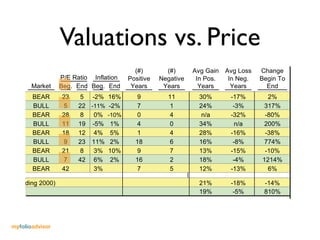

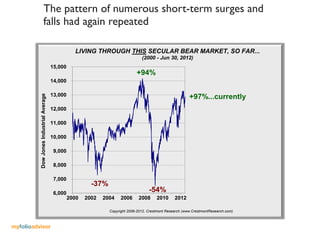

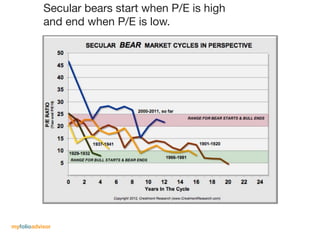

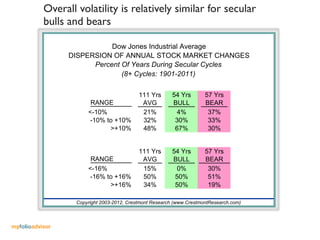

Successful investing requires different skills in bear markets than in bull markets. In bear markets, protecting assets from losses is crucial to long-term performance. Bear markets are typically characterized by high valuations at the start that decline, volatility with frequent rallies and falls, and negative returns that last for multiple years. In bull markets, gains can be achieved through buying and holding, as bull markets start at low valuations and end at high valuations, lasting for multiple positive years. Managing investments requires understanding the characteristics of secular bull and bear markets and employing different strategies depending on market conditions.