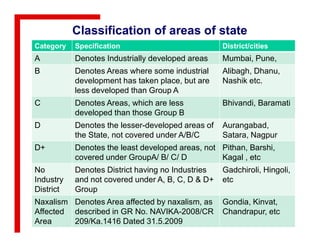

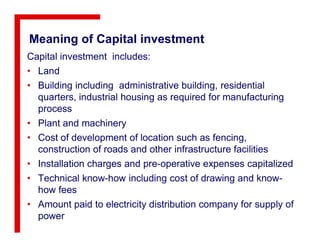

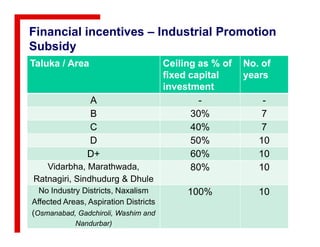

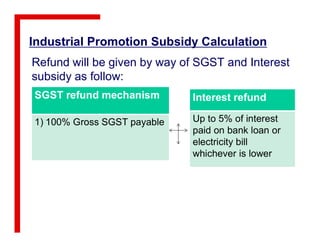

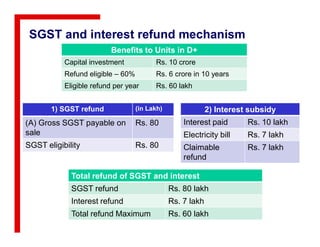

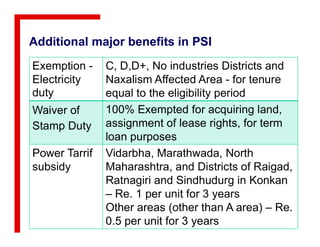

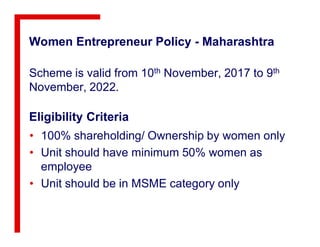

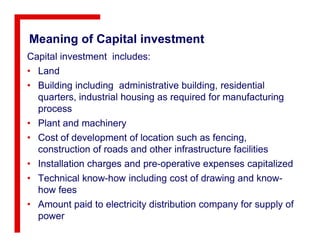

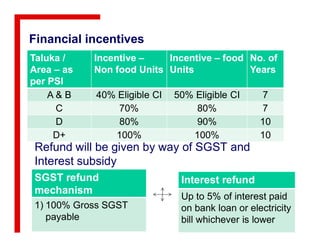

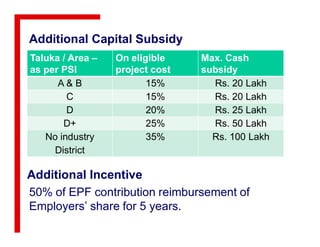

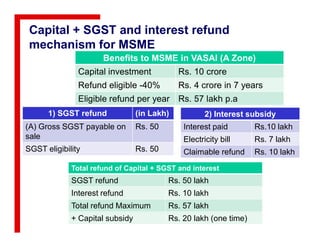

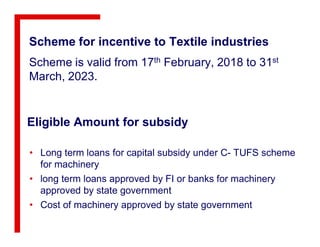

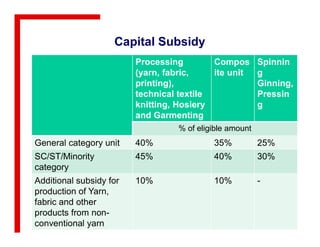

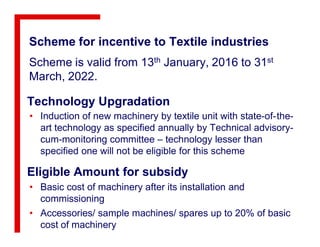

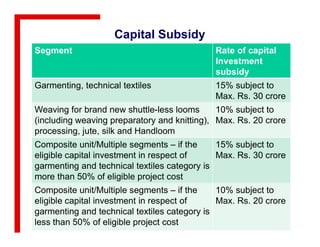

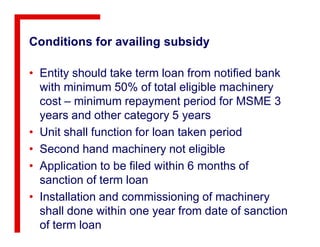

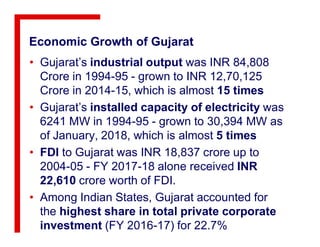

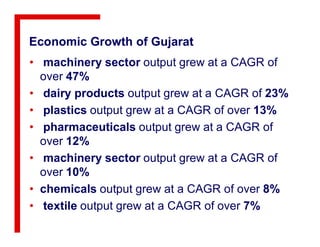

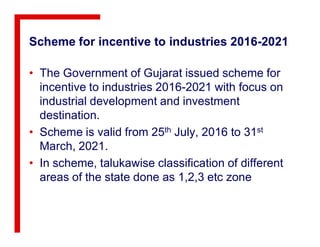

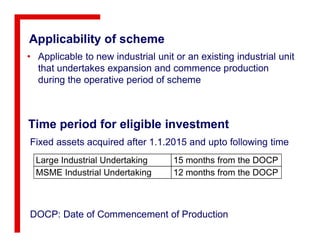

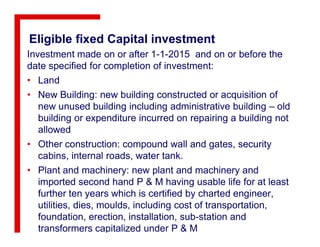

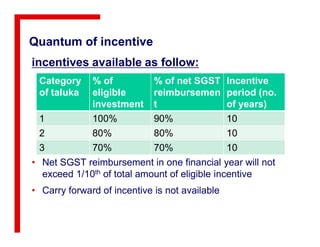

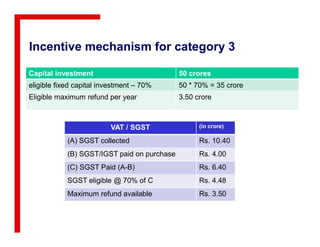

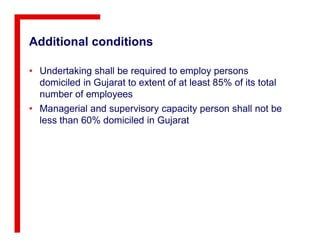

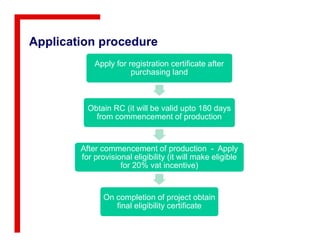

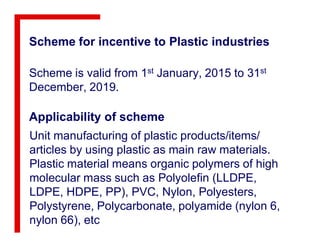

