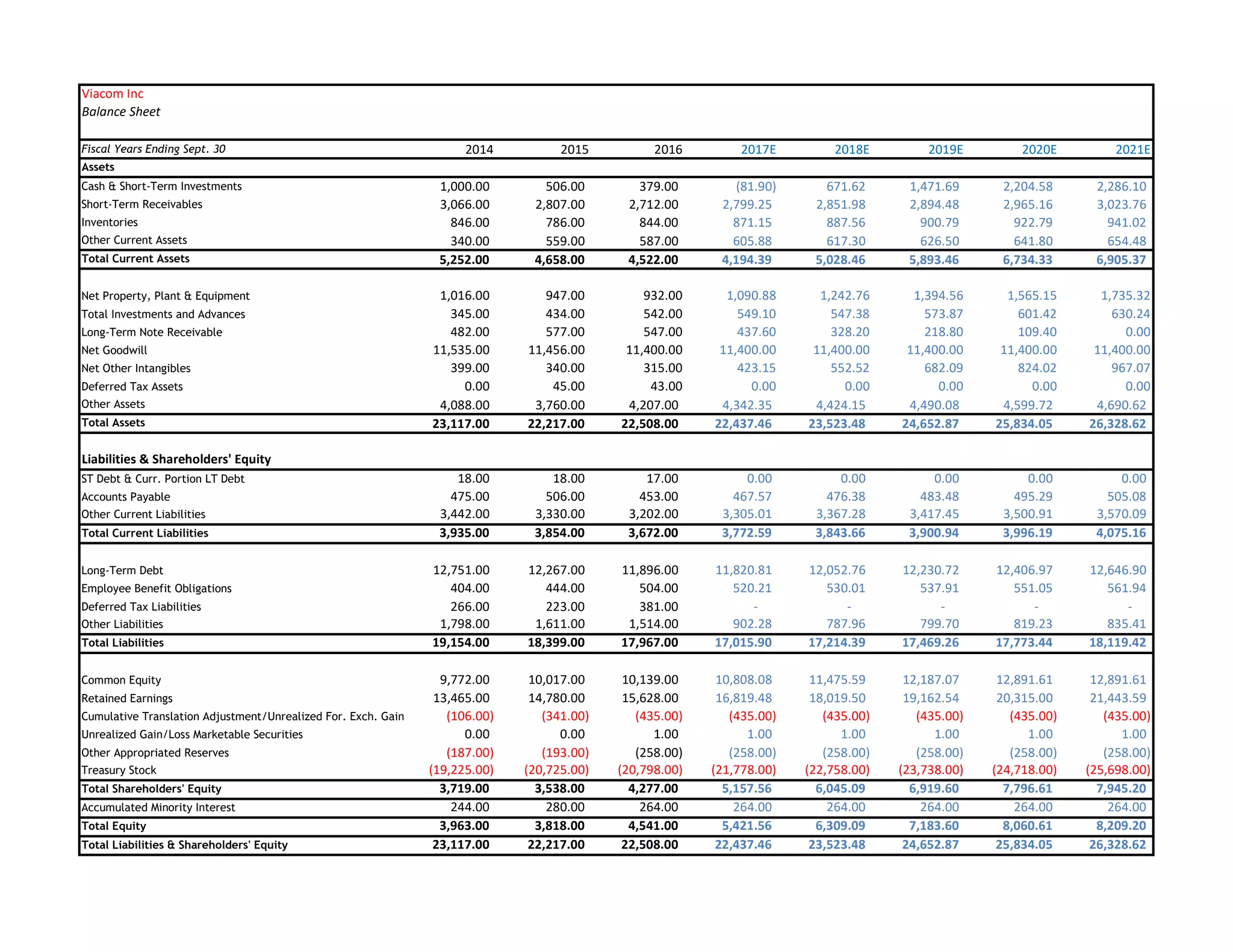

Viacom is a media and entertainment company facing challenges from the shift to online platforms and decline in traditional television. The company operates media networks like MTV and Nickelodeon and produces films through Paramount. Recent issues include a messy CEO change, weak film performances, and control of the company by one family through dual share classes. However, the stock price decline seems overdone given the company's large content library and plans to better integrate its film and television businesses. A potential merger with CBS could also create a stronger combined company. The analysis values Viacom at $52 per share based on conservative assumptions, indicating it is undervalued at its current price of $37.77.

![Important disclosures appear on the last page of this report.

The Henry Fund

Henry B. Tippie School of Management

Nihar Patel [nihar-patel@uiowa.edu]

