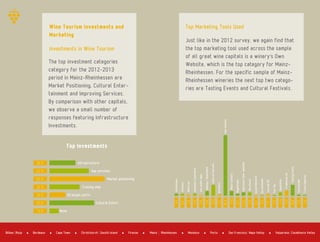

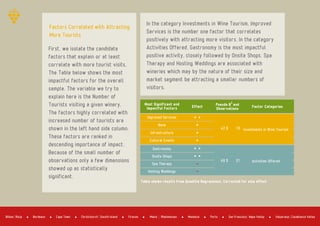

The report analyzes the wine tourism performance of Mainz-Rheinhessen, highlighting key findings from a 2013 survey with 38 responses. It indicates that accommodations constitute a major revenue source, while low-end wines generate significant profits, and the region attracts a high percentage of older, national tourists. The analysis underscores the importance of improved services and special events in increasing visitor numbers and spending.