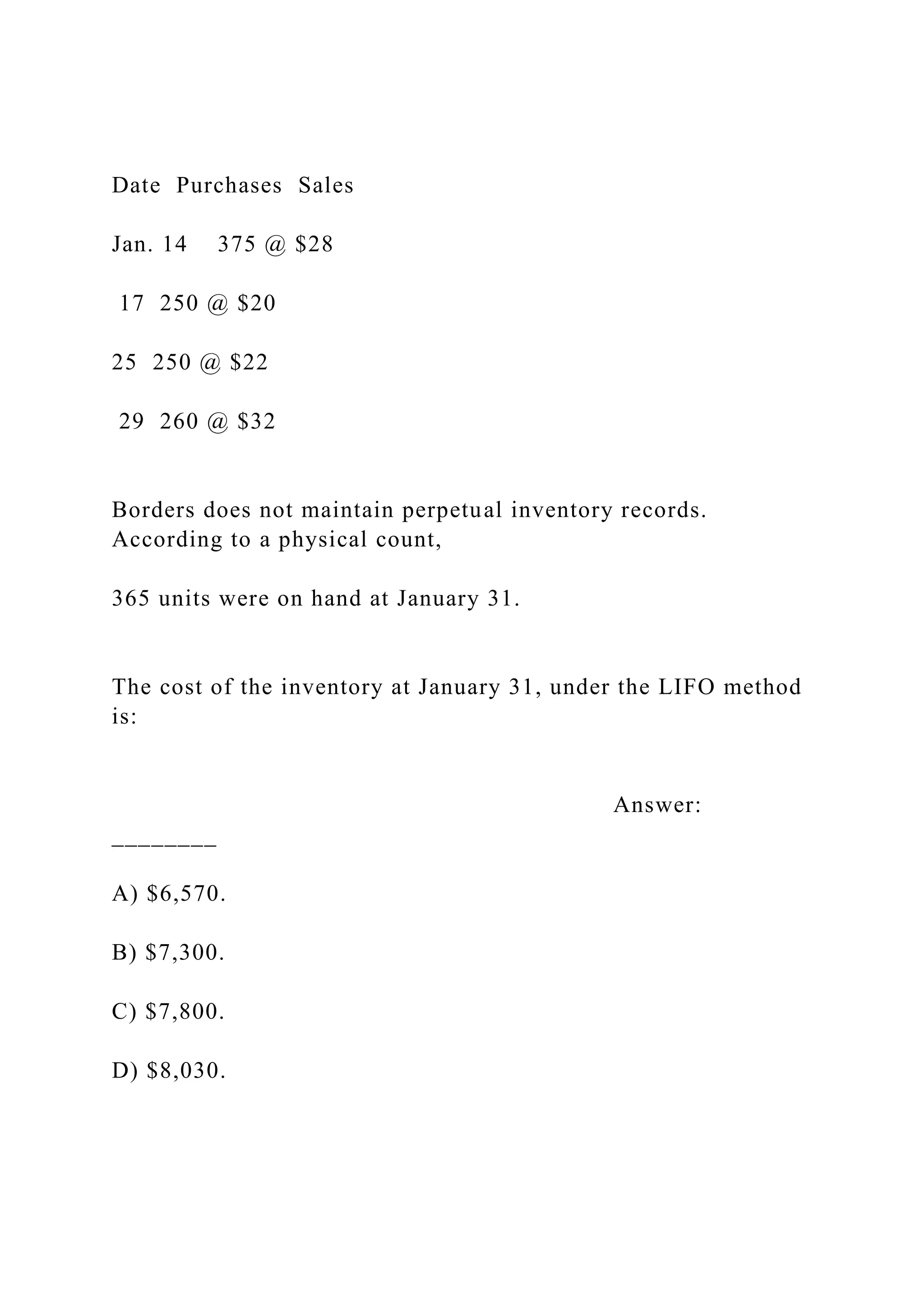

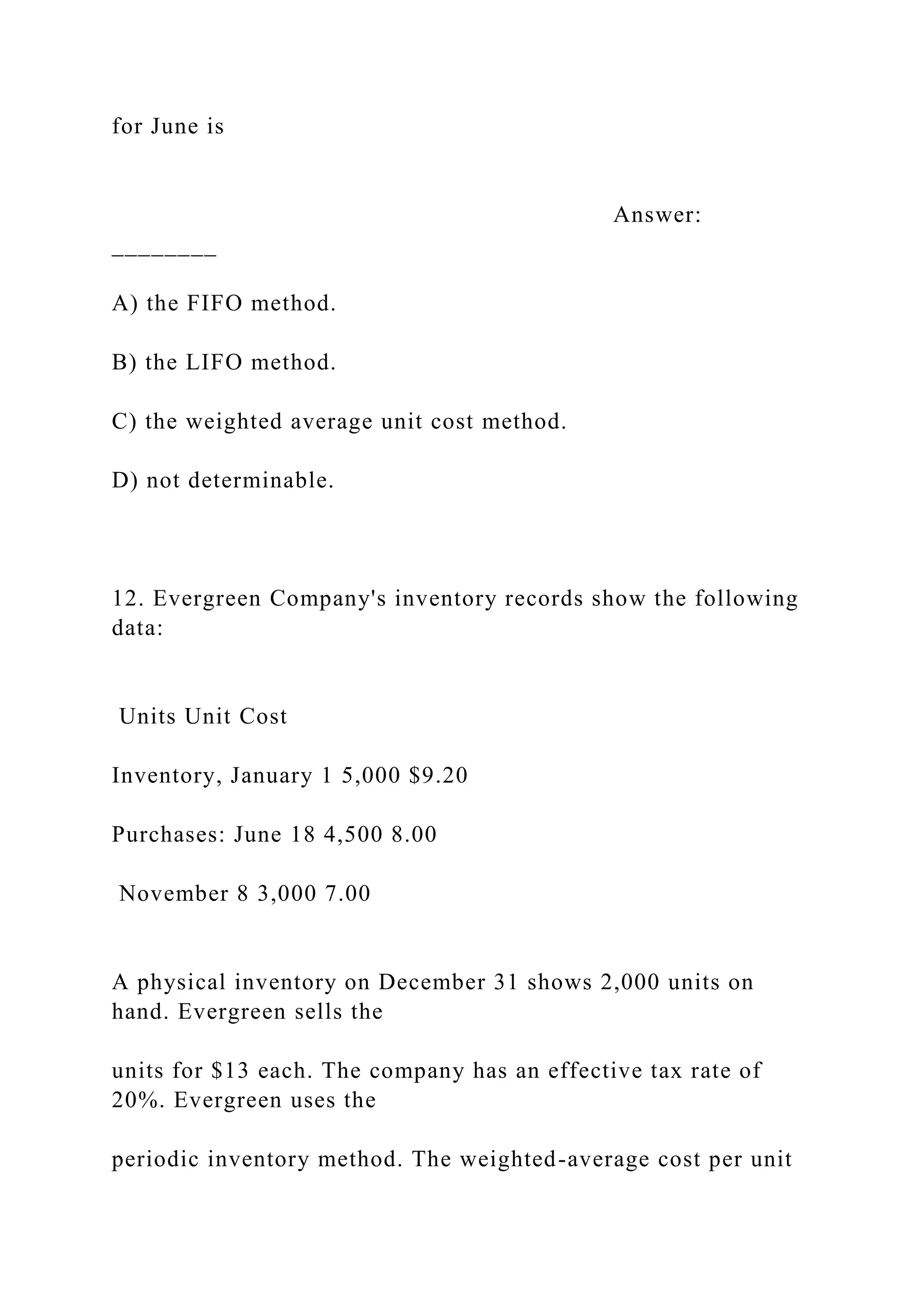

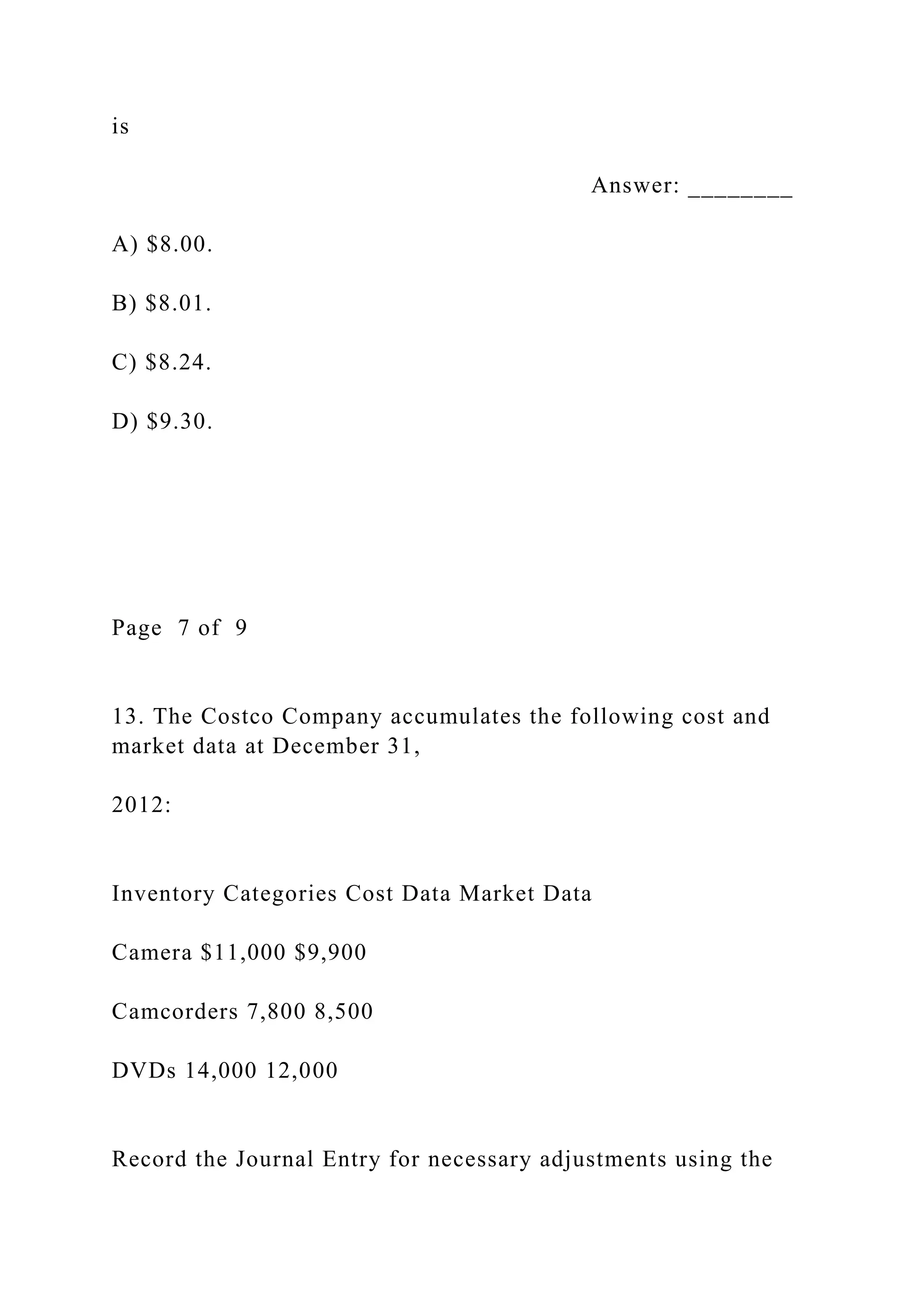

The document outlines the instructions for Quiz 2 for an accounting course, which includes various types of questions such as multiple-choice, problems, and an essay. It specifies guidelines for completing the quiz resourcefully and ethically, including submission format requirements. Additionally, it contains detailed questions related to financial concepts, inventory methods, and calculations, indicating the expected answers for each item.