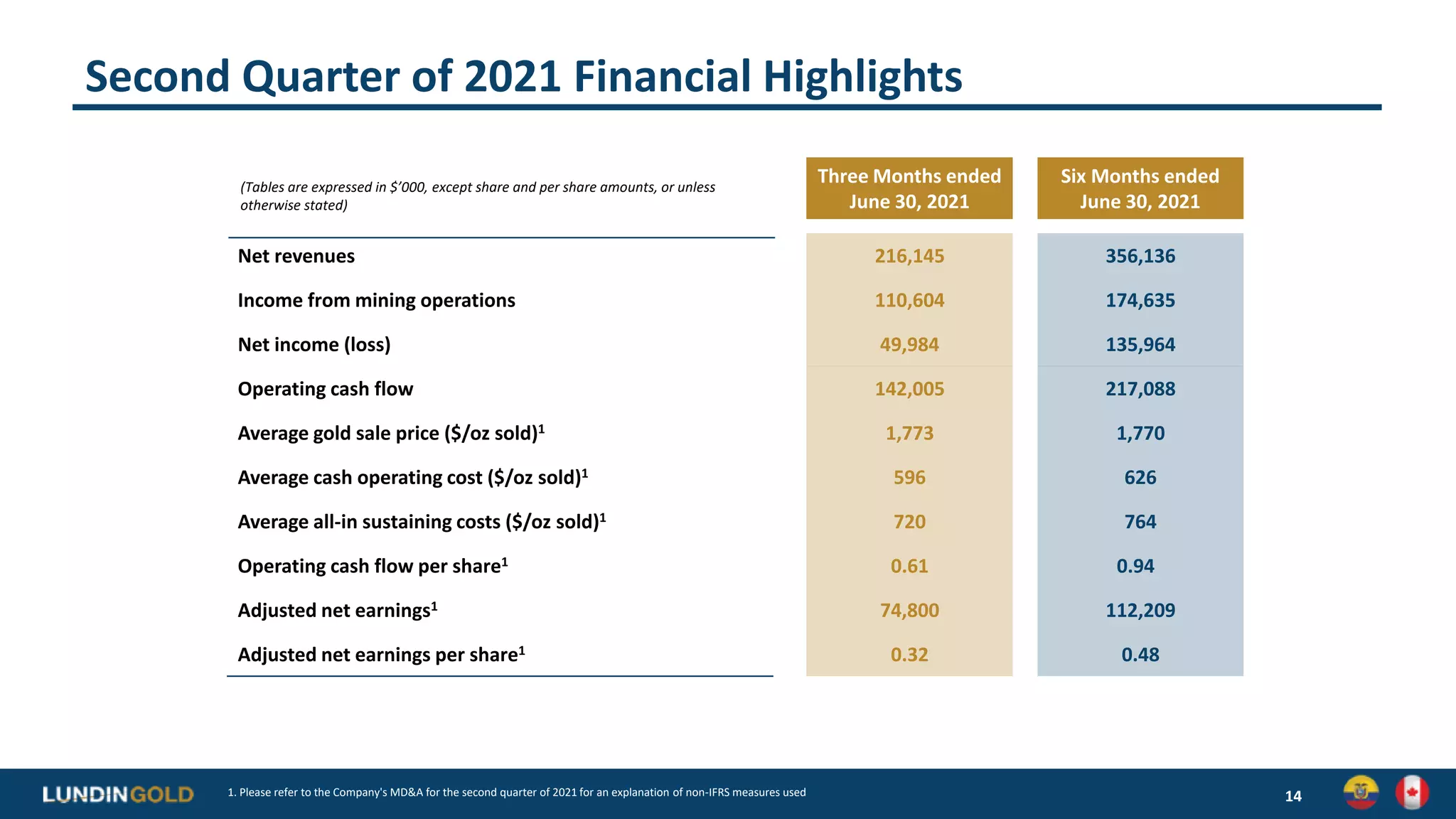

- Lundin Gold held a conference call to discuss its second quarter 2021 results

