Mtfx forecast 022016

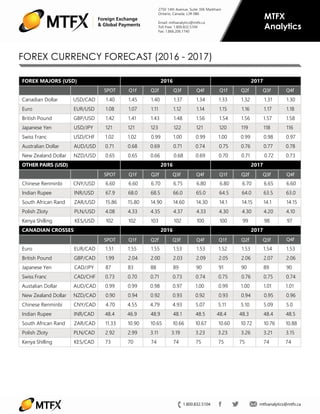

- 1. Section 6 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 1.800.832.5104 mtfxanalytics@mtfx.ca FOREX MAJORS (USD) 2016 2017 SPOT Q1f Q2f Q3f Q4f Q1f Q2f Q3f Q4f Canadian Dollar USD/CAD 1.40 1.45 1.40 1.37 1.34 1.33 1.32 1.31 1.30 Euro EUR/USD 1.08 1.07 1.11 1.12 1.14 1.15 1.16 1.17 1.18 British Pound GBP/USD 1.42 1.41 1.43 1.48 1.56 1.54 1.56 1.57 1.58 Japanese Yen USD/JPY 121 121 123 122 121 120 119 118 116 Swiss Franc USD/CHF 1.02 1.02 0.99 1.00 0.99 1.00 0.99 0.98 0.97 Australian Dollar AUD/USD 0.71 0.68 0.69 0.71 0.74 0.75 0.76 0.77 0.78 New Zealand Dollar NZD/USD 0.65 0.65 0.66 0.68 0.69 0.70 0.71 0.72 0.73 OTHER PAIRS (USD) 2016 2017 Chinese Renminbi CNY/USD 6.60 6.60 6.70 6.75 6.80 6.80 6.70 6.65 6.60 Indian Rupee INR/USD 67.9 68.0 68.5 66.0 65.0 64.5 64.0 63.5 63.0 South African Rand ZAR/USD 15.86 15.80 14.90 14.60 14.30 14.1 14.15 14.1 14.15 Polish Zloty PLN/USD 4.08 4.33 4.35 4.37 4.33 4.30 4.30 4.20 4.10 Kenya Shilling KES/USD 102 102 103 102 100 100 99 98 97 CANADIAN CROSSES 2016 2017 Euro EUR/CAD 1.51 1.55 1.55 1.53 1.53 1.52 1.53 1.54 1.53 British Pound GBP/CAD 1.99 2.04 2.00 2.03 2.09 2.05 2.06 2.07 2.06 Japanese Yen CAD/JPY 87 83 88 89 90 91 90 89 90 Swiss Franc CAD/CHF 0.73 0.70 0.71 0.73 0.74 0.75 0.76 0.75 0.74 Austalian Dollar AUD/CAD 0.99 0.99 0.98 0.97 1.00 0.99 1.00 1.01 1.01 New Zealand Dollar NZD/CAD 0.90 0.94 0.92 0.93 0.92 0.93 0.94 0.95 0.96 Chinese Renminbi CNY/CAD 4.70 4.55 4.79 4.93 5.07 5.11 5.10 5.09 5.0 Indian Rupee INR/CAD 48.4 46.9 48.9 48.1 48.5 48.4 48.3 48.4 48.5 South African Rand ZAR/CAD 11.33 10.90 10.65 10.66 10.67 10.60 10.72 10.76 10.88 Polish Zloty PLN/CAD 2.92 2.99 3.11 3.19 3.23 3.23 3.26 3.21 3.15 Kenya Shilling KES/CAD 73 70 74 74 75 75 75 74 74 MTFX Analytics FOREX CURRENCY FORECAST (2016 - 2017) SPOT Q1f Q2f Q3f Q4f Q1f Q2f Q3f Q4f SPOT Q1f Q2f Q3f Q4f Q1f Q2f Q3f Q4f

- 2. Section 6 MTFX Analytics 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 1.800.832.5104 mtfxanalytics@mtfx.ca USD CAD EUR GBP The beginning of the Fed’s tightening cycle, combined with increased market volatility provided the perfect ingredients for further appreciation in the US dollar in the month of January. However, the Fed’s dovish stance coupled with market expectations of a March rate hike being pushed out had most participants pare back positions and collapse the trajectory of the appreciating dollar. The Fed’s renewed patience should weigh on the greenback in the medium term with the USD losing ground against most majors well into 2017. Bias – neutral (neutral USD) The Canadian dollar experienced a wild ride in the month of January tumbling to the 1.46 level against the US dollar before recovering to the high 1.39’s to close the month. The CAD has dropped more than 16% in 2015 and has fallen over 30% over the last three years. Oil prices will continue to be the dominating factor for the CAD, however a shift from monetary policy to fiscal policy dynamics to stimulate growth should allow for a rebound in the loonie over the rest of the year. Bias – bullish (stronger CAD) All the hype that surrounded Mario Draghi and significant further stimulus did not live up to expectations in December or in January, which helped euro hold in value against its peers. However, Draghi and company were surprising dovish last month suggesting downside risks have dramatically increased while inflation projections remains sharply lower. Draghi’s comments make it more likely that the euro will weaken into the ECB’s March meeting as expectations for further stimulus increase. Bias – bearish (weaker EUR) The British pound has entered 2016 with a weakening bias, trading at fresh multi-month lows while maintaining a downward trend. Uncertainty over the country’s place in the EU and the ballooning account deficit are likely to weigh on the currency in the short term. However, fundamentals across the UK continue to remain strong with growth expected to outperform most of its peers, which should be pound supportive over the medium term. Bias – bullish (stronger GBP) FEBRUARY 2016 - CURRENCY HIGHLIGHTS

