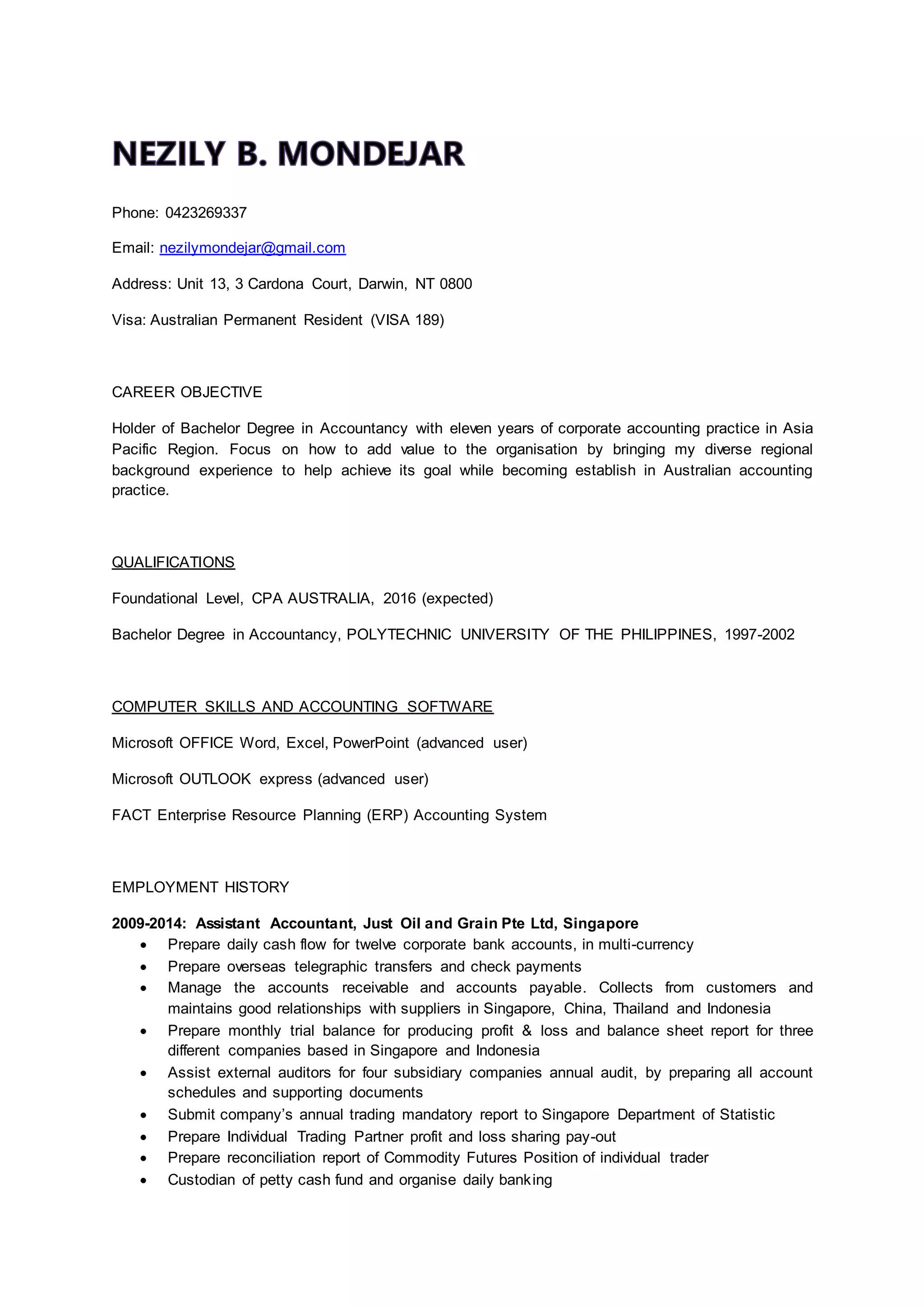

The document outlines the professional background of an Australian permanent resident with a bachelor's degree in accountancy and over eleven years of corporate accounting experience across Asia-Pacific. It details employment history in various accounting roles and responsibilities, including tax analysis and financial management, as well as part-time experience in child supervision and bank consulting in Australia. The individual possesses strong computer skills, particularly in Microsoft Office and ERP software, and aims to contribute to an Australian accounting practice with their diverse experience.