Viacom Inc., Class B (VIAB) November 18, 2016

Consumer Discretionary – Media & Entertainment Stock Rating Buy

Investment Thesis Target Price $49-53

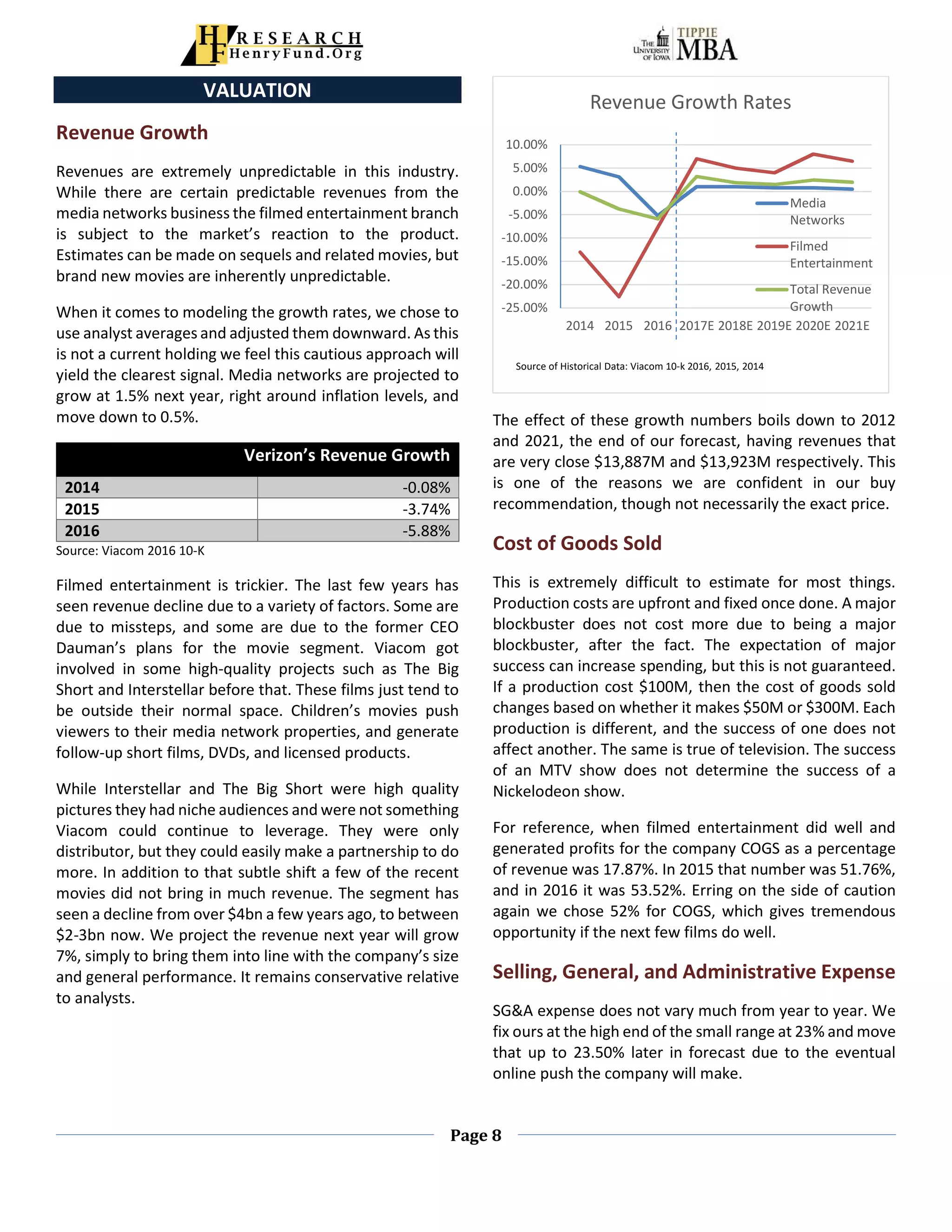

The media and entertainment industry is undergoing a change as more content

moves to online platforms. Viacom operates in two segments Media Networks,

which includes most traditional television, and Filmed Entertainment, which

includes movies. The company recently had a rough CEO change and a few

failed films that has hurt revenues. The company has two share classes, Class

A and Class B. Class A is voting and that is the only difference. 80% of the voting

Class A shares is controlled by one company that is owned by one family. CBS

is also contemplating a merger, and it has the same structure and majority

owner as Viacom.

Investment Positives

The recent trouble in the company has led to the stock being sold off than

its fundamentals would suggest. Between the messy CEO replacement,

weak performance at the box office, and one family’s control of the

company there have been many headwinds.

A merger with CBS could produce a leaner company with a larger content

library. That may create the capacity to launch its own online platform,

which is critical if the company intends to stay relevant into the future.

The company’s strategic plan is to go back to integrating its two lines of

business as it used to do. The goal is to create movies that drive television

views, and use television to bring people to the movies. This could bring

filmed entertainment back to normal, which would be a major boost for

the company’s returns.

