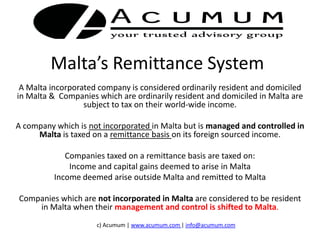

Malta's remittance system offers taxation benefits for companies managed in Malta but incorporated elsewhere, allowing tax on a remittance basis for foreign income and capital gains only when remitted to Malta. Companies incorporated in Malta are taxed on worldwide profits, while those not incorporated but managed in Malta benefit from treaty access without facing tax on unremitted foreign income. Acumum Services Group provides legal, corporate, and tax advisory services, assisting clients in leveraging the advantages of Malta's tax framework.