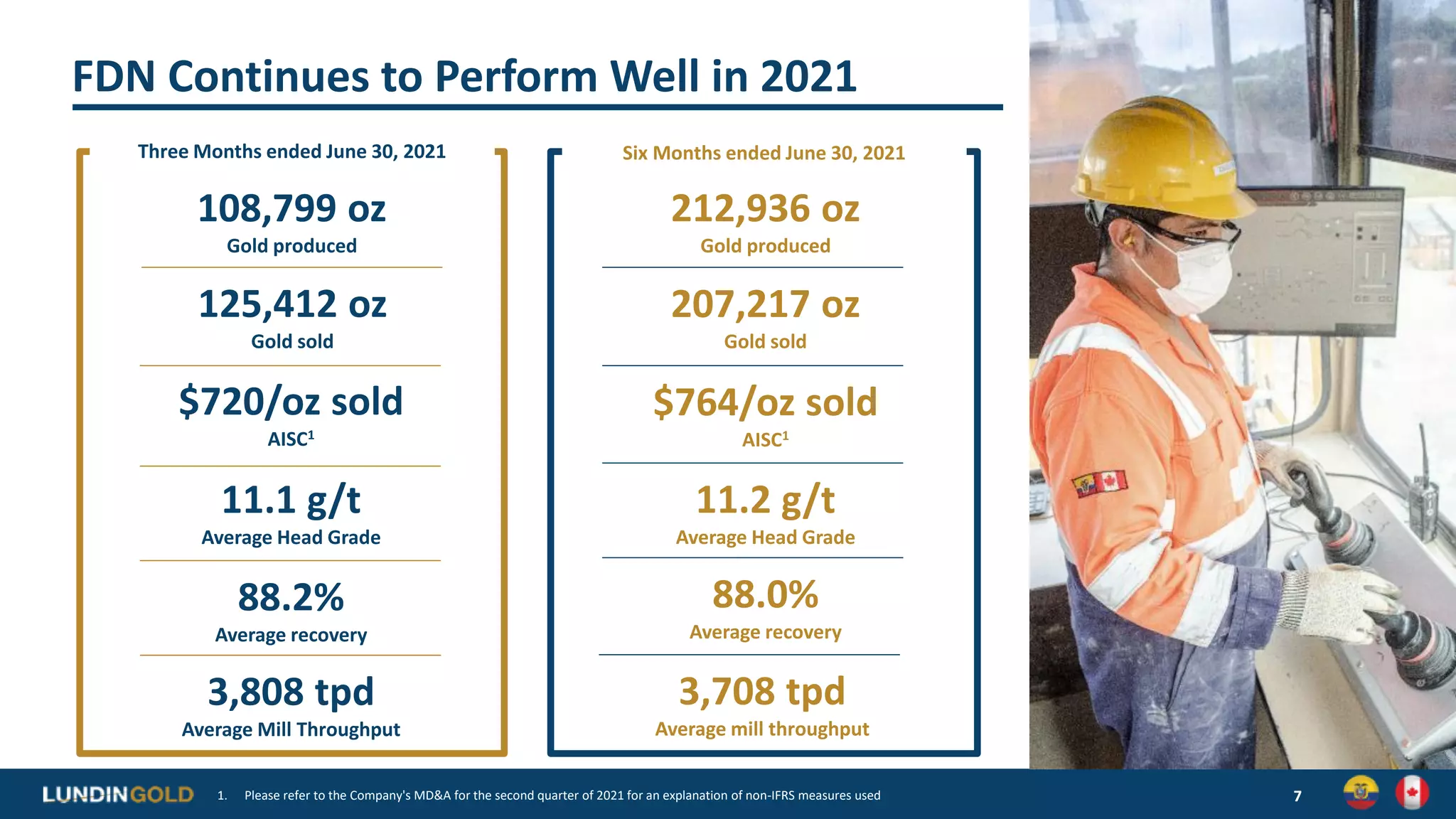

- The company produced over 108,000 ounces of gold in the first half of 2021 and remains