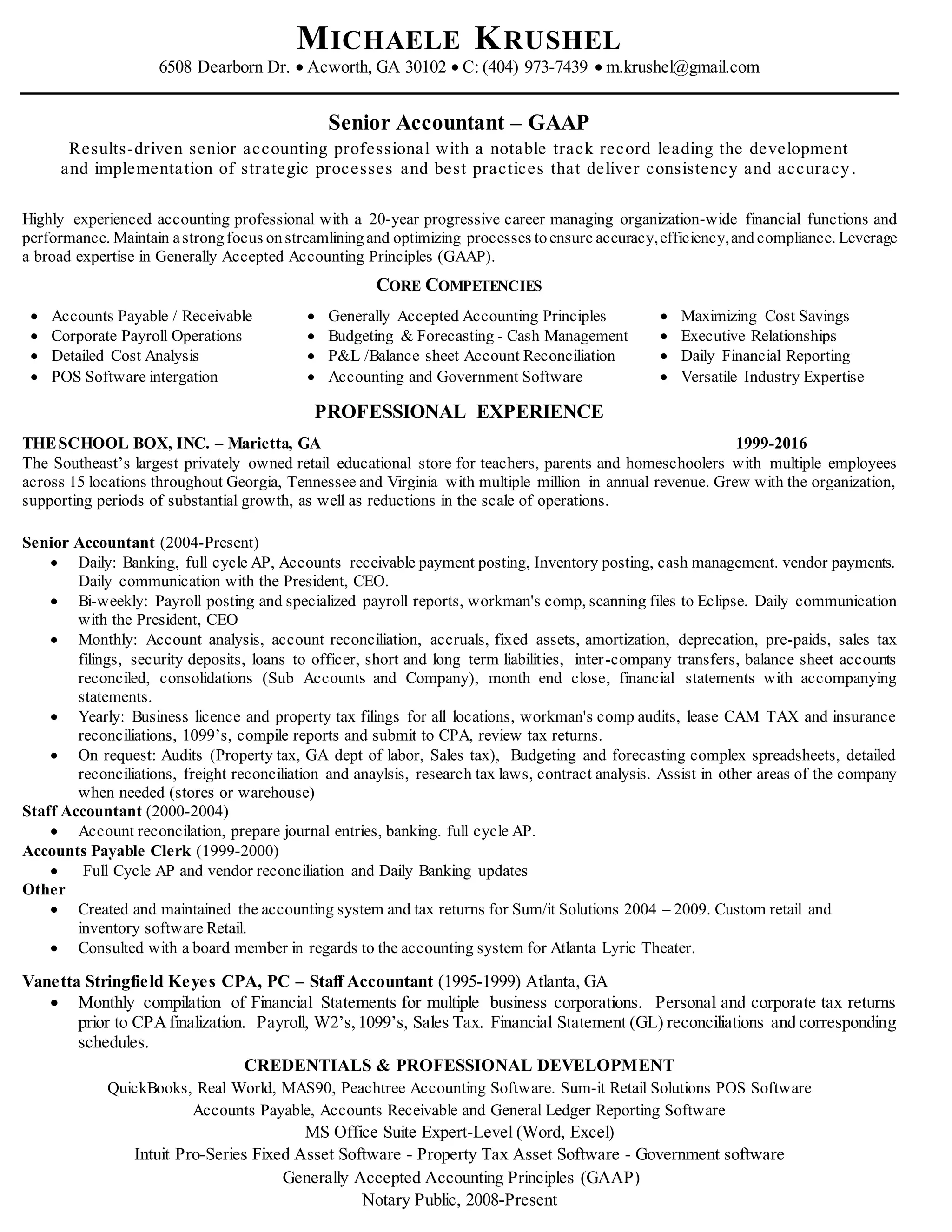

- Michael Krushel is a senior accountant with over 20 years of experience managing financial operations and ensuring accuracy, efficiency, and compliance.

- She has a track record of streamlining processes and optimizing accounting practices to deliver consistent results.

- Her experience includes daily, monthly, and yearly financial reporting as well as audit preparation for a large retail company with over $17M in annual credit card billing.