1) The document discusses the potential implications of the UK Labour party's proposed "Mansion Tax" on properties valued over £2 million.

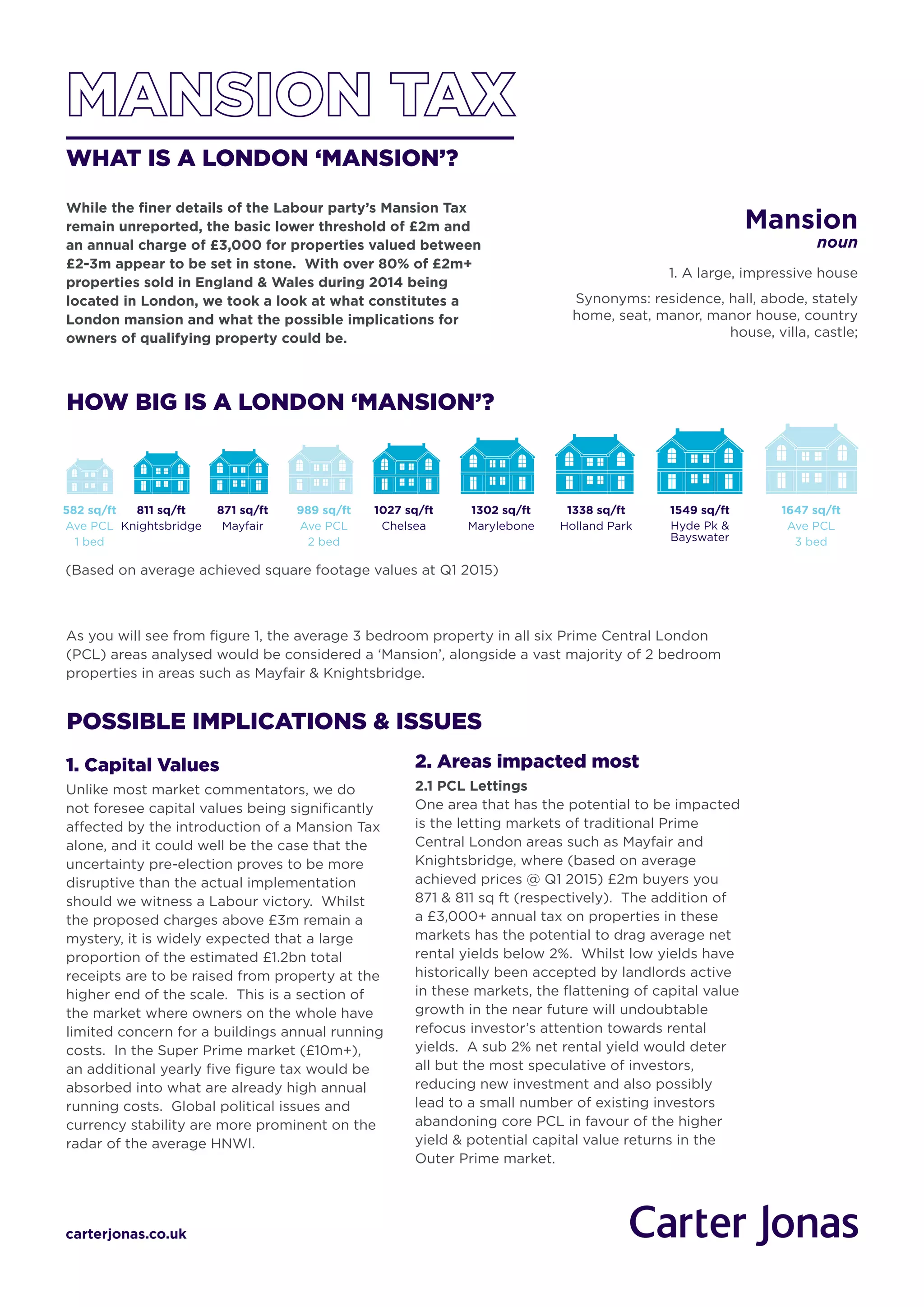

2) It finds that average 3-bedroom properties in prime central London areas like Mayfair and Knightsbridge would be subject to the tax.

3) While capital values are not expected to be significantly affected, the tax could reduce rental yields in these areas below 2% and deter some investors, potentially reducing new investment and causing some existing investors to look elsewhere.