on track to meet its full year guidance of 380,000-420,000 ounces

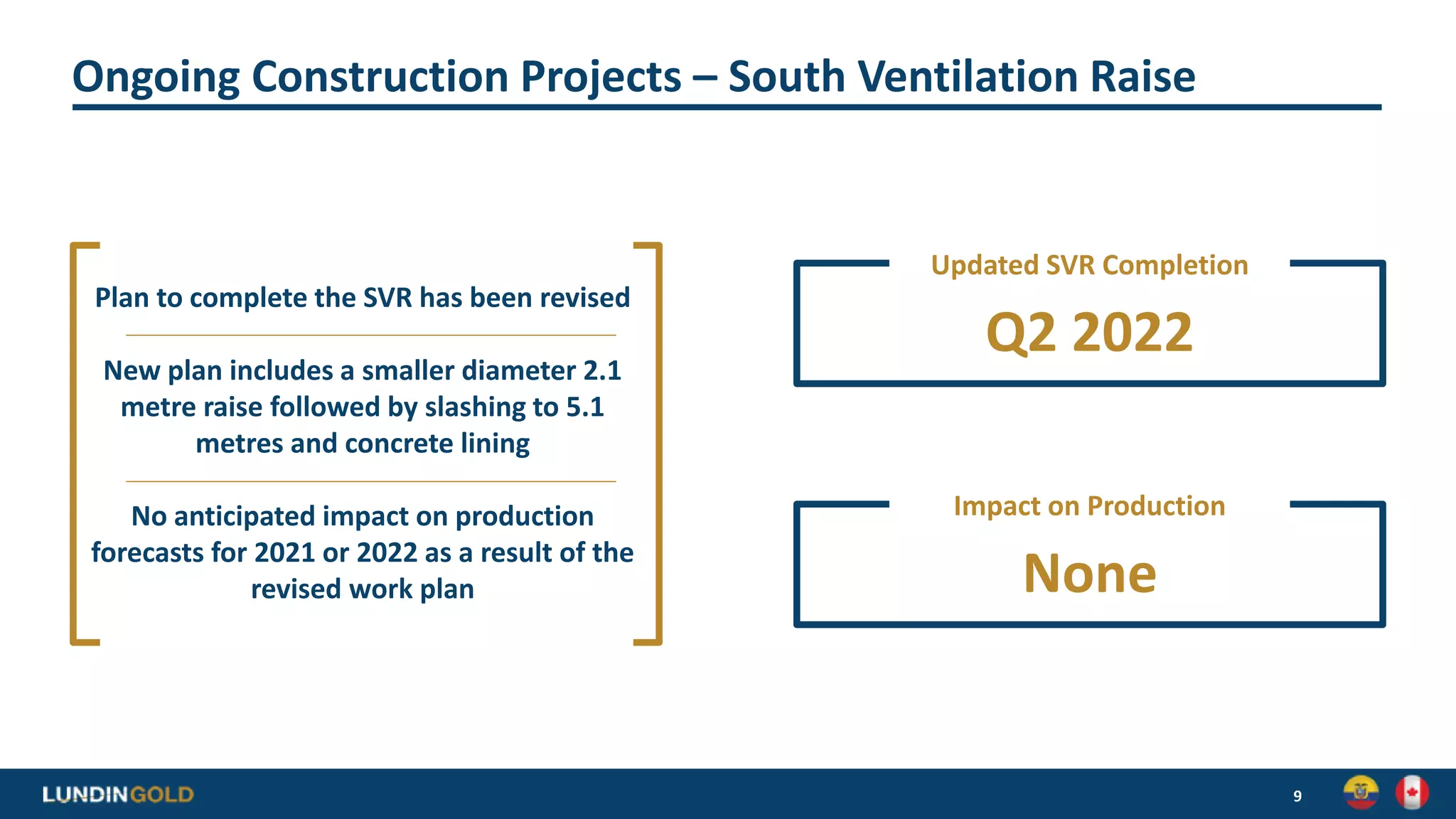

