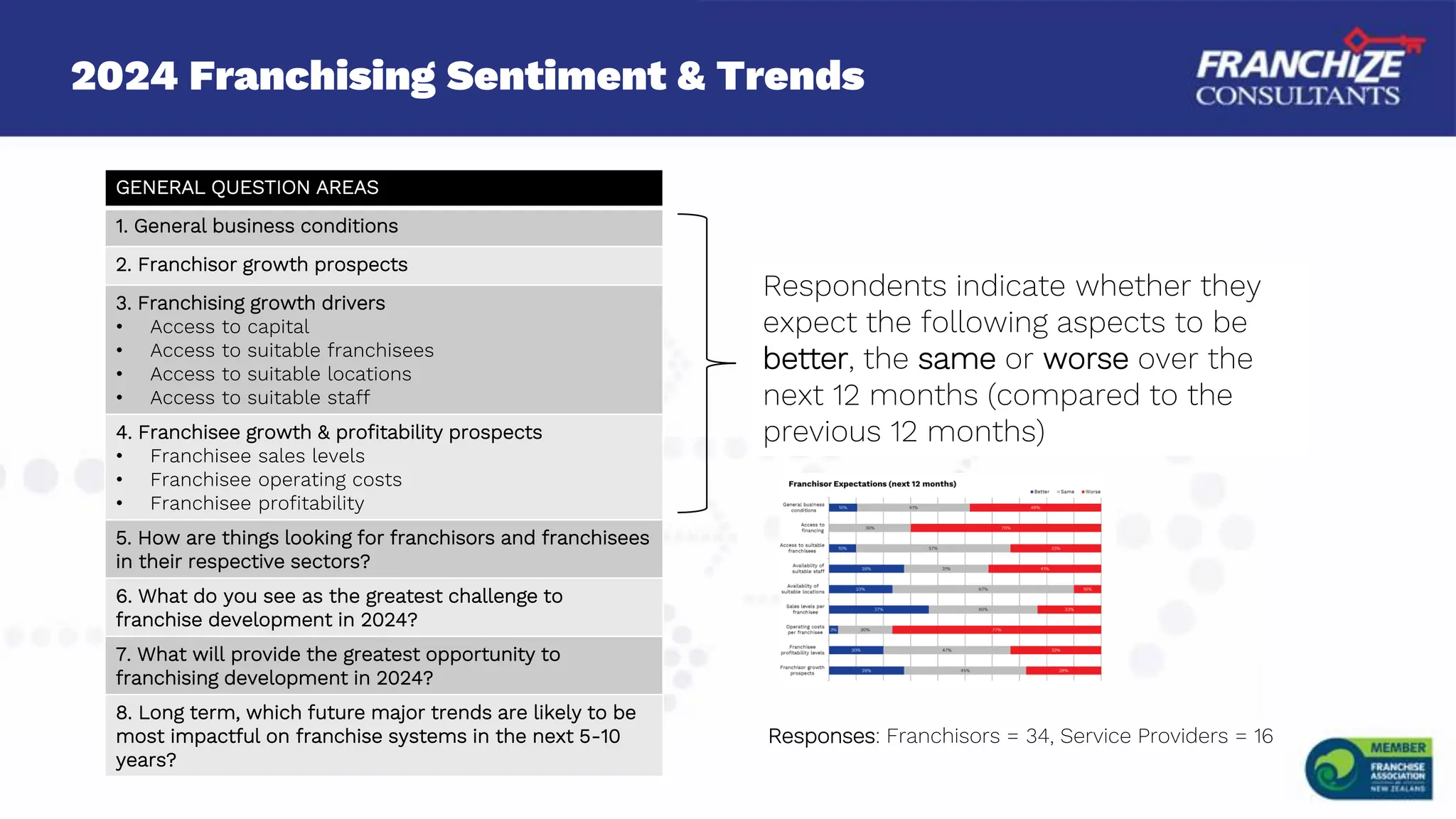

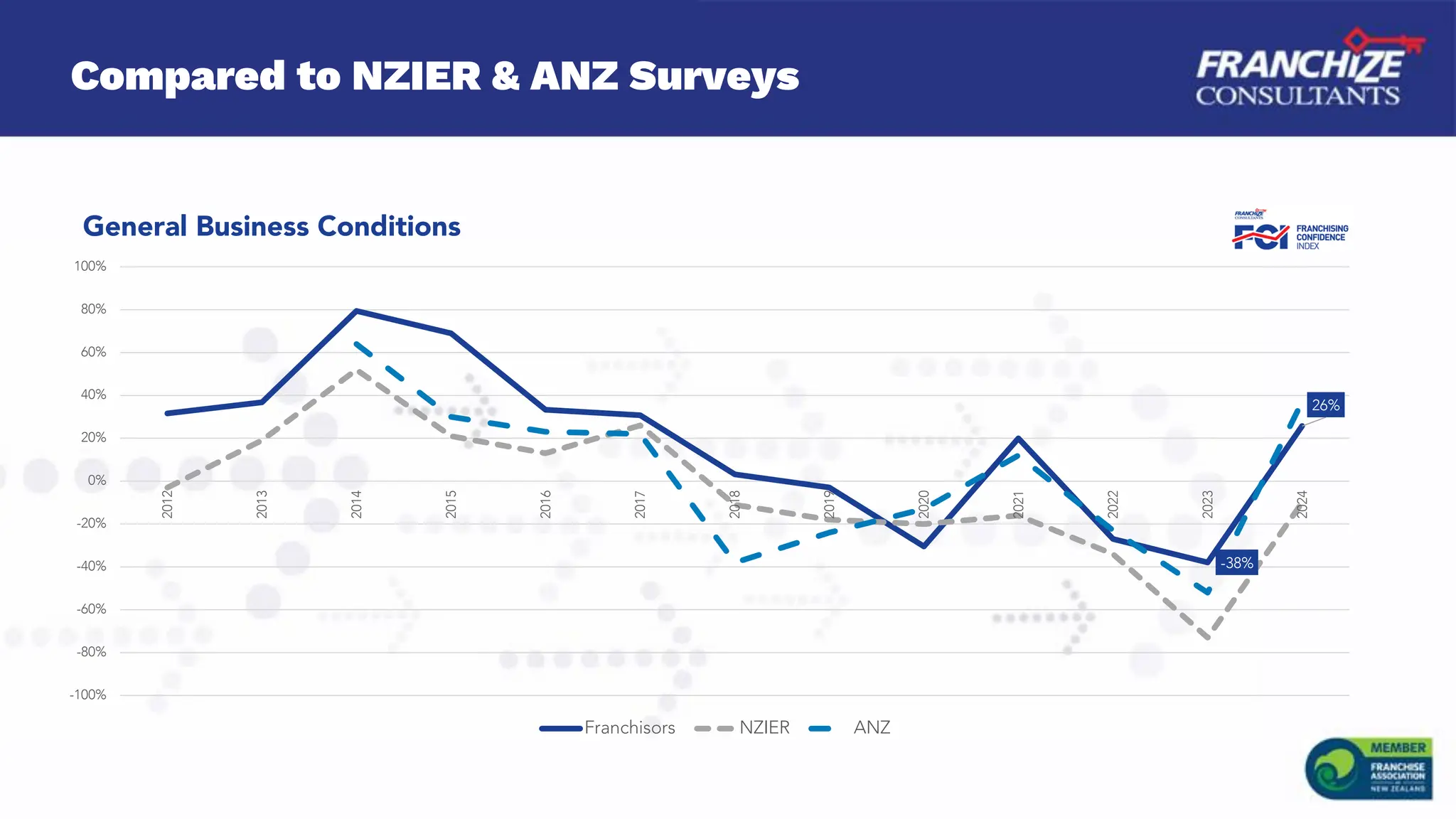

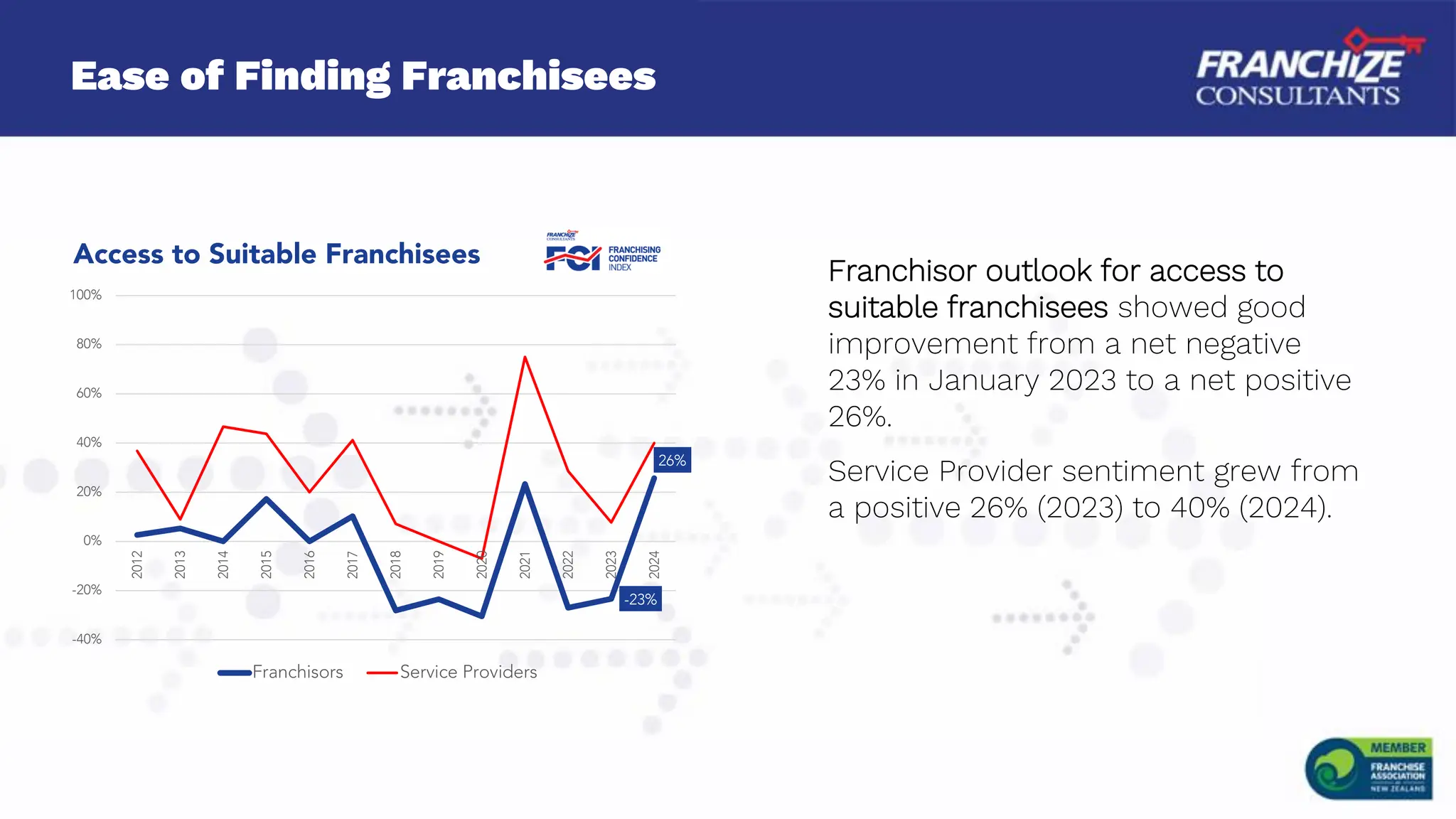