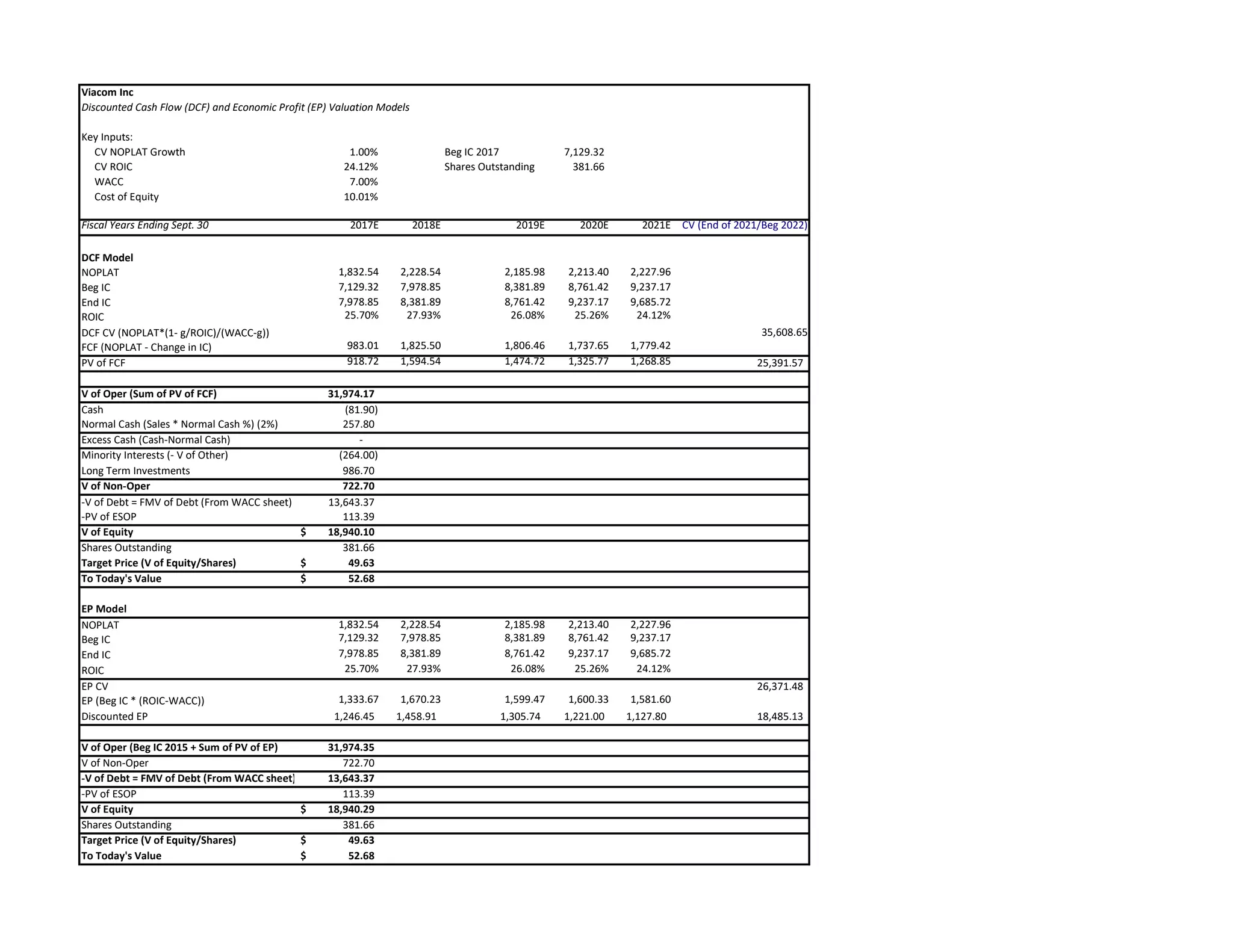

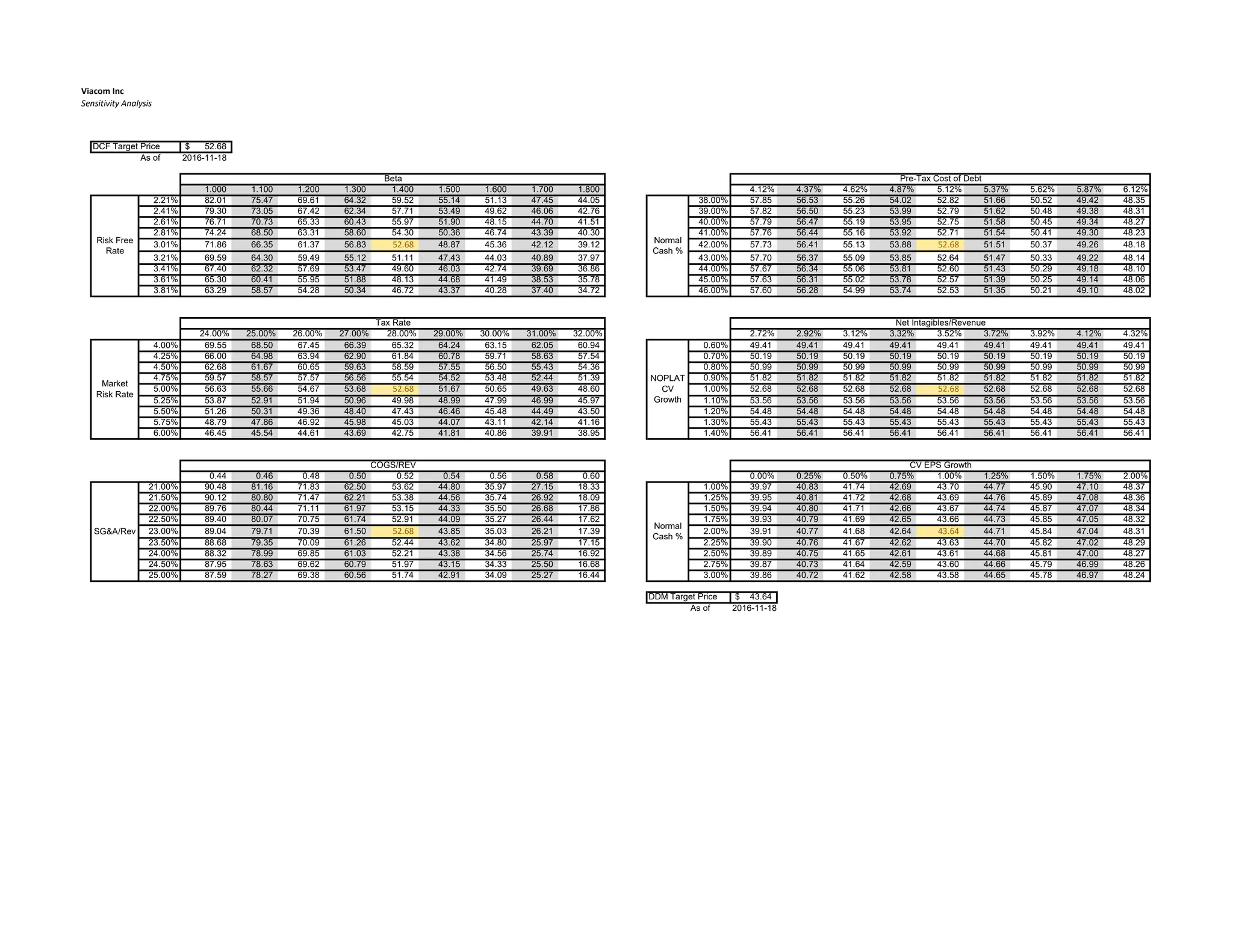

In the DCF model, we have used conservative assumptions as needed, and

there is still plenty of upside in the stock. However, the uncertainty

inherent in the business can change the story very fast.