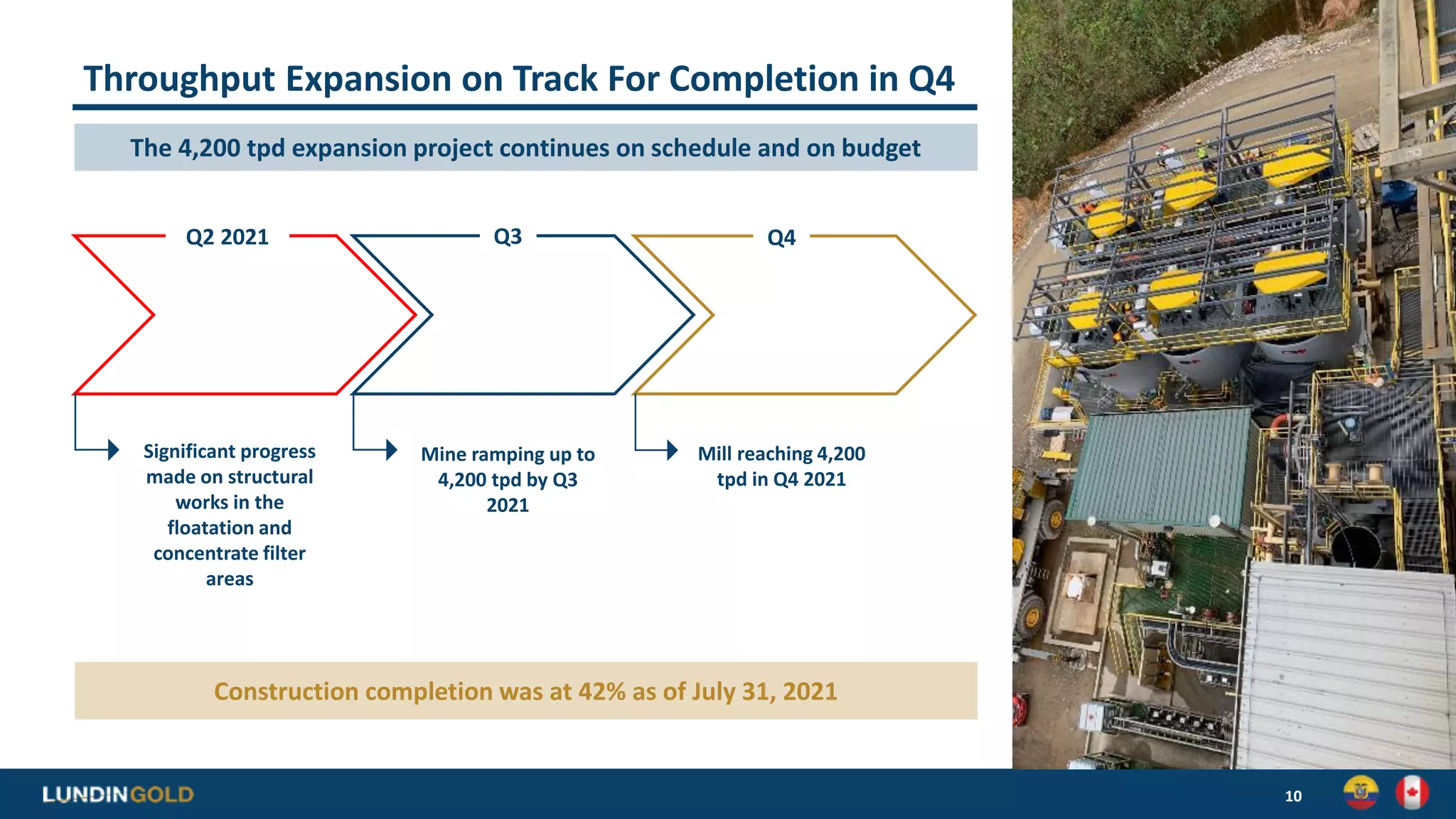

- Expansion projects continue on schedule, with the mill expected to reach 4,200 tonnes per day throughput in Q4 2021