- 3. Section 6 MTFX Analytics 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 1.800.832.5104 mtfxanalytics@mtfx.ca February 2016 2016f 2017f Spot USD/CAD MTFX 1.45 1.40 1.37 1.34 1.33 1.32 1.31 1.30 Consensus Forecast 1.40 1.39 1.38 1.38 1.37 1.36 EUR/USD MTFX 1.07 1.11 1.12 1.14 1.15 1.16 1.17 1.18 Consensus Forecast 0.95 0.98 1.00 1.07 1.12 GBP/USD MTFX 1.41 1.43 1.48 1.56 1.54 1.56 1.57 1.58 Consensus Forecast 1.42 1.44 1.45 1.46 1.48 1.50 FEBRUARY 2016 - US DOLLAR HIGHLIGHTS U.S. DOLLAR COMMENT: Although the USD opened the year on a strong footing as a result of heightened risk sentiment and an uncertain international backdrop, the Fed’s dovish stance at their January FOMC meeting coupled with expectations for a prolonged pause before the next interest rate increase is likely to see the USD lose ground against other majors despite a strong domestic economy. The US economy is showing healthy signs of momentum as we begin 2016. While most reports have been mixed, consumer spending and housing activity remain well supported by a robust job market, rising income, solid household balance sheets, cheap oil prices and low borrow- ing costs. Ongoing hiring gains have pushed the unem- ployment rate to a seven-year low of 5.0% and measures of labor market underutilization continue to improve. Con- sumer confidence has softened a little, but remains relative- ly firm as buying intentions remain solid. Industrial activity remains soft as a result of sluggish export sales being weighed by a strong US dollar. However, domestic sales continue to maintain an expansionary tone led by manufac- turing production and consumer goods. Core inflation remains muted tempered by lower import costs and commodity prices. Despite the strong domestic performance in the US, uncertainty about the international backdrop, weak price gains and lower inflation rates will cause the Fed to take long pause before the next interest rate increase meaning the USD is likely to cool over the coming months. The Fed’s renewed patience coupled with other economies beginning to show strength should see the USD lose ground against most of the other majors with a pullback extending well into 2017. JANUARY 2016 CURRENCY RETURNS Q1f Q2f Q3f Q4f Q1f Q2f Q3f Q4f 1.09 ECONOMIC EVENT DATE USD ISM Manufacturing PMI FEB 01 USD ADP Non Farm Payrolls FEB 03 USD ISM Non Manufacturing PMI FEB 03 USD Non Farm Payrolls & Unemployement Data FEB 05 USD Retail Sales FEB 12 EVENTS TO WATCH FEBRUARY 2016 -4.0% -3.5% -3.0% -2.5% -2.0% -1.5% -1.0% -0.5% 0.0% CAD EUR GBP 1.45 1.42 1.40 1.05 1.00 0.95 1.41 1.41 1.42

- 4. Section 6 MTFX Analytics 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 Februrary 2016 2016f 2017f USD/CAD Spot Q1a Q2a Q3a Q4f Q1f Q2f Q3f Q4f MTFX Forecast 1.45 1.40 1.37 1.34 1.33 1.32 1.31 1.30 Consensus Forecast 1.40 USD/CAD CURRENCY TREND - JANUARY 2016 HIGHLIGHTS: ECONOMIC EVENT DATE CAD Unemployment Data FEB 05 CAD Ivey PMI FEB 05 CAD Trade Balance FEB 05 CAD Consumer Price Inflation FEB 19 CAD Retail Sales FEB 19 Bearish Bullish 1.800.832.5104 mtfxanalytics@mtfx.ca Although our call for further CAD weakness was correct, the currency tumbled farther and faster than expected. The loonie tumbled to the 1.46 levels against the US dollar before recovering to the high 1.39s to close the month. Plunging oil prices and significant domestic risks including weak growth expectations, weak consumer confidence, low inflation and weak unemployment continue to weigh on the loonie. Markets expect no significant pick-up in commodity prices in the medium term which will provide additional head- winds for domestic growth prospects. Poloz is expected to hold interest rates steady for the remainder of the year and seems to have shifted the onus onto fiscal policymakers to provide the economy with much needed stimulus to the tune of at least a $30bn deficit. Over the remainder of the year, the use of fiscal stimulus instead of monetary stimulus should benefit the loonie as interest rate spreads with the US are likely to remain stable. The shift in policy mix combined with stabilizing oil prices and tighter US monetary policy will likely result in an appreciating bias for the loonie over the latter part of the year. USD/CAD FEBRUARY 2016 HIGHLIGHTS EVENTS TO WATCH FEBRUARY 2016 MARKET SENTIMENT: 1.39 1.38 1.38 1.37 1.36 1.38 1.39 1.4 1.41 1.42 1.43 1.44 1.45 1.46 1.401.421.45