Investment Negatives

The Redstone family continues to control the company. The CEO debacle is

not the first controversy that has been caused by the concentration of

voting shares.

Traditional television is in a decline with the shift to streaming, and this

segment still makes up most of Viacom’s revenue. The company does not

currently have a fast-growing alternative that could replace this revenue

segment.

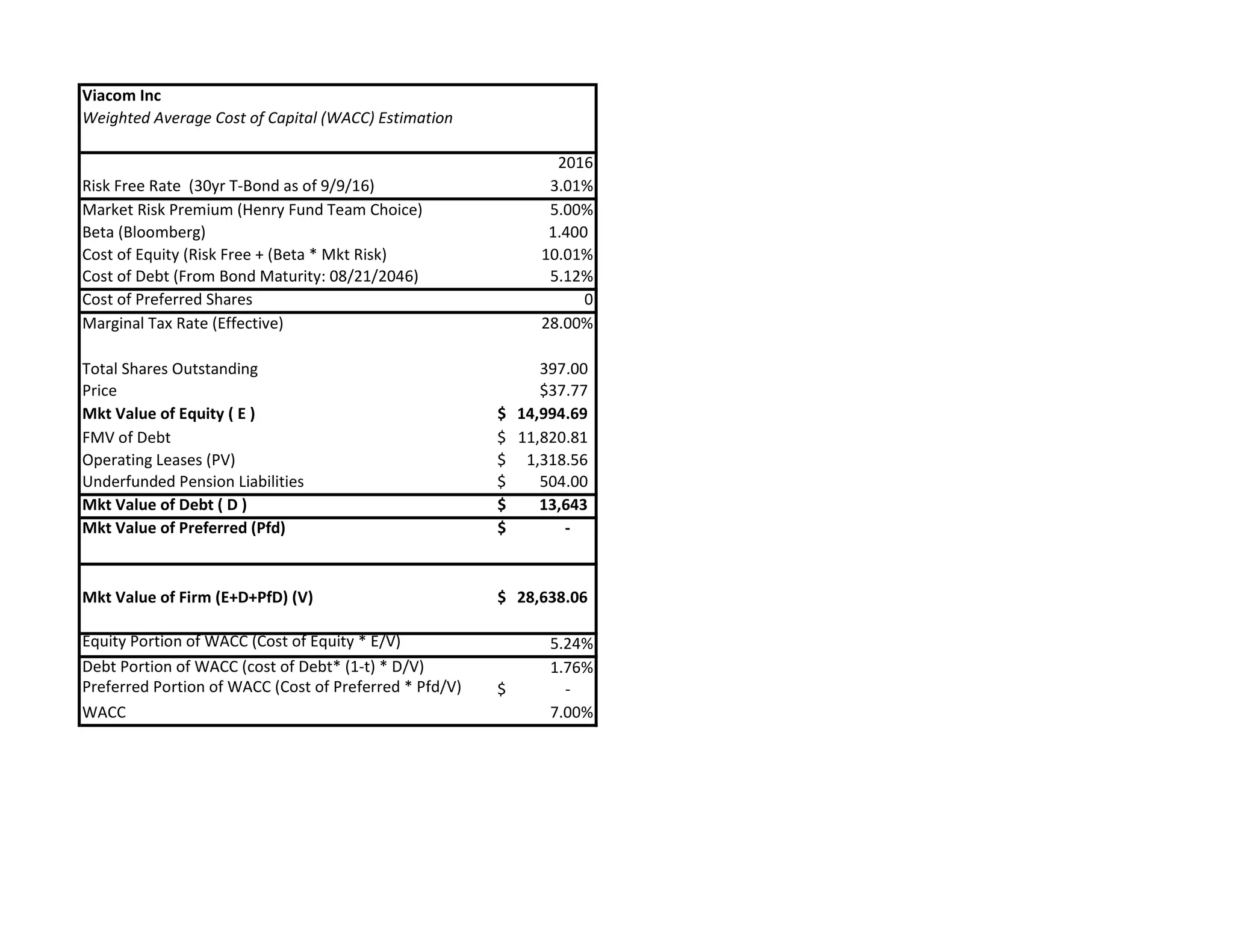

