Msil

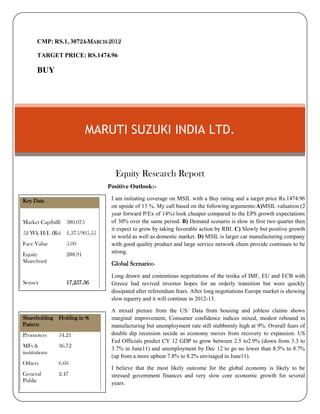

- 1. CMP: RS.1, 30724-MARCH-2012 TARGET PRICE: RS.1474.96 BUY MARUTI SUZUKI INDIA LTD. Equity Research Report Positive Outlook:- I am initiating coverage on MSIL with a Buy rating and a target price Rs.1474.96 on upside of 13 %. My call based on the following arguments:A)MSIL valuation (2 year forward P/Ex of 14%) look cheaper compared to the EPS growth expectations of 30% over the same period. B) Demand scenario is slow in first two quarter then it expect to grow by taking favorable action by RBI. C) Slowly but positive growth in world as well as domestic market. D) MSIL is larger car manufacturing company with good quality product and large service network chain provide continues to be strong. Global Scenario:- Long drawn and contentious negotiations of the troika of IMF, EU and ECB with Greece had revived investor hopes for an orderly transition but were quickly dissipated after referendum fears. After long negotiations Europe market is showing slow equerry and it will continue in 2012-13. A mixed picture from the US: Data from housing and jobless claims shows marginal improvement, Consumer confidence indices mixed, modest rebound in manufacturing but unemployment rate still stubbornly high at 9%. Overall fears of double dip recession recede as economy moves from recovery to expansion. US Fed Officials predict CY 12 GDP to grow between 2.5 to2.9% (down from 3.3 to 3.7% in June11) and unemployment by Dec 12 to go no lower than 8.5% to 8.7% (up from a more upbeat 7.8% to 8.2% envisaged in June11). I believe that the most likely outcome for the global economy is likely to be stressed government finances and very slow core economic growth for several years. Key Data AU Market Cap(bill) 380.075 52 Wk H/L (Rs) 1,375/905.55 Face Value 5.00 Equity Share(mn) 288.91 Sensex 17,257.36 Nifty 5,243.15 Shareholding Pattern Holding in % Promoters 54.21 MFs & institutions 36.72 Others 6.60 General Public 2.47

- 2. 1 MARUTISUZUKIINDIALTD.|[Pickthedate] MARUTI SUZUKI INDIA LTD. Equity Research Report Indian Economy:- Fiscal Year 2011-12 was tough for Indian economy. High interest rate (8%), inflation rate (9%-10%) and negative growth in manufacturing hurts the economic growth. Rupee depreciation (Rs 52.86) and increasing crude oil prices was big challenge for policy makers. In financial budget 2012-13 Government set GDP growth at 6.9% which is lowest from last 3 years. Increase in indirect tax (service and excise duty) will damage confidence of manufacturing companies (Auto companies) and increase price of basic goods. Budget and Auto Companies:- Financial Budget FY 12-13 will show mix effect on Auto companies. Increase in excise duty by 2% will increase car prices, but increase in exemption limit (up to 2L), decrease in interest rate (6.5% to 7%), appreciation of rupee (Rs 47/49) and no hick in diesel price in current financial budget and slow growth in global market helps to boost sale in domestic market. Company Outlook: Maruti Suzuki is the largest passenger vehicle manufacturer in India, with 1.2m units. And the company plans to increase its manufacture capacity to 1.75 million by year 2013.It dominates the cars segment with 44.9% market share. It is also emerging as the global export hub of small cars for Suzuki, with world strategic model A-Star exclusively produced in India. The company’s domestic contribution in sale is 88% and Export is 12%. Exports:- Maruti Suzuki exports, entry-level models across the globe to over 120 countries and the focus has been to identify new markets. Some important markets include Latin America, Africa, South East Asia and Oceana. 11.8% increase in export at end of the Month February 2012 0 200000 400000 600000 800000 1000000 1200000 1400000 2007 2008 2009 2010 2011 2012E 2013E NoofUnitsold Year Total Sale Domestic Export

