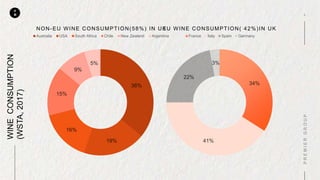

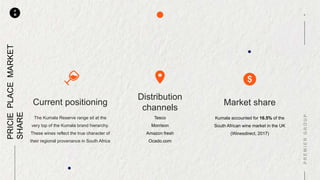

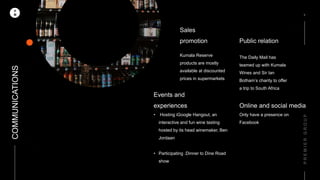

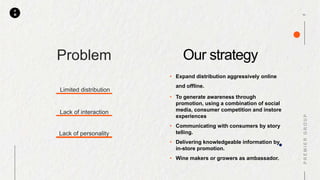

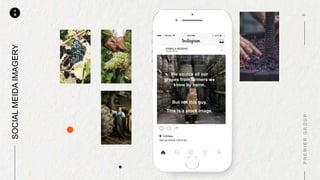

The document is a marketing plan for Kumala wines, outlining its market position, target audience, and communication strategies. It highlights the brand's current challenges such as limited distribution and lack of consumer interaction, while setting objectives to enhance brand awareness through promotions and online engagement. The plan emphasizes the desire to become an authentic South African wine brand with superior quality, targeting a demographic known as 'generation treaters' who are new to wine and cautious in their choices.