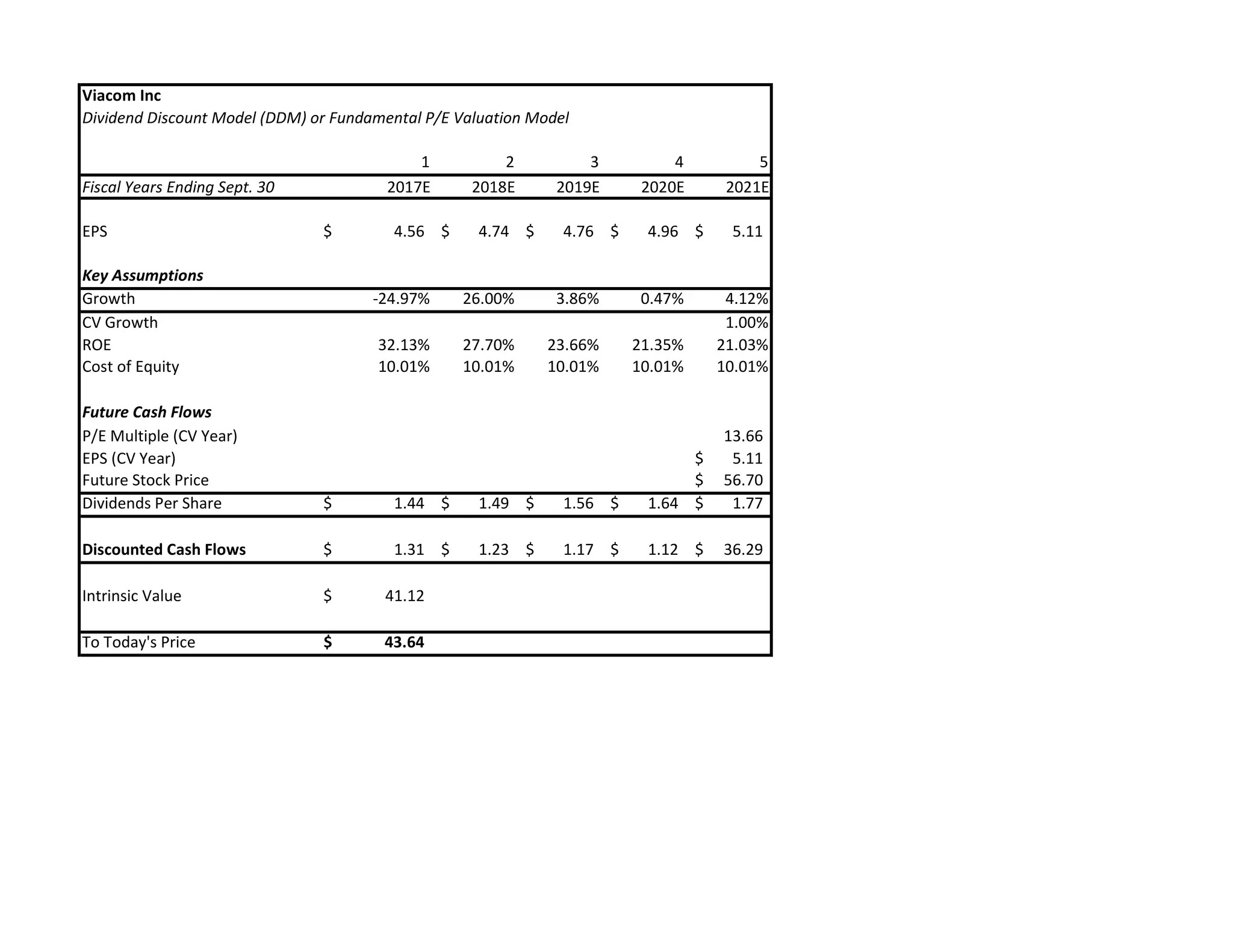

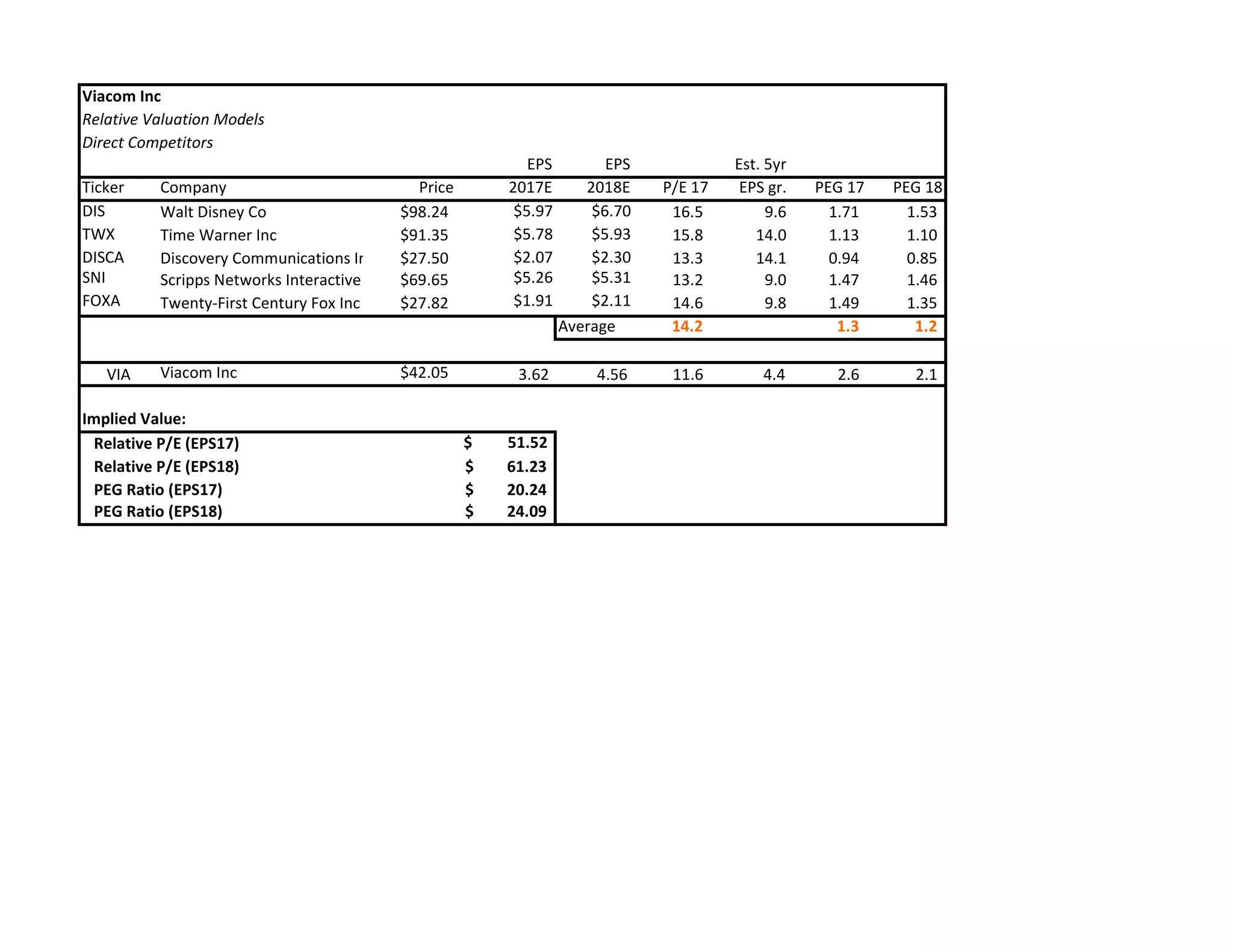

Henry Fund DCF $52.68

Henry Fund DDM $43.64

Relative PE (EPS17) $51.52

Price Data

Current Price $37.77

52wk Range $30.11-52.95

Consensus 1yr Target $42.59

Key Statistics

Market Cap (B) $15.15

Shares Outstanding (M) 397

Institutional Ownership 90.70%

Three Year Beta (weekly) 1.4000

Dividend Yield 2.1%

Est. 5yr Growth 4.5%

