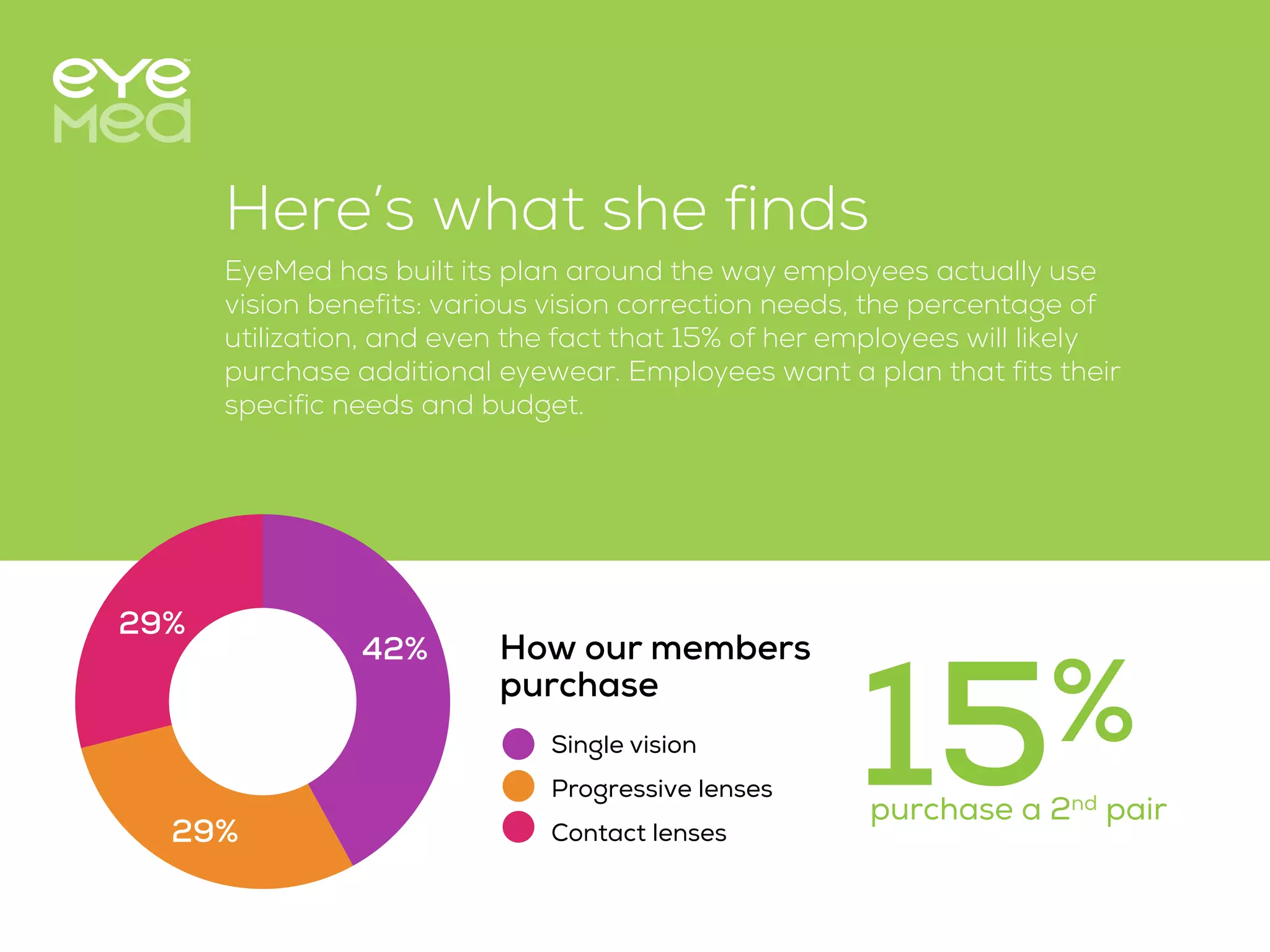

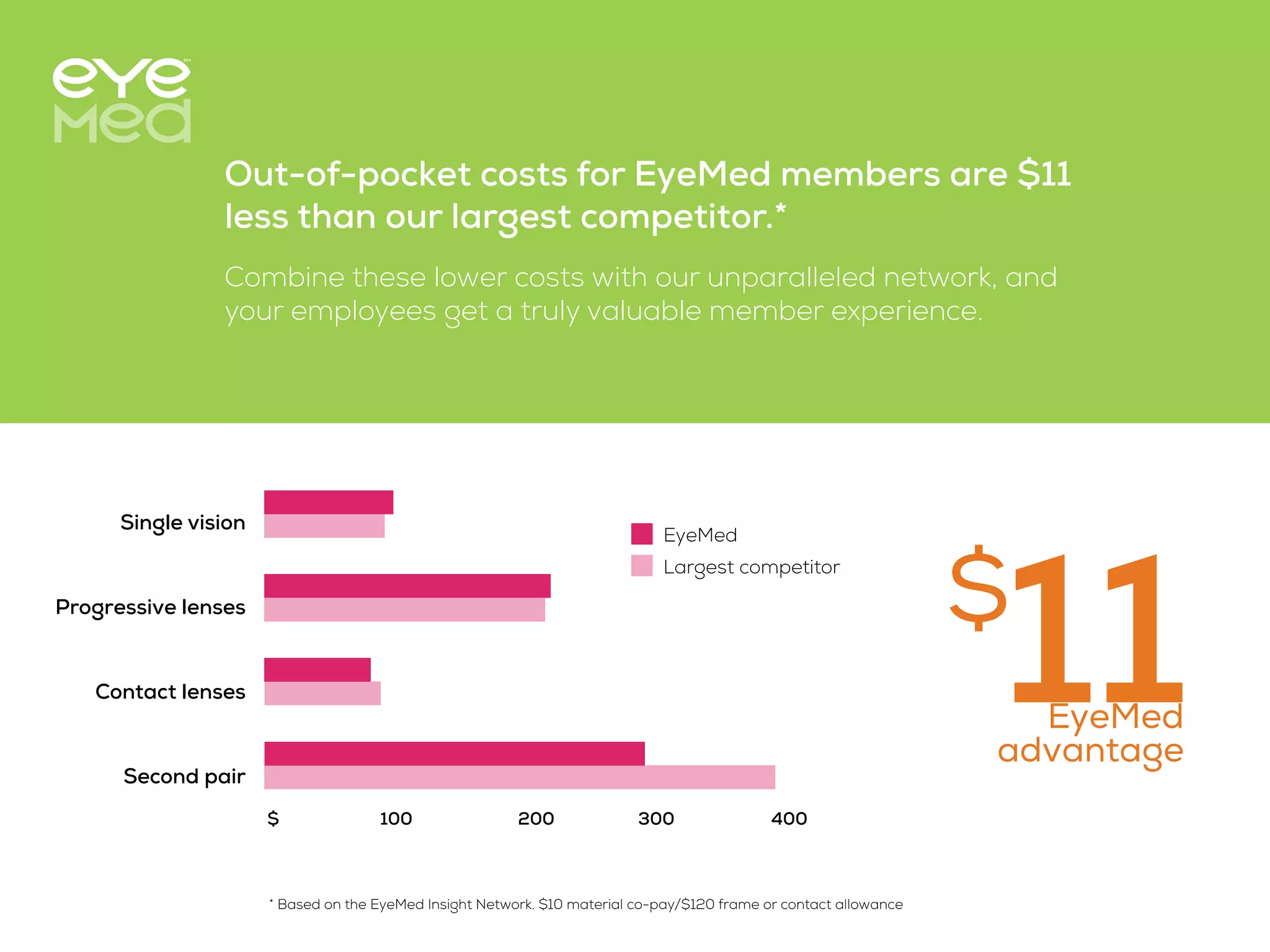

This document discusses how to properly evaluate and compare out-of-pocket costs for vision insurance plans. It notes that benefits companies may present information differently and not always provide an accurate picture. The document follows Kim, a benefits administrator, as she discovers EyeMed considers how employees actually use vision benefits like utilization rates and additional eyewear purchases. EyeMed is shown to provide the lowest out-of-pocket costs on average while also having the highest network coverage. By accounting for real member preferences and behaviors, EyeMed ensures the most accurate representation of savings.