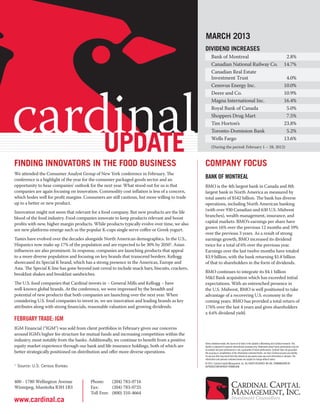

The document summarizes dividend increases announced by several Canadian and U.S. companies in March 2013. The increases ranged from 2.8% for Bank of Montreal to 23.8% for Tim Horton's. It also provides a brief profile of Bank of Montreal, noting its size, operations, earnings growth, and dividend yield.