Price/Earnings (TTM) 10.67

Price/Earnings (FY1) 9.9

Price/Book (mrq) 3.5

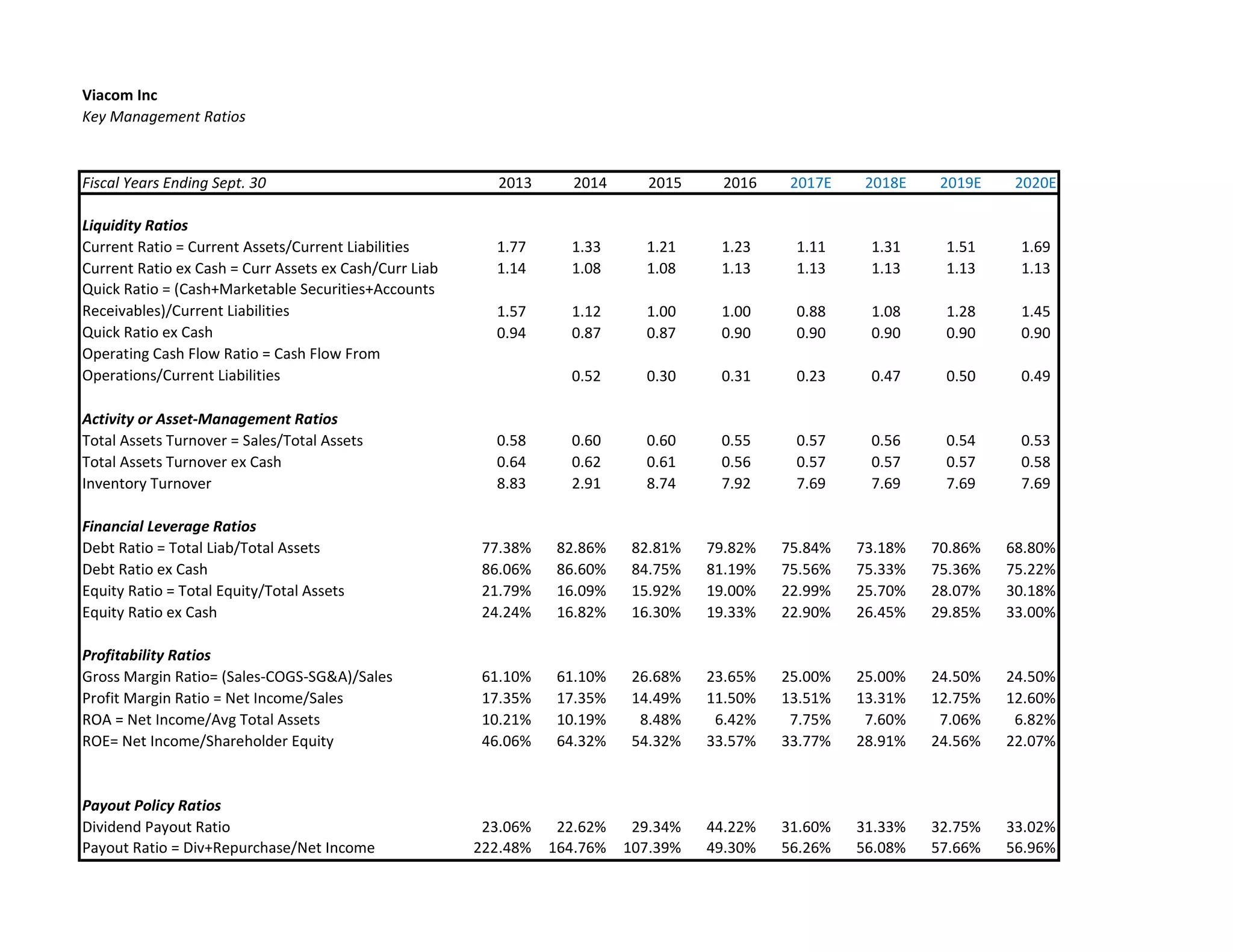

Profitability

Operating Margin 21.88%

Profit Margin 11.50%

Return on Assets (TTM) 6.42%

Return on Equity (TTM) 36.75%

Earnings Estimates

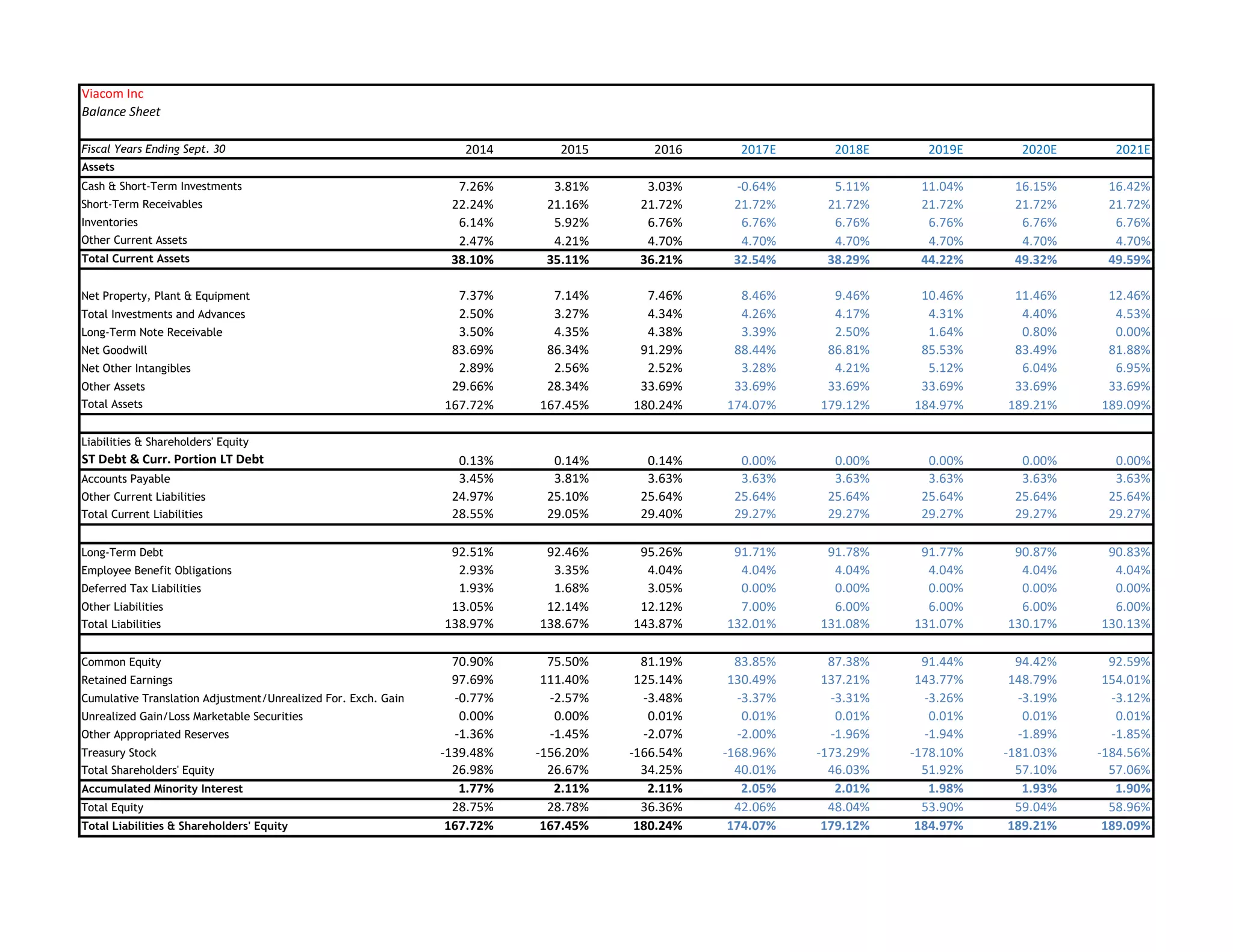

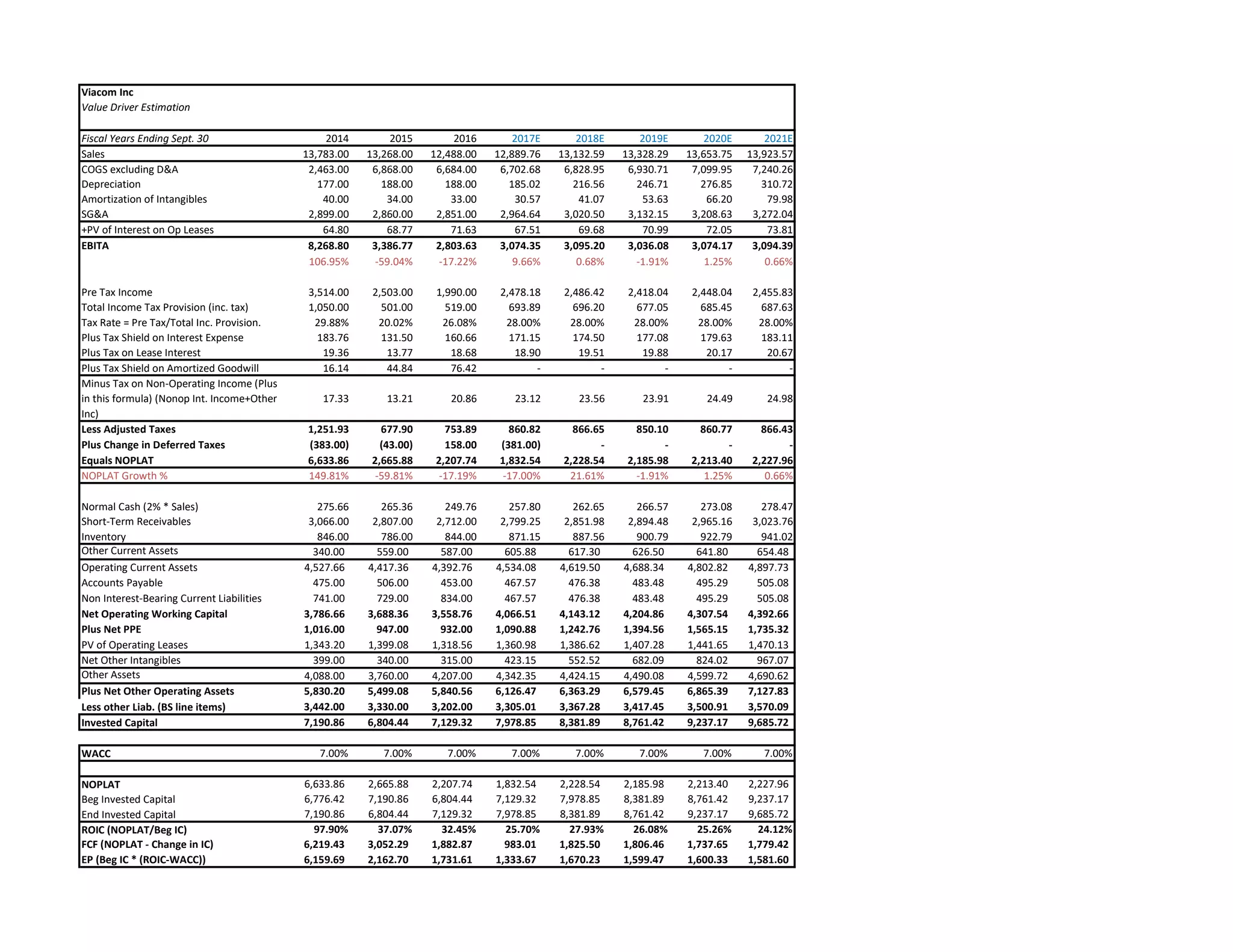

Year 2014 2015 2016 2017E 2018E 2019E

EPS $5.77 $4.83 $3.62 $4.56 $4.74 $4.78