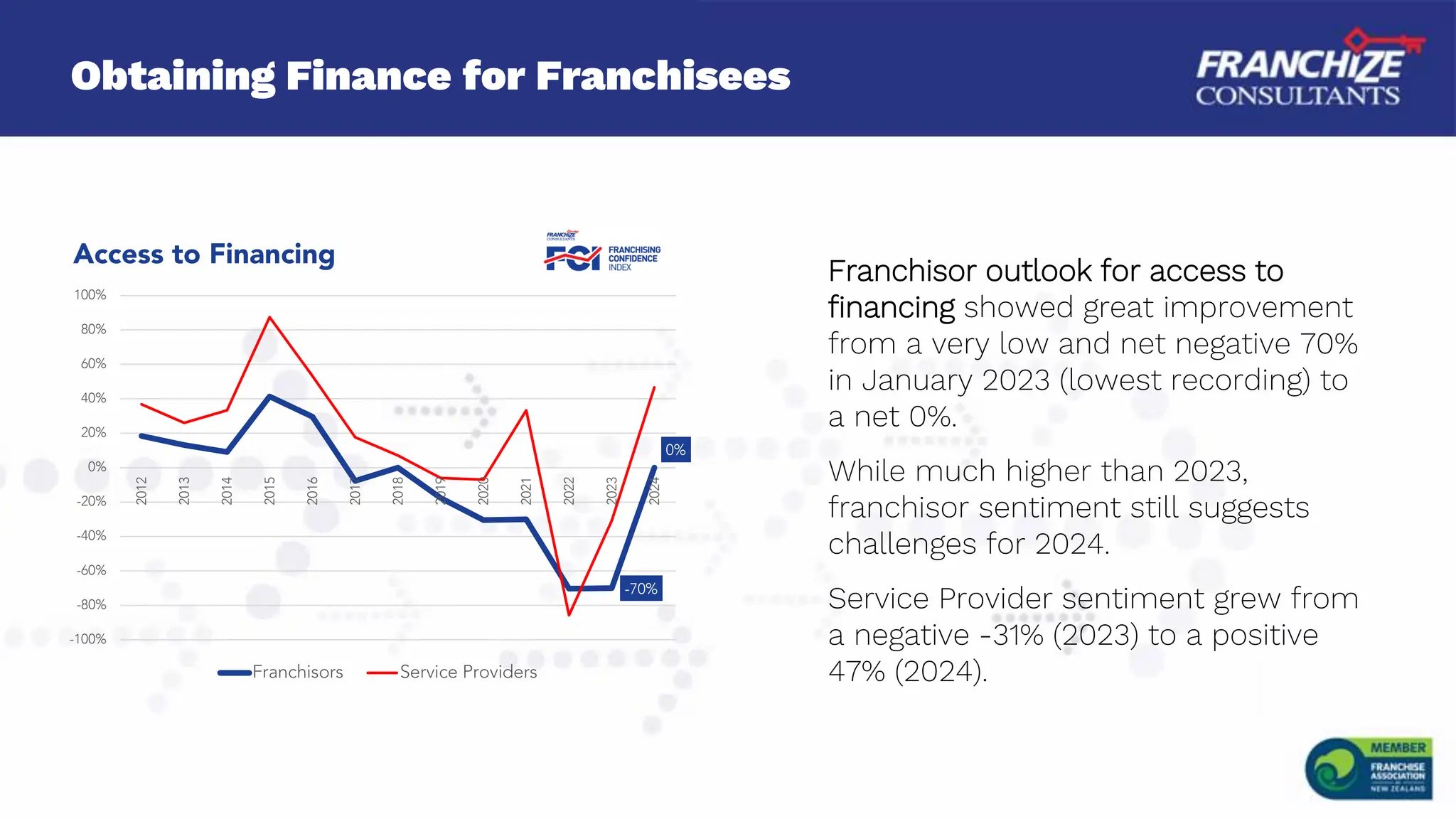

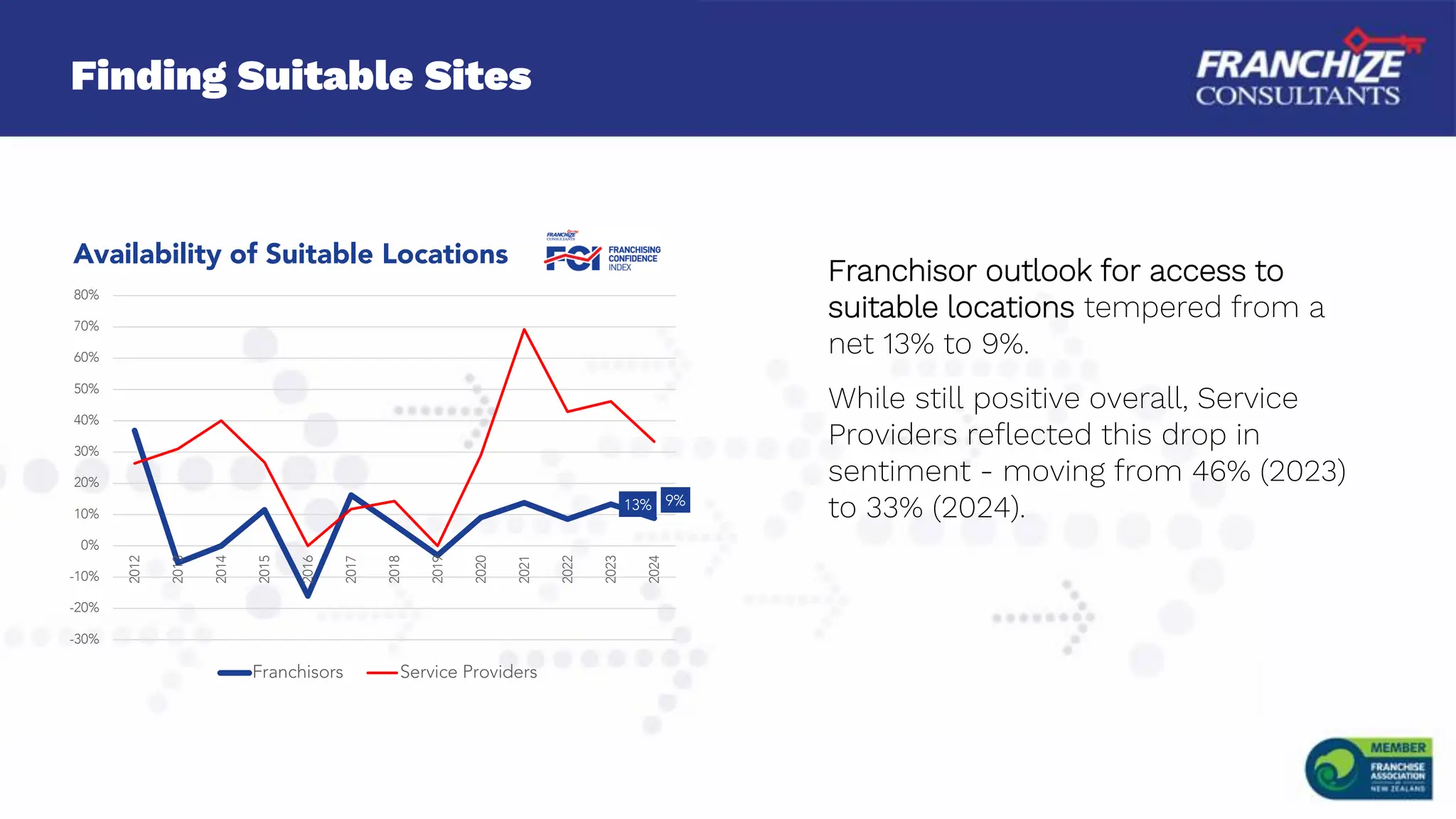

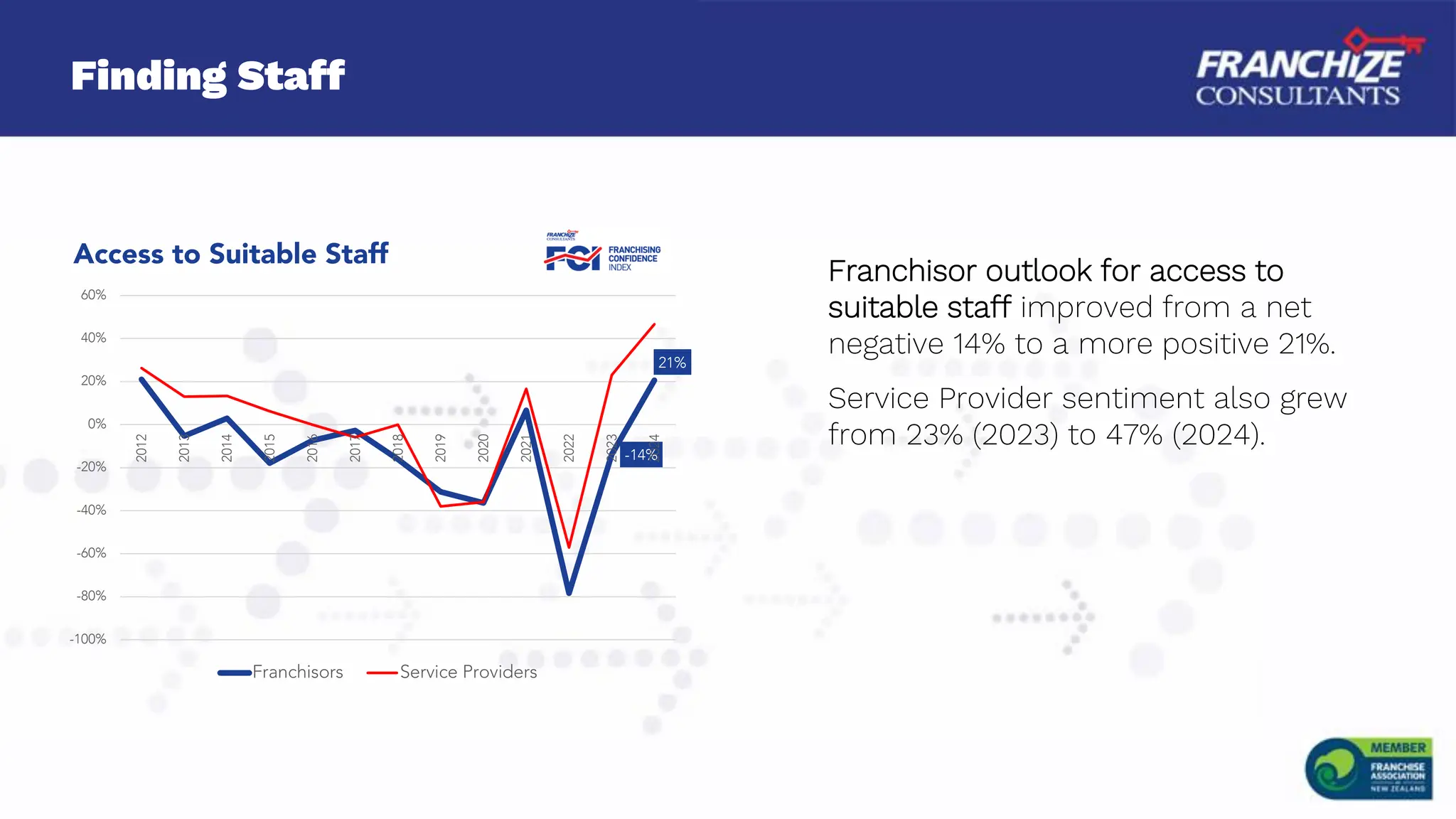