- 3. 2 MARUTISUZUKIINDIALTD.|[Pickthedate] Financial Outlook:- MSIL Showing average growth in Net sale is 25.85% from last 5 years. EBIDTA growth down by 6.84% and PAT down by 8.37% in financial year 11-12 due to unfavorable economic condition, like increase oil prices, interest rate, high inflation rate ,global crisis. At profitability of company EBIDTA margin shown down 11.48% as against 15.37% last year(FY10) andPAT down by 2% compare to last year 8.62%(FY10).I expecting to improve it by 1% in FY12. I can see positive improvement in Div. Yeild is 0.57% as compare to 0.42% in FY10.MSIL giving average return on equity is 18% from last 5 years, P/E shown positive growth by 0.30% in FY11. Valuation:- By taking average growth in Gross sale and no. of unit sold are 24% and 18%, estimated EPS for the FY12 and FY13 are Rs.104.40 and Rs.174.00 respectively. Using FCFE model, target price per share for FY12-13 is Rs.1474.91.I am giving BUY call for on the aspect of long term returns. DIVIDEND: The board recommends a dividend of Rs 7.50 per equityshare of Rs 5 each for the year ended 31st March 2011 amounting to Rs2, 167 million.

- 4. 3 MARUTISUZUKIINDIALTD.|[Pickthedate] SIZE OF THE INDUSTRY The Indian Automotive Industry after de-licensing in July 1991 has grown at a spectacular rate on an average of 17% for last few years. The industry has attained a turnover of USD $35.8 billion, (INR 165,000 crores) and an investment of USD 10.9 billion. The industry has provided direct and indirect employment to 13.1 million people. Automobile industry is currently contributing about 5% of the total GDP of India. India's current GDP is about $1.4 trillion and is expected to grow to $3.75 trillion by 2020. The projected size in 2016 of the Indian automotive industry varies between $122 billion and $159 billion including USD 35 billion in exports. This translates into a contribution of 10% to 11% towards India's GDP by 2016, which is more than double the current contribution. SEGMENTATION OF MARKET SHARE OF AUTOMOBILE INDUSTRY IN INDIA India is being recognized as potential emerging auto market. Foreign players are adding to their investments in Indian auto industry. Unlike the USA, the Indian passenger vehicle market is dominated by cars (79%). India is the second largest tractor manufacturer in the world. India is the fifth largest commercial vehicle manufacturer in the world. India is the fourth largest car market in Asia - recently crossed the 1 million mark.

- 5. 4 MARUTISUZUKIINDIALTD.|[Pickthedate] Labor cost comparisons ($/Hour)8 Today’s high cost of production 12 $40.0 10 $35.0 8 $30.0 6 $25.0 4 $20.0 3 $15.0 2 $10.0 1 $5.0 0 $0.0 us/canada Mexico Eastern Western Eroup Japan South Eroup India Chiana Brazil High cost developed markets Low cost Emerging markets Cost of Labor S o urc e : Co s t o f Labo r – Ec o no mic Inte llige nc e Unit, Data Dic tio nary : Light vehicle production forecast (millions of units) 80 70 South America 60 North America 50 Japan/ Korea 40 South Asia 30 Greater China 20 Middle East/ Africa 10 Europe 2008-09 2010-11 2012-13 2014-15 S o urc e : C S M Wo rldwide Number of vehicles produced (millions) Cost of Production Automakers will focus on more user-friendly and low-cost vehicles that are also the most advanced technologically. The automakers will continue to shift their production facilities from high- cost regions such as North America and the European Union to lower-cost regions such as China, India and South America. The Indian passenger vehicle market grew by 29 per cent in 2010-11 Light vehicle production forecast (millions of units)

- 6. 5 MARUTISUZUKIINDIALTD.|[Pickthedate] P/E(x) Company FY07 FY08 FY09 FY10 FY11 Maruti Suzuki indialtd. 14.79 13.73 18.49 16.40 16.61 TataMotors ltd 11.36 2.29 22.21 33.27 6.25 Mahindra& Mahindraltd. 19.20 5.94 35.21 21.09 15.04 Revenue Growth:- MSIL is a India’s fast growing company with 90% retention ratio ,company is producing 1.2 million cars and expected to increase production capacity to 1.75 million by 2013.Revenue average increase by 25% y-to-y and expected same for 2012-13. P/E ratio:- Maruti Suzuki showing consistency in P/E ratio gives the good returns to the investors.As compare to peers it shows high volatility in P/E ratios, it means MSIL share is cheaper than pears .I am expecting 14x to 10x P/E ratios in 2012-13 and that is one important reasons which we believe that why one should prefer MSIL.