Growth 8.29% -16.36% -24.97% 26.00% 3.86% 0.47%

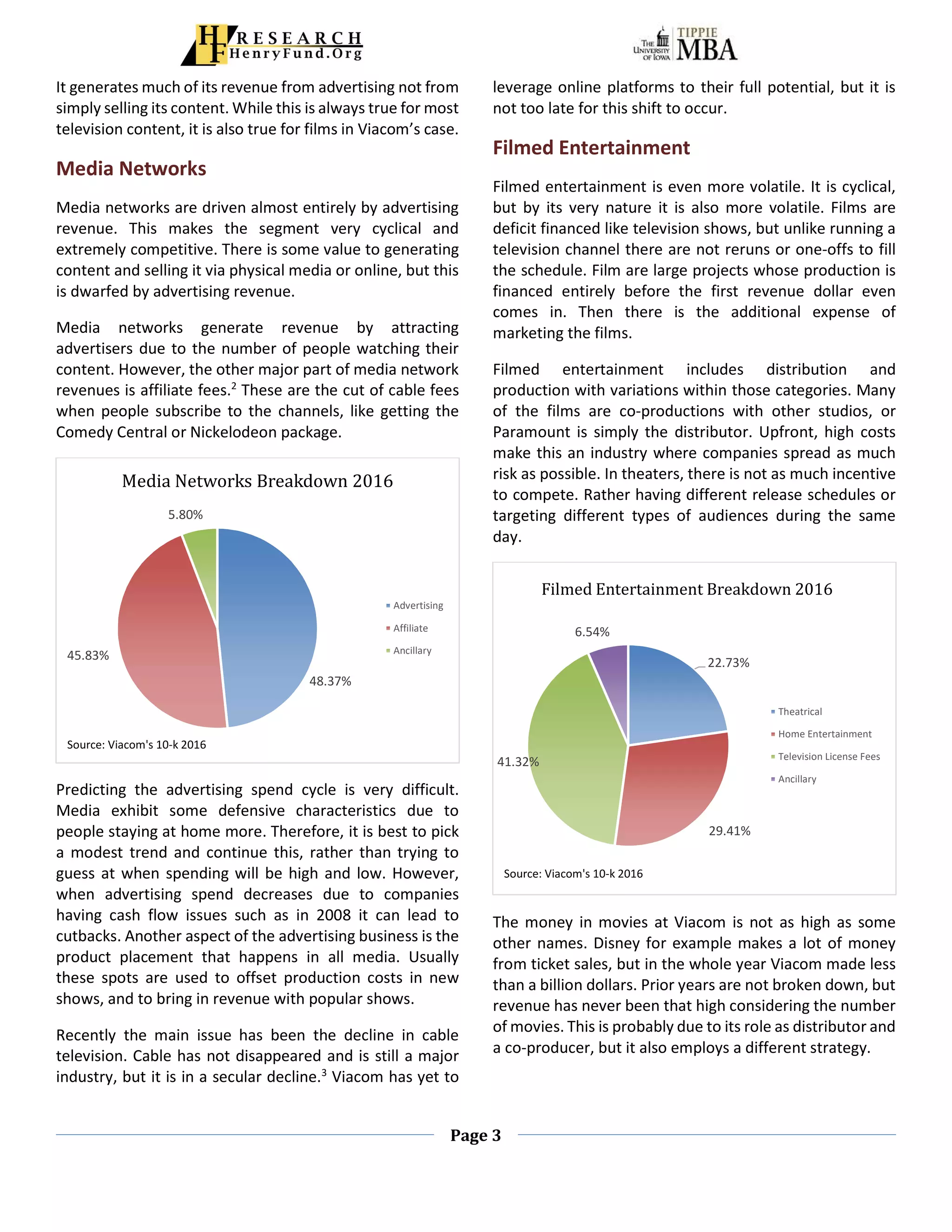

12 Month Performance Company Description

Viacom Inc. is a media and entertainment

company that operates television channels,

produces content across all kinds of media, and

distributes films. Revenue is generated through

two segments media networks and filmed

entertainment. The company operates numerous

brands and owns many franchises. More than

some of its peers it relies more on marketing and

sees itself as a marketing firm

10.7

6.4

36.7

17.8

10.4

20.3

15.8

6.9

18.618.12

6

20

0

25

50

P/E ROA ROE

VIAB DIS TWX FOXA

Data Source: FactSet

-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

N D J F M A M J J A S O

VIAB S&P 500 TR

Data Source: Factset](https://image.slidesharecdn.com/ddf4cef9-4050-4336-bed8-06e84c71f16b-170130075014/75/Nihar-Patel-Viacom-Report-1-2048.jpg)