More Related Content Similar to NextPhase Flyer 1 Similar to NextPhase Flyer 1 (20) 1. <Logo>

www.coach4retirees.com

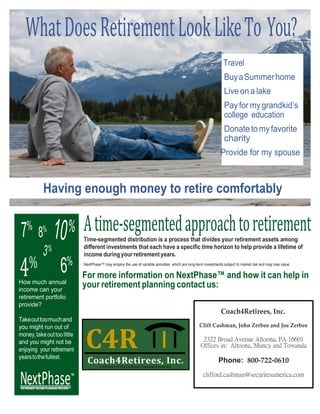

WhatDoesRetirementLookLikeTo You?

Travel

BuyaSummerhome

Live on a lake

Pay for mygrandkid’s

college education

Donatetomyfavorite

charity

Provide for my spouse

Having enough money to retire comfortably

Atime-segmentedapproachtoretirementTime-segmented distribution is a process that divides your retirement assets among

different investments that each have a specific time horizon to help provide a lifetime of

income during your retirement years.

NextPhase™ may employ the use of variable annuities, which are long-term investments subject to market risk and may lose value.

For more information on NextPhase™ and how it can help in

your retirement planning contact us:

Coach4Retirees, Inc.

Cliff Cashman, John Zerbee and Joe Zerbee

2322 Broad Avenue Altoona, PA 16601

Offices in: Altoona, Muncy and Towanda

Phone: 800-722-0610

clifford.cashman@securitesamerica.com

4%

How much annual

income can your

retirement portfolio

provide?

Takeouttoomuchand

you might run out of

money,takeouttoolittle

and you might not be

enjoying your retirement

yearstothefullest.

NextPhaseTM

RETIREMENT INCOME PLANNING PROCESS

2. Securities offered through Securities America Inc., Member FINRA/SIPC and advisory services offered through Securities America

Advisors, Inc. Cliff Cashman, John Zerbee, and Joe Zerbee, Representatives. The Cashman Financial Group Inc. and the Securities

America companies are independent entities and are not affiliated. Coach 4 Retirees is a division of The Cashman Financial Group, Inc.

Securities America and its representatives do not provide tax or legal advice; therefore it is important to coordinate with your tax or legal

advisor regarding your specific situation. 8/16

Mutual Funds and Variable Annuities are investments involving risk and are offered by prospectus only. Before investing, investors should carefully

consider the investment objectives, risks, charges and expenses of the investment and its underlying investment options. The prospectuses contain

this and other important information. Please contact the investment company to obtain the prospectuses. Please read the prospectuses carefully

beforeinvestingorsendingmoney.•TheNextPhasePlanningProcessmakescertainassumptionsfortherateofinflation.Theactualrateofinflationyouexperienceduringyour

retirementyearscouldbemoreorlessthentheassumptionusedintheplanningprocess.•ThegoaloftheNextPhasePlanningProcesswhenprovidingan“IncomeDesignedtoLast

YourLifetime”isbasedoncurrentdataavailableandassumesaveragelifeexpectanciesforyourlifetime.Duetochangesinhealthcare,longerlifeexpectanciesandyourindividual

situation it is possible to outlive the plan.Annuities are long term investments designed for retirement purposes.Withdrawals of taxable amounts are subject to income tax, and, if taken

prior toage59½,a 10%federal taxpenaltymayapply.Earlywithdrawals maybe subjectto withdrawal charges.Thepurchaseof avariableannuity isnot required for,andisnot a

termof,theprovisionofanyfinancialserviceoractivity.•Purchaseofanannuitycontractthroughaqualifiedplandoesnotprovideanyadditionaltax-deferralbenefitsbeyondthose

alreadyprovidedthroughtheplan.Ifyouarepurchasinganannuitycontractthroughaplan,youshouldconsiderpurchasingitforitsdeathbenefit,annuityoptions,andothernon-tax-

relatedbenefits.•Guaranteedmonthlyincomeisbasedoncurrentvaluesaswellasthetermsandconditionsoftheannuitycontractoroptionalrider.Theseadvantagescanonlybe

fullyrealizedifyoufollowthebenefit’srulesandholdannuitythroughsurrenderperiod.•Guaranteesincludingoptionalbenefitsmayhaveanextrafeeandaresubjecttoexclusions,

limitations,reductionsofbenefitsandtermsforkeepingtheminforce.Yourlicensedfinancialprofessionalcanprovideyouwithcompletedetails.•Thebenefitpaymentobligations

arising under the annuity contract guarantees, rider guarantees, or optional benefits and any fixed account crediting rates or annuity payout rates are backed by the claims-paying ability

oftheissuinginsurancecompany.Thosepaymentsandtheresponsibilitytomakethemarenottheobligationsofthethirdpartybroker/dealerfromwhichtheannuityispurchasedor

anyofitsaffiliates.•Allinvestmentsinvolvetheriskofpotentialinvestmentlosses.Investmentsinmodelstrategieshaveadditionalmanagementfeesandexposetheinvestortothe

risksinherentwithinthemodelandthespecificrisksoftheunderlyingfundsdirectlyproportionatetotheirfundallocation.•Assetallocationdoesnotguaranteeaprofitorprotection

from losses in a declining market.•Investments are not FDIC or insured,not Bank Guaranteed and May LoseValue.•Securities offered through SecuritiesAmerica,Inc.,Member

FINRA/SIPC,John Doe,Registered Representative.Advisory Services offered through SecuritiesAmericaAdvisors,Inc.,John Doe,InvestmentAdvisor Representative.Advisor’s Branch

Address:Address,City,STATE00000.DBAandtheSecuritiesAmericacompaniesarenotaffiliated.NextPhase™isatrademarkofSecuritiesAmerica.©Copyright2006Securities

America.All Rights Reserved.