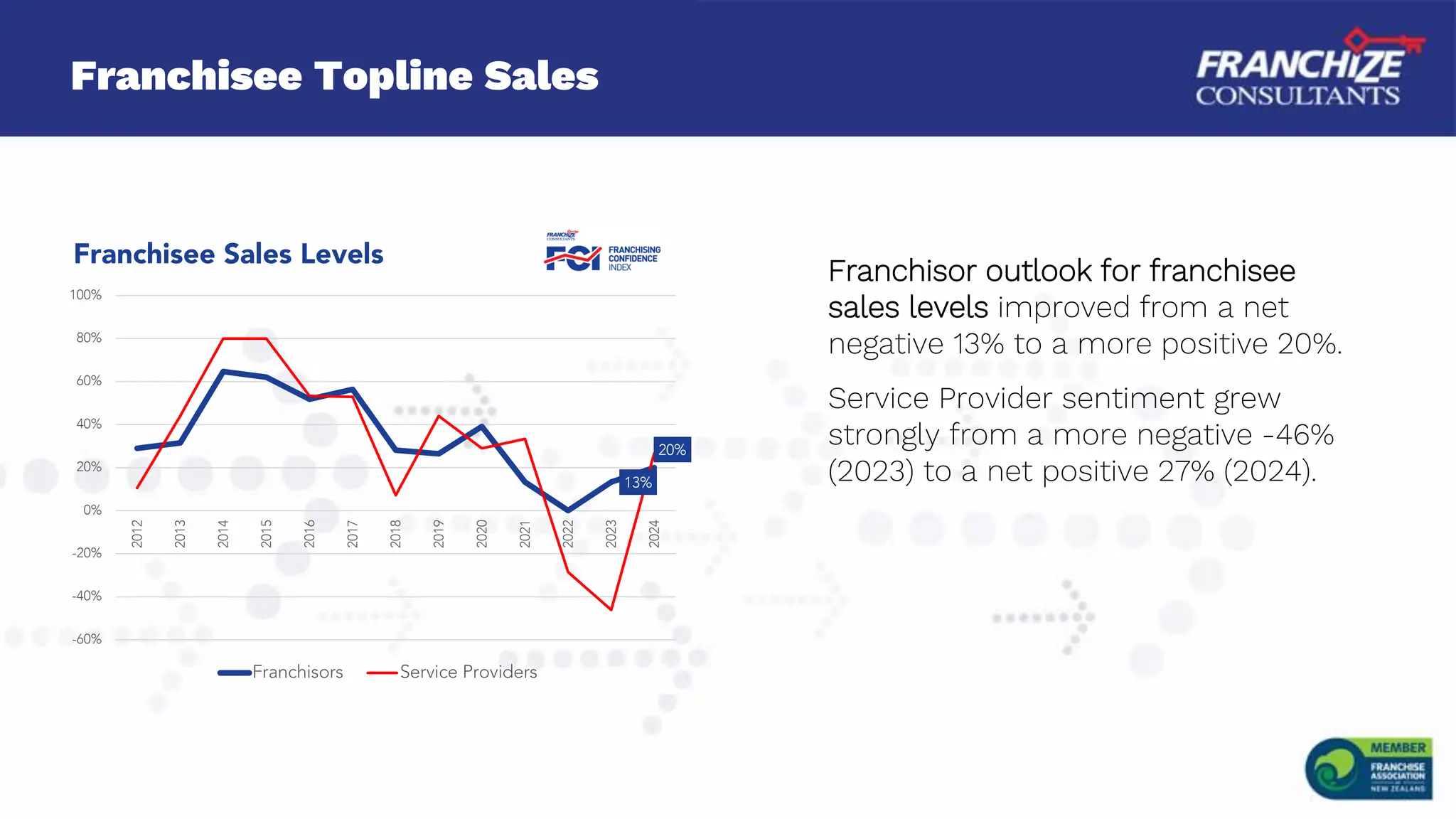

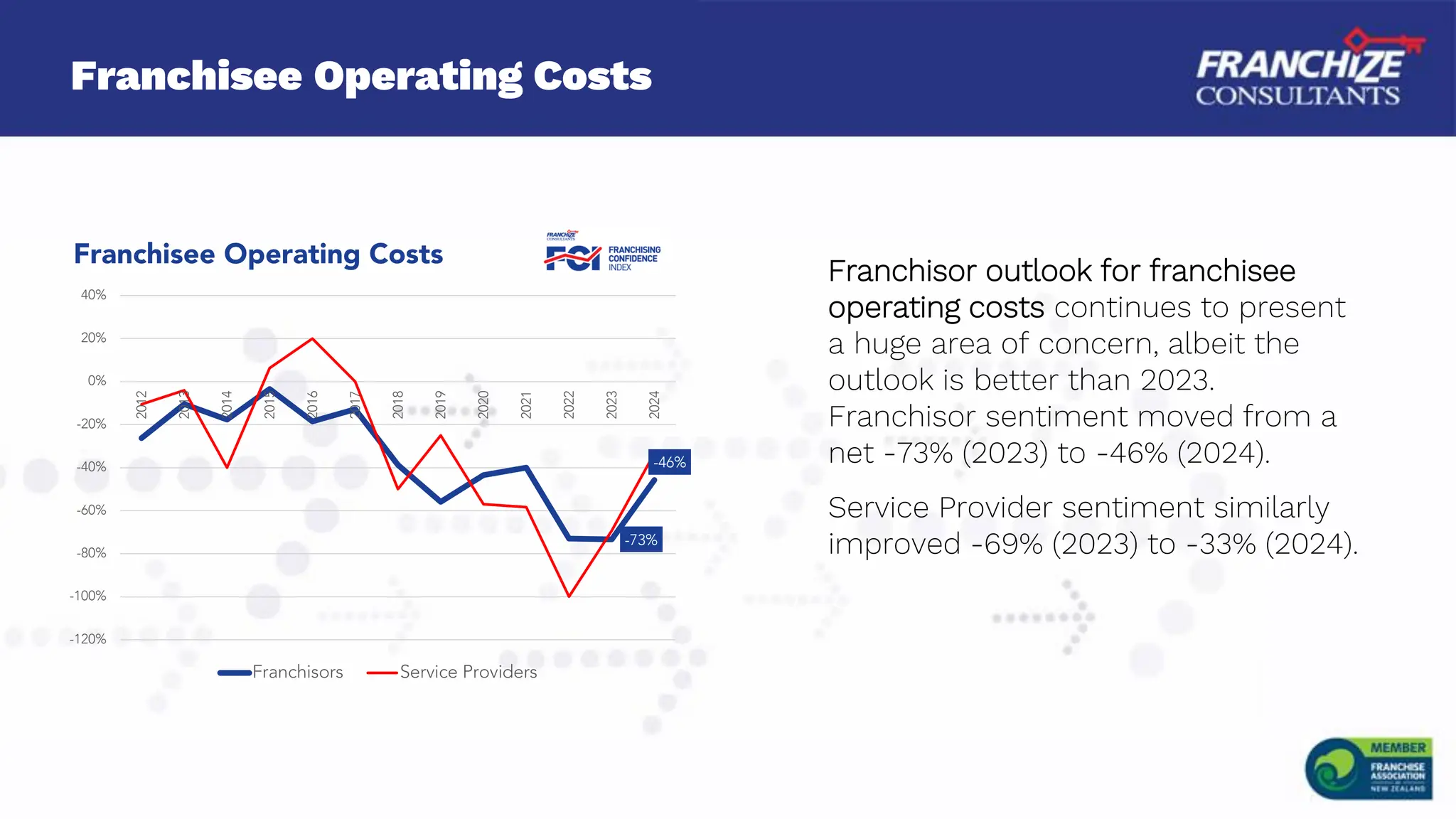

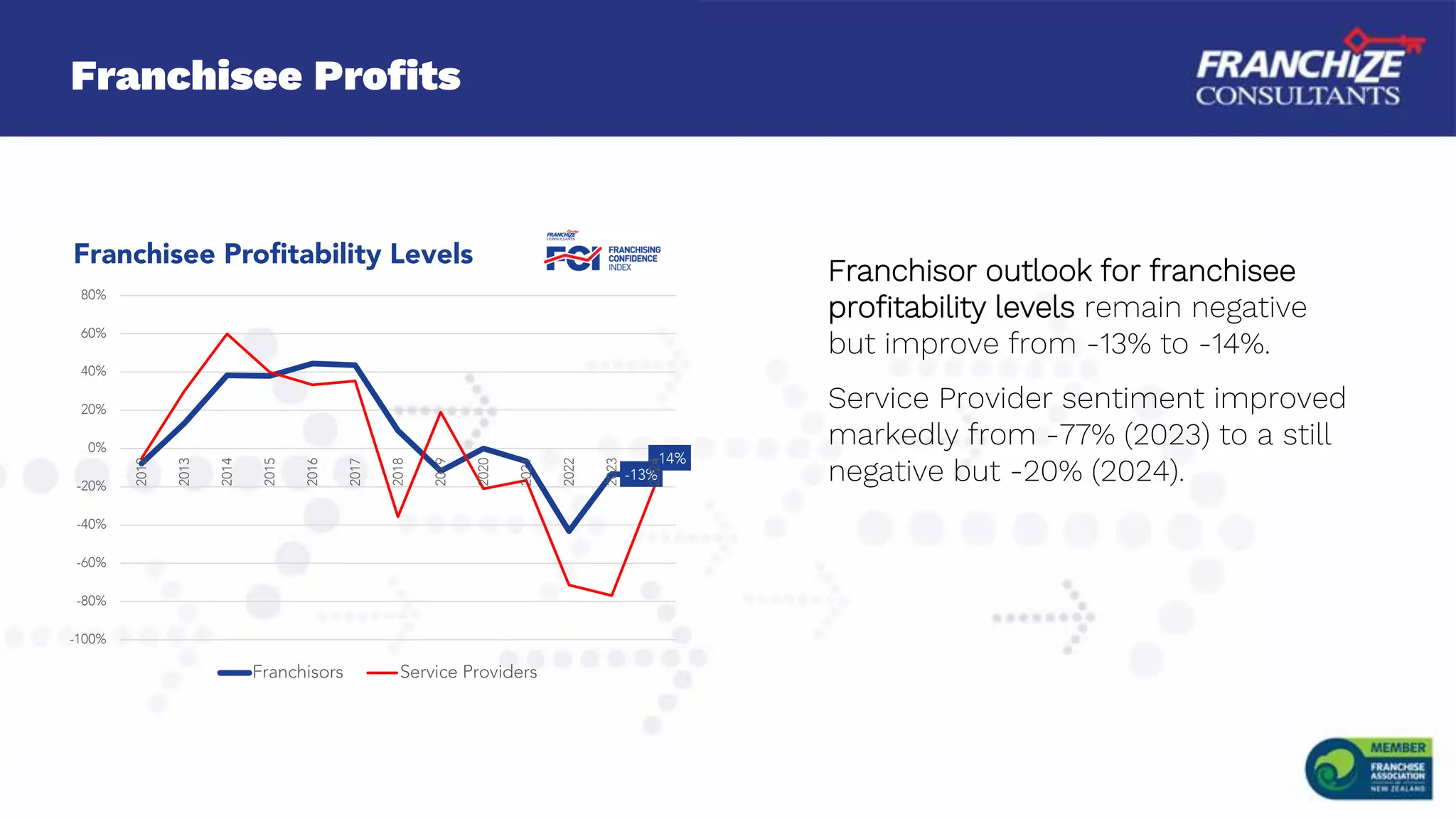

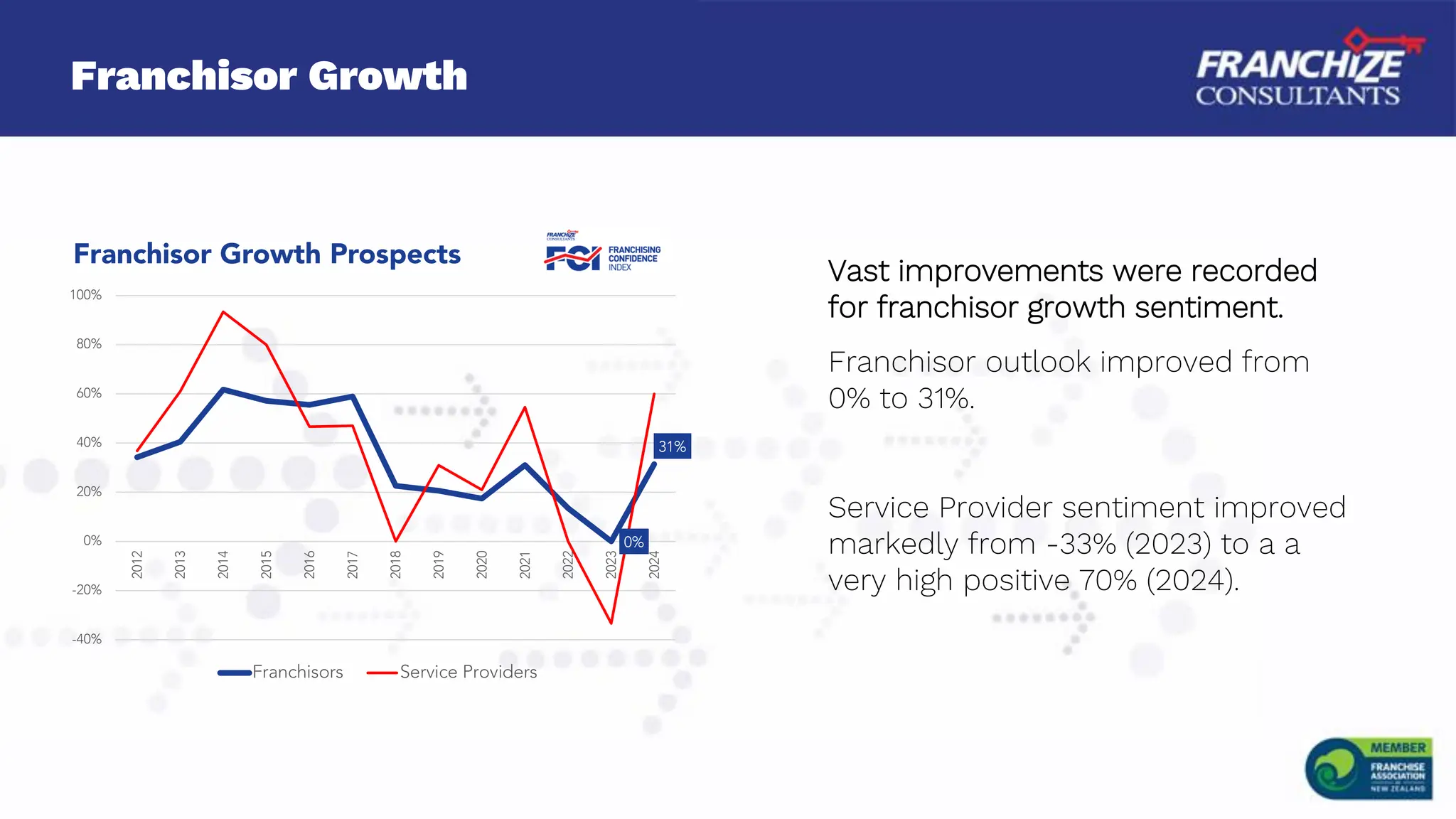

Franchize Consultants conducted its annual survey of New Zealand franchisors and service providers in January 2024 to gauge confidence in the franchising sector. Sentiment showed improvement from 2023, with franchisors and service providers more optimistic about general business conditions, access to suitable franchisees and staff, and franchisor growth prospects. However, rising costs remained a top concern, and outlook on franchisee profitability and operating costs was still negative. Access to financing for franchisees also showed signs of ongoing challenges. The report provides insights into trends in the New Zealand franchising sector.