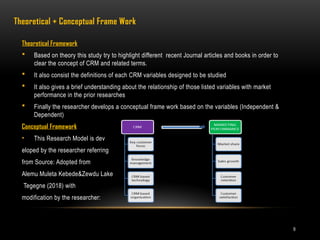

This document discusses a study on the effect of customer relationship management (CRM) practices on the marketing performance of the Bank of Abyssinia in Ethiopia. The research aims to identify how CRM-based technology, organizational structure, customer focus, and knowledge management influence marketing outcomes, using both qualitative and quantitative methods. The findings indicate a positive correlation between these CRM dimensions and marketing performance, with knowledge management having the most significant impact.