Send semester details to get fully solved MBA assignments

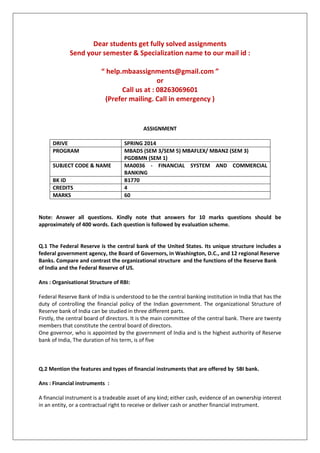

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency ) ASSIGNMENT DRIVE SPRING 2014 PROGRAM MBADS (SEM 3/SEM 5) MBAFLEX/ MBAN2 (SEM 3) PGDBMN (SEM 1) SUBJECT CODE & NAME MA0036 - FINANCIAL SYSTEM AND COMMERCIAL BANKING BK ID B1770 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q.1 The Federal Reserve is the central bank of the United States. Its unique structure includes a federal government agency, the Board of Governors, in Washington, D.C., and 12 regional Reserve Banks. Compare and contrast the organizational structure and the functions of the Reserve Bank of India and the Federal Reserve of US. Ans : Organisational Structure of RBI: Federal Reserve Bank of India is understood to be the central banking institution in India that has the duty of controlling the financial policy of the Indian government. The organizational Structure of Reserve bank of India can be studied in three different parts. Firstly, the central board of directors. It is the main committee of the central bank. There are twenty members that constitute the central board of directors. One governor, who is appointed by the government of India and is the highest authority of Reserve bank of India, The duration of his term, is of five Q.2 Mention the features and types of financial instruments that are offered by SBI bank. Ans : Financial instruments : A financial instrument is a tradeable asset of any kind; either cash, evidence of an ownership interest in an entity, or a contractual right to receive or deliver cash or another financial instrument.

- 2. According to IAS 32 and 39, it is defined as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity". Financial instruments can be categorized by form depending on whether they are cash instruments or derivative instruments: 1. Cash instruments are financial 3 Discuss the features of the latest monetary policy of RBI. Answer:-The main features of the monetary policy of the Reserve Bank of India are given below: 1. Active Policy: Before the advent of planning in India in 1951, the monetary policy of the Reserve Bank was a passive, cheap and easy policy. It means that Reserve Bank did not use the measures of monetary policy to regulate the economy. For example from 1935 to 1951, the bank rate remained stable at 3%. But since 1951, the Reserve Bank has been following an active 4 Describe the internal and external machinery of handling customer complaints. Answer:-Explain the internal and external machinery of handling customer complaints. In a competitive banking Industry excellent service is most important and has to be provided to the customers for the sustained business growth. Many steps have been taken by the industry to attain a high standard of customer satisfaction, in order to have a bank without any complaint. Providing efficient service to the customers is to retain the old and to attract the new customers. A customer complaint arises due to the following: Attitudinal aspects in dealing with 5 Do you agree that succession planning is an important parameter of corporate governance? If so, please analyse this argument with respect to Axis bank and ICICI bank. Answer : Selecting the chief executive officer and planning for CEO succession are among the most important responsibilities of a company’s board of directors. In ideal circumstances, the succession process will be managed by a successful and trusted incumbent CEO, with the board or a board committee overseeing the process, reviewing the candidates and providing advice throughout. However, in exceptional circumstances, such as when the board lacks full confidence in the incumbent CEO or when a crisis occurs and the Q. 6 Compare and contrast of any two Bank’s Basel –II disclosures (Tier-I capital, Tier-I ratio, Total capital, Capital Adequacy Ratio -CAR). Ans: SBI : Capital Structure: Quantitative Disclosures (Rs in crores) (a) Tier-I Capital 85732 Paid-up Share Capital 635 Reserves 84123 Innovative Instruments (only total) 6063 Other Capital Instruments (only total) 0 Dear students get fully solved assignments Send your semester & Specialization name to our mail id :

- 3. “ help.mbaassignments@gmail.com ” or Call us at : 08263069601 (Prefer mailing. Call in emergency )