- 7. 6 MARUTISUZUKIINDIALTD.|[Pickthedate] Income Statement Y / E, 3 1st Ma rc h FY 0 9 FY 10 FY 11 FY 12 E FY 13 E Ne t S a le s 2 , 0 3 , 5 8 3 2 , 8 9 , 5 8 5 3 , 6 1, 2 8 2 4 , 5 3 , 3 4 8 5 , 2 0 , 8 2 3 EBITDA 2 4 , 3 3 3 4 4 , 5 10 4 1, 4 6 7 5 4 , 2 0 5 8 0 , 7 2 3 EBITDA margin (%) 12% 15% 11% 12% 15% Depreciation 7,065 8,250 10,135 13,168 16,099 EBIT 17 , 2 6 8 3 6 , 2 6 0 3 1, 3 3 2 4 1, 0 3 7 6 4 , 6 2 4 Other income 10,001 10,243 12,227 15,343 17,626 Interest exp/ (inc) 510 335 244 394 624 P BT 16 , 7 5 8 3 5 , 9 2 5 3 1, 0 8 8 4 0 , 6 4 3 6 3 , 9 9 9 PBT margin (%) 8% 12% 9% 9% 12% Cos share in JV 0 0 0 0 0 Taxes 4,571 10,949 8,202 10,495 13,741 Extra ord exp/ Minority Interest 0 0 0 0 0 P AT (Re porte d) 12 , 18 7 2 4 , 9 7 6 2 2 , 8 8 6 3 0 , 14 8 5 0 , 2 5 8 Less: Extraordinary Income /Others 0 0 0 0 0 Adj P AT 12 , 18 7 2 4 , 9 7 6 2 2 , 8 8 6 3 0 , 14 8 5 0 , 2 5 8 Adj PAT margin (%) 6% 9% 6% 7% 10% EP S 42.18 86.45 79.22 104.35 173.96 FINACIAL OUTLOOK The Net revenue of the Company was Rs.3,61,282 million as against Rs.2,89,585 million in the previous year showing a growth of 24.6 per cent. Sale of vehicles in the domestic market increased to 1,132,739 units as compared to 870,790 units in the previous year showing a growth of 30.1 per cent.Total number of vehicles exported was 138,266 as compared to 147,575 last year. Earnings before interest, depreciation, tax and amortisation (EBIDTA) was Rs. 41,467 million against Rs. 44,510 million in the previous year. Profit beforetax (PBT) was Rs.31,088 million against Rs. 35,925 million in the previous year and profit after tax (PAT) stood at Rs.22,886 million against Rs. 24,976 million in the previous year.

- 8. 7 MARUTISUZUKIINDIALTD.|[Pickthedate] Balance sheet Y/E, 31st March FY09 FY10 FY11 FY12E FY13E Liabilities Equity share capital 1,445 1,445 1,445 1,445 1,445 Reserves & Others 92,004 1,16,906 1,37,230 1,64,830 2,10,465 Total Shareholders’ funds 93,449 1,18,351 1,38,675 1,66,275 2,11,910 Secured 1 265 312 343 378 Unsecured 6,988 7,949 2,781 2,677 2,577 Total loans 6,989 8,214 3,093 3,020 2,955 Deferred tax lia. (net) 1,551 1,370 1,644 1,585 1,532 Total liabilities 1,01,989 1,27,935 1,43,412 1,70,881 2,16,397 Assets Net fixed assets 87,206 1,04,067 1,17,377 1,45,987 1,75,999 Less: Depreciation / Amortisation 46,498 53,820 62,083 77,215 93,089 Capital WIP 8,613 3,876 14,286 13,319 15,522 Total non- current assets 49,321 54,123 69,580 82,091 98,432 Investments 31,733 71,766 51,067 75,436 95,423 Current assets Inventories 9,023 12,088 14,150 17,756 20,399 Sundry debtors 9,378 8,099 8,933 12,439 12,114 Cash & cash equivalents 19,390 982 25,085 11,597 24,918 Loans and Advances 16,328 15,707 13,722 17,203 19,778 Other current assets 981 848 1,673 2,097 2,411 Total current assets 55,100 37,724 63,563 61,093 79,620 Total current liabilities 30,358 29,365 35,540 41,182 49,830 Total provisions 3,807 6,313 5,258 6,557 7,249 Net current assets 20,935 2,046 22,765 13,354 22,541 Misc. expenditure 0 0 0 Total assets 1,01,989 1,27,935 1,43,412 1,70,881 2,16,397

