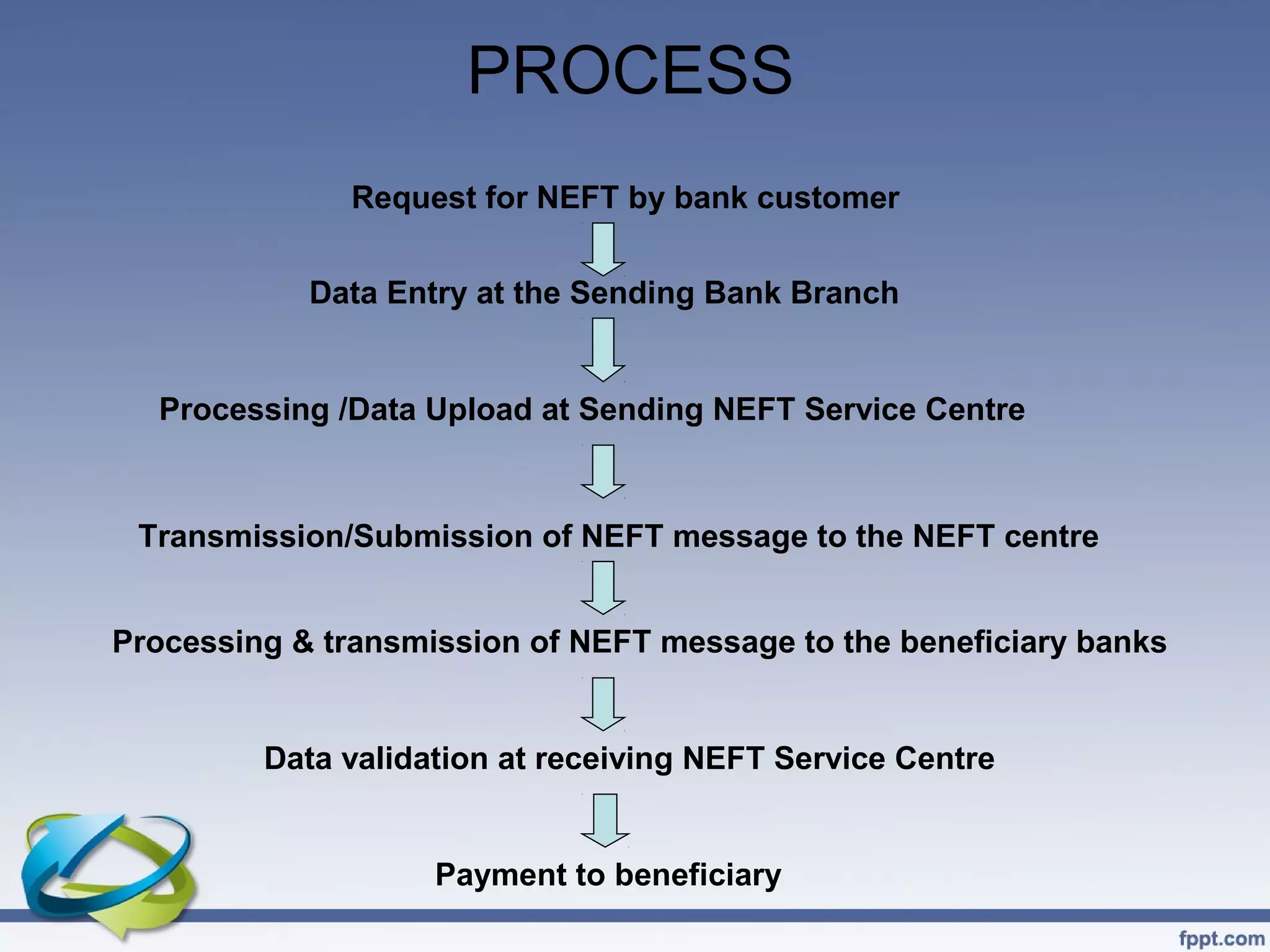

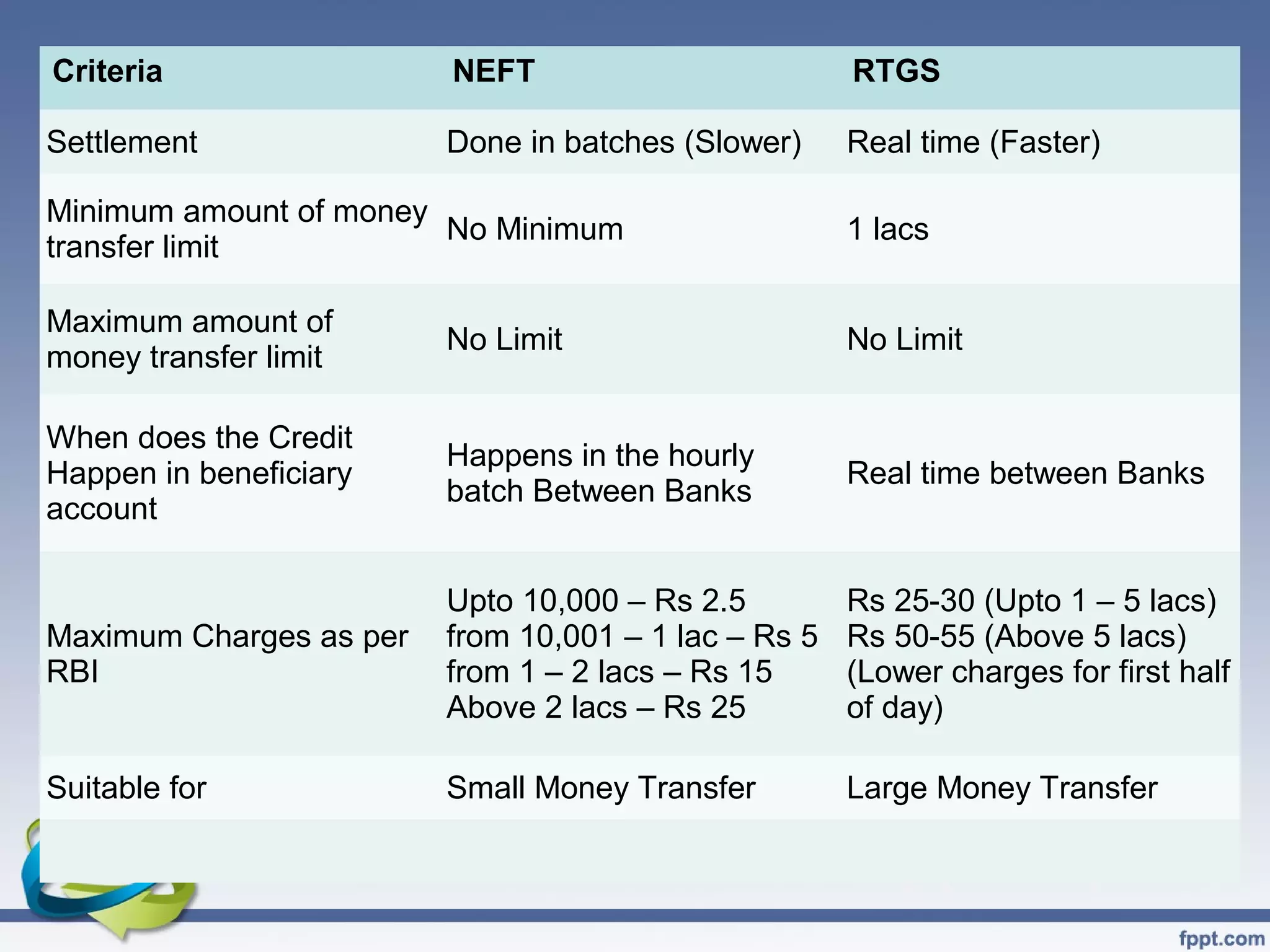

NEFT and RTGS are electronic funds transfer systems operated by the Reserve Bank of India. NEFT operates in hourly batches for fund transfers of any amount with no minimum limit. RTGS provides real-time fund transfers for high-value transactions of Rs. 2 lacs and above, with settlement occurring individually on a continuous basis. Both systems allow fast domestic transfers between banks across India using IFSC codes, with NEFT being suitable for smaller transfers and RTGS for larger, time-critical transfers.