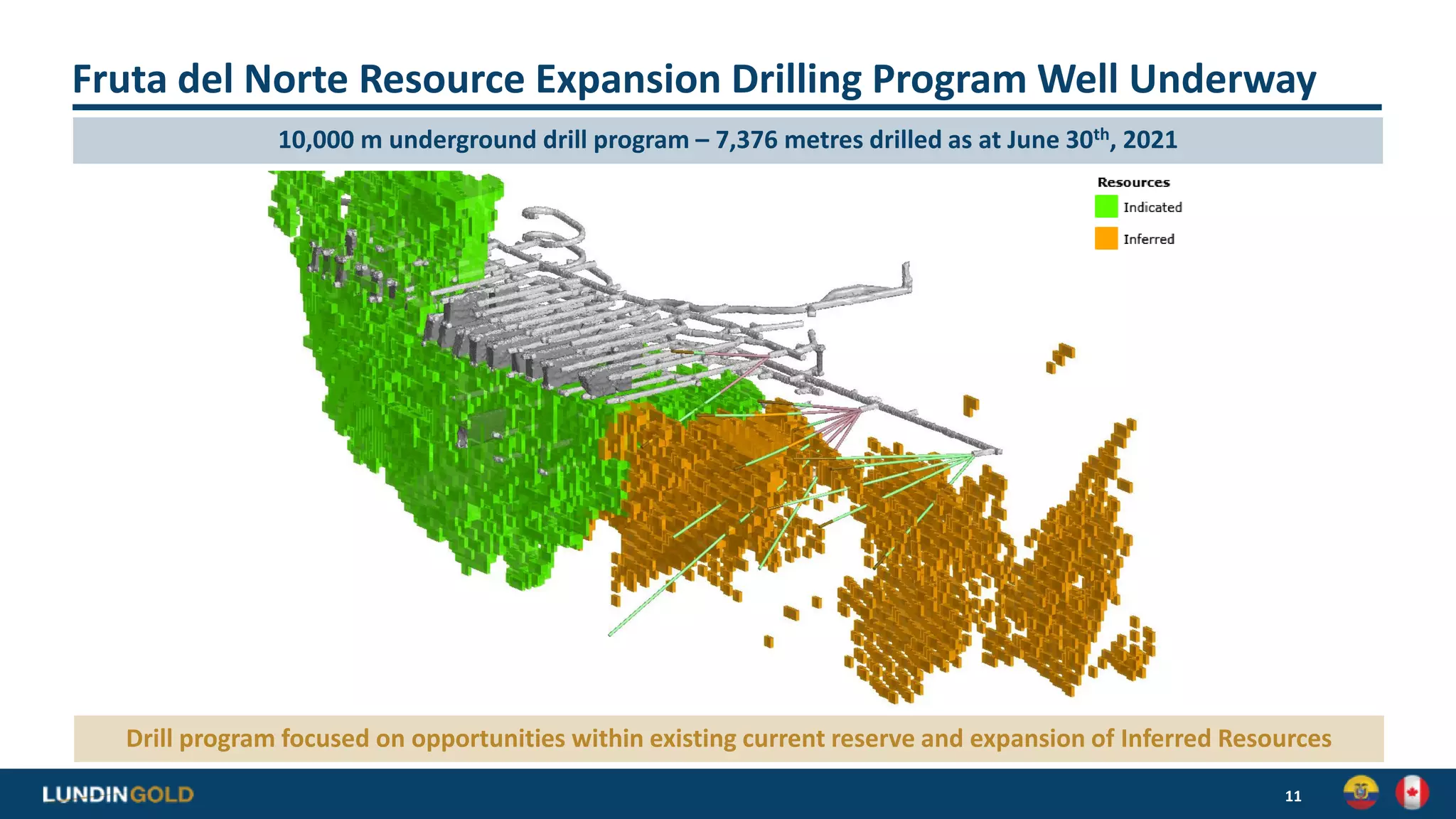

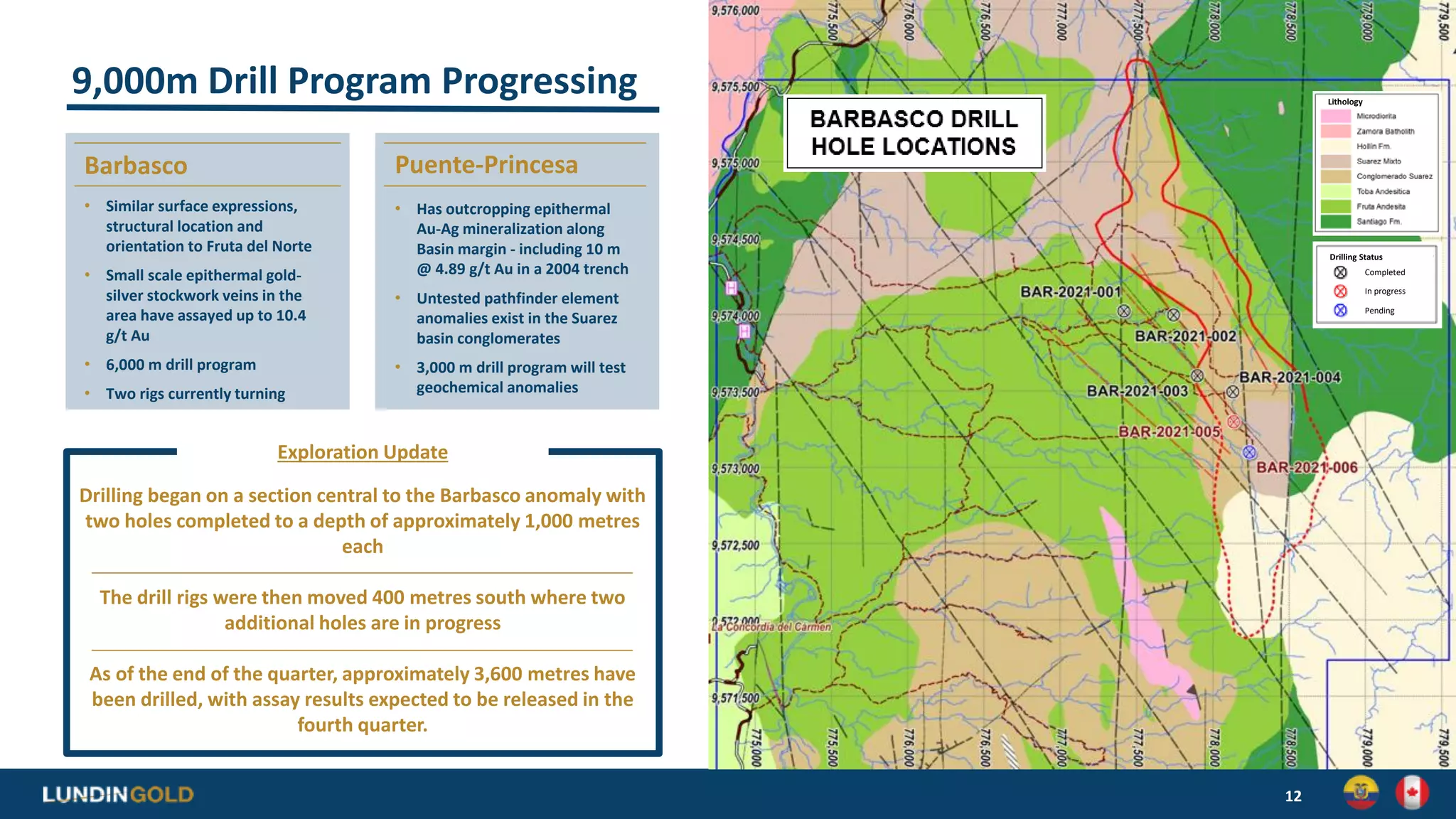

- Exploration drilling is underway to expand resources at the Fruta del Norte deposit and test new targets, with over 7,000 meters drilled so far in 2021