- 5. Section 6 MTFX Analytics 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 February 2016 2016f 2017f EUR/USD Spot Q1a Q2a Q3a Q4f Q1f Q2f Q3f Q4f MTFX Forecast 1.07 1.11 1.12 1.14 1.15 1.16 1.17 1.18 Consensus Forecast 1.09 EUR/USD CURRENCY TREND - JANUARY 2016 HIGHLIGHTS: ECONOMIC EVENT DATE EUR German Manufacturing PMI FEB 01 EUR German Unemployment Change FEB 02 EUR ECB Draghi Speech FEB 04 EUR German GDP FEB 12 EUR German ZEW Sentiment FEB 16 Bearish Bullish 1.800.832.5104 mtfxanalytics@mtfx.ca The hype of a December policy easing and additional stimulus did not live up to expectations and resulted in an almost 3% increase the day following the announcement. January saw the euro hold in value against the green- back as well as other major currencies. However, much of 2016’s appreciation should reverse as risk appetites rebound and fundamentals begin to weigh on the currency. From a fundamental perspective, Draghi stated last month that inflation was sharply lower than forecast and that downside risks have increased since the beginning of the year. As a result of these dovish comments, market chatter about additional stimulus in March have increased which may encourage further weakness in the near term. In the longer term there are signs of “green shoots” that could see the euro rebound. Taking a step back from the current volatility, markets expect the euro area to support global growth by growing at a pace of just under two percent. Stabilization of fundamentals should allow the single currency to recover to the mid-teens by end of 2016. EUR/USD FEBRUARY 2016 HIGHLIGHTS EVENTS TO WATCH FEBRUARY 2016 MARKET SENTIMENT: 0.95 0.98 1.00 1.07 1.12 1.07 1.075 1.08 1.085 1.09 1.095 1.1 0.951.001.05

- 6. Section 6 MTFX Analytics 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 Februrary 2016 2016f 2017f GBP/USD Spot Q1a Q2a Q3a Q4f Q1f Q2f Q3f Q4f MTFX Forecast 1.41 1.43 1.48 1.56 1.54 1.56 1.57 1.58 Consensus Forecast 1.42 GBP/USD CURRENCY TREND - JANUARY 2016 HIGHLIGHTS: ECONOMIC EVENT DATE GBP Services PMI FEB 03 GBP BoE Interest Rate Decision and MPC Minutes FEB 04 GBP Consumer Price Inflation FEB 16 GBP Employment Data FEB 17 GBP Retail Sales FEB 19 Bearish Bullish 1.800.832.5104 mtfxanalytics@mtfx.ca The British Pound is likely to trend lower in the coming months given the UK’s large current account deficit and uncertainty over the country’s place in the EU. The confidence in the timing of rate increases by the Bank of England have weakened and may not material- ize until the end of the year. As a result, Sterling is likely to remain under pressure in the near term and possibly test lower-lows as we approach the EU summit on February 18-19. Despite the current downdraft on the currency, better days are expected in the second half of the year. Fundamen- tally, the UK will continue to outper- form most of its peers with GDP advancing at a solid pace and unem- ployment continuing to decline. This continuing upward trend is likely to accelerate wage growth and inflation, allowing for a relatively strong economic outlook. Our call of a H1 2016 rate increase has been priced out toward the end of 2016 and possibly 2017. However, strong economic fundamentals and solid growth should drive recovery in the pound and the UK economy. We hold 2016 year-end target of 1.56-1.57. GBP/USD FEBRUARY 2016 HIGHLIGHTS EVENTS TO WATCH FEBRUARY 2016 MARKET SENTIMENT: 1.44 1.45 1.46 1.48 1.50 1.41 1.42 1.43 1.44 1.45 1.46 1.47 1.48 1.421.411.41

- 7. Section 6 MTFX Analytics 2750 14th Avenue, Suite 306 Markham Ontario, Canada, L3R 0B6 Email: mtfxanalytics@mtfx.ca Toll Free: 1.800.832.5104 Fax: 1.866.206.1740 1.800.832.5104 mtfxanalytics@mtfx.ca - This publication has been prepared by MTFX Inc. for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which MTFX Inc., its affiliates or any of their employees incur any responsibility. Neither MTFX Inc. nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. MTFX Analytics 2750 14th Avenue, Suite 306 Markham, Ontario Canada L3R 0B6 Toll Free: 1.800.832.5104 Fax: 1.866.832.5104 Email: mtfxanalytics@mtfx.ca This report has been prepared by MTFX Inc. as a resource for its clients. The opinions, projections and estimates contained herein are our own and subject to change without notice. FOREIGN EXCHANGE DISCLAIMER