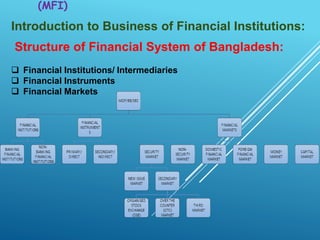

The document discusses the management of financial institutions in Bangladesh. It outlines the key constituents that make up Bangladesh's financial system, including financial institutions, instruments, and markets. It also describes the various regulators of the financial system, such as the Ministry of Finance, Central Bank, and Security Exchange Commission. Finally, it provides details on the types of banking and non-banking financial institutions that operate in Bangladesh, as well as the money market instruments that are available.