- 9. 8 MARUTISUZUKIINDIALTD.|[Pickthedate] P e r sha re Da ta (Rs) Y /E, 3 1st Ma rc h FY 0 9 FY 10 FY 11 FY 12 E FY 13 E EPS Adj 42.2 86.4 79.2 104.4 174.0 EPS diluted Wtd. 42.2 86.4 79.2 104.4 174.0 CEPS 66.6 115.0 114.3 149.9 229.7 BVPS 307.4 366.6 444.8 527.5 653.3 Dividend 3.5 6.0 7.5 9.4 17.4 O/s shares.- actual (mn) 288.91 288.91 288.91 288.91 288.91 Dividend Yield (%) 0.45% 0.42% 0.57% 0.64% 1.07% Ratios Y /E, 3 1st Ma rc h FY 0 9 FY 10 FY 11 FY 12 E FY 13 E Growth Net sales (%) 13.99% 42.24% 24.76% 25.48% 14.88% EBITDA (%) - 22.28% 82.92% - 6.84% 30.72% 48.92% PAT adjusted (%) - 29.95% 104.94% - 8.37% 31.73% 66.71% EPS adjusted (%) - 30% 105% - 8% 32% 67% EPS diluted wtd. (%) - 30% 105% - 8% 32% 67% EPS Consolidated & dil V a lua tions P/E (x) 18.5 16.4 16.6 14.1 9.3 Price/BV (x) 2.5 3.9 3.0 2.8 2.5 EV/EBITDA (x) 8.7 9.4 8.6 7.7 5.5 P/ Sales (x) 1.1 1.4 1.1 0.9 0.9 P rofita bility EBITDA margin (%) 11.95% 15.37% 11.48% 11.96% 15.50% Adj PAT margin (%) 5.99% 8.62% 6.33% 6.65% 9.65% RoE (%) 12.59% 21.95% 16.12% 18.00% 23.97% RoCE (%) 12.76% 21.93% 17.00% 19.09% 25.08% BVPS (Rs) 307.4 366.6 444.8 527.5 653.3 Liquidity a nd Le ve ra ge ra tios Quick Ratio 1.35 0.72 1.21 0.96 1.16 Total Asset Turnover 1.50 1.77 1.96 2.03 1.82 Debt to Equity Ratio 0.07 0.07 0.02 0.03 0.05 Debt Ratio 0.83 0.85 0.68 0.80 0.88 Current Ratio 1.61 1.06 1.56 1.33 1.52

- 13. 12 MARUTISUZUKIINDIALTD.|[Pickthedate] Risks to my call Fluctuations in the US$-INR and GBP-INR and GBP-US$ Change in the economic climate/ legislation against Indian offshore development in the countries where the company provides its services. Hick in petrol and disel prices will adversely impact on Sale. Any slowdown in the Auto sector can adversely affect the company revenues. Availability of Tax holidays and incentives from Government of India. Rating definition Buy : > 15% returns relative to Sensex Reduce : Up to (-) 15% returns relative to Sensex Accumulate : Up to (+) 15% returns relative to Sensex Sell : > (-) 15% returns relative to Sensex

- 14. 13 MARUTISUZUKIINDIALTD.|[Pickthedate] DESCLAIMER This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for any investment decision .The investment discussed of views expressed may not be suitable for all investors.The user assumes the entire risk of any use made of this information. The recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits risks involved), and should consult its own advisors to determine the merits and risks of such an investment. Price and value of the investment s referred to in material may go up of down. Past performance is not a guide for future performance. Certain transactions including those involving futures. Options and other derivatives as well as non investment grade securities involve substantial s based on technical analysis centers on studying charts of a stock’s price movement and trading volume, as opposed to focusing on a company’s fundamentals and as such , may not match with a report on a company’s fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only .We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information current. Also there may be regulatory, compliance, of other reasons that may prevent Religare affiliates frame doing so. Prospective investors and others are cautioned that any forward looking statements are not predictions and may be subject to change without notice. This report is not directed of intended for distribution to or use by, any person or entity that is a citizen of resident of or located in any locality, state country of other jurisdiction. Where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Religare and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform them of and to observe such restriction. Copy right in this document vests exclusively with Religare. This information should not be reproduced of redistributed of passed on directly of indirectly in any form to any other person of published, copied, in whole of in part, for any purpose, without prior written permission from Religare. We do not guarantee the integrity of any e-mails of attached files and are not responsible for any changes made to them by any other person. The analyst for this report certifies that all of the views expressed in this report accurately reflect his of her personal views about the subject company of companies and its of their securities, and no part of his of her compensation was, is or will be, directly or indirectly related to specific recommendations of views expressed in this report. Analyst’s holding in the stocks mentioned in the report.