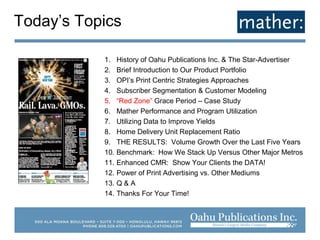

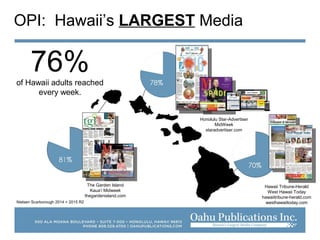

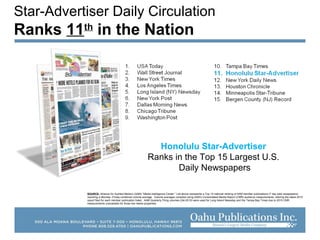

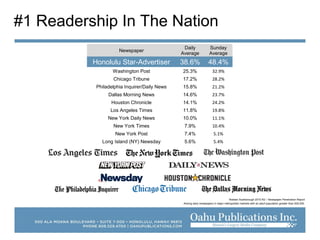

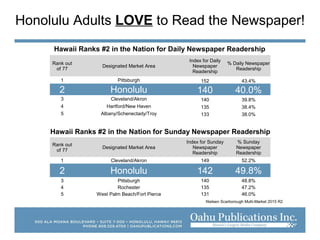

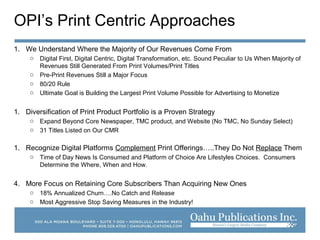

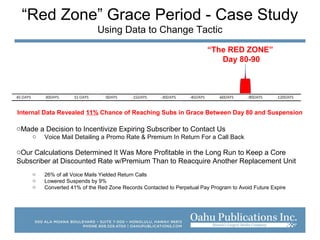

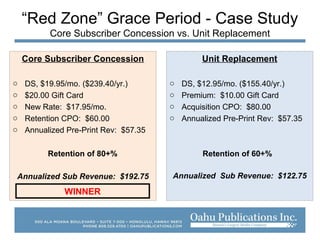

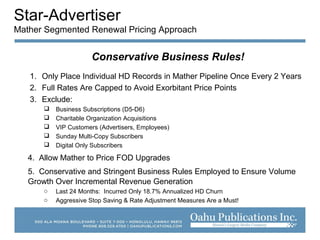

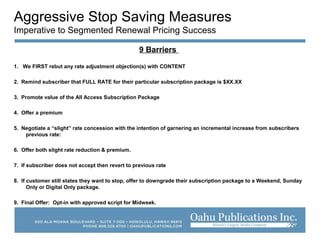

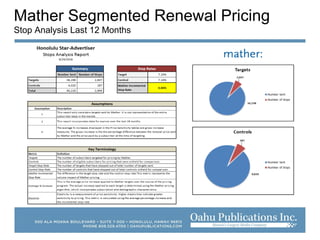

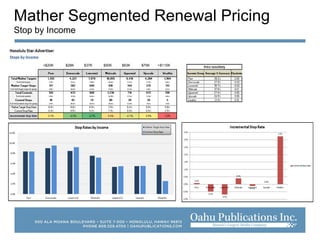

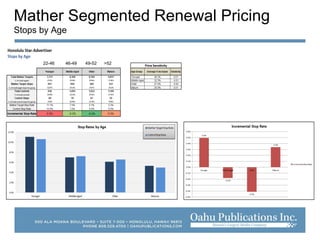

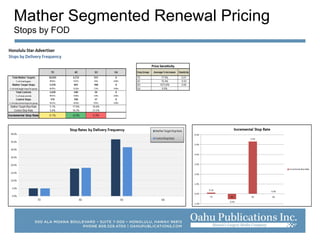

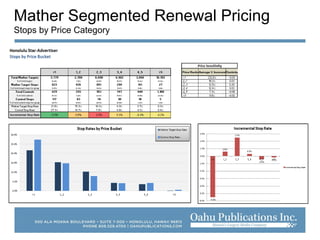

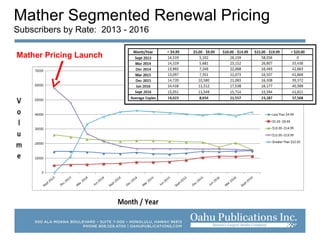

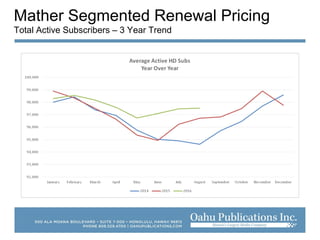

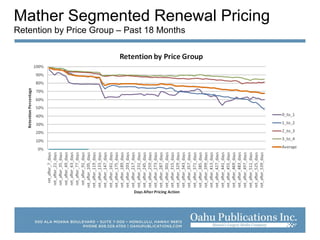

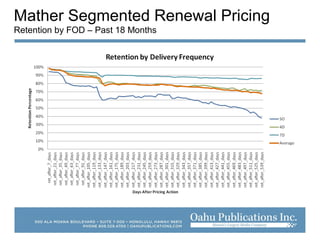

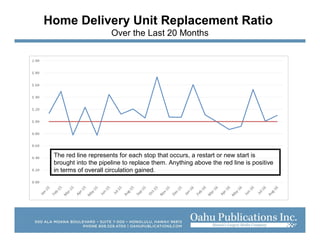

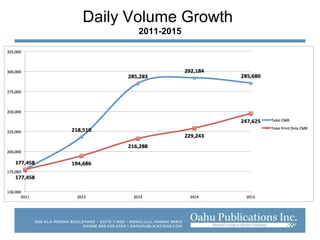

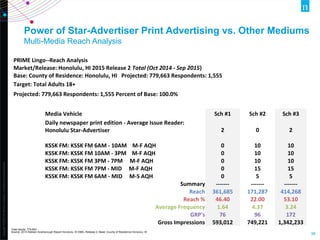

Aaron Kotarek presented on Oahu Publications Inc.'s print-centric strategies and use of data. Some key points included segmenting subscribers based on demographics and using customer modeling to target marketing to non-subscribers similar to current subscribers. OPI focuses on growing print volumes first and revenues second using tools like Mather to determine personalized renewal pricing. The goal is building the largest possible print audience to monetize through advertising.