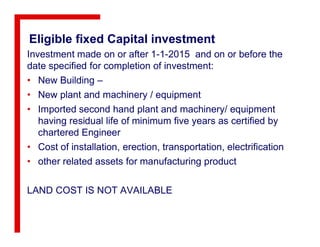

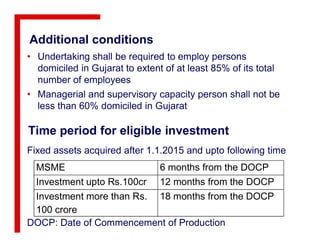

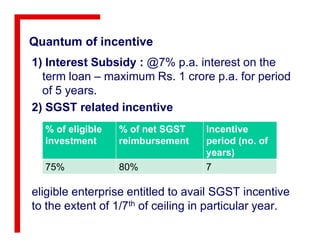

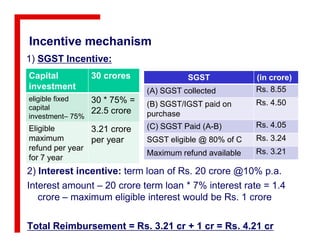

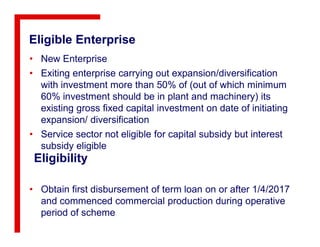

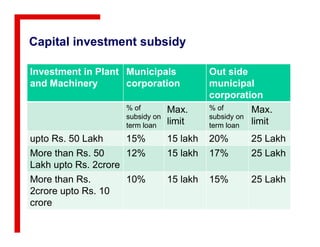

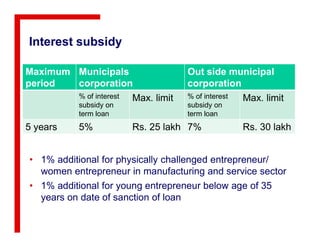

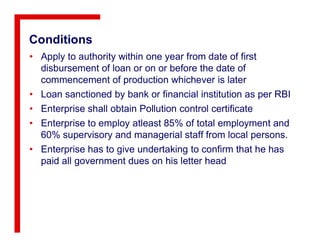

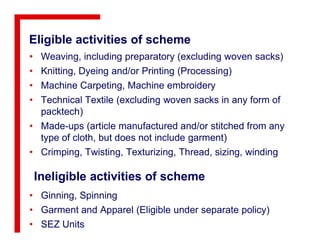

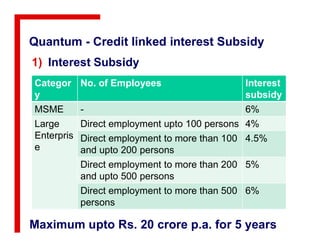

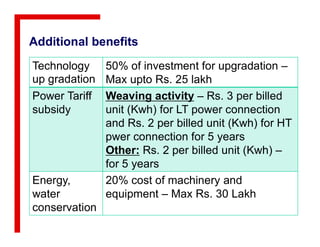

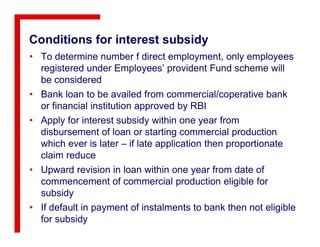

This document provides information on industrial incentive schemes offered by the state governments of Maharashtra and Gujarat. It summarizes the key industrial policies, eligibility criteria, classification of areas, incentives provided like capital subsidy, interest subsidy, SGST refund etc. under the schemes. The Maharashtra section covers the industrial policy 2019, women entrepreneur policy and textile policy. The Gujarat section discusses the industrial policy 2016 and schemes for industries. Eligible investments, timelines and quantum of incentives are also outlined.