Scott Podvin presented at Harvard University's Graduate School of Design on distressed real estate opportunities. He discussed several topics:

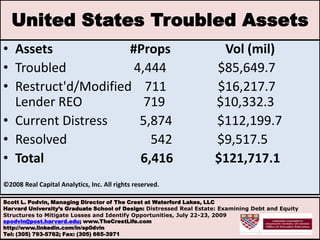

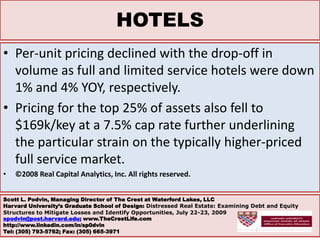

1) Current opportunities exist in sourcing, underwriting and executing distressed real estate deals, with capital coming from places like hedge funds and private equity firms.

2) The best markets for investment are those with strong job growth, deep property discounts, and long-term demand drivers like population growth. These include cities hit hard by the real estate crisis like Miami and Las Vegas.

3) Hundreds of billions of dollars are being withdrawn from hedge funds and private equity due to poor performance and redemptions, forcing the sale of illiquid real estate assets at discounted prices.